Savills has examined the top 6 office rental markets in Germany in the first half of 2025.

The following are the results in brief:

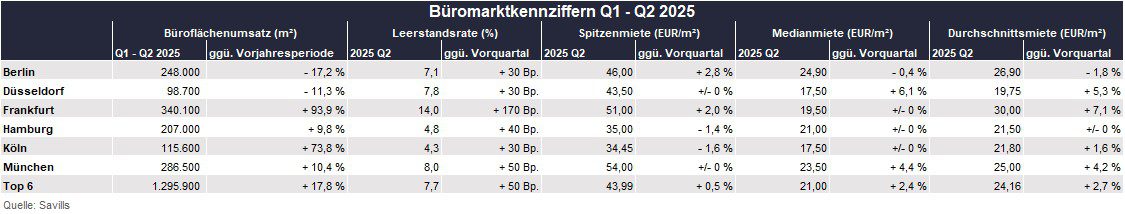

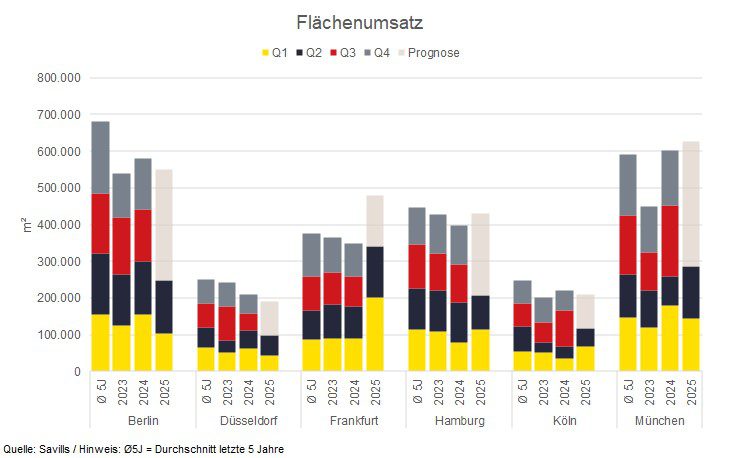

- Take-up: In the first half of 2025, take-up amounted to 1.3 million m², which corresponds to an increase of around 17.8% compared to the same quarter of the previous year.

- Rental development: Prime rents rose 0.5% sequentially, while median rents rose 2.4%.

- Vacancy: The vacancy rate increased by 50 basis points compared to Q1 2025, reaching 7.7% on average for the top 6 cities.

- View: Take-up in 2025 is likely to be above the previous year’s level. Prime rents are likely to rise further.

In the first half of 2025, the top 6 office markets* recorded take-up of around 1.3 million m². This was 17.8% higher than in the same period of the previous year. Compared with the average take-up of space in the first half of the past ten years, however, this represented a decline of 9.1%.

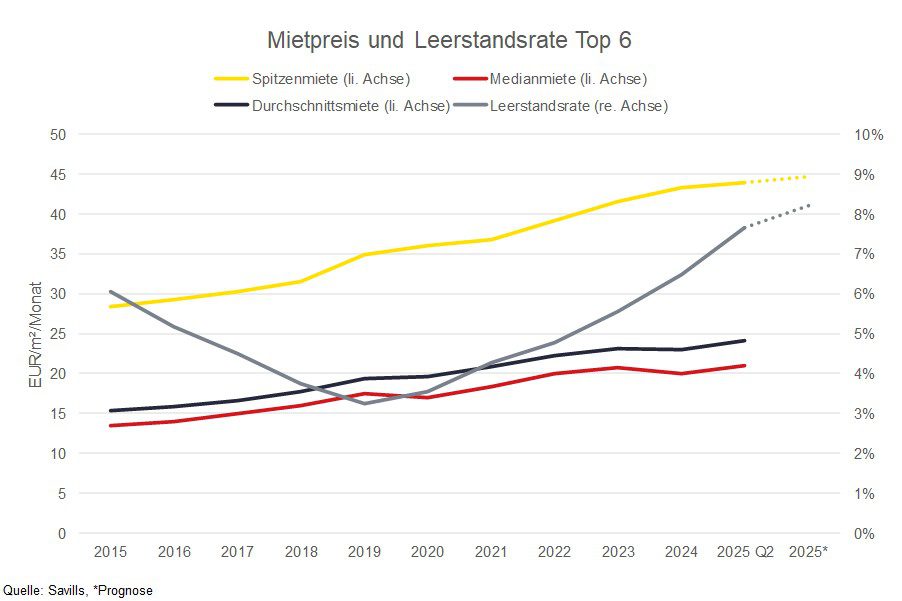

On average, the prime rent of the top 6 cities rose by 0.5% in the 2nd quarter of 2025 compared to the previous quarter and by 5.6% compared to the same quarter a year earlier. The median rent also continued to rise, rising by 2.4% compared with the first quarter of 2025 and by 5.0% compared with the same quarter a year earlier. The average rent rose by 2.7% compared with the previous quarter.

The average vacancy rate for the top 6 cities was 7.7% in the 2nd quarter of 2025. Compared to the 1st quarter, this corresponded to an increase of 50 basis points. Compared to the same quarter last year, it was 180 basis points higher.

Jan-Niklas Rotberg, Managing Director and Head of Office Agency Germany at Savills, reports: “Office take-up in the top 6 cities is showing a slight recovery – the rental markets are more active than in the first half of the previous year. In a long-term comparison, however, the level remains below average. One reason for this is the ongoing trend towards reducing space through hybrid working models: Larger offices in particular are being downsized when moving. In addition, many users continue to renew their leases in order to wait out the current uncertain environment and plan their future space requirements. The development also varies greatly from region to region: In Frankfurt, large-scale leases in particular generated significant growth in the first quarter, while Cologne also provided positive impetus. In contrast, cities such as Düsseldorf and Berlin had a harder time. While take-up varies depending on the region, the vacancy rate is rising in all top 6 cities. We are observing stronger vacancy increases, especially in peripheral locations. The prime rent continues to be unimpressed by this and continues its upward trend. This is due to the continuing high demand for central and modern space, which remains scarce in many markets. In view of the falling number of completions and declining building permits, this trend is likely to continue in the medium to long term.”

Outlook: Take-up up slightly – vacancies and prime rents continue to rise

For the current year, Savills forecasts office take-up that will exceed the previous year’s level and approach the long-term average. The ongoing shortage of modern, central office space means that a further increase in prime rents is expected. At the same time, the vacancy rate is likely to continue to rise.

* Berlin, Dusseldorf, Frankfurt, Hamburg, Cologne and Munich