Focus topic: Affordability of home ownership

On behalf of the Cologne-based German American Realty Group, the consulting and analysis company bulwiengesa has published the US Multifamily Monitor for the 2nd half of 2025 on the current situation on the US housing market.

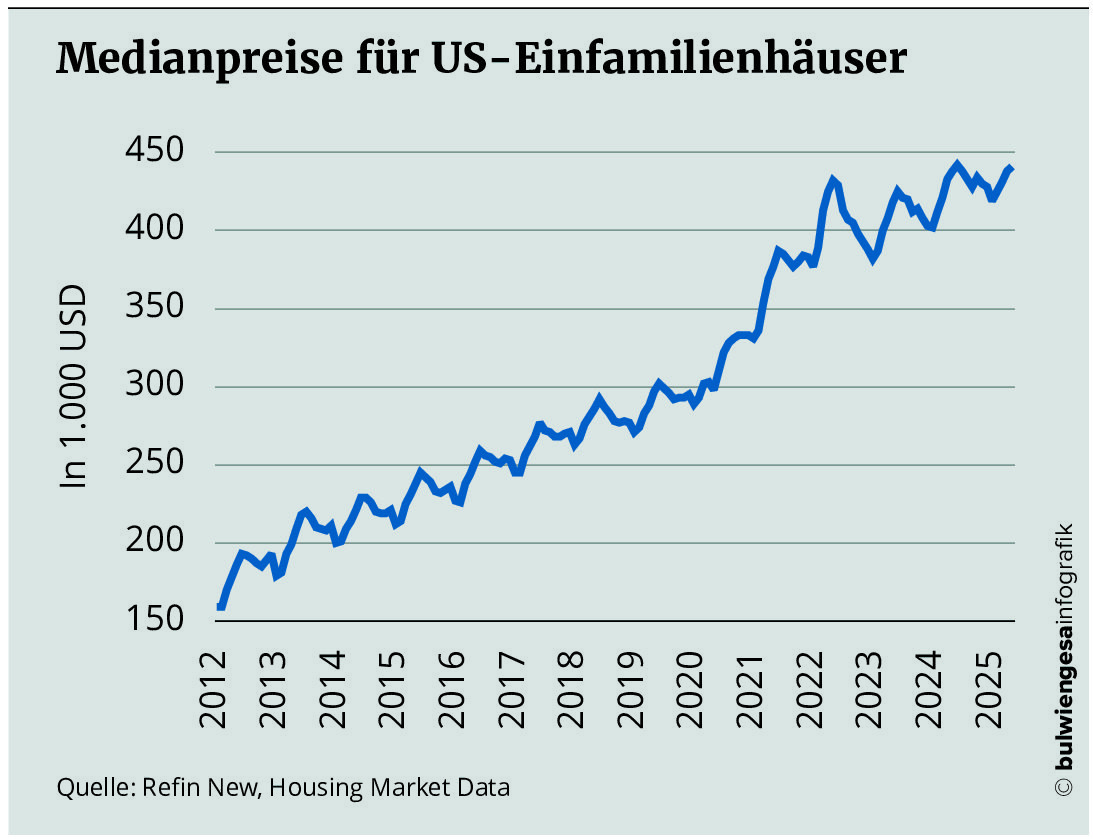

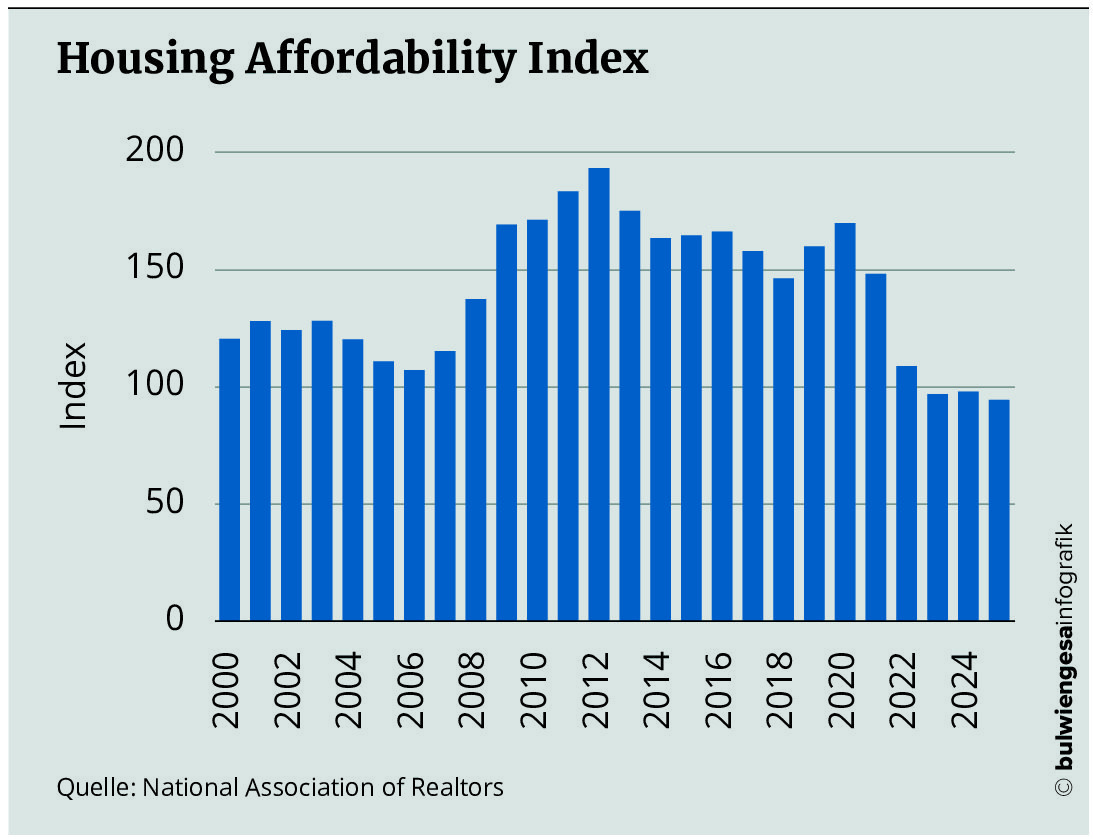

The report shows that the US economy is resilient despite geopolitical uncertainties and political upheavals. Nevertheless, access to residential property has deteriorated significantly for broad sections of the population. Increased mortgage interest rates, high real estate prices and stricter lending are leading to a structural property crisis. The median price for single-family homes is now $444,000 – an increase of over 17 percent since 2022. At the same time, monthly charges for borrowers have risen to an average of $2,326.

“The classic idea of the ‘American Dream’ of owning a home is no longer realistic for many households,” explains Felix Embacher, Head of Research & Data Science at bulwiengesa. “Demand is increasingly shifting to the rental sector – and not only out of necessity, but increasingly also for lifestyle reasons.”

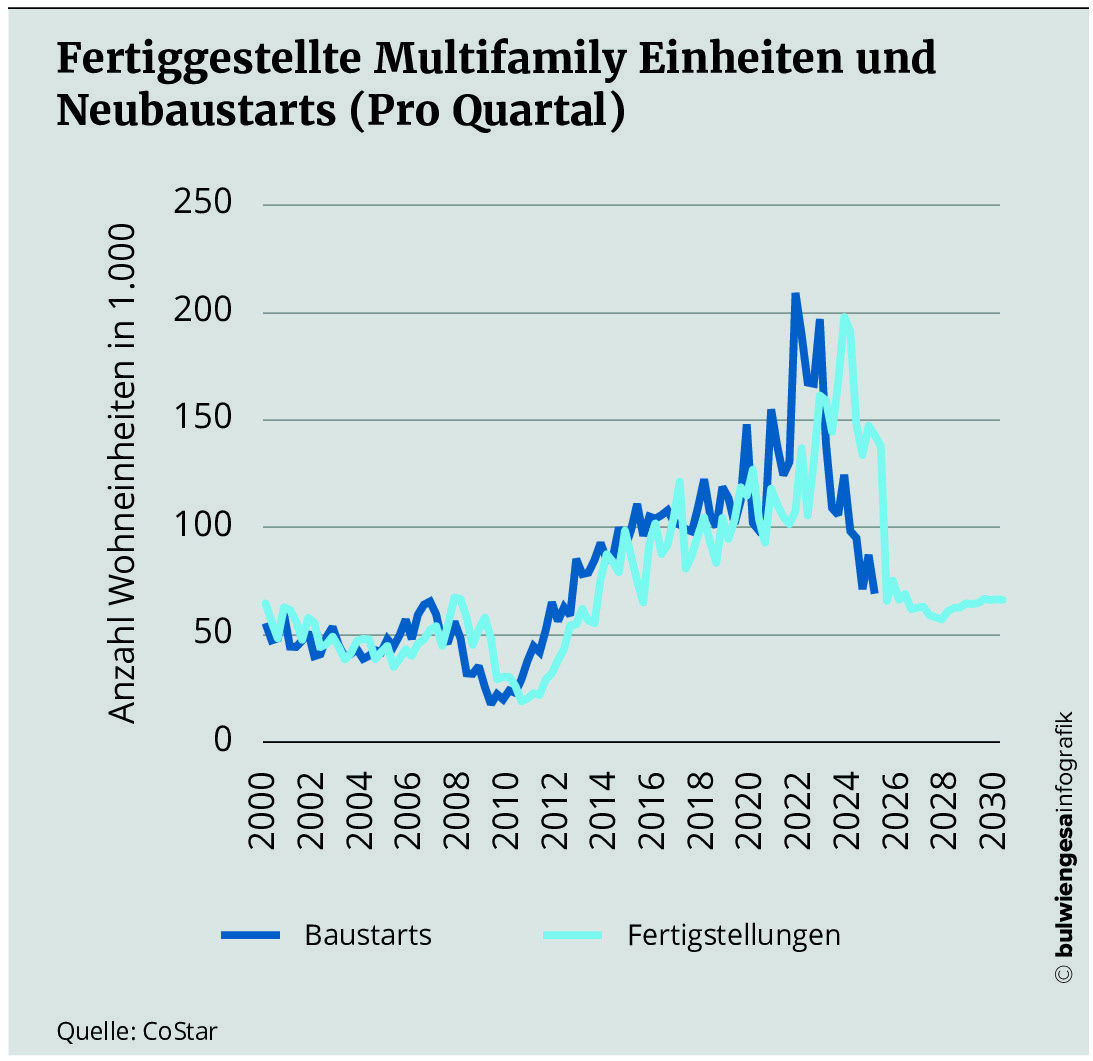

Dr. Christoph Pitschke, Managing Partner of German American Realty, adds: “Demand in the rental housing market is robust. At the same time, the supply is decreasing. The number of new project start-ups in the multifamily segment has fallen by around 67 percent since 2022. The pipeline of future completions is drying up. We currently see the market transitioning from recession to recovery. For long-term investors, there are excellent entry opportunities – especially for existing properties with stable cash flows.”

On behalf of the Cologne-based German American Realty Group, the consulting and analysis company bulwiengesa has published the US Multifamily Monitor for the 2nd half of 2025 on the current situation on the US housing market.

The report shows that the US economy is resilient despite geopolitical uncertainties and political upheavals. Nevertheless, access to residential property has deteriorated significantly for broad sections of the population. Increased mortgage interest rates, high real estate prices and stricter lending are leading to a structural property crisis. The median price for single-family homes is now $444,000 – an increase of over 17 percent since 2022. At the same time, monthly charges for borrowers have risen to an average of $2,326.

“The classic idea of the ‘American Dream’ of owning a home is no longer realistic for many households,” explains Felix Embacher, Head of Research & Data Science at bulwiengesa. “Demand is increasingly shifting to the rental sector – and not only out of necessity, but increasingly also for lifestyle reasons.”

Dr. Christoph Pitschke, Managing Partner of German American Realty, adds: “Demand in the rental housing market is robust. At the same time, the supply is decreasing. The number of new project start-ups in the multifamily segment has fallen by around 67 percent since 2022. The pipeline of future completions is drying up. We currently see the market transitioning from recession to recovery. For long-term investors, there are excellent entry opportunities – especially for existing properties with stable cash flows.”