Savills has the Berlin office letting market of the third quarter of 2025 and has come to the following conclusion:

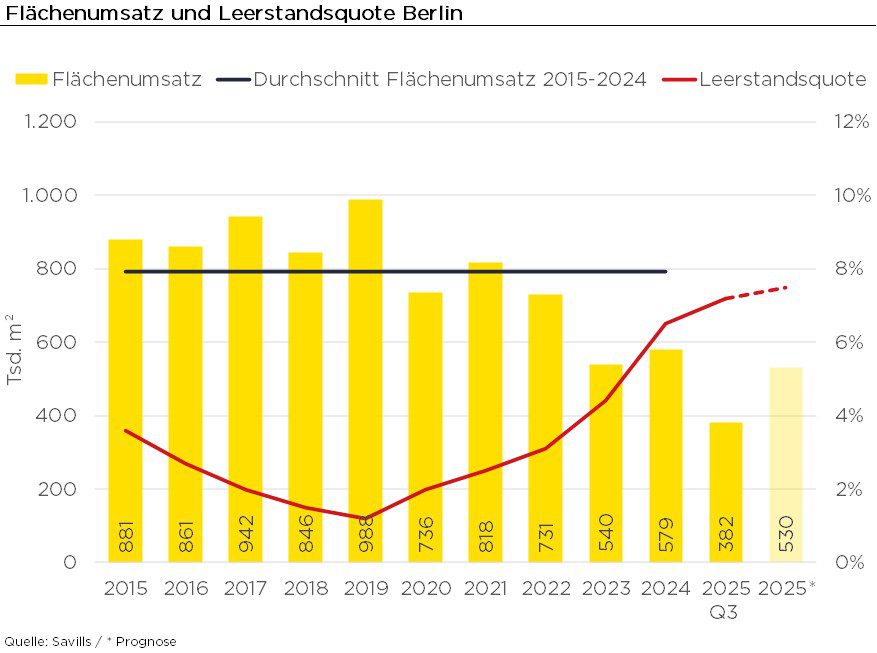

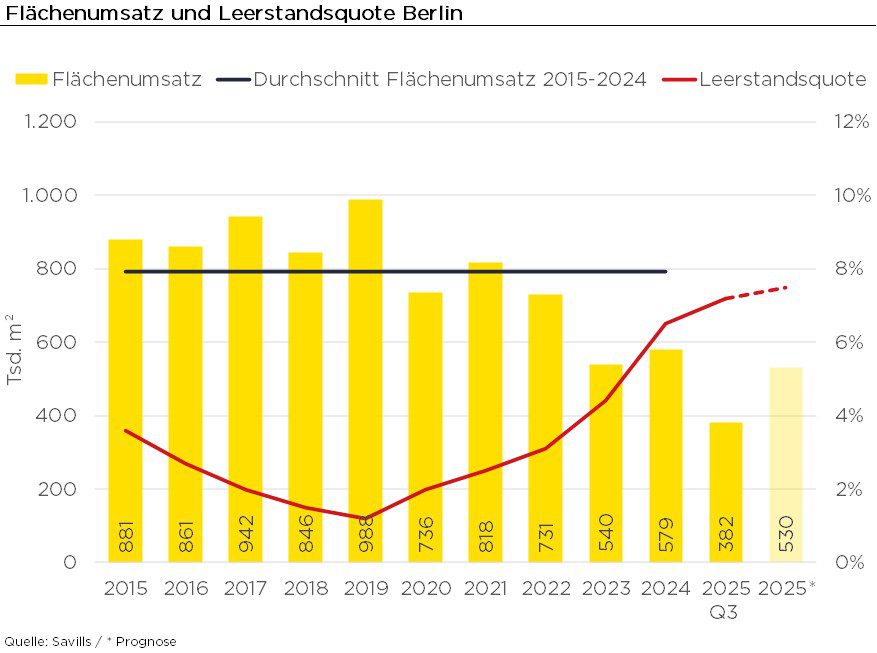

Between January and September 2025, take-up on the Berlin office letting market amounted to 382,200 m². This corresponds to a decrease of 13.5% compared to the same period last year. Compared to the ten-year average, sales were around 33.7% lower.

The vacancy rate increased by 10 basis points to 7.2% in the third quarter of 2025 compared with the previous quarter. Year-on-year, the ratio increased by 100 basis points. The prime rent reached EUR 46.00/m² and was thus on a par with the previous quarter. It increased by 2.2% year-on-year. The median rent amounted to EUR 24.05/m², a decrease of 1.8% compared to the previous quarter and a decrease of 3.8% compared to the same quarter of the previous year.

Karina Sauer, Associate Director and Teamleader Office Agency at Savills in Berlin, comments: “

We are currently seeing two very different search profiles of office users in Berlin. Small users are concentrating on modern existing space with efficient layout in central locations, while large companies are specifically requesting certified new buildings, often driven by ESG requirements. Unrenovated old stocks are increasingly falling through the cracks for many users. The vacancy rate is not only continuing to grow, it is becoming entrenched above all in peripheral B and C locations. This puts owners under pressure and leads to increasingly flexible contracts, from long rent-free periods to individual fit-outs. In the sought-after inner-city locations, however, a different picture emerges. The highest rents were achieved for small, high-quality space under 1,000 square metres over the course of the year. This is a sign that the shortage in this segment ensures a stable prime rent, even in an overall subdued market.”

Savills expects take-up for the year as a whole to be slightly below the previous year’s level. At the same time, the ongoing trend towards high-quality office space is likely to ensure that prime rents are likely to rise further in the further course of the year.