No change in prime yields, office rents continue to rise

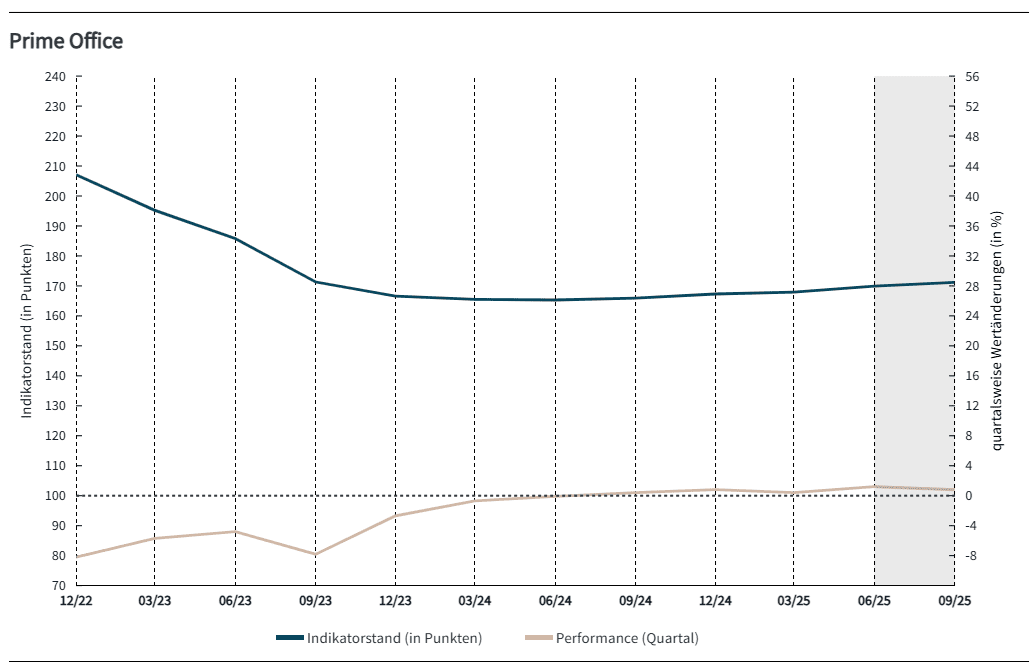

The moderate upward trend in the office property market will remain intact in the third quarter of 2025, which is reflected in the development of the Victor Prime Office office performance indicator . With an increase of 0.8 percent compared to the previous quarter, growth is somewhat weaker than in the second quarter of this year (1.2 percent), but this nevertheless confirms the positive development of the past quarters. The indicator level for the observed top locations in the German real estate strongholds of Berlin, Düsseldorf, Frankfurt, Hamburg and Munich stood at 171.2 points at the end of September 2025. All cities have a positive performance.

“The summer break is dragging on longer than expected, and there was relatively little movement on the investment market in the third quarter,” says Ralf Kemper, Head of Value and Risk Advisory at JLL Germany, commenting on the figures. After the compression of prime yields in Munich, Düsseldorf and Hamburg in the second quarter, they remained stable in the third quarter in all five real estate strongholds considered. “Impulses and data points for deriving market prices on the office property market continue to be rare. For example, the hoped-for deals of landmark properties on the market did not yet materialise in the third quarter,” Kemper continues. Nevertheless, the transaction volume on the office investment market in the five cities under consideration reached the best quarterly result of the past three years at around 1.5 billion euros. However, large deals remain in short supply, with the size category between 25 million and 75 million euros being the most liquid for the institutional part of the market. “The Hamburg investment market, where there was a lot of high-quality product in the small to medium-sized segment on the market, noticeably outperformed the markets with the big tickets. International investors are also interested in this, which is why we expect further yield compression.”

While on the debt side, the supply from banks and alternative lenders is high, raising equity, especially for large deal volumes, is challenging for investors. The processes have lengthened noticeably in all size categories over the past few years. In addition, it seems that the gap between bids and sellers’ expectations is still too large in many cases to bring more transactions to the finish line. Those who do not have to or do not want to sell will take the properties off the market again if the bidding situation is unsatisfactory.”

Demand for office space was also characterized by restraint in the third quarter. Due to the livelier first half of the year, cumulative take-up in the five metropolises after three quarters nevertheless shows a slight increase of around 1.73 million m² compared to the same period last year (1.69 million m²). Because the supply of top space in prime locations is scarce, prime rents are still rising. However, an increase in incentives can also be seen, which has a dampening effect on the development of the effective rent. In Frankfurt in particular, high-profile large-scale leases almost doubled in the first half of the year, but the strong letting impulses were not sufficient to sustainably regain investor confidence or convert it into transactions.

Düsseldorf extends gap to Frankfurt

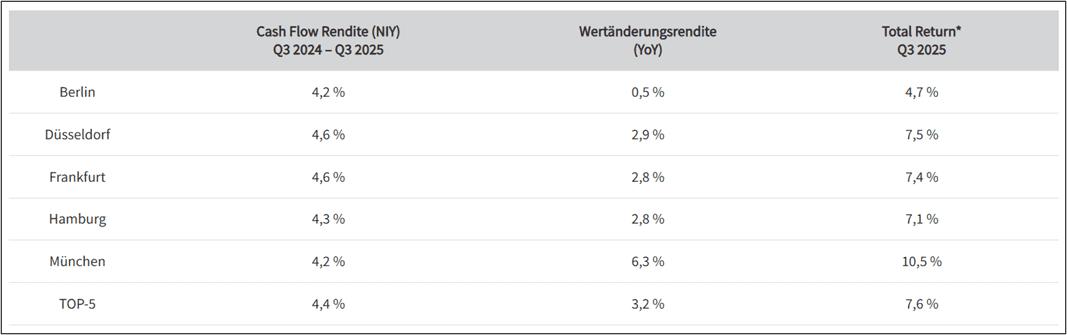

In the third quarter, the index values in all five cities showed a moderate upward movement, with prime yields stagnating in all locations and the indicator increases being attributable to varying degrees of impetus from the rental markets. The most significant growth was recorded in Düsseldorf’s banking situation, with an increase of 1.1 percent to 154.8 points. The development was driven by rising rents in the top segment, but also away from the top products. Munich’s city center follows with an increase of 0.9 percent to 193.4 points. The Bavarian metropolis benefited from the strongest increase in prime rents, thus confirming its strong market position.

In Hamburg’s prime location, the index rose by 0.8 percent to 186.4 points. The growth was mainly due to the reduction in vacancy rates in the prime segment and strong rent increases across the board, even though the prime rent remained stable compared to the previous quarter. Berlin’s premium locations and Frankfurt’s banking district share last place with quarterly growth of 0.6 percent each. The new indicator levels are thus quoted at 180.5 points in Berlin and 152 points in Frankfurt. Both locations show only minor changes in rents both at the top and across the board, and in the Main metropolis the prime rent even stagnated.

The annual performance calculated across all locations also shows a positive result of 3.2 percent in all core markets (comparison of the indicator level Q3 2025 to Q3 2024), after 2.8 percent in the previous quarter. As in the second quarter, Munich is at the top with an increase of 6.3 percent. Düsseldorf follows in second place with 2.9 percent thanks to the good quarterly performance. Frankfurt and Hamburg are close behind Düsseldorf with 2.8 percent each. Berlin is far behind in terms of annual performance with 0.5 percent due to the weak development in the first and second quarters of 2025 (minus 0.4 percent and minus 0.6 percent).

Overall, the third quarter was characterized by restraint. Many players are still waiting for clearer signals, be it from letting, fundraising or transaction activity. As long as significant drivers are missing,

A noticeable catch-up effect is not yet expected until 2026 due to the sluggishness of the market; In 2027, the volume of completions is expected to increase significantly again. “The already existing shortage of space in combination with the still low completion figures in the short term will support the price stability of high-quality existing properties. Even in the event of a further economic slowdown, top offices are therefore unlikely to lose value and rents are likely to continue to rise in the coming quarters. Even if the image of a market in ‘stand-by’ mode currently predominates, the fundamentals suggest a moderate market recovery, provided that the investment markets follow the strong impulses from the user markets,” says Kemper.