Real Blue Kapitalverwaltungs-GmbH (Real Blue), investment manager of the Drees & Sommer Group, surveyed institutional investors and asset managers about their expectations of the real estate investment markets and their planned activities. The results show that despite ongoing uncertainties, many market participants expect a revival in transaction activity and are at the same time planning concrete adjustments to their portfolios.

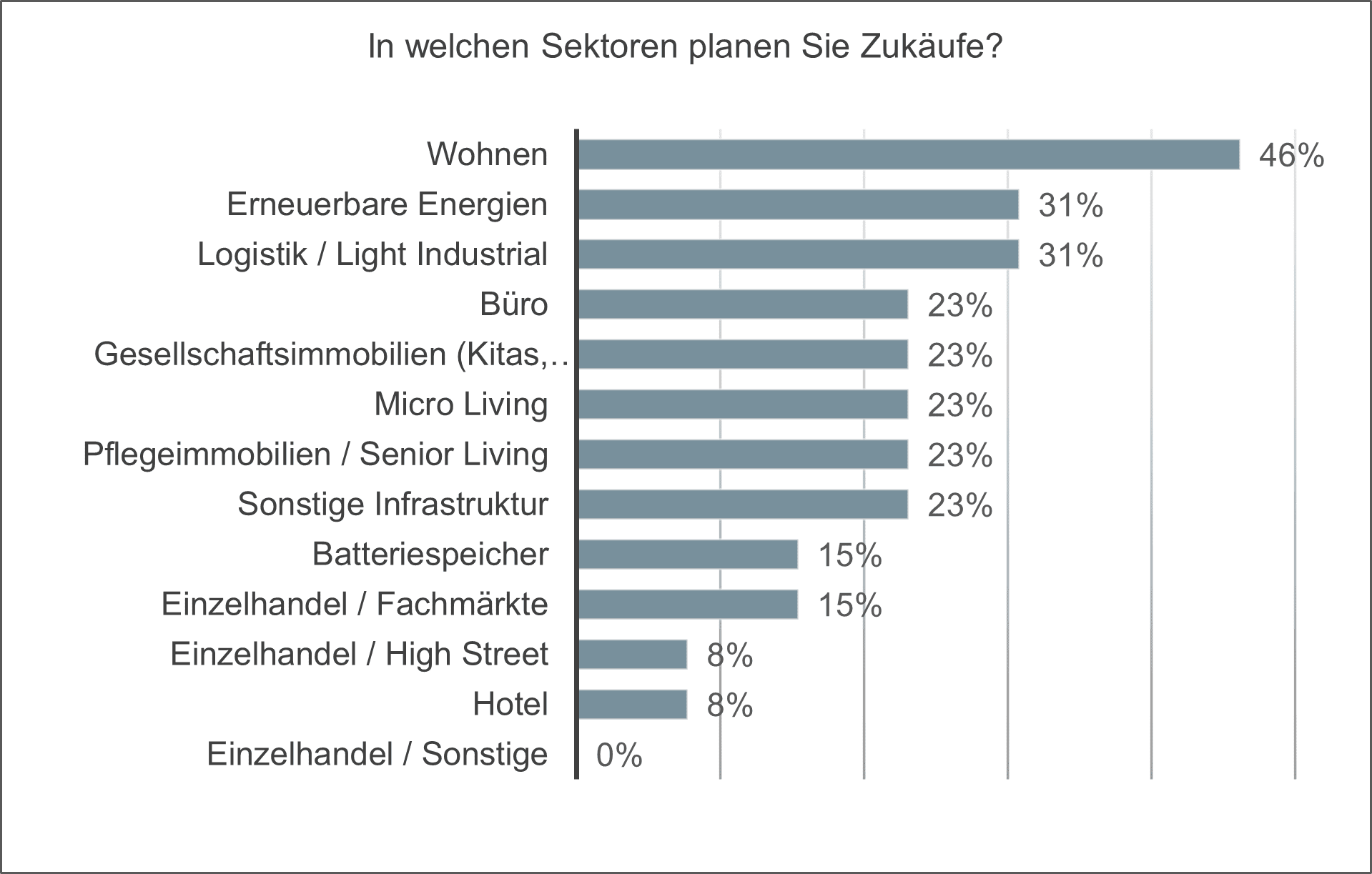

On the buyer side, the picture remains stable: 57% of participating investors intend to add new investments to their portfolios in the next six months (H1 2025: 60%). In terms of uses, residential real estate is in first place with 46%. Logistics/Light Industrial and Renewable Energies follow in second place with 31% each. There is lower demand for office properties (23%) and for socially used properties such as daycare centres or educational institutions (23%).

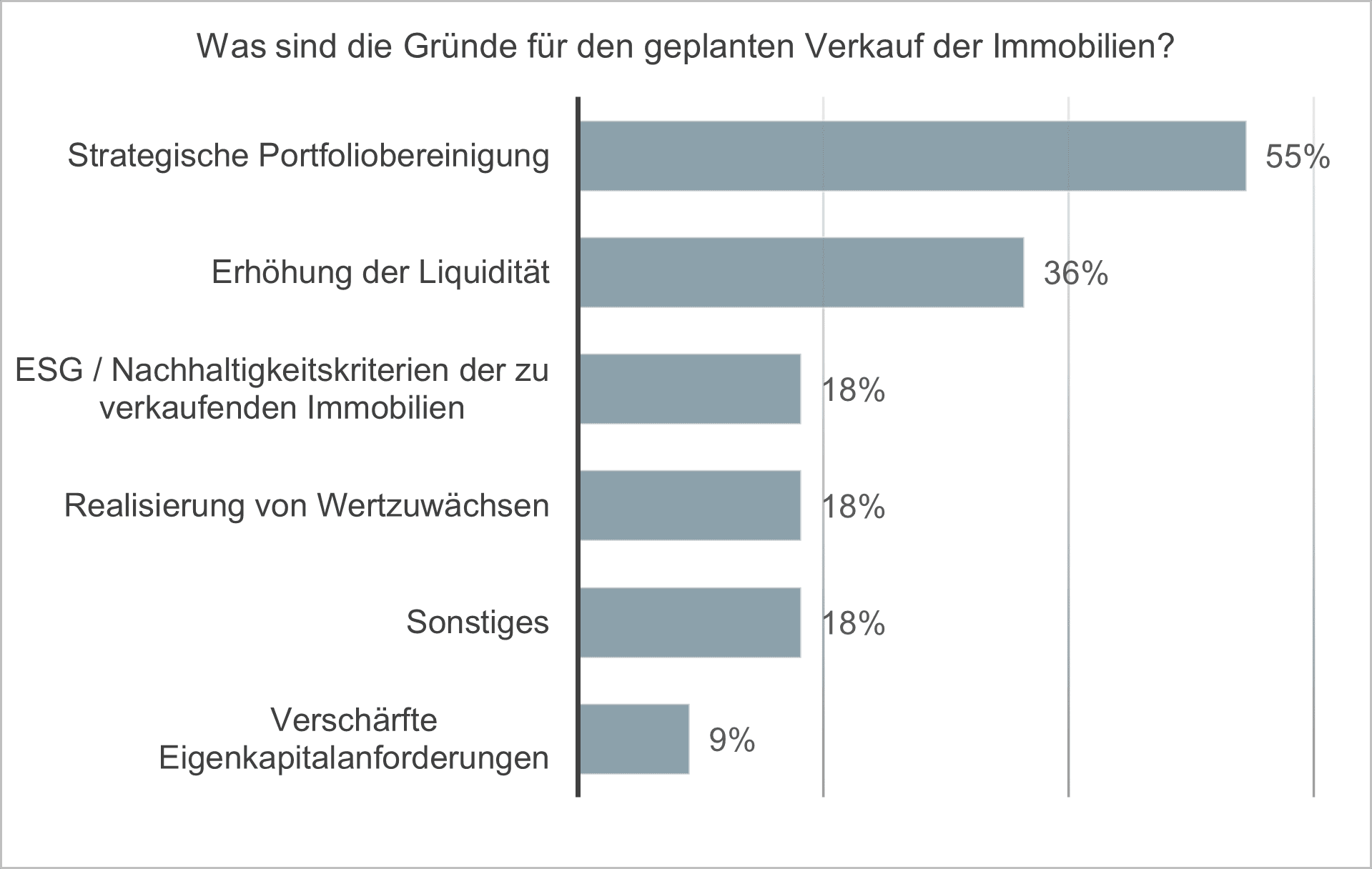

Almost half (48%) of the investors surveyed are also planning to sell real estate in the next six months. The sales decisions are mainly based on considerations of strategic portfolio adjustment (55%) and liquidity requirements (36%). In the first half of the year, 50% of those surveyed had reported sales due to liquidity protection.

“The survey results confirm that housing and logistics continue to be at the center of institutional investment strategies. Alternative assets such as renewable energies are also coming into focus, especially as investors increasingly focus on sustainable, future-proof portfolios,” says Michael Eisenmann, Managing Director of Real Blue.

Growing interest in data centers

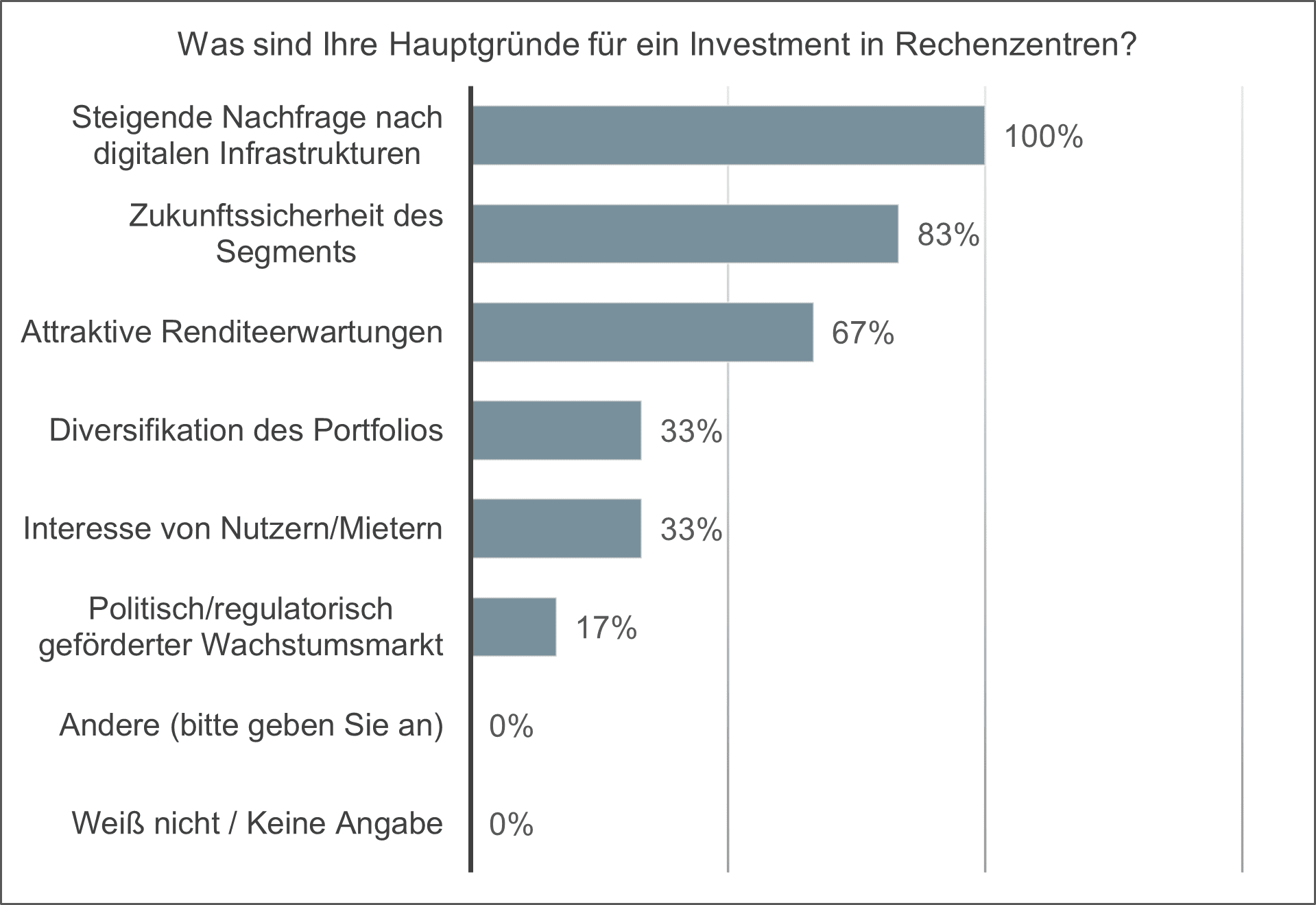

Another key finding of the survey is the growing interest in investing in data centers or digital infrastructure: 46% of the participating investors stated that they wanted to become active in this area. The main reasons for this are the increasing demand for digital infrastructure (100%), the future-proofing of the segment (83%) and the comparatively attractive return expectations (67%). In addition to a good data connection, the main location factors in the selection of properties are a reliable and low-cost energy supply (67%), low risk of natural disasters (83%) and proximity to end customers (67%).

“Digital infrastructure is playing an increasing role in the strategic portfolio allocation of institutional investors. The criteria of energy efficiency and location quality are decisive for the participating investors. However, investors often still lack the appropriate internal know-how for this asset class. Only 38% of the survey participants say they have sufficient expertise in the segment,” says Eisenmann.

To the survey

The online survey “Outlook – Real Assets” was conducted by Real Blue in the period from 28 July to 4 September 2025. 23 institutional investors and asset managers took part. The respondents cover a wide range of investment strategies and the majority manage real estate assets in the billions.