Long-term perspective: Sustainable stability in core markets, slight recovery visible

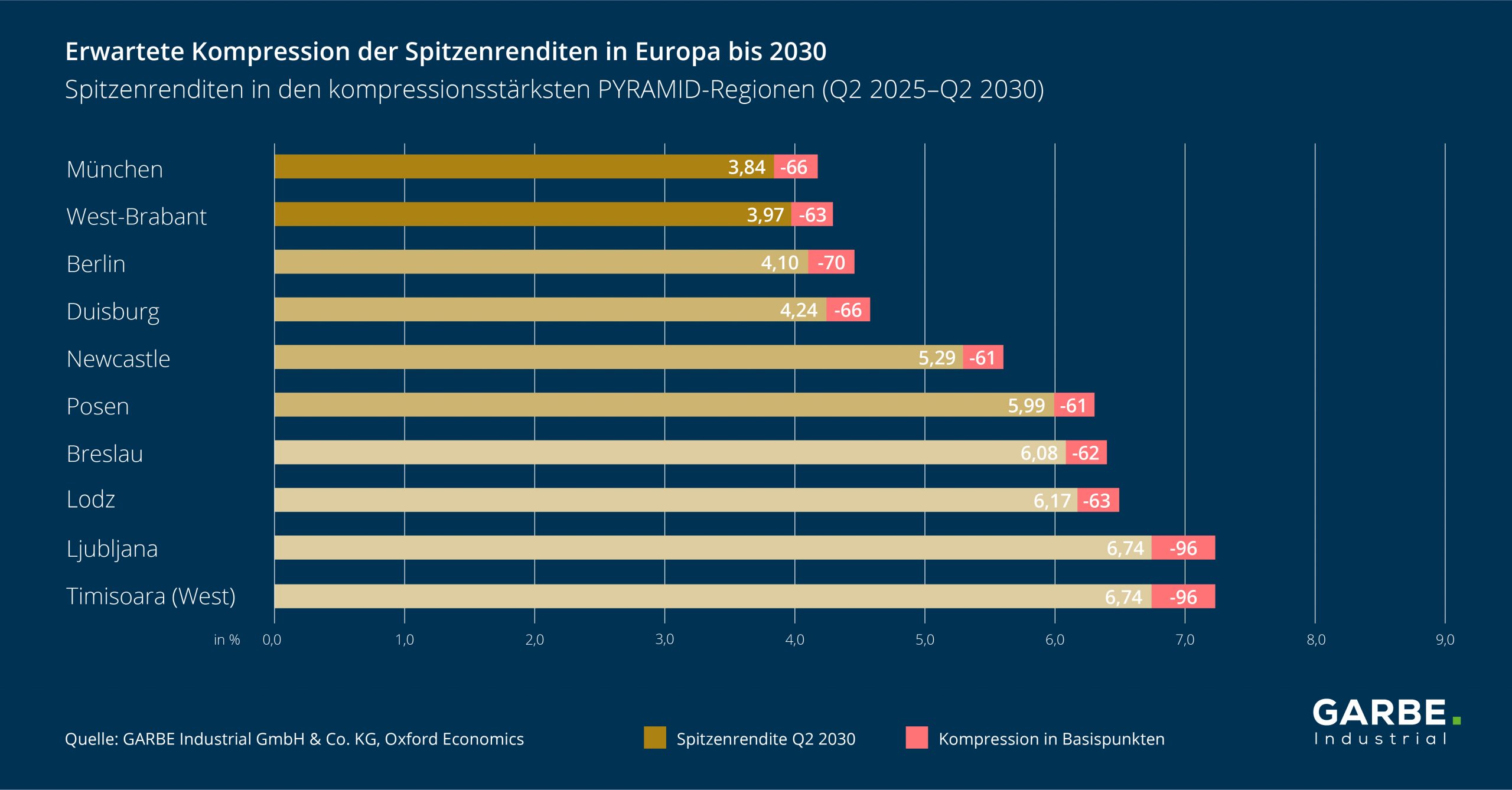

The European logistics real estate market continues to be robust. Based on 88 regions, a forecast up to the 2nd quarter of 2030 shows a gradual convergence of prime yields. On average, a slight compression of 40 basis points is expected – supported by moderate easing of interest rates, a weakening of risk aversion and the structurally high level of confidence in the logistics asset class. These are the findings of GARBE Research in its current GARBE PYRAMID MAP for the first half of 2025, an overview of prime rents and net initial yields for the 121 most important European sub-markets for logistics real estate in 25 countries. In addition, the PYRAMID contains forecast values for 88 regions, which were developed in cooperation with Oxford Economics.

Yield levels remain solid, especially in established markets such as Germany, the Netherlands and the United Kingdom, while individual regions such as Munich or West Brabant could even achieve yields below the 4.0 percent mark in the medium term.

“This development is a sign of stability and confidence,” explains Tobias Kassner, Head of Research and ESG at GARBE Industrial. “Investors are recognizing the intrinsic value of logistics real estate – despite challenging conditions, the asset class remains a reliable anchor.”

First half of 2025: High consistency, selective movements

In the first half of 2025, prime yields remained unchanged in 84 of the 121 regions surveyed. The European average fell only minimally by 3 basis points to 5.58 percent. In 36 regions, there were slight yield compressions. Spain was particularly dynamic, with Zaragoza down 30 basis points, while Madrid and Barcelona each fell 20 basis points. The German market is showing the first signs of a revival. In 16 regions, yields fell by 10 basis points each – in Munich by as much as 20 basis points. In the Netherlands, established markets such as Amsterdam/Schiphol, Tilburg, West Brabant and Venlo also saw declines of 10 basis points. In contrast, Italy and France remained stable, and the CEE regions also showed predominantly sideways movements.

Stability as a key quality feature

The current results make it clear that the European logistics real estate market is on a stable foundation after the upheavals of recent years. Logistics properties maintain their position compared to alternative asset classes, as stable or rising rents ensure intrinsic value. Institutional investors are increasingly focusing on Core+ properties with rental growth potential, while classic core products remain attractive, especially with long lease terms.

“Stability is the key feature of this market phase,” says Kassner. “Logistics real estate is proving to be one of the asset classes with the most stable value, even in difficult market phases, with a high cash flow yield at the same time.”

Detailed figures and methodological information can be found in the interactive GARBE PYRAMID MAP. The data referred to in the press release comes from the PYRAMID project.