Wüest Partner publishes new study format: Germany-wide analysis and in-depth look at 30 cities

The German housing market continues to be under pressure. This is shown by the new Housing Market Study 2025 by Wüest Partner. For the first time, the new study format combines a nationwide market analysis of supply, demand, construction activity, and rental and purchase price development up to the second quarter of 2025 with detailed evaluations of 30 regional markets – from A to D cities.

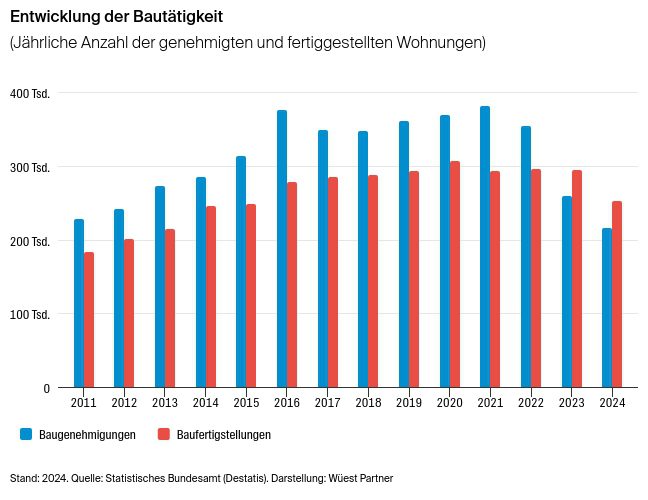

Although the first slight signs of recovery are visible in building permits, a sustainable trend reversal is not yet in sight. With around 215,000 building permits in 2024, the lowest level in over ten years was reached. In the first half of 2025, only a slight recovery has been seen so far. Especially in metropolitan regions, demand significantly exceeds supply – while in less sought-after locations, non-marketable apartments are vacant. The proportion of tenants who are dependent on affordable and adequate housing remains high.

“Our analysis shows that the housing issue increasingly also has a social dimension,” says Sophie Nieder, Senior Economic Market Analyst at Wüest Partner. “The continuing discrepancy between demand and supply is exacerbating tensions in many cities and highlights the urgent need for new impetus in housing construction.”

Scarce supply keeps price pressure high

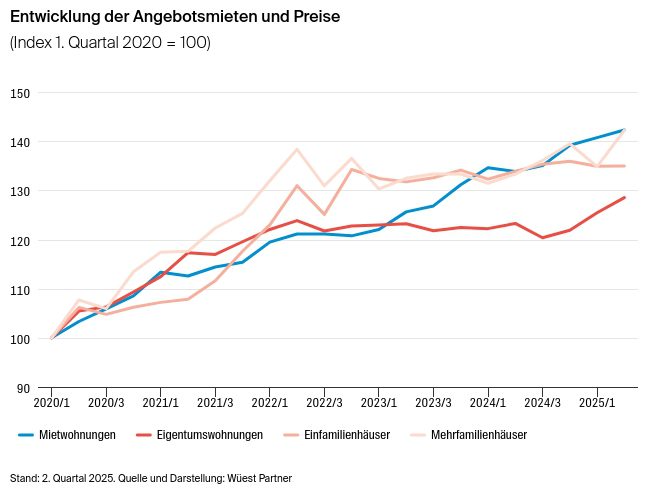

Parallel to the low level of construction activity, price pressure remains high. Asking rents and purchase prices continued to rise in some segments in the second quarter of 2025. Particularly large apartments (from 100 m²) rose noticeably in price, while smaller and medium-sized properties increased only moderately. Prices for condominiums are also rising again, while prices for single-family homes have largely stagnated. Apartment buildings have recently recorded significant price jumps, especially for large properties. The figures make it clear that supply remains scarce in many segments, so that the market situation is driving prices further up in many places.

Regional markets with an attractive risk-return profile

The detailed analysis of 30 regional housing markets by Wüest Partner shows that return and risk are strongly differentiated from region to region. Attractive investment opportunities are also visible outside the top 5 cities.

Leipzig recorded the strongest rent increases in the past five years (+9.3% p.a.), followed by Rostock, Bremen and Erfurt (+6% p.a.). Here, persistent supply bottlenecks and population growth are driving price development. Flensburg achieved the highest yield growth between 2021 and 2024 (+2 percentage points), followed by Kiel (+1.8), Bremen and Koblenz (both +1.7).

“Especially in cities with dynamic population development and at the same time a scarce supply of housing, worthwhile investment opportunities open up away from the top locations,” emphasizes Sophie Nieder.

In the current risk-return profile, Leipzig, Flensburg and Osnabrück are particularly favourable. In contrast, cities such as Chemnitz, Nuremberg and Frankfurt am Main pose higher risks, where population, purchasing power and rents are developing less dynamically.

Practical tool for investors

The Housing Market Study 2025 combines a well-founded nationwide analysis with detailed regional evaluations. A map of Germany and the risk-return profile make it easier for investors to find their way around and show opportunities and risks at a glance.

Link to the study