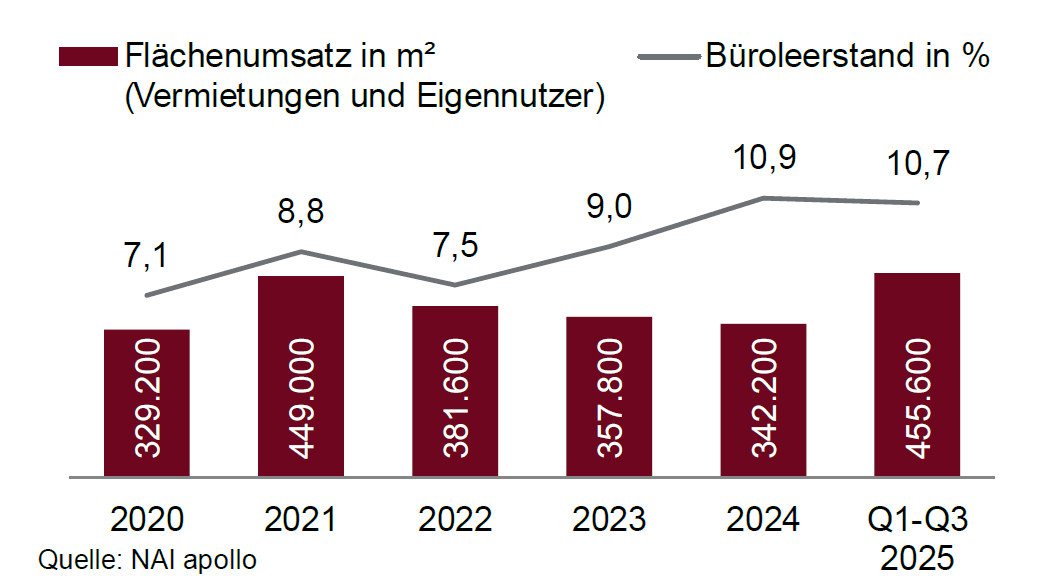

Frankfurt’s office space market, including Eschborn and Offenbach-Kaiserlei, ended the third quarter of 2025 with take-up from lettings and owner-occupiers of 111,400 square metres. According to an analysis by NAI apollo, a member of NAI Partners Germany, the past three months have fallen short of the results from the first half of 2025. But compared to the sales from 2023 and 2024, where the 100,000 square metre mark could not be reached in any quarter, this again represents a very positive result.

For the first nine months of the current year, take-up totals 455,600 square metres. The previous year’s figure was thus exceeded by 73 percent (Q1-Q3 2024: 264,000 square meters). The five- or ten-year average is also more than clearly exceeded at 76 and 44 percent, respectively. “The trend reversal on the Frankfurt office market that began at the beginning of the year has been further stabilised in the last few summer months. We do not expect this to turn away from this at the end of the year either. In particular, there are some medium-sized space applications on the market, which will be completed in the fourth quarter and should keep market activity high,” says Michael Preuße, Head of Office and Retail Letting at NAI apollo.

With regard to the general economic development, the current joint forecast of leading economic research institutes expects a slow recovery for the second half of the year and stronger economic growth for the next two years after the stagnation in the first half of 2025. “In particular, the Frankfurt office market should also be able to benefit from the predicted increase in the service sector, even if there are still some risks that are slowing down long-term momentum,” adds Dr. Konrad Kanzler, Head of Research at NAI apollo.

More than half of the turnover through large-scale leasing

“The positive market activity to date has been driven primarily by the large-scale segment, which is also confirmed in the third quarter. Deals above the 5,000 square metre mark account for almost 60 per cent of total take-up so far this year, at 263,800 square metres. Compared to the previous year, this means more than a fourfold increase. In the segment above 10,000 square metres, take-up of space has increased almost sixfold to 209,000 square metres,” explains Martin Angersbach, Director Business Development Office Germany at NAI apollo. By far the largest lettings were made by the project leases of the entire “Central Business Tower” with 73,000 square metres by Commerzbank and 32,000 square metres in the “HPQ Offices” in the “Hafenpark Quartier” by ING Germany in the first quarter. “But we were also able to record two deals above 10,000 square metres in the third quarter. The largest was the lease of around 17,400 square metres from Allianz Global Investors in the ‘Fürstenhof’ office building at Gallusanlage, which is currently undergoing extensive renovation,” adds Preuße.

Banks, financial service providers and insurance companies form the most important demand group

With a total of 163,600 square meters and a market share of 35.9 percent, “Banks, Financial Services and Insurance Companies” lead the industry comparison by a wide margin as the strongest demand group. The major financial statements of the year made a significant contribution to this. “This is followed by companies from ‘management consulting, marketing and market research’ with 51,200 square metres. Third place is secured by the ‘industrial production and manufacturing sector’ with 41,800 square metres. Above all, with the leasing of 15,000 square meters by the pharmaceutical manufacturer Sanofi in Industriepark Höchst, the ‘public sector’, which was still in third place in the summer, was overtaken,” said Kanzler.

In terms of spatial differentiation of leasing activities within the market area, the banking sub-market has the highest take-up with 114,200 square metres. This is followed by the Westend with 59,700 square metres, the Ostend-Ost with 56,000 square metres, the city centre with 34,800 square metres and the financial district West with 25,000 square metres.

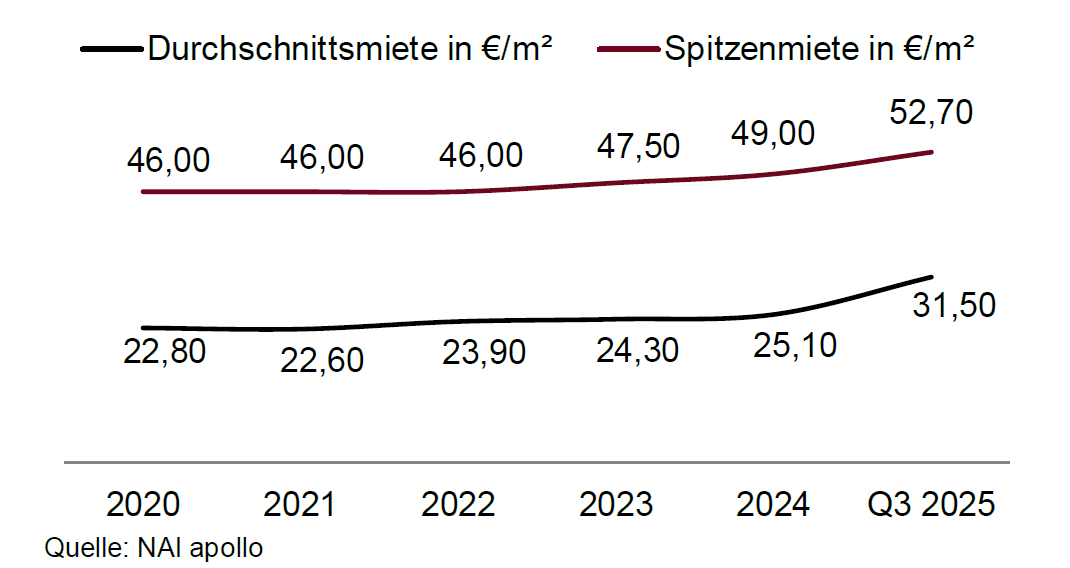

Further increase in prime and average rents

Demand for office space in central locations and, above all, for modern, high-quality space remains high despite higher rents. The share of leases in projects, new buildings and revitalisations has continued to increase and is currently around 60 per cent in the segment over 1,000 square metres (Q1-Q3 2024: 52 per cent). “At the end of the third quarter, the prime rent was quoted at 52.70 euros per square metre. This is 20 cents per square metre more than in the previous quarter and 4.70 euros per square metre more than in the previous year. The area-weighted average rent has increased by EUR 0.30 and EUR 6.90 per square metre respectively as a result of the large-scale new leases in central locations and thus now amounts to EUR 31.50 per square metre,” said Kanzler.

Vacancy rate continues to stabilize

The market-active vacancy rate remained almost stable in the course of 2025. A total of around 1.22 million square metres will be available for rent at short notice at the end of September. This equates to a vacancy rate of 10.7 percent. “This corresponds to the level from the first quarter of 2025 and represents a reduction of 0.1 percentage points compared to the middle of the year. After the rapid increase in vacancies in previous years, the now longer-lasting stabilization is to be viewed positively. However, longer-term comparisons are sobering. At the end of September 2023, the market-active vacancy rate was still 9.0 percent, 1.7 percentage points below the current value,” says Angersbach.

Due to low space disposals and space completions in the past three months, the office space stock stagnated at around 11.46 million square metres at the end of the quarter. “By the end of the year, however, the momentum here will increase. Completion of project developments and revitalisations with over 90,000 square metres of office space is expected in the final quarter of the year. As a result, a total of over 116,000 square metres of office space will have come onto the market in 2025 as a whole. According to current knowledge, completions for 2026 will be reduced to around 65,000 square metres due to postponements. Of these, around 43 percent are currently still available for renting,” says Preuße.

Active market activity expected to continue in the coming months

The omens for a continued recovery of the Frankfurt office market in the coming months are good. “Traditionally, the year-end quarter is the strongest in terms of turnover, with a few medium-sized leases in particular still expected to be concluded this year. There are also large-scale searches on the market, but in all likelihood these will no longer be included in the statistics this year. Consequently, a continuation of the market activities from the third quarter and thus a year-end result well above 550,000 square meters is expected,” Angersbach forecasts. The vacancy rate could rise slightly at the end of the year in view of the upcoming increased completion volume with space still available, but should then fall again in the coming year in the wake of a further increase in demand for space. “Demand continues to focus on modern, ESG-compliant and centrally located new-build space. As a result, there is further potential for growth, especially in prime rents,” says Preuße, summarizing the further development.