A market commentary by Jürgen Michael Schick

After two years of restraint, confidence is returning to the German residential investment market. Long-term interest rates have stabilized at a level of around 3.5 to 3.7 percent, prices have adjusted, and buyers and sellers meet on an equal footing. This creates what has been missing for a long time: a market with reliable fundamentals.

Stability instead of stagnation

The number of transactions has been increasing noticeably since 2024. Many investors who waited during the high-interest phase are returning to the market. After the price exaggerations at the end of the super cycle, there are now good buying conditions again. In the seven largest cities in Germany, the purchase price factor is now 24 times the annual net cold rent. This is nine annual rents less than at the peak in 2021/2022.A-cities have the same factor today as C-cities in 2021.

The leverage effect returns

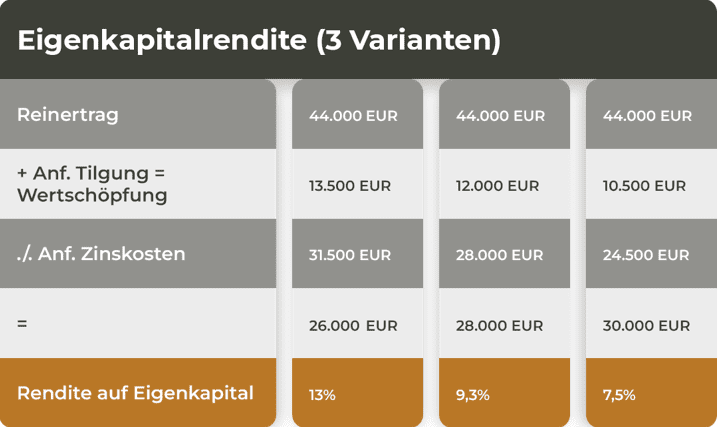

The decisive factor here is that the classic leverage effect is once again effective in residential investments. Returns on equity employed are usually in the high single-digit range, and in the double-digit range with higher debt financing.

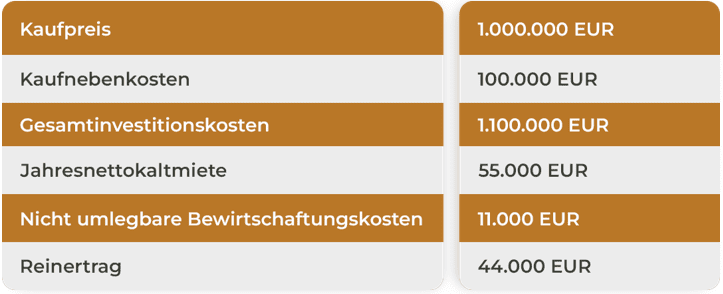

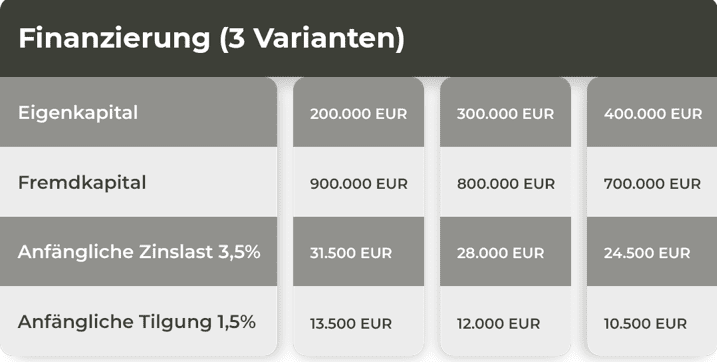

An example of an apartment building in a B-town for a purchase price of EUR 1,000,000 and an annual net rent of EUR 55,000 (factor of 18.2) shows it clearly:

In the calculation example mentioned above, the return on equity employed is 13% for about 18.2% equity, and the return on equity is 9.3% for around 27.3% equity.

Possible increases in value from rising rental income are not taken into account here.

Bonds or real estate? A question of perspective

It is often argued that investors can also invest their capital in bonds – virtually “risk-free” with a return of four percent. This is only true at first glance. This is because bonds do not offer any real increase in value, are at risk of inflation and have to be reinvested at the end of the term, usually at lower interest rates. Residential real estate, on the other hand, combines current cash flow with net asset value, inflation protection and repayment effect.

Berlin remains the largest market in Germany

Berlin is an example of the stabilisation in the residential investment market. With a share of 24% of the nationwide transaction volume (50 largest cities in Germany), the capital Berlin remains the pacesetter in the residential investment market. Munich’s market share is 9%, Hamburg accounts for 6%.

Prices in Berlin are moving sideways, slightly upwards in good locations. Multi-family houses are quoted at an average of 2,200 euros per square metre, while residential and commercial buildings recently rose by around eleven percent to 2,315 euros. Buyers will again find reliable values, sellers realistic prices. This means that Berlin is once again the reference point for the entire German market.

What’s next: A market with prospects

The German residential investment market is an opportunity market. The demand for housing continues to rise in the big cities, in the surrounding areas of the metropolises, in regional centres and university towns. The supply due to the faltering new building is not keeping up. With long-term financing, the multifamily housing market offers numerous buying opportunities for investors.