Balance Sheet Q1-Q3 2025 of DIP – Deutsche Immobilien-Partner

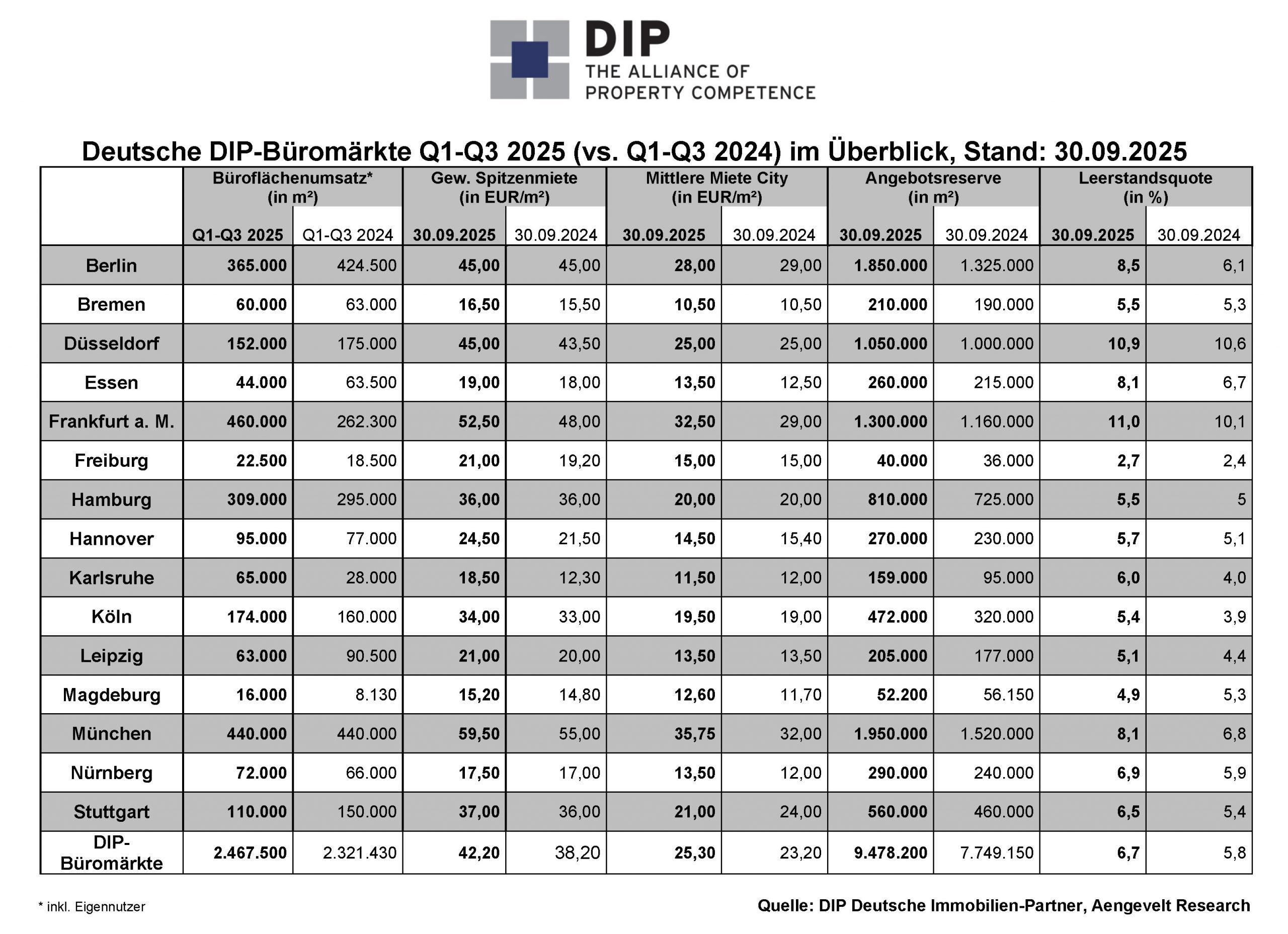

With the continuous and comparative analysis of 15 German office markets (Berlin, Bremen, Düsseldorf, Essen, Frankfurt am Main, Freiburg, Hamburg, Hanover, Karlsruhe, Cologne, Leipzig, Magdeburg, Munich, Nuremberg and Stuttgart), DIP – Deutsche Immobilien-Partner enables insightful cross-sectional comparisons between the markets in northern and southern or western and eastern Germany and between cities of different market sizes.

The analyses by DIP – Deutsche Immobilien-Partner show that take-up is on the upswing again in most office locations. Overall, a moderate increase can be observed compared to the same period in 2024:

- Total take-up (including owner-occupiers) amounted to around 2.47 million m² in the first three quarters of 2025. This result represents an increase of around 6% compared to the same period last year (Q1-Q3 2024: approx. 2.32 million m²). The long-term average (Ø Q1-Q3 2015-2024: 2.84 million m²) was missed by around 13%.

- The supply reserve in the DIP markets increased by around 1.73 million m² or around 22% within one year to currently around 9.48 million m² (end of Q3 2024: 7.75 million m²). The vacancy rate rose from 5.8% in the third quarter of 2024 to 6.7% now.

- Regardless of the economic challenges, the weighted prime rent in the DIP office markets increased by around €4.00/m² (+10%) to around €42.20/m² within one year.

DIP office markets: Turnover momentum is increasing.

Even though office space take-up in the 15 German DIP office markets increased by around 6% to around 2.47 million m² compared to the same period last year (Q1-Q3 2024: approx. 2.32 million m²), the development was not positive in all DIP office markets.

- Despite the current difficult situation, Karlsruhe recorded a marked increase in turnover of around 132%. Magdeburg also recorded significant growth of +97%, while Frankfurt am Main achieved an increase of around 75%. Further increases were recorded in Hanover (+23%), Freiburg (+22%), Nuremberg and Cologne (+9% each) and Hamburg (+5%).

- Of the Big Seven locations, Stuttgart (-27%), Berlin (-14%) and Düsseldorf (-13%) suffered a drop in sales.

- Declines in take-up can also be observed for the other medium-sized DIP markets: While take-up in Essen (-31%) and Leipzig (-30%) fell markedly, the percentage decline in Bremen (-5%) was moderate.

- Munich has recorded no change compared to the previous year.

“Big Seven” with increased sales.

- The “Big Seven” (Berlin, Düsseldorf, Frankfurt/M., Hamburg, Cologne, Munich, Stuttgart) accounted for a total of around 2.01 million m² of office space. This represents an increase of around 5% compared to the same period last year (Q1-Q3 2024: 1.91 million m²). As in the previous year, the share of total DIP office space take-up was approx. 82 %.

- Frankfurt am Main is the take-up winner with around 460,000 m² (Q1–Q3 2024: 262,300 m²), ahead of Munich, which, as in the previous year, achieved office space take-up of around 440,000 m² and thus still took first place in 2024. Last year’s runner-up Berlin, which was second last year, is once again showing a downward trend: After slipping from first to second place in the previous year, the capital has now fallen further to third place with around 365,000 m² (Q1–Q3 2024: 424,500 m²), followed by Hamburg with around 309,000 m² (Q1–Q3 2024: 295,000 m²).

- This is followed by Cologne with around 174,000 m² (Q1-Q3 2024: 160,000 m²), Düsseldorf with around 152,000 m² (Q1-Q3 2024: 175,000 m²) and Stuttgart with around 110,000 m² (Q1-Q3 2024: 150,000 m²).

Growing sales in the other DIP office locations.

- The remaining 8 DIP office centres (Bremen, Essen, Freiburg, Hanover, Karlsruhe, Leipzig, Magdeburg and Nuremberg) achieved a total take-up of 437,500 m² in the first three quarters of 2025. Compared to the previous year, office take-up increased, even if it was only an increase of around 7% (Q1-Q3 2024: 414,630 m²). This means that their share of the total turnover recognised by DIP is stable at approx. 18 %

- The results in the cities surveyed were very heterogeneous: On the one hand, significant increases in take-up were recorded in Karlsruhe with around 65,000 m² (Q1-Q3 2024: 28,000 m²) and in Magdeburg with around 16,000 m² (Q1-Q3 2024: 8,130 m²). Moderate increases in take-up were recorded in Hanover with 95,000 m² (Q1-Q3 2024: 77,000), Freiburg with 22,500 m² (Q1-Q3 2024: 18,500 m²) and Nuremberg with 72,000 m² (Q ́1-Q3 2024: 66,000 m²). On the other hand, market activity lost momentum in Leipzig at around 63,000 m² (Q1-Q3 2024: 90,500 m²), in Essen at around 44,000 m² (Q1-Q3 2024: 63,500 m²) and in Bremen at 60,000 m² (Q1-Q3 2024: 63,000 m²).

Significantly increasing office space vacancies.

- Within one year, the total volume of office space available at short notice in the 15 DIP locations increased by 1.73 million m² (+22%) within one year, from around 7.75 million m² to currently around 9.48 million m². Accordingly, the average vacancy rate in the DIP office markets rose from around 5.8% to around 6.7%.

- There are similar developments in the individual markets: The “Big Seven” recorded a significant expansion of the supply reserve over the course of the year. The other eight DIP office centers show an almost identical picture: In Bremen, Essen, Freiburg, Hanover, Karlsruhe, Leipzig, and Nuremberg, the supply reserve increased. Only in Magdeburg did it decline moderately again.

Rent level rises moderately.

- Notwithstanding the increase in available office space, the weighted prime rent in the 15 German DIP office markets analysed rose by around 10% or €4.00/m² to €42.20/m² within one year.

Above all, the increased prime rents in Karlsruhe (€18.50/m² = +50%) and Hanover (€24.50/m² = +14%) should be mentioned here. At €59.50/m² (+8%), Munich once again occupies the top spot as the rental price leader, ahead of Frankfurt at €52.50/m² (+9%), followed by Berlin and Düsseldorf at €45.00/m² each. - The median rent level for office space in city locations also rose by around 9.1% or €2.10/m² from around €23.20/m² to around €25.30/m².