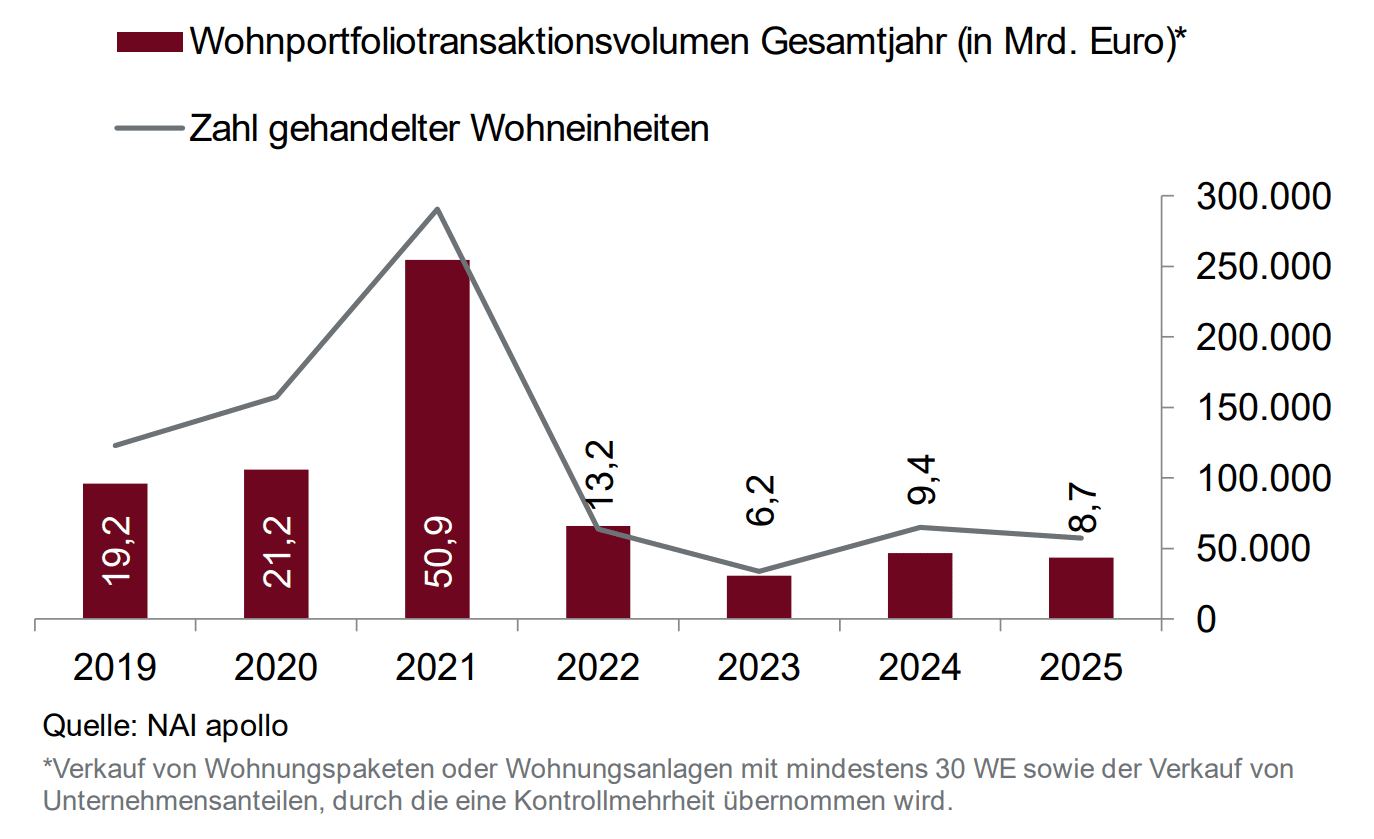

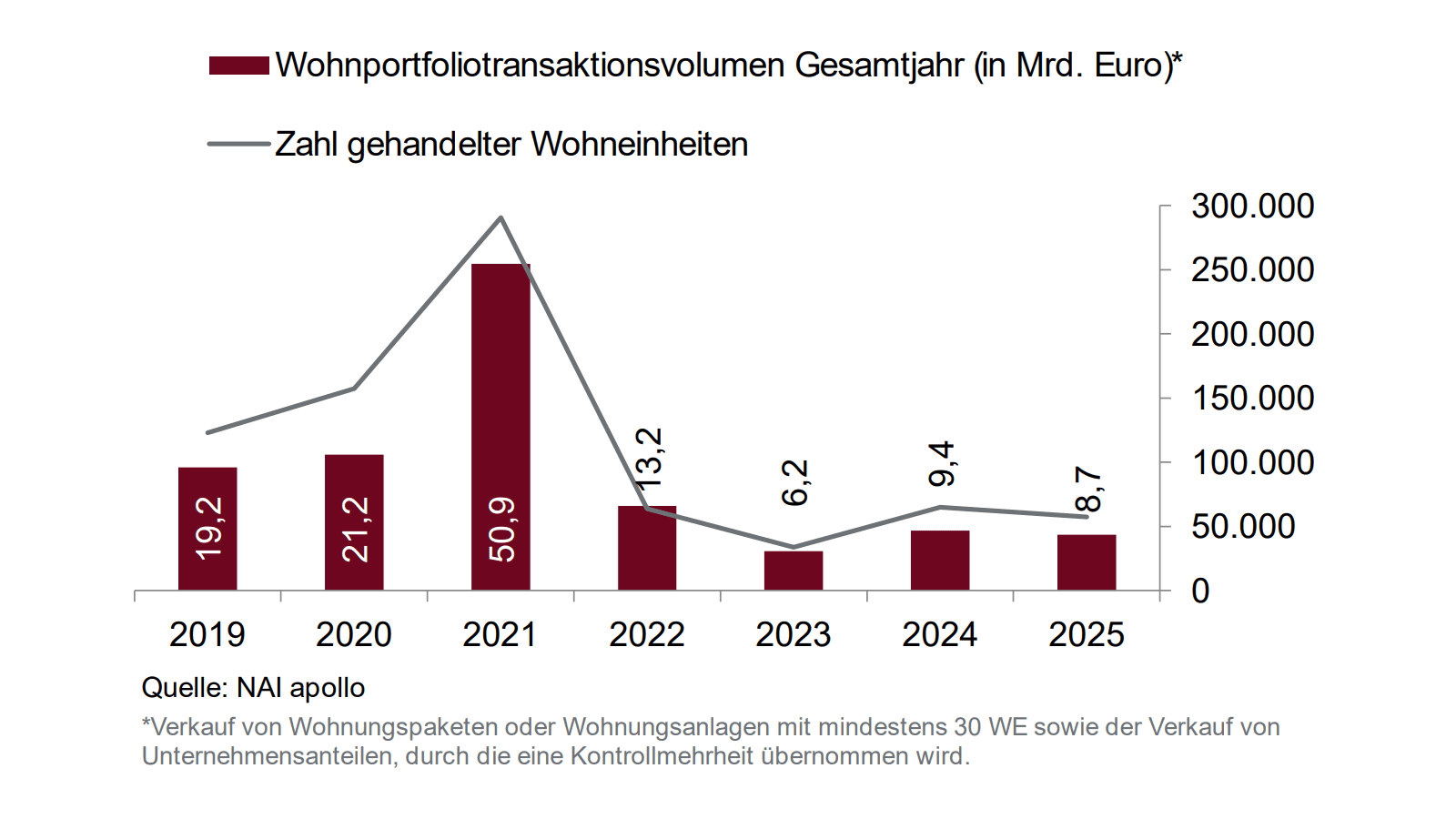

According to the latest analysis by NAI apollo, a member of NAI Partners Germany, market activity in the German transaction market for residential portfolios (30 residential units or more) gained momentum towards the end of the year. In the past three months, transactions totalling EUR 2.4 billion were registered, the highest quarterly result was recorded. Previously, the volume amounted to EUR 2.3 billion in the first quarter and around EUR 2.0 billion each in the second and third quarters of 2025. Over the course of the year, residential portfolios worth EUR 8.7 billion and around 57,500 units were traded. Compared to the previous year, this represents losses of 6.9 percent (2024: 9.4 billion euros with 65,000 units). This was mainly due to a decline in large-volume trades and thus significantly lower activity in the segment above EUR 100 million. At the same time, thanks to a strong increase in revenue from medium-sized portfolio deals, the annual result exceeded the transaction volume of 2023 (EUR 6.2 billion) by around 40.0 percent. “Despite a continuing challenging economic environment and ongoing geopolitical uncertainties, residential real estate has once again proven to be a comparatively resilient asset class, even if the residential portfolio transaction market is under noticeable pressure. Demand is currently being driven by domestic institutional investors. At the same time, international investors and especially private investors as well as private equity funds and opportunity funds are noticeably expanding their investment focus in Germany,” says Dr. Marcel Crommen, Managing Director of NAI apollo, summarizing the developments of the last four quarters. “The focus of investor interest was on medium-sized portfolios in metropolitan regions, supplemented by existing properties with manage-to-green strategies and new-build properties with a high proportion of subsidised housing. Large-volume transactions over EUR 500 million played a subordinate role in 2025 – similar to 2023 and in contrast to 2024,” adds Dr. Konrad Kanzler, Head of Research at NAI apollo.

Medium-priced cluster grows significantly

The performance of the mid-priced segments of EUR 10 million to EUR 100 million improved significantly in 2025. These price ranges account for a market share of 59.3 percent or 5.2 billion euros. The category from 25 to 50 million euros developed particularly dynamically – with its sales almost doubling compared to the previous year and the second-highest market share among the size classes of 22.0 percent. Likewise, the category of 50 to 100 million euros recorded an above-average year-on-year increase in sales of 78.5 percent. “In contrast, the large-volume segments above EUR 100 million showed sharp declines. With a total volume of only 3.1 billion euros, this was 46.4 percent below the previous year’s figure in 2025. With the sale of around 8,000 residential and commercial units from the open-ended real estate fund UniImmo: Wohnen ZBI in the first quarter of 2025, the largest and only transaction of the year above the EUR 500 million mark falls into this category. Despite sales losses of 31.1 percent, the segment between 100 and 500 million euros represents the largest market share with 27.4 percent. A comparatively moderate decline of 5.2 percent was recorded in the price category below EUR 10 million, which reached a total volume of EUR 408.3 million,” says Stefan Mergen, Managing Partner of apollo valuation & research GmbH.

Open-ended real estate and special funds are the strongest group in the investor ranking

Open-ended real estate and special funds have significantly reduced their acquisition activities (-24.3 percent compared to 2024) and at the same time noticeably expanded their sales activities (+129.4 percent compared to 2024). Nevertheless, with 1.7 billion euros and a market share of 19.3 percent, they continue to represent the strongest group of buyers. On the seller side, they rank second behind project developers and property developers (3.4 billion euros, -6.4 percent) with disposals amounting to 1.8 billion euros. “The importance of private investors and family offices has increased in the last months of the year, mainly as a result of acquisitions by large private investors. With a volume of 1.4 billion euros, they achieve a market share of 16.0 percent. This secures them second place in the investor ranking,” said Kanzler. “International buyers who have so far focused primarily on value-add and opportunity strategies are now expanding their activities to the core segment. Their acquisition volume amounts to EUR 3.06 billion, which is 21.9 percent higher than the previous year’s figure. As a result, domestic investors have lost market share. However, with 64.9 percent or 5.65 billion euros, Germany remains the most important buyer nation on the domestic market,” explains Mergen.

Despite decline in revenue, share of project developments remains stable

Trading in project developments has declined as a result of the difficult conditions and the resulting shortage of supply. In the last three months, the transaction volume of forward deals has decreased significantly from EUR 993 million in the third quarter to EUR 594 million. The full-year volume for 2025 amounts to 2.7 billion euros, which is 6.9 percent below the previous year’s figure. This corresponds to a market share of 30.8 percent (2024: 30.9 percent). “The shortage of supply remains one of the central issues on the market: declining new construction activity meets continued high demand. At the same time, older portfolios are increasingly on the sales lists, as comprehensive energy-efficient renovations are often considered difficult to implement economically. Accordingly, the focus is increasingly on new buildings in sustainable, mixed-use districts as well as on serial and modular construction methods in subsidised housing. In this context, the planned building type E could gain relevance. In this way, lower construction and planning costs would make developments in secondary locations and in price-controlled rental housing construction more economically attractive,” Kanzler emphasises.

Cautiously positive market outlook with slight increase in transaction volume below previous high cycles

“Overall, the German real estate industry is in a phase of structural restructuring, characterised by higher financing costs and regulatory requirements. However, the current price level in combination with rising rents opens up selective entry opportunities, which have recently been increasingly seized by foreign investors. For 2026, we expect a further revival of the transaction market at a moderate level below previous high cycles,” says Crommen. “In the residential portfolio transaction market, the willingness to sell is increasing. Valuation adjustments have largely been made and refinancing pressure is increasing. Portfolio and platform transactions in the existing segment are gaining in importance. Purchase prices in major cities are likely to develop sideways to slightly positively, while at the same time the investment focus is shifting more strongly towards cash flow stability and affordable residential products. Regionally, a broader spread to economically strong locations in North Rhine-Westphalia and Bavaria can be observed, while A-cities and their surrounding areas remain highly competitive,” says Mergen. “Overall, the gradual normalisation of the residential portfolio transaction market is continuing. Our outlook is cautiously optimistic. Larger portfolio deals will once again become the focus of market activity. Within the core segment, the importance of forward deals is increasing, especially in subsidized and price-controlled residential construction. For 2026, we expect an investment volume of less than 10 billion euros and thus a level roughly at the level of 2024 at 9.4 billion euros,” Kanzler predicts.