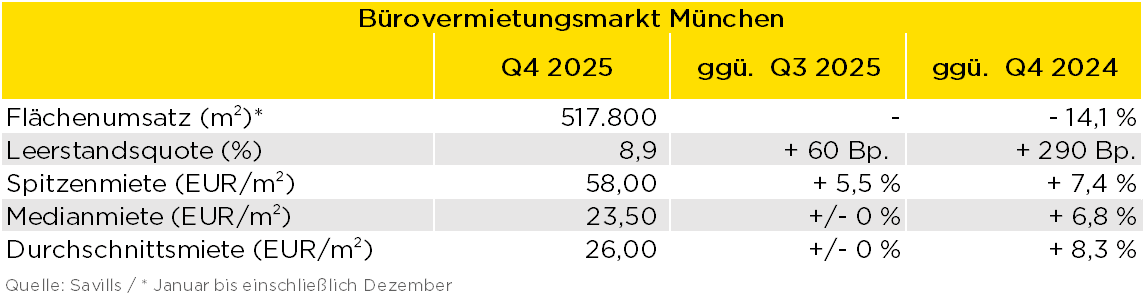

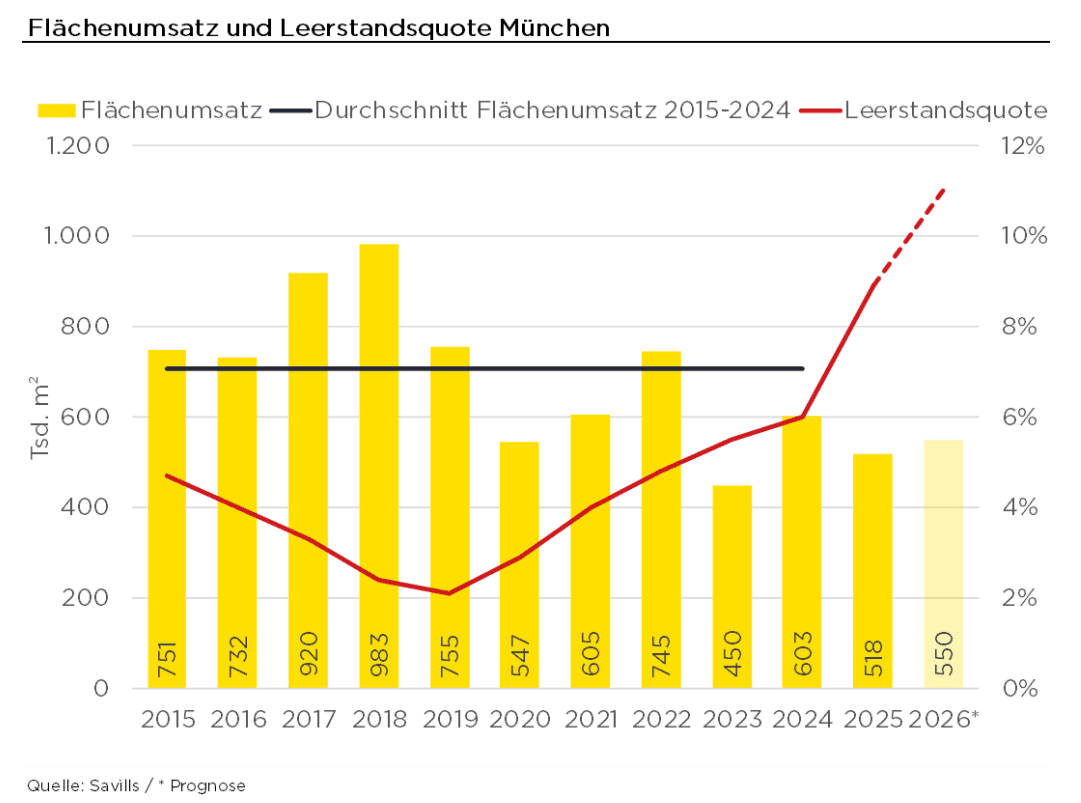

In 2025, take-up on the Munich office letting market amounted to 517,800 m². This corresponds to a decrease of 14.1% compared to the previous year. Compared to the ten-year average, sales were around 27% lower.

The vacancy rate increased by 60 basis points to 8.9% in the 4th quarter of 2025 compared with the previous quarter. Year-on-year, the ratio increased by 290 basis points. The prime rent reached EUR 58.00/m² and was thus 5.5% higher than in the previous quarter. On a year-on-year basis, it increased by 7.4%. The median rent amounted to EUR 23.50/m² and remained stable compared to the previous quarter. Compared to the previous year, an increase of 6.8% was recorded.

Alexander Meyer, Director and Head of Munich Office at Savills, reports: “At the end of 2025, it is clear in Munich how selective office users have become. Within the Mittlerer Ring, especially within the Altstadtring and in the Werksviertel, modern, well-connected and ESG-compliant space remains scarce and is absorbed at prime rents. At the same time, the choice for users outside these zones is growing, reinforced by additional subletting offers. In most cases, only locations with very good connections and well thought-out concepts that offer a clear range of services can be convincing there. Landlords in existing buildings are reacting to increasing competition as a result of rising total vacancies in a two-pronged way. Those who do not invest work more with expansion cost subsidies, incentives and flexible terms. Those who reposition create a product that can step in as an alternative as soon as the last new building space has been allocated. This could pay off in 2026/27, because new construction projects are hesitant to comply due to high pre-letting requirements. This supply logic explains why prime rents continue to rise, even though the vacancy rate is rising slightly.”

Savills expects take-up in 2026 to be slightly above the previous year’s level. At the same time, the ongoing trend towards high-quality office space is likely to lead to rising prime rents.

Additional graphs and data can be found in our online dashboard on the top 6 office markets.