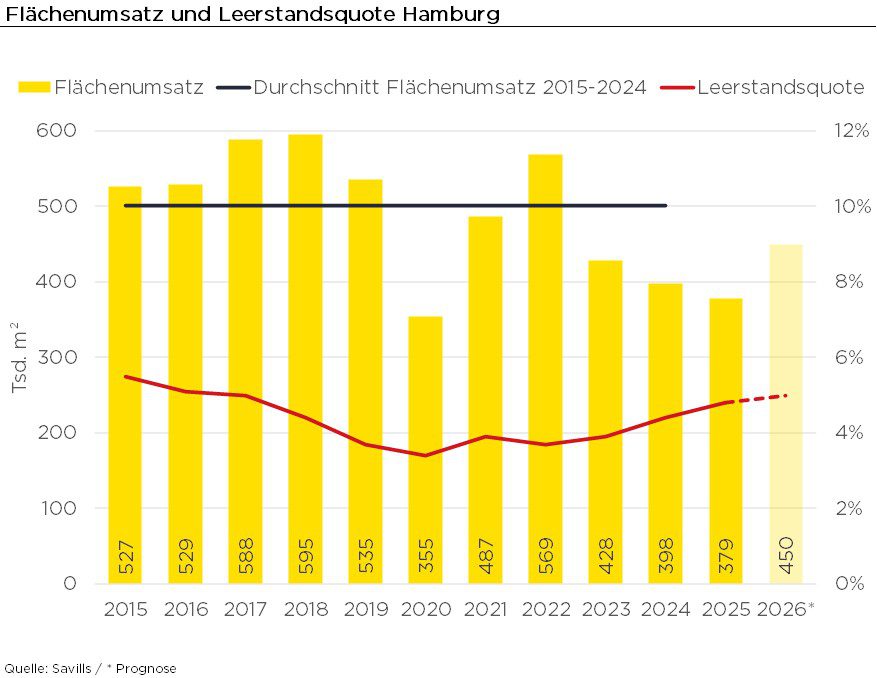

In 2025, take-up on the Hamburg office rental market amounted to 378,600 m². This corresponds to a decrease of 4.8% compared to the previous year. Compared to the ten-year average, however, sales were around 24% lower.

The vacancy rate remained constant at 4.8% in the 4th quarter of 2025 compared with the previous quarter. Year-on-year, the ratio increased by 40 basis points. The prime rent was 35.50 euros/m² and recorded an increase of 1.4% compared to the previous quarter. In a year-on-year comparison, it remained stable. At EUR 20.00/m², the median rent was unchanged quarter-on-quarter, but recorded a decline of 4.8% compared to the same quarter of the previous year.

Matthias Huss, Director and Head of Hamburg Office at Savills, comments: “Hamburg is currently a market with a very small space buffer and that is exactly what is shaping the dynamic. This is because modern space is still scarce in the City and HafenCity submarkets, where vacancy rates are sometimes below three percent, which is well below the average for all Hamburg submarkets. The bottleneck in new construction is caused by a pre-letting dilemma: banks only finance projects with a high level of pre-letting, and at the same time many users are more cautious about early commitments after the insolvency experience. This leads to fewer projects starting. Projects under construction with foreseeable completion, on the other hand, can be rented out well and are therefore already very far in advance. The pre-letting rate for 2026 is over 90 percent. As long as there is little in the short term, the vacancy rate is likely to rise only slightly and the prime rent will continue to rise.”

Savills expects take-up in 2026 to be above the previous year’s level, which is likely to approach the long-term average. At the same time, the continued focus on high-quality office space with limited supply is likely to lead to a slight increase in prime rents by the end of 2026.

Supplemental graphs and data can be found in the Savills online dashboard of the top 6 office markets