Vacancy rate stabilizes, prime rent is on the verge of a jump

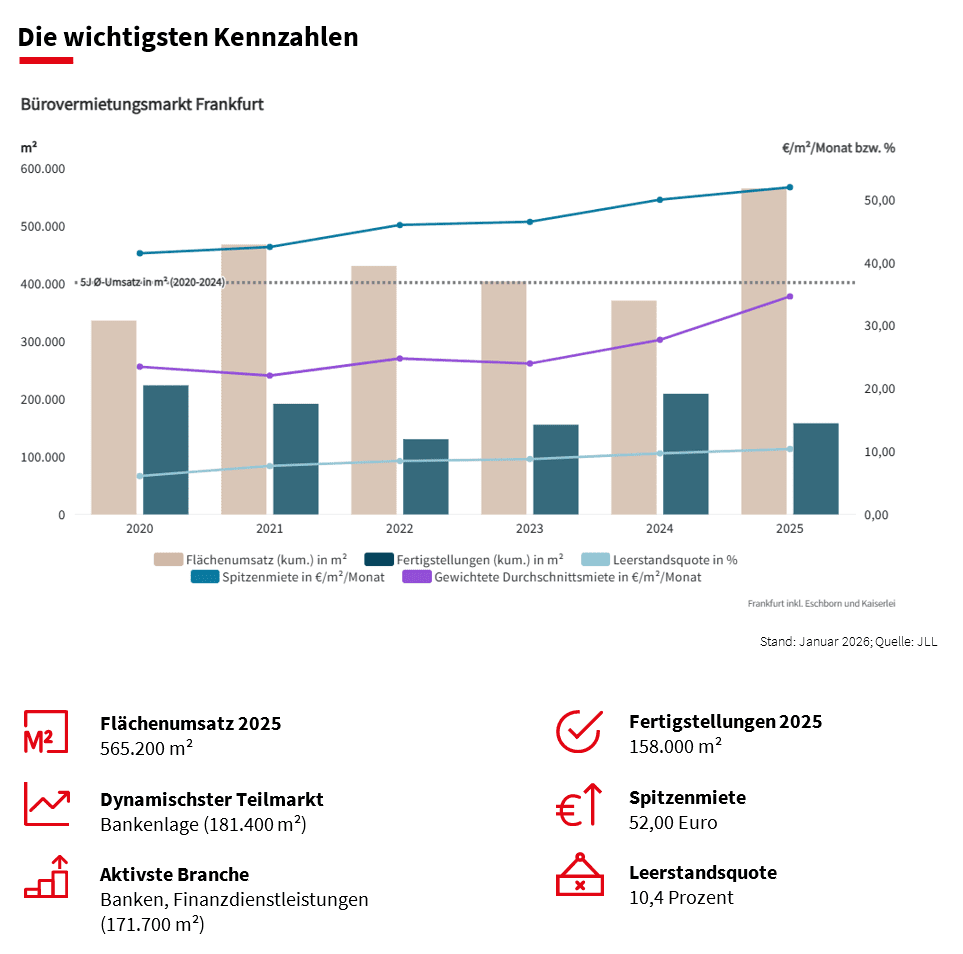

It was no longer enough to set the record, but at the end of 2025 there is a very good result for the Frankfurt office market at 565,200 m². After take-up of 200,100 m² in the first three months – the best first quarter ever – momentum slowed somewhat as the year progressed. In the second half of the year, 229,000 m² were taken up, of which 100,200 m² were in the final quarter. Nevertheless, the overall result is one of the best in recent years, 53 percent above the previous year’s figure and 17 percent above the ten-year average.

This is thanks to various major deals, such as Commerzbank with a lease of 73,000 m² in the “Central Business Tower”, ING with 32,000 m² in the “Hafenpark Quartier” and KPMG with two deals totalling 33,400 m² in the “Park Tower” and the “Opernturm”. All three deals were finalized in the first half of the year. In the further course of the year, Allianz Global Investors with 17,400 m² in the “Fürstenhof” and Sanofi-Aventis with 15,800 m² in Industriepark Höchst accounted for the largest deals.

“At the end of the year, one or two larger applications were no longer completed. Part of the demand has therefore been pushed into the new year. This means that there will also be major deals in 2026,” emphasizes Suat Kurt, Senior Team Leader Office Leasing and Branch Manager JLL Frankfurt.

Although large-scale leases drove up take-up, market activity was also characterised by many smaller deals. Of the total of 495 deals, 317 were in the size class of less than 500 m². By far the strongest sub-market is the banking sector with a share of 32 per cent of total take-up, followed by the East (twelve per cent) and trade fairs (nine per cent). Banks and financial service providers account for a little less than a third of sales, while the “business-related service providers” sector contributed a share of 18 percent.

The prime rent has risen from 50 euros/m² to 52 euros/m² over the course of the year. Kurt expects it to “increase significantly” again in 2026. “The demand for top space in the best locations is immense in Frankfurt. I expect the prime rent to jump to a level of 55 euros/m² to 56 euros/m² in the coming quarters.”

The vacancy rate in Frankfurt rose to 10.4 percent at the end of the fourth quarter of 2025 and, according to Kurt’s assessment, should now move sideways. “Since hardly any new building space will come onto the market in the foreseeable future, the vacancy rate is likely to decline somewhat again in the course of 2026,” Kurt predicts.