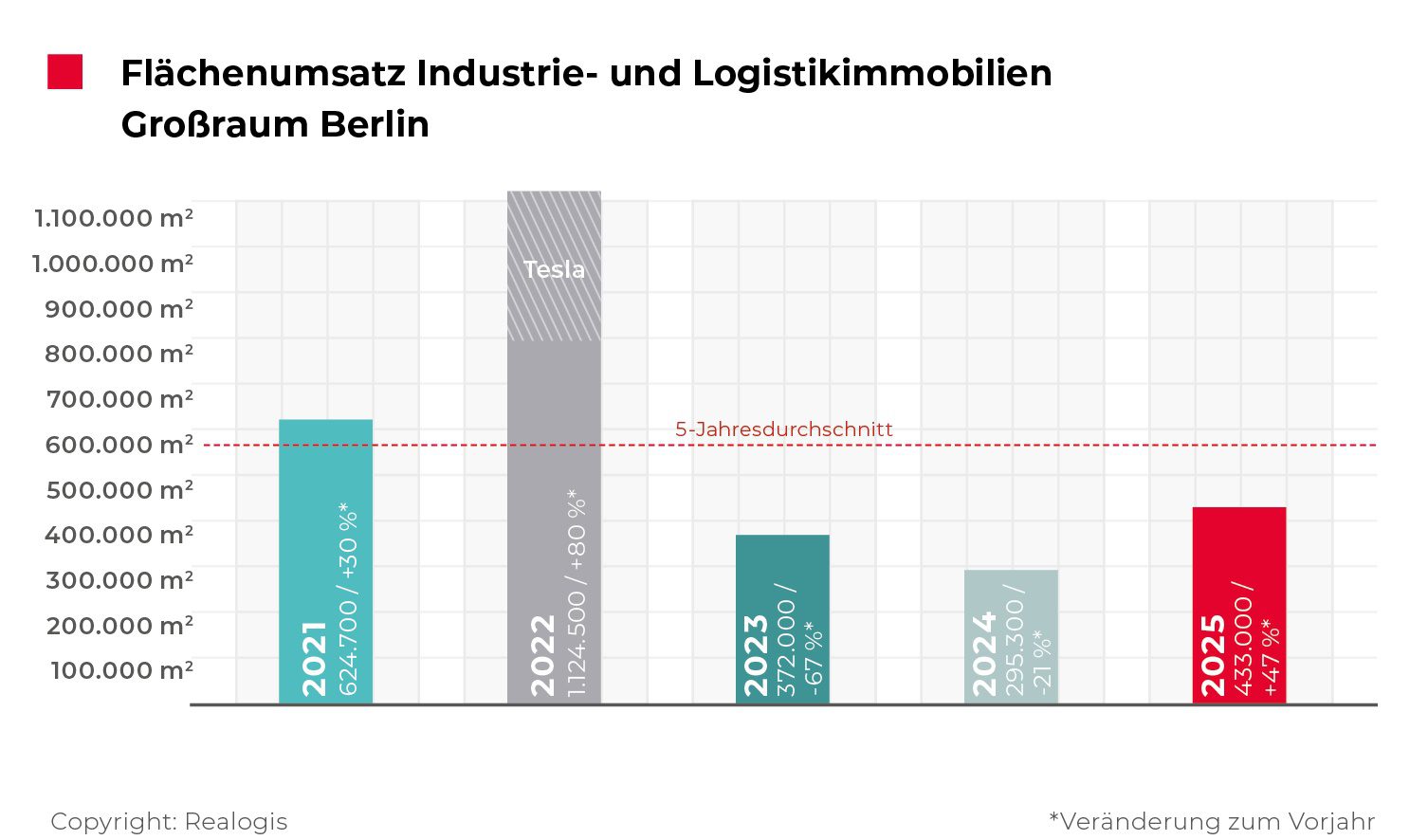

Take-up in the Berlin region rises by 47% to 433,000 m²

The REALOGIS Group, Germany’s leading consulting firm for industrial and logistics real estate as well as commercial properties, observed a noticeable revival in Berlin’s logistics and industrial real estate market for 2025 for the first time in two years. In the Berlin region as a whole, take-up of 433,000 m² was recorded in 2025 as a whole, an increase of 137,700 m² or 47% compared to the previous year 2024. Nevertheless, the 5-year average of 569,900 m² is undercut by 24%. The five largest deals from Netto (65,000 m²), a major industrial customer (30,000 m²), Bär & Ollenroth KG Berlin (26,100 m²), the Radeberger Group (26,000 m²) and Tesla (18,500 m²) comprise a total of 165,600 m² or 38% of the total result.

Alexander Ego, Managing Director of REALOGIS Immobilien Berlin GmbH, comments: “The Berlin market gained significant momentum last year. We expect this positive trend to continue in the current year. We are currently observing a further increase in demand for logistics properties, driven in particular by Asian and American companies that are choosing Berlin as a location for their expansion.”

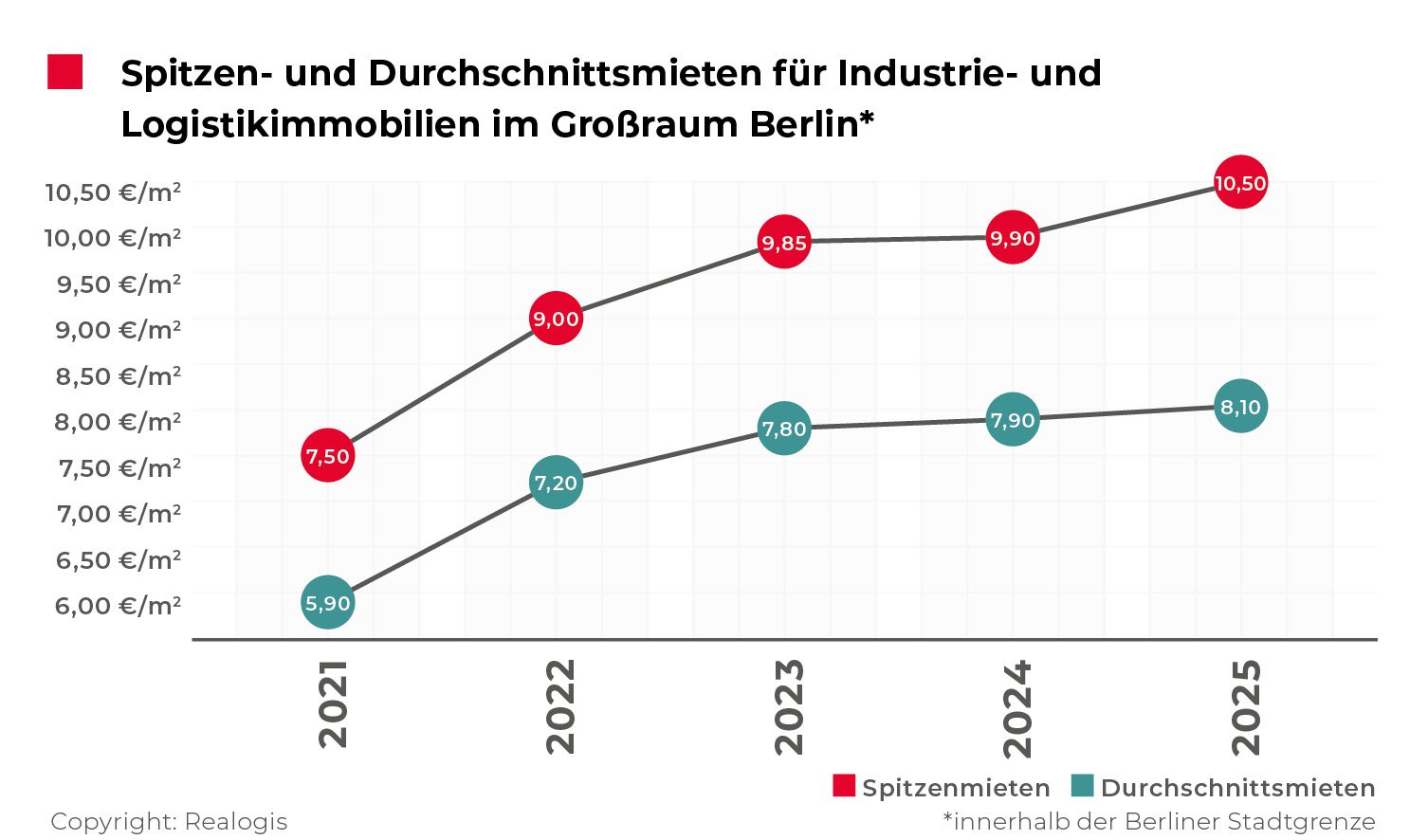

Rents continue to rise, peak above the 10 euro mark

The prime rent rose by 60 ct/m² or 6% to €10.50/m² in the course of 2025, continuing the upward trend that has existed since 2016. The average rent rose moderately by 20 ct/m² to €8.10/m². The increase in prime and average rents occurred mainly in the 1st half of the year, while they will remain stable in the 2nd half of 2025.

Deals in new-build areas on greenfield sites almost doubled

With a share of around 42% of total take-up each, deals in new-build greenfield space are almost on a par with 183,800 m² and deals in existing space with 181,400 m². While take-up of new-build buildings on greenfield sites rose by 90,100 m² or 96% compared to the previous year, it fell by 20,200 m² or 10% for existing space. New buildings on former brownfields played a major role for the first time in 2025, accounting for 67,800 m² or 16% of take-up. The acquisition of 30,000 m² by a major industrial customer, which accounted for 44% of brownfield sales, made a significant contribution to this positive development. In terms of building type, big box space dominated with 294,600 m², followed by business parks with 84,800 m² and other space with 53,600 m². The market remained tenant-driven. Leases accounted for 350,200 m² or 81%. Owner-occupiers reached 82,800 m² or 19%, which corresponds to a significant revival of +626% compared to the previous year.

The urban area of Berlin remains the largest buyer of land despite decline

With 132,800 m² or a share of 31%, the city of Berlin remains the strongest take-up area (2024: 155,700 m² / 53%). For the Berlin Umland Nord region, take-up increased from 98,900 m to 118,300 m² or a share of 27% (2024: 19,400 m² / 6%). The southern Berlin area follows in third and fourth place with 85,800 m² and 20% respectively, and the western Berlin area with 49,600 m² or 11%. The East Berlin region remains at the bottom with take-up of 46,500 m² or 11%.

Retail dominates, e-commerce continues negative trend with halved sales

With take-up of 182,400 m² or a share of 42% of take-up (2024: 112,900 m² / 38%), retail remains by far the user group with the highest take-up. Within retail, traditional retail dominates with a take-up of 161,300 m² or a share of 88% (2024: 70,700 m² / 63%), while e-commerce, which continues to decline, with a share of 12% or 21,100 m² (2024: 42,200 m² / 37%).

The main reason for the strong result in the traditional retail category was the three major deals concluded by Netto, Bär & Ollenroth KG Berlin and the Radeberger Group, which together accounted for around 73% of take-up in this category.

As in the previous year, industry and production took second place with 98,900 m² or 23%, ahead of the logistics/freight forwarding sector with 92,200 m² (21%). The “Other” collective category achieved take-up of 59,500 m² (14%).

Large areas are the most important drivers

Large spaces of 10,001 m² or more remain dominant in the market and, at 225,800 m², account for more than half (52%) of total take-up. Compared to the previous year, take-up in this category increased by 139,100 m² or more than 2.5 times. The area size between 5,001 m² and 10,000 m² accounts for 72,800 m², while the segment between 3,001 m² and 5,000 m² accounts for 45,700 m². Lettings between 1,000 m² and 3,000 m² add up to 70,900 m², and 17,800 m² for small spaces of less than 1,000 m².

Key figures at a glance

- Take-up: 433,000 m²

- Prime rent: 10.50 €/m²

- Average rent: €8.10/m²

- Existing areas: 181,400 m² | New building on a greenfield site: 183,800 m² | New building on brownfield: 67,800 m²

- Tenants: 350,200 m² | Owner-occupier: 82,800 m²