Content: Aengevelt analyses the subdued office market in Berlin.

– Decreased: Office take-up below previous year’s figure.

– Increasing: supply reserve increased.

– Quality remains in demand: Prime rent level stable at a high level.

No year-end rally.

- According to analyses by Aengevelt Research, the Berlin office market achieved office space take-up of around 110,000 m² in the fourth quarter of 2025, which was around a quarter below the same quarter of the previous year (Q4 2024: around 145,000 m²).

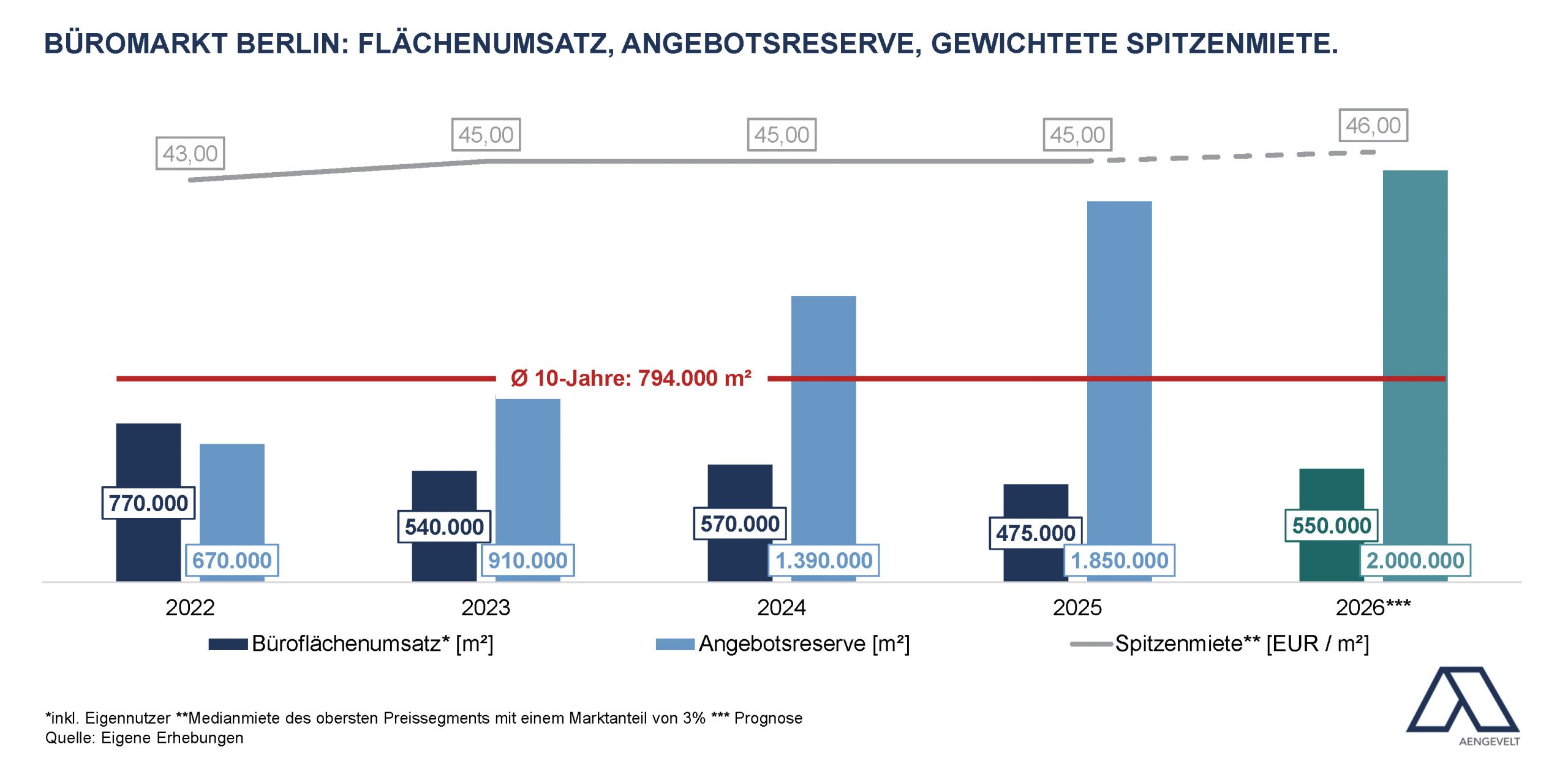

- With office space take-up (including owner-occupiers) of around 475,000 m², 2025 as a whole is around 17% below the previous year’s figure (2024: approx. 570,000 m²) and around 40% below the annual average (Ø 2015–2024: 794,000 m² p.a.).

With this result, Berlin ranks third nationwide behind Frankfurt (approx. 564,000 m²) and Munich (approx. 550,000). - For 2026 as a whole, Aengevelt Research forecasts an increase in office space take-up of 550,000 m² for Berlin.

Supply reserve continues to grow.

- In 2019, the supply reserve in Berlin reached 280,000 m², its lowest level in this millennium. In 2020, a trend reversed and the volume of office space available at short notice has since increased continuously to around 1,390,000 m² by the end of 2024.

- This trend continued significantly in the course of 2025: at the beginning of 2026, the supply reserve in Berlin stood at around 1,850,000 m², according to analyses by Aengevelt Research.

- The vacancy rate has thus increased to around 8.4% (beginning of 2025: 6.4%) with a total office space stock of around 22 million m².

- By the end of 2026, Aengevelt Research expects the supply reserve to increase further to around 2 million m².

Above-average office space completion.

- Since 2020, the volume of new or extensively renovated office space has grown significantly and significantly exceeded the 500,000 m² mark between 2021 and 2023 (2021: approx. 580,000 m², 2022: approx. 750,000 m²; 2023: approx. 617,000 m²). In 2024, there was significantly less new construction space at around 495,000 m².

- For 2025, Aengevelt Research analyses a further decline in the volume of completions of around 400,000 m², which is moderately below the decade average (Ø 2015-2024: approx. 422,000 m²).

- According to the current state of registration, a completion volume of around 400,000 m² of new office space is expected for 2026.

This means that the supply of sustainable, ESG-compliant office space continues to grow – a positive development, as this space is also the focus of demand for broad, especially international user groups. On the other hand, older, energy-suboptimal properties are losing their attractiveness and are becoming increasingly difficult to market.

Stable rent level.

- The weighted prime rent has remained stable since 2023 at currently around EUR 45/m², as has the median rent in central locations at around EUR 29/m².

- In the course of 2026, Aengevelt Research forecasts a slight increase in prime rents of around EUR 46/m².