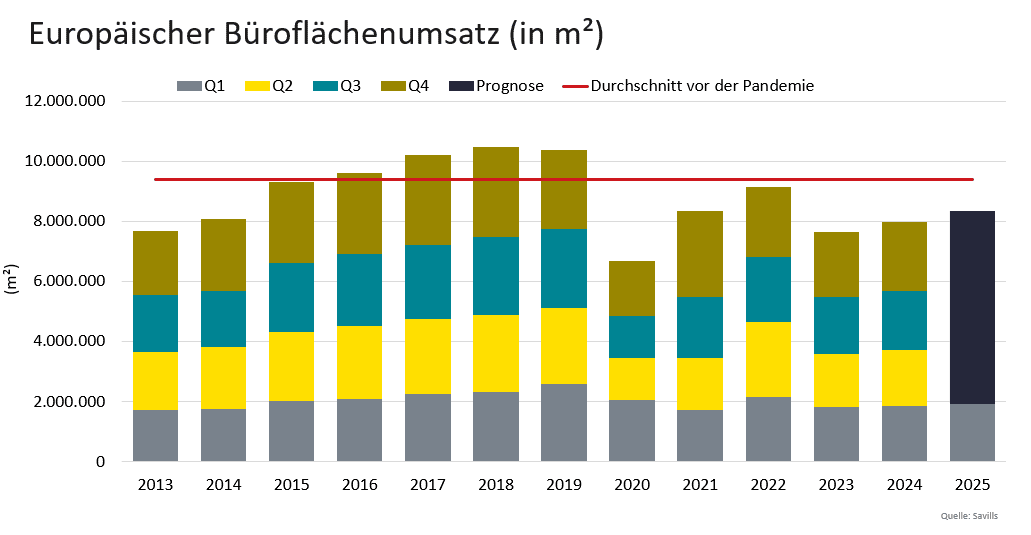

In the first quarter of 2025, European office space take-up reached 1.9 million m², an increase of four per cent compared to the previous year, according to a recent analysis by Savills. The strong start to the year means Savills expects an increase of 5% year-on-year for 2025 as a whole.

Significant growth in several European cities

In the past twelve months, Prague (+41%), Dublin (+29%) and London City (+26%) recorded the most significant increases in take-up compared to the five-year average. Germany’s top 6 cities reported an average increase of 13% in the first quarter of 2025 compared to the same period last year, while Madrid continued to be particularly robust with four strong quarters in a row.

“In the first quarter of 2025, increasing momentum was observed in Germany’s top 6 office letting markets. This is reflected in the significant increase in take-up compared with the previous year. Individual large-volume deals made a significant contribution to the quarterly result – the three largest lettings accounted for just under a fifth of total take-up. The trend towards space efficiency is continuing: large companies in particular are downsizing their space after moving or consolidating their locations,” says Jan-Niklas Rotberg, Managing Director and Head of Office Agency Germany at Savills.

Stabilisation of vacancies – prime rents are on the rise

Mike Barnes, Director in Savills’ European Commercial Research Team, reports: “The average office vacancy rate in Europe increased by 10 basis points to 8.4% in the first quarter of 2025, but seems to be gradually stabilising after several years of rising. Vacancies are increasing especially in peripheral locations, while central locations remain much more stable.”

Average prime rents for office space rose by 4.5% in the last twelve months, largely due to the shortage of supply of prime office space, according to the international real estate consultancy. London’s West End, Cologne and Paris CBD saw increases of 21%, 21% and 18%, respectively.

Completion volume increases for the time being – decline expected from 2026

The total volume of office buildings completed in Europe increased by 5% year-on-year to 3.8 million m² in 2024. However, this was still 11% below the five-year average. Savills expects the completion volume to increase to 4.3 million sq m in 2025 before falling to 3.1 million sq m in 2026. This would correspond to the lowest annual completion level since 2017.

Mike Barnes adds: “The share of speculative projects in the total stock has fallen by half in the last three years to just 1.6%. New projects are increasingly being leased before they are completed, limiting options for occupiers and increasing pressure on prime rents. With a limited speculative pipeline and an increasingly scarce supply of prime properties, we believe this will support the growth of prime rents in key European markets over the next two to three years.”

Sustainability and quality as important investor criteria

According to Savills, the profitability of project developments in selected European core markets for office properties has improved. This is supported by rental growth and stable yields. Outside of these core markets, landlords are renovating their existing spaces to offer high-quality space and ensure that their buildings comply with sustainability regulations.

James Burke, Director, Global Cross Border Investment at Savills, explains: “Investors continue to look for office properties with high EPC values* in European cities to maximise operational performance and meet the needs of the funds. The CEE markets have seen the highest share of new office space developed over the past decade, led by Bucharest (39%), Warsaw (37%), Budapest (32%) and Prague (27%). Office development in London City and Dublin has also been strong in recent years.