Market outlook for 2025: robust, but differentiated

The Real Estate Market Research Competence Group and the Center for Real Estate Studies (CRES) at Steinbeis University conduct semi-annual surveys on the forecast of prime rents, prime yields and vacancies in Germany’s top 5 locations. The survey, which has been conducted since 2010, has now taken place for the 30th time.

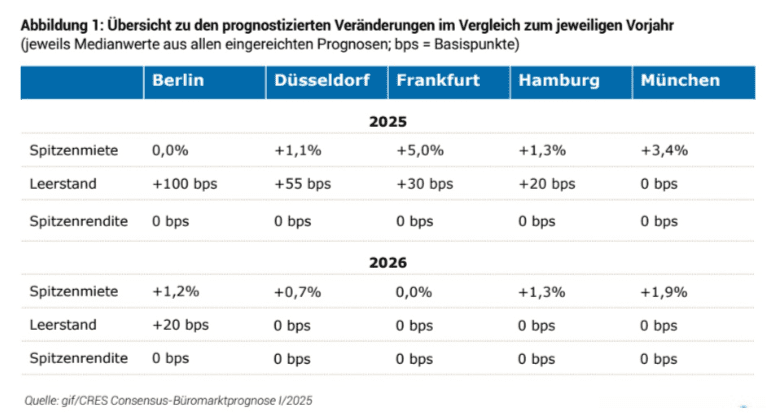

The current gif/CRES Consensus Office Market Forecast 1/2025 provides an overall robust but regionally very inconsistent picture of Germany’s top 5 office property markets: Berlin, Düsseldorf, Frankfurt, Hamburg and Munich.

Prime rents: Continued “Flight to Quality”

Despite rising vacancies, a further increase in prime rents is expected. Frankfurt and Munich in particular are showing a particularly dynamic development. For Frankfurt, the psychologically important limit of €50/m² is expected to be exceeded, while Munich is approaching the €60/m² mark. According to media forecasts, the rent increase in these cities is expected to be around 5% by the end of 2026.

In the other cities – Hamburg, Düsseldorf and Berlin – there is also a slightly positive outlook. With an increase of +2.6%, the forecast for Hamburg is slightly above the growth in Berlin and Düsseldorf.

Vacancies: Significant increase – with regional exceptions

Vacancy rates paint a less optimistic picture. In Düsseldorf and Frankfurt, values of over 10% have already been reached – a clear signal of structural oversupply in some sub-markets. Munich also surprised with an increase to over 7%, but is expected to remain stable in 2025. According to the forecast, Berlin will achieve a vacancy rate of up to 9% by 2026. Only Hamburg is still in the range of the natural vacancy rate at around 5%.

Prime yields: stability across the board

Despite geopolitical and economic uncertainties, prime yields are stable. The majority of market participants do not expect any significant changes in 2025 and 2026. Munich once again takes the leading role and asserts itself as the “yield capital” with a prime yield of 4.3%. The other cities move in a narrow corridor between 4.4% and 4.%. Some optimists even expect yields to fall slightly.

Summary of forecast values

The following table (Figure 1) summarises the expected changes in the three key market indicators – prime rent, vacancy and prime yield – for the years 2025 and 2026.

Conclusion: Light and shadow – depending on the location

The German office real estate market is resilient, but uneven in its overall development, and the location and quality differentiation are gaining in importance. While Frankfurt and Munich are benefiting from the demand for high-quality office space in terms of rental development, Düsseldorf and Berlin are struggling with structural vacancies in some district locations. Overall, the forecasts signal confidence in market stability – especially for top properties with high quality and good locations.

For investors, this still means keeping your eyes open when buying. The selective choice of location is and remains crucial.