“The knot has burst,” states the introduction to the broad-based study on the ELTIF market by the analysis firm Scope. In fact, ELTIFs have become the trendsetter of recent years. And German private investor capital is also increasingly discovering ELTIFs for themselves. However, Germany as a fund location can once again hardly benefit from this. What are the developments and what reasons are to be assumed for this, this article would like to help classify.

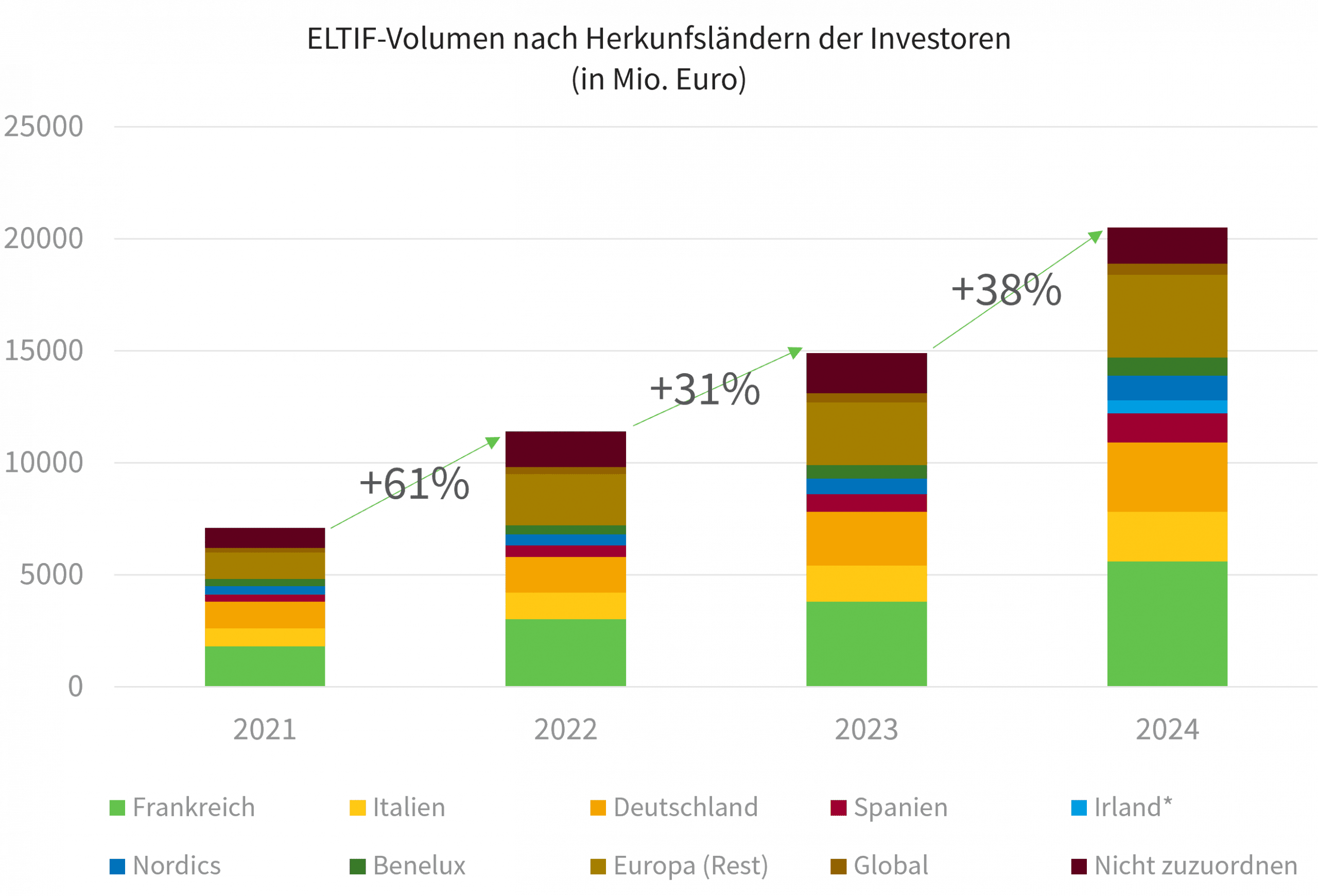

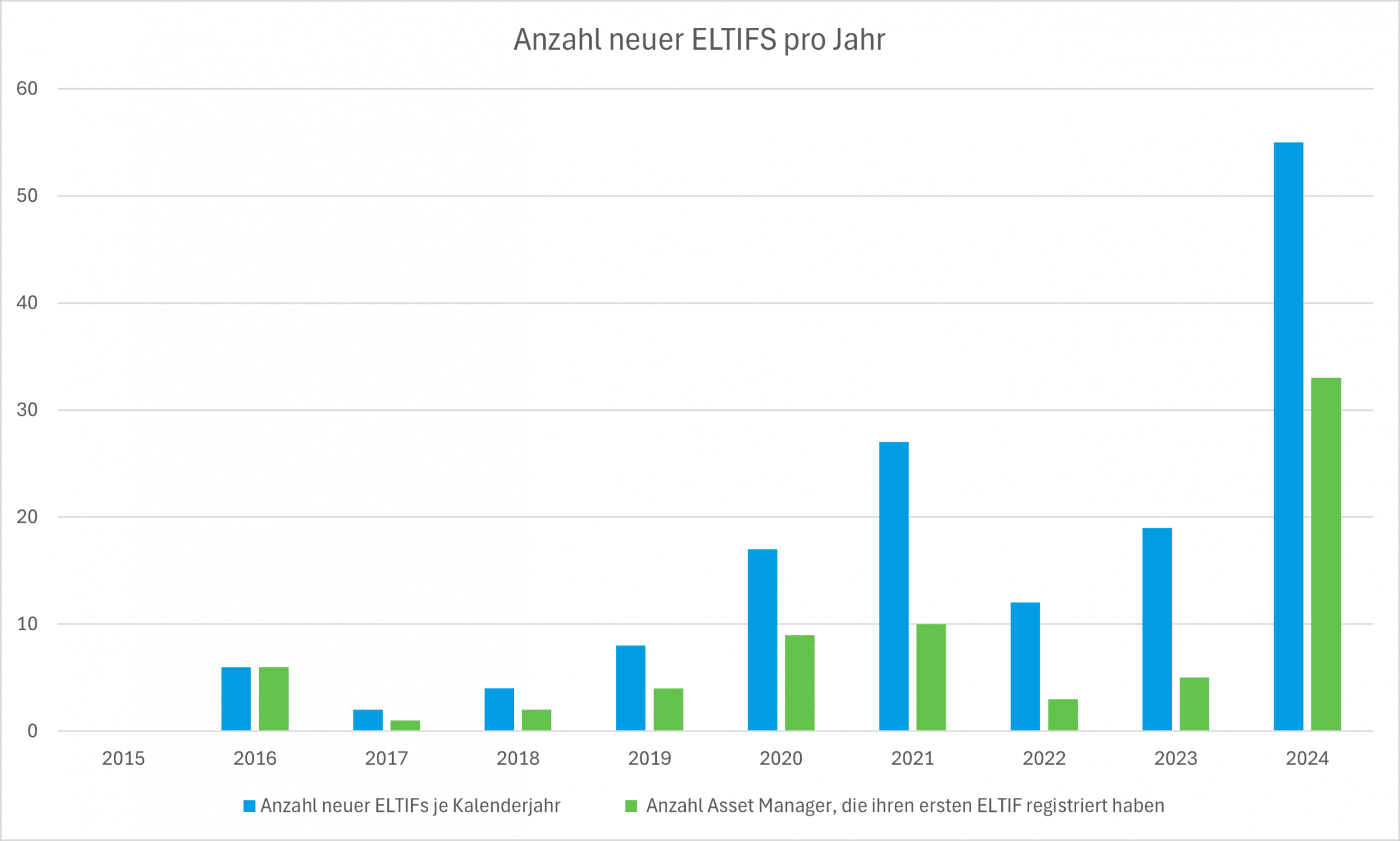

As in previous years, the analysis firm Scope has conducted a major study on the ELTIF market (“ELTIF Study”). The following figures are intended to refer to this and thus clarify the core findings of the ELTIF study:

- Observation period: Year 2024

- The study is based on the 150 ELTIFs known by 31.12.2024, of which 55 ELTIFs were issued to investors in 2024 alone

- Estimated total ELTIF market of around EUR 20.5 billion, of which EUR 5.7 billion alone is attributable to growth in 2024

This increasing market penetration is reason enough to classify the ELTIF a little more closely in terms of what it does, who uses it and what it is demanded for. And of course, there is also the question of who can offer their workbench within the framework of the fund industry and thus participate in value creation on the administrative side. More on that below.

Quick recap on ELTIF 1.0 and ELTIF 2.0 before entering the ELTIF study

Because before we get into the details of the ELTIF study, let’s briefly recall the main developments of ELTIF. ELTIFs stand for “European Long-Term Investment Fund”. The first generation of ELTIFs launched since its launch in 2015 are now also referred to as “ELTIF 1.0” to distinguish them from the second-generation ELTIFs, which were launched after the entry into force of the ELTIF 2 Regulation on 10 January 2024 and are therefore in turn referred to as “ELTIF 2.0”:

- Promoting long-term investments in Europe with the aim of providing capital for projects and companies with a longer maturity, such as infrastructure, real estate or sustainable projects. The aim is to increase capital commitment in the economy to support growth and innovation, especially in areas that are often less considered by short-term investors.

- Conventional fund structures before ELTIF 1.0, which were aimed at shorter maturities and other investment objectives in some EU member states – although not necessarily in Germany – should be supplemented by a uniform Europe-wide legal framework that

- specialises in long-term, especially illiquid investments

- regulatory protection for investors

- creates access for private investors, which until then was not necessarily possible in every country of the EU on the basis of the traditional fund structures.

A real game-changer for the ELTIF 1.0 was already the EU sales passport. This allowed asset managers to register the ELTIF with a single national supervisory authority and distribute it in other EU member states. It should be remembered that this was a real novelty at the time, because until then only AIFM, but not one product of an AIFM, had been passport-eligible in the EU.

Initially, however, the ELTIF had difficulties in absorbing the market, which had been due to conceptual teething problems of the ELTIF 1.0. Despite these conceptual weaknesses, sales have been hesitant at first, but have been quite buoyant in recent years. The ELTIF 2 Regulation, which came into force on 10 January 2024, continued this fundamentally positive trend. It is resolutely committed to making the ELTIF regime more flexible and harmonised. The intention to help the ELTIF achieve its final sales breakthrough cannot be misunderstood. Since then, ELTIF has been called “ELTIF 2.0” in this context. The ELTIF 2.0 has become much more attractive, especially for private investors and asset managers, among other things through:

- Greater openness for private investors: For investment amounts of up to 100,000 euros, it is easier for average private investors to invest in ELTIFs, as all the strict qualification criteria of ELTIF 1.0 no longer have to be met.

- Flexibilisation of so-called “qualifying assets”, which is the real salt in the soup of an ELTIF; these are the non-liquid, long-term investments; these were much narrower in ELTIF 1.0 and were considered one of the main reasons why the ELTIF regime was initially used rather hesitantly by asset managers as product initiators.

- Authorisation of semi-liquid ELTIFs, which – unlike a usual closed-end fund – even allow a redemption window (provided liquidity management in the fund) during the term, so that investors do not have to commit themselves for 10 years or more.

The ELTIF study by the analysis company Scope

After working through the basics, however, we now want to turn to the study itself. At the end of the ELTIF study period (31.12.2024), there were 150 ELTIFs on the market. The figures of the study speak so clearly for the success of ELTIF 2.0 that a further interpretation seems almost inconsequential:

- 55 ELTIF in 2024.

- These 55 ELTIFs were issued by 43 asset managers, of which 34 asset managers issued an ELTIF for the first time.

- A direct comparison with 2023: At that time, only 20 ELTIFs were issued by only 13 asset managers, of which only 5 asset managers had issued an ELTIF for the first time.

- The estimated size of the ELTIF market is around EUR 20.5 billion at the end of 2024 (basis: ELTIFs currently available).

- Direct comparison compared to 2023: In 2024, this means an increased market value of around EUR 5.7 billion or a market volume increase of 38% compared to 2023.

The first results of this are that the ELTIF market was able to develop a relevant market size, despite the conceptual initial teething problems of the ELTIF 1.0. The ELTIF 2.0 builds on this and was able to increase sales brilliantly in the course of 2024:

- Continuous optimisation of the legal structure of ELTIF 2.0 throughout 2024. The improved regulations of “ELTIF 2.0” already applied from 10 January 2024. However, in October 2024, the application-related details were finally agreed between ESMA and the EU Commission and fixed in the RTS (Technical Regulatory Standards).

- The definition of the RTS and the elimination of the last practical ambiguities had therefore been able to further strengthen the strong momentum in the course of 2024. Of the 55 ELTIF 2.0 launched in 2024, 19 of them were launched in the fourth quarter of the year alone.

- This momentum continues and is even intensifying: While the observation period of the ELTIF study only covers the period up to 31.12.2024 and shows 150 ELTIFs, the daily updated number of ELTIFs can be retrieved from the ELTIF register of the European Securities and Markets Authority ESMA .

And according to this, there are already 192 ELTIFs as of 21.6.2024, so based on this as a connecting fact, the forecast for this year does not seem too ambitious that even more ELTIFs should be launched in 2025 than in the already successful year 2024.

Who invests the most in ELTIF and why

According to the regional distribution of the countries of origin of the acquired capital, the ELTIF study shows the following picture:

- 1st place: French with 7.5 billion euros (37% of the total market)

- By far 2nd place: Italians with 3.5 billion euros (17% of the total market)

- Closely followed by 3rd place: Germans with 2.8 billion euros (14% of the total market)

Of the German capital market as a whole, klimaVest, registered with the CSSF in Luxembourg, alone accounts for half of the total market with a volume of EUR 1.4 billion at the time of the ELTIF study. The differences in allocation are also interesting: Infrastructure (71%) and private equity (27%) dominate among the products subscribed by Germans. Private debt (1%) is far behind in the German market. Among Italians, infrastructure accounts for only a small share (7%), but private debt dominates (44%), followed by private equity (31%) and other asset classes to a lesser extent. For the French, private debt (37%), infrastructure (33%) and private equity (28%) are more or less evenly distributed. Presumably, the reason for the deviation in the allocation with regard to German investor funds is that German investors had already had suitable fund structures at their disposal for investments in real estate or private markets, which had also been regulated since the introduction of the KAGB in 2013. What they all have in common is that real estate plays no or a very subordinate role for them in ELTIF. One reason for this is certainly at least the past period until the introduction of the ELTIF 2 Regulation. It was not until the ELTIF 2 Regulation that the aim was to remove some narrow definitional hurdles, which had previously made real estate less well included in ELTIFs. It will be interesting to see whether more real estate investments in ELTIF will now be observed under ELTIF 2.0 with a view to the future.

Why is the ELTIF market in Germany much smaller than in France, which has a less population, and even smaller than in Italy, which has even fewer inhabitants than France?

On the one hand, the fact that there are different approaches in the countries on how fund products are integrated into retirement provision certainly plays a role. In addition, Germany has always had regulated real asset funds, so that ELTIFs had to fight their way into distribution in an already well-organized market with diverse legal structures. However, it can also be assumed that the different funding of ELTIFs in the countries also plays a relevant role:

- Germany: No subsidies and normal taxation

- Italy: Tax incentives, under certain conditions even tax exemption possible after 5 years

- France: institutionalised support through insurance and pension products; Under specific conditions, ELTIFs can be purchased as unit-linked life insurance policies by private investors. Policyholders benefit from this in the form of tax advantages (reduced income tax on capital gains) and the insurers themselves, because the ELTIFs in the insurance shell construct are not held by the policyholder, but by the insurer; in connection with this, insurers can achieve capital deposit privileges for long-term investments under Solvency II

The ELTIFs are not launched at the fund location in Germany

Including all 192 ELTIFs listed in the ESMA Registry, the distribution of invested investor capital – with France in first place and Italy in second place – broadly corresponds to the number of funds domiciled in these countries. According to this, 38 ELTIFs were domiciled in France and 13 ELTIFs in Italy. In view of Germany’s placement in 3rd place in terms of acquired investor money, it would have been at least a presumption that a larger number of ELTIFs are domiciled by German KVGs in this country as well. In fact, there are only two of them! At the moment, the CSSF in particular is bringing the PS onto the streets. With 120 domiciled ELTIFs, Luxembourg is the absolute leader. According to the ELTIF study, in 2024 alone, of the 55 ELTIFs launched, 37 of them were registered in Luxembourg.

What might be the reason for this? Regarding the inception process of an ELTIF in Germany, a product provider in the ELTIF study by Scope can be quoted as follows: ” The communication with BaFin was very good. BaFin asked many questions to understand the product. In total, the entire process from submission to approval by the ELTIF in October 2024 took seven months. ” So this should not have been the reason. In France, for example, “patriotisme économique” is once again coming into play, according to which it is specifically promoting its own fund industry as part of a “buy local” logic. According to this provision, the specific tax incentives for investors require that the ELTIF is issued by a French AIFM. Germany can take this as an example that would help investors in their retirement provision on the one hand, and the German fund industry on the other.

RESULTS:

- ELTIFs are unstoppable in Europe

- In Germany, they also play a certain role as a product for private investors and wealthy private investors, although the market is distorted to the extent that half of the invested funds alone are accounted for by just one product

- In the other European countries, above all France and Italy, the ELTIF is understood to make a relevant component of retirement provision for private investors through targeted support measures.

- For institutional investors, simplifications in regulatory capital deposits can be decisive whether they invest in ELTIFs or integrate them into their insurance shell-based retail customer products.

- The countries that specifically promote ELTIFs as an investment product also get a larger piece of the fund location pie. Luxembourg now seems to be an important Eldorado as a fund location for the launch of ELTIFs.