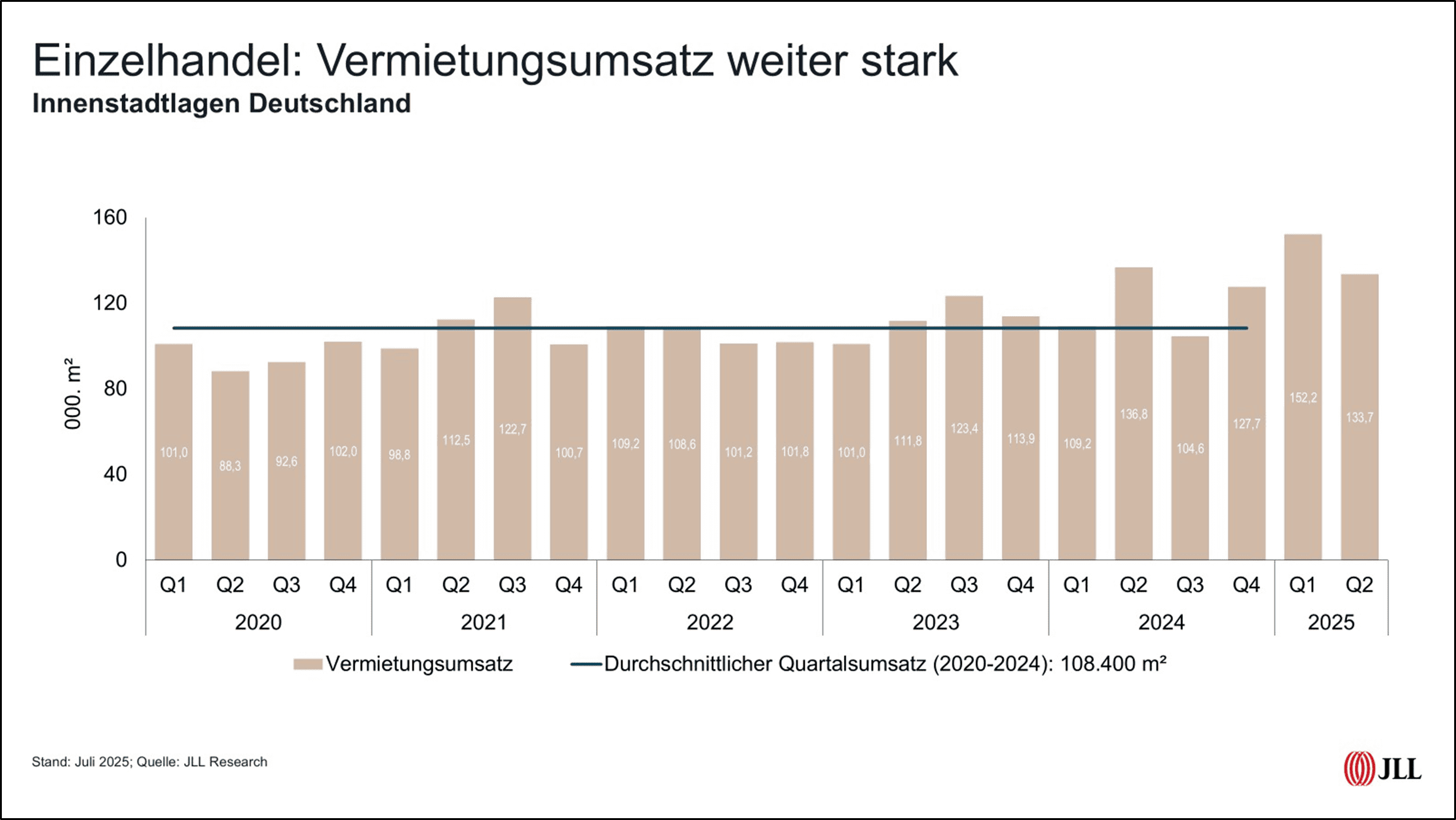

At 133,700 m², the second quarter is the third-strongest single quarter since the beginning of 2020

German city centres are in demand as rarely in recent years, retail concepts are expansive, and so the real estate market for retail space has followed an extraordinary start to the year with another strong quarter. The market generated a total of 285,900 m² in the first half of the year. Although the second quarter of 133,700 m² was slightly weaker than the first quarter of 152,200 m² – these two quarters occupy first and third place in the table of the strongest individual quarters since the beginning of 2020. The number of leases also remained consistently high: with 251 deals in the second quarter, 548 were concluded after the first half of the year – 43 percent more than in the same period last year.

Aniko Korsos, Head of Retail Leasing JLL Germany: “At the end of last year, it had already become apparent that the market would break out of its constant take-up corridor of around 100,000 m² upwards. One reason for this is that an above-average number of large spaces have rented – partly through established, but also new concepts. The coming quarters will have to show to what extent these are one-off effects or whether the market is now levelling off at a higher level of take-up. The fact is, however, that retail concepts seize opportunities for expansion when they are presented to them in prime locations.”

Many retailers prefer shops with 1,000 m² to 2,000 m² of space

In particular, deals in the range of 1,000 m² to 2,000 m² left their mark on the first half of the year, thus fuelling take-up. This size category accounts for around one in eight lettings and a total of just under a third (32.3 per cent) of the rented space. After the letting performance in the first quarter of 2025 in the order of magnitude between 1,000 and 2,000 m² and from 2,000 m² onwards was still on a par, which was mainly characterised by subsequent uses of Galeria space, the second quarter reached its peak in letting performance for space between 1,000 and 2,000 m², which accounted for around 37 per cent of the space.

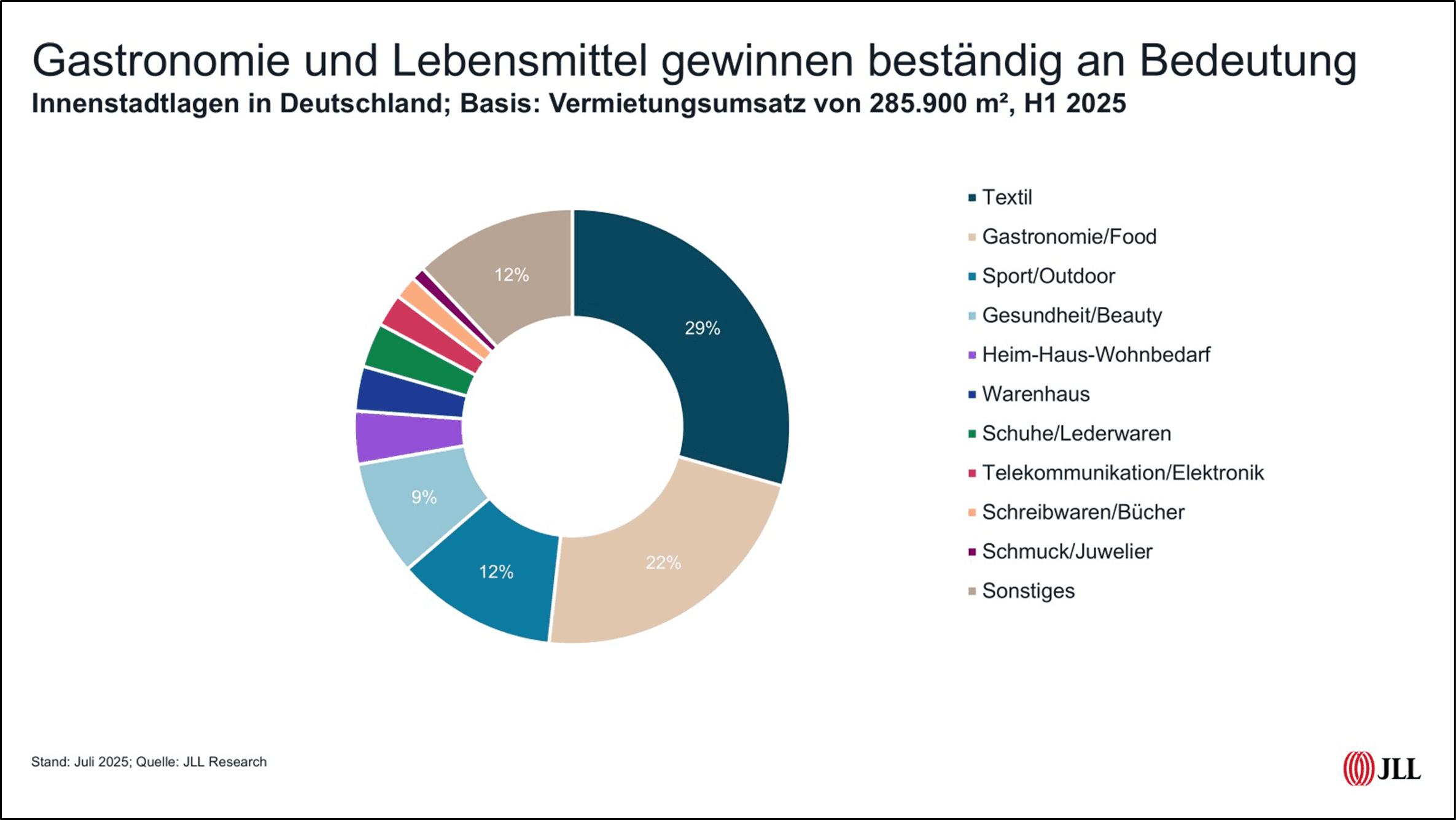

In this size class, the gastronomy/food segment accounted for the largest share of rental take-up with 31 percent of the space, ahead of the textile segment, which reached 26 percent. In the gastronomy/food sector, food retailers were mainly represented in this size category, with the restaurant segment playing only a subordinate role. The Go Asia concept, which offers Asian food, was particularly active. “This development shows that city centres continue to be interesting for food retail markets,” says Korsos , explaining the trend.

Gastronomy/food dominate for rentals of less than 250 m² of retail space

In addition to the large-scale leases, numerous smaller deals were also concluded, with every second deal being in the size classes smaller than 250 m². Here, too, the gastronomy/food sector was in first place with 38 percent of the rented space in this size class, ahead of the textile segment (25 percent). Here, in addition to system restaurateurs such as fries, friends and mayors, restaurants also dominated the events of the first half of the year.

In the size segment of medium-sized spaces between 250 and 1,000 m², on the other hand, the textile sector was still in first place in terms of take-up, just ahead of gastronomy/food. About 25 percent of the area in the size class was accounted for by textile retailers. Every second of these comes from the young fashion sector. The most expansive of these in the mid-size segment were New Yorker, Only and Guess with new leases and space expansions.

Across all space sizes, the textile trade has defended its pioneering position in new leases, but at 29 percent, the share has fallen again, after the industry had been above the 40 percent mark a few quarters ago. “With the end of the pandemic, many textile retailers were initially on a large-scale expansion course, while local suppliers initially slowed down their pace after their wave of expansion during the pandemic and have been more aggressive again since the beginning of the year. This balances out the ratio somewhat,” Korsos classifies the change.

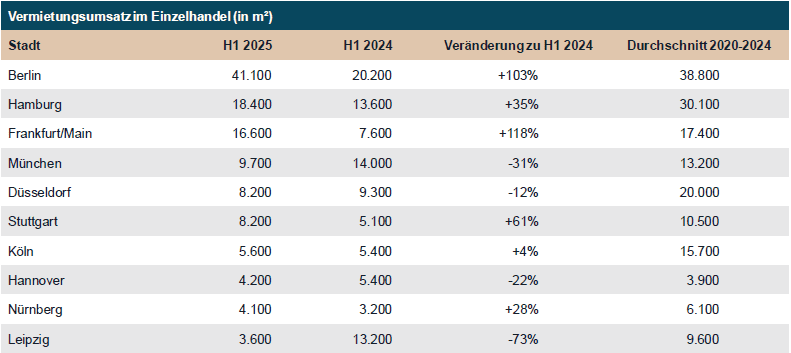

Berlin doubles its take-up compared to 2024

In the first half of 2025, the ten most important retail markets in Germany accounted for around 46 per cent of take-up and around 55 per cent of transactions. The strongest market among the strongholds was the capital Berlin with 41,100 m², where the letting result doubled compared to the same period last year. Hamburg (18,400 m²) and Frankfurt (16,600 m²), both of which were able to increase compared to the previous year, follow at a considerable distance. Weaker than in the previous year were Munich (minus 31 percent) and Düsseldorf (minus twelve percent).

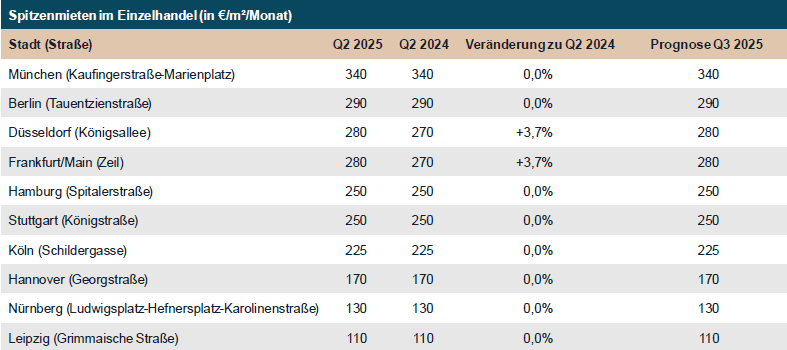

With regard to prime rents, there is an upward trend in the prime locations of the metropolises in both Düsseldorf and Frankfurt. In both markets, the peak value will increase from EUR 270/m²/month to EUR 280/m²/month in the first half of 2025. Even though the letting performance in the two cities has recently been rather moderate across the board, there is a constant demand from users willing to pay for top space in the best locations – especially in Düsseldorf – which is leading to this rent increase. Rents at the remaining eight markets will remain unchanged.