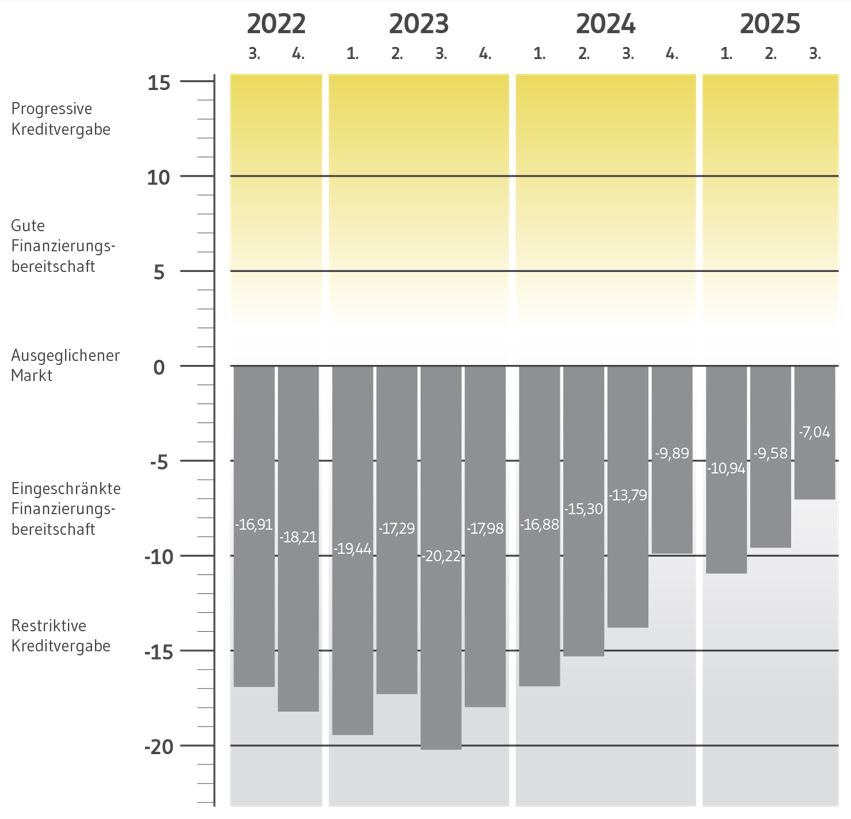

Sentiment among commercial real estate financiers continues to improve in the third quarter of 2025, according to the new BF. quarterly barometer.

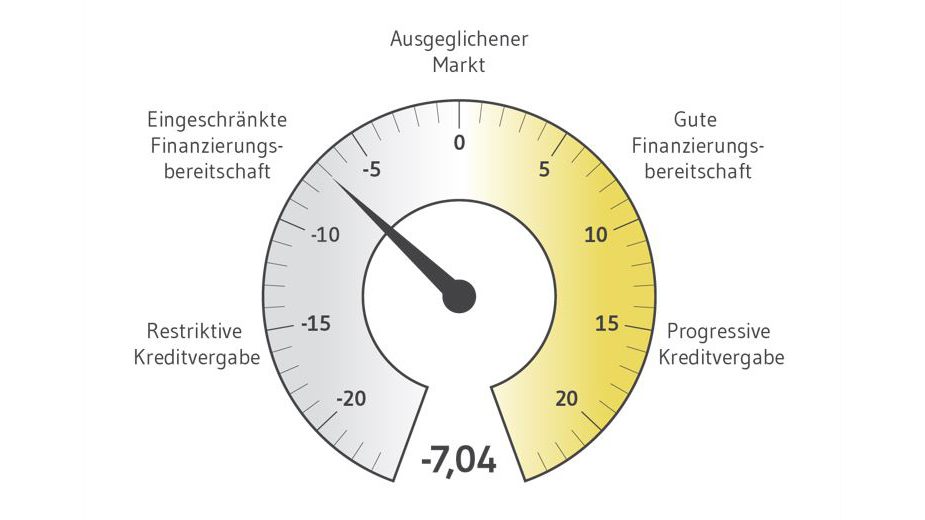

The sentiment index of real estate financiers rose from -9.58 points in the second quarter to -7.04. Although the barometer value is still clearly in negative territory, it is the best value since the first quarter of 2022.

There are several reasons for this development, first and foremost better refinancing conditions. 70.3 percent of respondents state that liquidity costs are stable for their respective institution. In the previous quarter, it was only 41.2 percent. While 50.0 percent of respondents were still talking about rising refinancing premiums in the second quarter, it was now only 18.9 percent.

Furthermore, about half of the financing experts surveyed are recording growing new business. The average loan volumes increased slightly: the range between EUR 10 million and EUR 50 million grew by 3.9 percentage points to 39.0 percent, while loan volumes below EUR 10 million fell slightly to 43.9 percent (-4.7 percentage points).

“I see the fact that banks are financing on a larger scale again as proof that they have their refinancing under control and can thus operate in this segment. This goes hand in hand with a stable market recovery, even if we are still a long way from a balanced financing market. With the provisional settlement of the US customs dispute and the planned comprehensive economic policy incentives of the German government, many market players are looking to the future somewhat more positively than recently,” says Professor Dr. Steffen Sebastian, holder of the Chair of Real Estate Finance at IREBS and scientific advisor to the BF. Quarterly Barometer.

Willingness to finance offices remains high

When it comes to the question of which type of use the respective institution finances, residential real estate remains the most popular, both in existing buildings and in project developments. “It is striking that office properties are almost on a par with logistics properties in terms of the types of use financed and continue to rank far ahead in the popularity scale. Accordingly, there can be no talk of a swan song to this asset class: 69.8 percent of respondents are currently financing existing office properties and 53.5 percent office project developments,” comments Franceso Fedele, CEO of BF.direkt AG.

Loan-to-values for existing properties fell slightly from 61.94 to 61.05 between the second and third quarters. Loan-to-costs for project developments fell from an average of 70.30 to 69.68. At the same time, margins fell remarkably sharply. The average margin for existing properties fell from 225.2 to 203.5 basis points, and for project developments from 331.5 to 302.1.

“This is a thoroughly positive development. It shows that there is more competition in commercial real estate financing again. I observe that new players are also entering the market. More competition means that providers have to reduce their margins. In addition, falling margins are an indicator of decreasing risk,” explains Fedele.

Return of Anglo-Saxon investors

In an additional question, the participants of the BF. Quarterly Barometer for their assessment of whether they are observing an increased presence of foreign lenders on the German financing market. 19 percent of those surveyed confirmed this perception, while 79 percent said no. In addition, the panel participants were asked about the influence of international investors on the German real estate market. The vast majority see this influence as an opportunity for market stability. Only a few respondents see a risk. The financing experts observed above all a return of Anglo-Saxon investors to the German market.

Methodology

The BF. Quarterly barometer is compiled by the analysis company bulwiengesa AG on behalf of BF.direkt AG, a specialist in the financing of real estate projects. The index comprehensively reflects the mood and business climate of real estate financiers in Germany.

In order to determine the BF. Quarterly Barometer, around 110 experts are interviewed quarterly, all of whom are directly entrusted with the granting of loans to real estate companies. The panel consists of representatives from various banks and other financiers. The value of the BF. The Quarterly Barometer is made up of various components of the questionnaire: the assessment of the change in financing conditions, the development of new business, the amount of loan tranches granted, the risk appetite of financiers by asset class, the level of LTV/LTC values, the development of margins, the importance of alternative financing options and the development of liquidity costs.