Investor and developer confidence is increasing, with 41% of users expecting to expand their warehouse space next year, up 12 percentage points from last year.

Brookfield Properties, Savills and Analytiqa have released the fifth annual survey of the European real estate logistics market. It shows that developers and investors are stepping up their activities in anticipation of a recovery, while users remain cautious in their growth strategies. The survey of 715 investors, developers, and users across Europe found that:

Trust grows as users recover

Investor sentiment continues to improve, with 46% believing that market conditions are more favourable than a year ago, and 56% expect investment volumes to increase over the next 12 months. Project developers are also stepping up their activities: 36% are planning the speculative construction of further space, which corresponds to an increase of 12 percentage points compared to the previous year. This confidence reflects the cautious optimism of occupiers, 41% of whom expect their need for warehouse space to increase in the coming year, although 57% have scaled back their expansion plans.

Developers are looking for opportunities in Western Europe

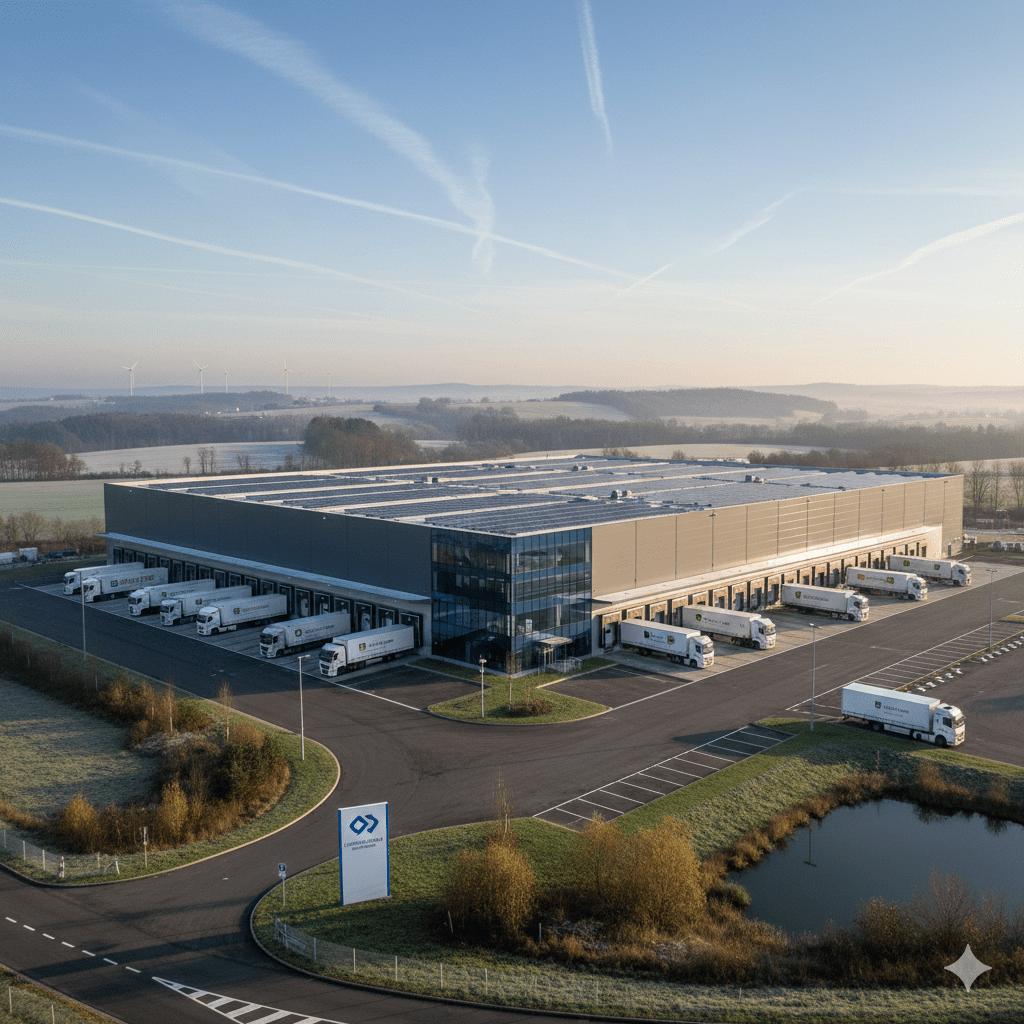

Western Europe continues to drive growth, with users looking to expand most actively in continental Europe and especially in Germany and France. Two-thirds of the users are aiming for medium-sized units between 5,000 and 9,999 m². However, the developers tend to focus on larger spaces, suggesting a discrepancy between the current needs of users and the spaces prioritized for future deployment.

ESG and AI are reshaping strategies

Users are actively looking for more efficient and resilient facilities. ESG regulations are now considered the most significant structural change, with 88% of users rating them as a game-changing trend. At the same time, AI is rapidly gaining momentum. A remarkable 82% of users see AI as transformative, a 25% increase from the previous year. More than a third have already invested in predictive optimization and analytics technologies, and nearly half plan to make further investments within the next two years.

Ben Segelman, Head of Logistics and Data Center Real Estate Europe at Brookfield, said: “We are at a strategic inflection point in the logistics market. Investors are increasingly focusing on long-term fundamentals and proactively creating the space they believe will be needed by occupiers in the coming years. Users remain cautious and adapt to macroeconomic and operational constraints, but they are actively developing strategies around ESG and AI to future-proof their portfolios. The next 12 to 18 months will be crucial to match demand with the right space.”

George Coleman, UK & EMEA Logistics, Savills, added: “This year’s survey saw record turnout, highlighting how structural change is shaping the next chapter of logistics real estate. ESG and AI are no longer emerging trends, but are at the heart of users’ strategies as investors and developers position themselves to provide the space needed for this transformation. The sector continues to adapt with resilience, creating a solid foundation for long-term, sustainable growth.”