Above-average sales in the first three quarters.

Aengevelt Research analyses the Magdeburg office market after a significant increase in half-year results compared to the same period last year (1st half of 2025: approx. 10,600 m²; 1st half of 2024: 6,100 m²) continued to be dynamic in the third quarter of 2025 with take-up of around 5,400 m². This result is more than twice as high as the take-up figure for the same quarter of the previous year (Q3 2024: approx. 2,000 m²) and also reaches the level of the ten-year average for this period (Ø Q3 2015–2024: 5,200 m² p.a.).

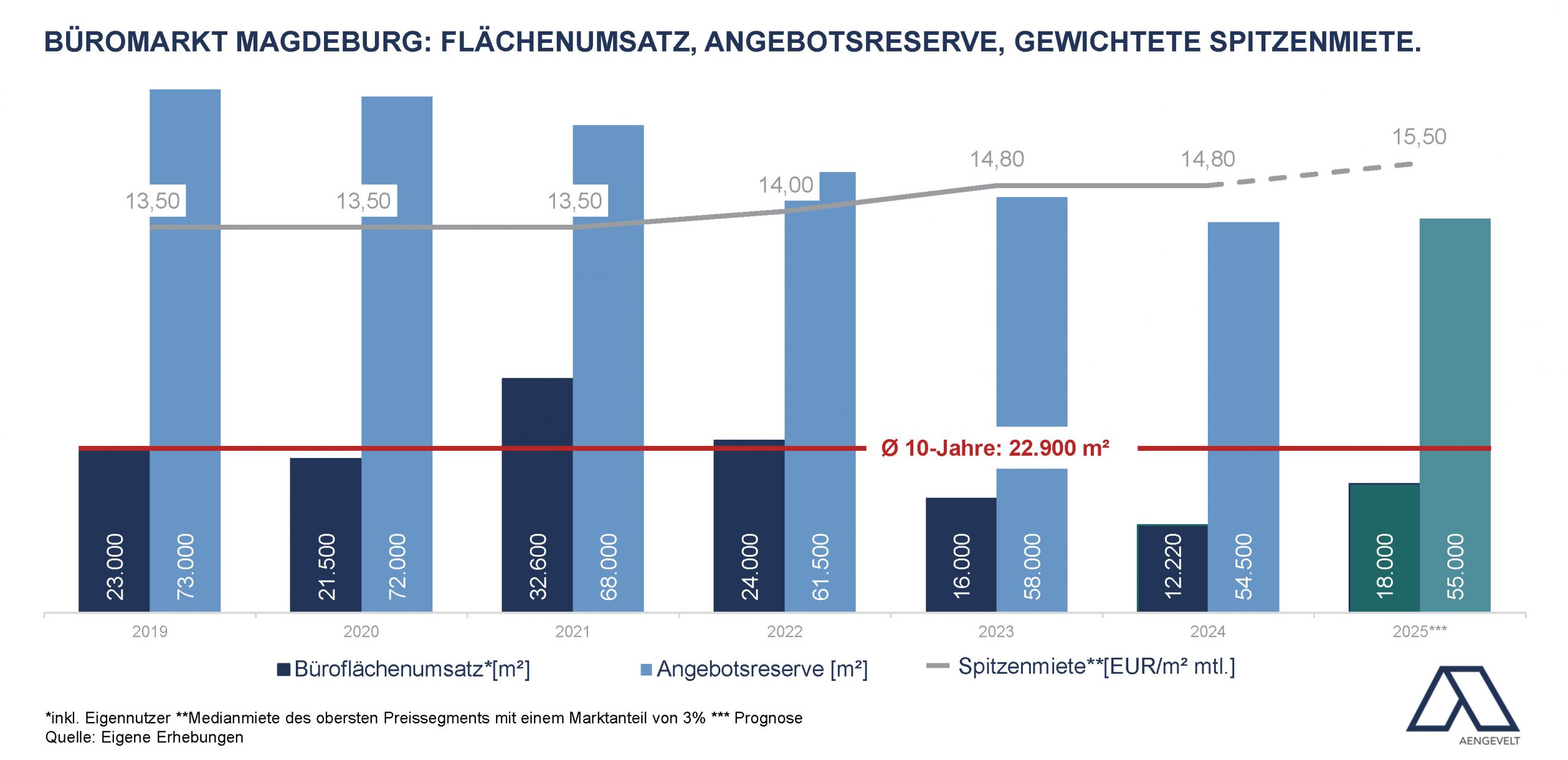

• At around 16,000 m², total take-up on the Magdeburg office market so far in 2025 represents a doubling of the result for the same period of the previous year (Ø Q1 – Q3 2024: approx. 8,000 m²) and is also slightly above the ten-year average (Ø Q1–Q3 2015–2024: 15,100 m² p.a.).

The background to the good result is in particular an increase in the number of major 1,000 m² deals > . In the first four months alone, Aengevelt brokered three lease agreements, which together amount to more than 6,000 m².

• By the end of 2025, Aengevelt forecasts office space take-up of around 20,400 m² in view of the current somewhat quieter market activity. Although this figure would clearly exceed the previous year’s take-up (2024: approx. 12,200 m²), it would still be around 11% below the decade average (Ø 2015–2024: 22,900 m² p.a.).

Supply reserve continues to fall.

• The short-term supply reserve (available within three months) fell further within 12 months from 56,150 m² to currently around 52,200 m². With a total stock of 1.07 million m² of office space, this corresponds to a vacancy rate of around 4.9% (end of Q3 2024: 5.3%).

• By the end of 2025, Aengevelt Research forecasts a supply reserve of around 55,000 m².

Among other things, this is due to the optimisation or reduction of space at existing tenants with regard to new office concepts.

Completion volume increases significantly.

• While only around 1,000 m² of new office space was completed in 2024, this figure will rise to up to 24,000 m² by the end of 2025.

Of this, around 14,000 m² is accounted for by the new administration building of AOK Saxony-Anhalt, which is building the property entirely for its own use.

Overall, the completion volume in 2025 would thus significantly exceed the decade average (Ø 2015 – 2024: 6,400 m² p.a.).

Slightly rising rent level.

• The prime rent rose slightly from EUR 14.80/m² to EUR 15.20/m² compared to the same time last year. The median rent in city locations has also risen: from EUR 11.70/m² to around EUR 12.60/m².

• By the end of 2025, Aengevelt forecasts a further increase in prime rents to around EUR 15.50/m².