BF. Quarterly Barometer Q4 2025: Sentiment among real estate financiers remains poor, but new business picks up slightly

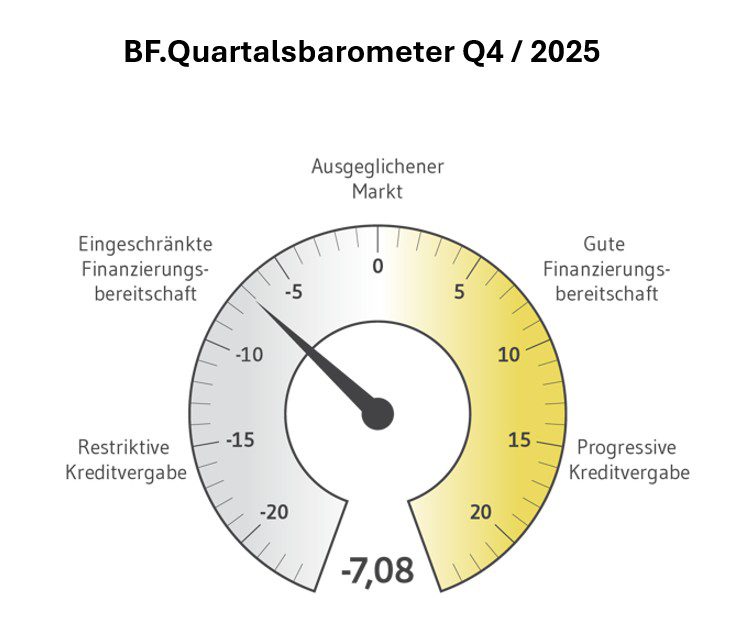

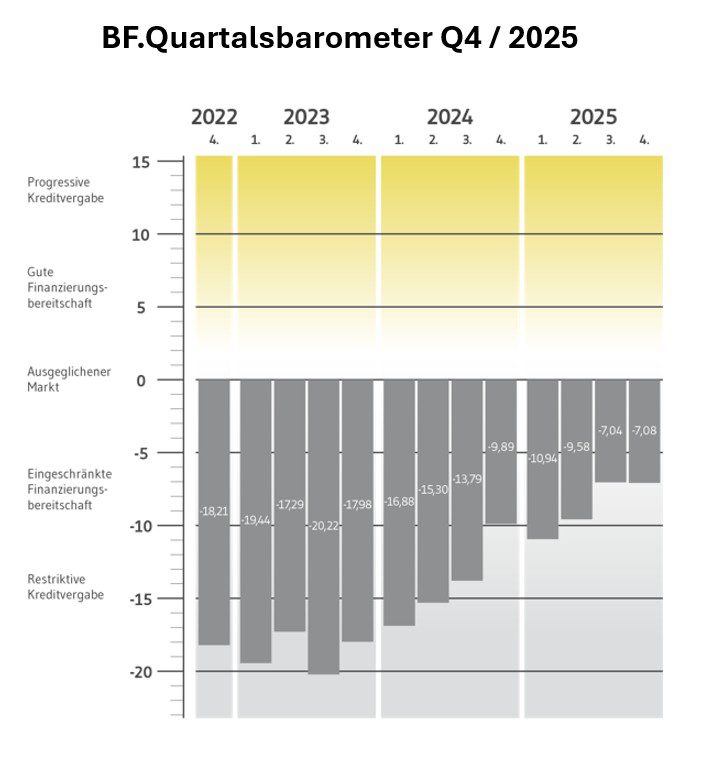

The mood among commercial real estate financiers has hardly changed in the fourth quarter of 2025: the sentiment index is almost unchanged at -7.04. In the previous quarter, it was -7.08. This is according to the current BF. quarterly barometer. Although the barometer value is still in negative territory, the slight recovery that has been going on since the fourth quarter of 2023 continues.

The growing new business has a positive effect on the barometer value, which 44.1 percent of respondents state; only 14.7 percent are recording a decline in new business.

There was movement in margins: In the case of portfolio financing, these have been declining for several quarters. The average margin across all real estate segments is 196.3 basis points (bp). In the previous quarter, the figure was slightly higher at 203.5 bp. Loan-to-values (LTV) were between 40 percent and 100 percent; the average is 62.6 percent.

In the financing of project developments, the average margin increased slightly compared to the previous quarter: from 302.1 to 305.3 bps. For project developments, the loan-to-cost (LTC) is between 55 percent and a maximum of 90 percent. The average LTCs fell slightly from 69.7 percent to 68.9 percent.

“This continues the trend of declining margins that we have been observing since the third quarter of 2024. The greater competition contributes to the fact that financiers are willing to accept a lower margin if the quality is right,” says Professor Dr. Steffen Sebastian, holder of the Chair of Real Estate Finance at IREBS and scientific advisor to the BF. Quarterly Barometer.

“However, this competition is limited to the premium project segment. Here, several banks often vie for the contract, while less qualitative properties do not get financing,” explains Franceso Fedele, CEO of BF.direkt AG.

There were hardly any changes in the asset classes financed. Existing apartments top the list of the most frequently financed property types with 19.7 percent (-0.4 percent). This is followed by offices (15.8 percent, -0.1 pp). Logistics properties (-1.4 pp) and micro-apartments (+1.2 pp) are on a par with 14.5 percent. The picture is similar for project developments: housing for one’s own portfolio leads with 18.8 percent (+0.4 pp). This is followed by micro-apartments (15.9 percent, +0.1 pp) and housing with developer financing (15.2 percent, -0.6 pp). The other places are occupied by logistics (14.5 percent, -0.7 pp) and office (14.5 percent, -0.1 pp).

There were slight changes in the financing sizes: In the fourth quarter, many small-volume financing projects of up to EUR 10 million were granted. Their share increased to 50.0 percent (+6.1 pp). The share of financing in the medium loan range (EUR 10 to 50 million) fell by 3.7 percentage points. Loan volumes of between EUR 50 million and EUR 100 million increased slightly by 0.1 percentage points to a share of 14.7 percent. Financing of more than EUR 100 million was not reported in the fourth quarter.

Methodology

The BF. Quarterly barometer is compiled by the analysis company bulwiengesa AG on behalf of BF.direkt AG, a specialist in the financing of real estate projects. The index comprehensively reflects the mood and business climate of real estate financiers in Germany.

In order to determine the BF. Quarterly Barometer, around 110 experts are interviewed quarterly, all of whom are directly entrusted with the granting of loans to real estate companies. The panel consists of representatives from various banks and other financiers. The value of the BF. The Quarterly Barometer is made up of various components of the questionnaire: the assessment of the change in financing conditions, the development of new business, the amount of loan tranches granted, the risk appetite of financiers by asset class, the level of LTV/LTC values, the development of margins, the importance of alternative financing options and the development of liquidity costs.