CBRE Group, Inc. (NYSE: CBRE) announced its financial results for the fourth quarter ended December 31, 2025.

Key highlights:

- Fourth quarter GAAP earnings per share of $1.39 and core earnings per share of $2.73

- 2025 GAAP EPS of $3.85 and Core EPS of $6.38

- Revenue up 12 percent to $11.6 billion in Q4 and 13 percent to $40.6 billion in 2025

- Resilient Businesses revenue up 12 percent for Q4 and 13 percent for 2025

- Transaction revenue up 12 percent in the fourth quarter and 14 percent for 2025

- Cash flow from operating activities for 2025 at ~$1.6 billion and free cash flow at ~$1.7 billion

- For 2026, core earnings per share are expected to be between $7.30 and $7.60, representing a growth of 17 percent on average

“We had a strong end to 2025, with double-digit fourth-quarter revenue and core earnings per share growth, both of which reached the highest levels in CBRE’s history,” said Bob Sulentic, CBRE’s chairman and chief executive officer. “Our strength was broadly based. We saw significant sales and leasing growth in the U.S. and much of the rest of the world, and our resilient businesses continued to deliver double-digit revenue growth, a trend that we expect to continue,” said Bob Sulentic, Chairman and Chief Executive Officer of CBRE.

“CBRE is positioned for strong, sustainable growth,” Sulentic continued. “We are taking advantage of these circumstances to optimize our operations, while investing to ensure that this growth continues in the future.”

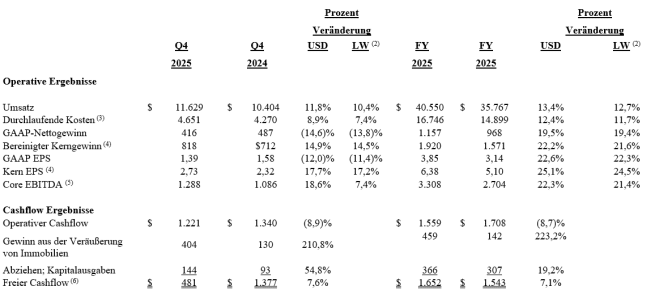

Overview of consolidated financial results

The table below shows CBRE’s key results (in millions of U.S. dollars, excluding per-share figures).

· GAAP net income in the fourth quarter decreased by $279 million due to the non-cash impact of the purchase of the Advisory Pension Plan in the United Kingdom, which will result in future net cash savings, as well as an increased provision for fire refurbishment in the UK development business. Excluding these items, GAAP net income would have increased 43 percent in the fourth quarter.

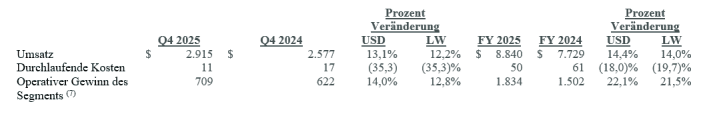

Advisory Services segment:

The following table shows the key results of the Advisory Services segment (in million U.S. dollars):

- Sales and segment operating profit increased by 13 percent (12 percent in local currency) and 14 percent (13 percent in local currency) respectively.

- Global leasing revenue increased by 14 percent (13 percent in local currency) and reached a new quarterly record.

- EMEA set the pace globally with leasing revenue growth of 26 percent (19 percent in local currency). In the USA, leasing revenue again rose by a double-digit rate of twelve percent, driven by industrial and data centers.

- Global real estate sales revenue increased 19 percent (17 percent in local currency), led by the U.S. with a 27 percent increase.

- Revenue from mortgage originations increased 18 percent (in the same local currency), driven by higher brokerage fees, primarily from loan funds and CMBS lenders.

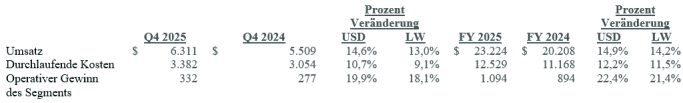

Building Operations & Experience (BOE) segment:

The following table shows the key results of the BOE segment (in millions of U.S. dollars):

- Sales and segment operating profit increased by 15 percent (13 percent in local currency) and 20 percent (18 percent in local currency) respectively.

- Facility Management revenue increased 13 percent (12 percent local currency), led by above-average growth in data center services and continued double-digit growth in local facility management.

- Property management revenue increased by 28 percent (27 percent in local currency). Contributions from Industrious, the flexible workspace operator acquired at the beginning of January 2025, contributed to the growth rate.

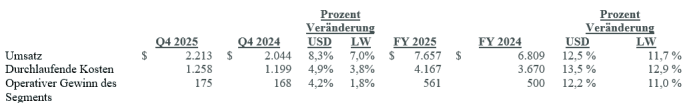

Project Management segment:

The following table shows the key results of the Project Management segment (in million U.S. dollars):

- Sales and segment operating profit increased by eight percent (seven percent in local currency) and four percent (two percent in local currency) respectively.

- Growth was supported by new real estate projects for hyperscalers in the U.S. and new infrastructure contracts in the U.K. public sector.

- As expected, the growth of the segment operating profit was dampened by some unusual one-off expenses. The segment achieved solid operating leverage for the full year.

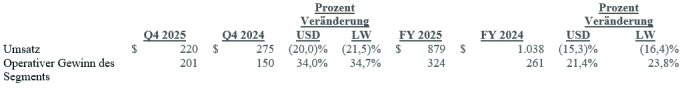

Real Estate Investments (REI) segment:

The following table shows the key results of the REI segment (in millions of U.S. dollars):

- Segment operating profit increased by 34 percent (35 percent in local currency).

Real Estate Development:

- Operating profit increased 46 percent (47 percent in local currency) to $179 million, driven by the monetization of data center locations in the U.S.

- The portfolio of ongoing projects and the pipeline amounted to 29 billion US dollars at the end of the year.

Investment Management:

- Sales fell by one percent (three percent in local currency) to 155 million US dollars. The decrease was due to lower contingency fees. Recurring asset management fees increased by seven percent (five percent in local currency).

- Operating profit (8) decreased due to lower performance fees and co-investment returns.

- Assets under management (AUM) increased by more than $9 billion to $155 billion in 2025 as a whole.

Core Corporate segment:

- The core company’s operating loss decreased by about two million US dollars in the quarter.

Overview of capital allocation:

- Free Cash Flow – For the full year 2025, free cash flow was nearly $1.7 billion.

- Share Repurchase Program – Since January 1, 2025, the Company has repurchased more than 7.6 million shares for over $1.0 billion (average price per share: $138.03).

- Acquisitions and Capital Expenditures – In the fourth quarter, CBRE acquired Pearce Services, LLC., a leading provider of advanced technical services for digital and energy infrastructure, for approximately $1.2 billion.

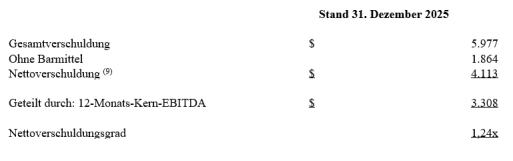

Overview of the debt ratio and financing

- Leverage – CBRE’s net leverage ratio (net debt (9) as a percentage of trailing twelve months EBITDA) was 1.24x as of December 31, 2025, well below the Company’s primary credit agreement of 4.25x. The net leverage ratio is calculated as follows (in millions of dollars):

- Liquidity – At the end of the fourth quarter, the company had total liquidity of around $5.7 billion, up from around $5.2 billion at the end of the third quarter.

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding the Company’s future growth dynamics, operations, business prospects, capital deployment and financial performance, including core earnings per share. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results and performance of the Company in future periods to differ materially from those expressed or performed by the forward-looking statements in this press release. The Company expressly disclaims any obligation to update or revise these statements to reflect actual results, changed expectations or changes in events, except as required by applicable securities laws. If the Company updates one or more forward-looking statements, it should not be inferred that it will make further updates with respect to these or other forward-looking statements. Factors that could cause results to differ materially include, but are not limited to: disruptions to general economic, political and regulatory conditions and significant public health events, particularly in regions or industries where our business may be concentrated; volatility or adverse developments in the securities, capital or credit markets, interest rate hikes and conditions affecting the value of real estate assets inside and outside the United States; poor performance of real estate investments or other conditions that negatively impact clients’ willingness to enter into real estate or long-term contractual commitments, as well as the cost and availability of capital to invest in real estate; currency fluctuations and changes in foreign exchange restrictions, trade sanctions and import/export and transfer pricing rules; our ability to compete globally or in specific geographic markets or business segments that are significant to us; our ability to identify, acquire and integrate companies that add value; costs and potential future capital requirements related to businesses we may acquire; integration challenges arising from businesses we may acquire; increase in unemployment and general slowdown in economic activity; trends in pricing and risk-taking for commercial real estate services; the impact of significant changes in capitalisation rates for different types of real estate; a reduction in companies’ reliance on outsourcing their commercial real estate needs, which would impact our revenues and operational performance; Actions taken by customers to limit their project spend and reduce the number of outsourced employees; our ability to further diversify our revenue model to offset cyclical economic trends in the commercial real estate industry; our ability to attract new occupier and investor customers; our ability to retain major customers and renew corresponding contracts; our ability to leverage our global services platform to maximize and maintain long-term cash flow; our ability to continue to invest in our platform and customer service offering; our ability to maintain cost discipline; the emergence of disruptive business models and technologies; negative publicity or damage to our brand and reputation; the failure of third parties to comply with service agreements or regulatory or legal requirements; the ability of our investment management business to maintain and grow assets under management and deliver the desired investment returns for our investors, and any related potential litigation, liabilities or reputational damage that could arise if we fail to do so; our ability to manage fluctuations in net income and cash flow that could result from the poor performance of our investment programs, including our participation as a principal in real estate investments; the ability of our indirect subsidiary, CBRE Capital Markets, Inc. to periodically amend or replace the arrangements for their warehouse credit lines on satisfactory terms; declines in U.S. GSE lending, regulatory oversight of these activities, and our mortgage servicing revenues in the commercial real estate mortgage market; changes in U.S. and international legislation and regulatory environment (including anti-corruption, anti-money laundering, trade sanctions, tariffs, currency controls, and other trade control laws), particularly in Asia, Africa, Russia, Eastern Europe, and the Middle East, due to political instability in these regions; litigation and the associated financial and reputational risks to us; our liability risk in connection with real estate advisory and management activities and our ability to obtain sufficient insurance cover on acceptable terms; our ability to retain, attract and motivate key personnel; our ability to address organizational challenges associated with our size; liabilities arising from warranties or for construction defects that we incur in our development services business; deviations from historically customary seasonal patterns that result in our business not performing as expected; our leverage under our debt instruments, as well as the limited limitations on our ability to take on additional debt and the potentially higher borrowing costs that we may incur as a result of a credit rating downgrade; our ability and that of our employees to implement and adapt to information technology strategies and trends; cybersecurity threats or other threats to our IT networks, including potential misappropriation of assets or sensitive information, data corruption, or business disruption; our ability to comply with laws and regulations related to our global operations, including real estate licenses, tax, labor and employment laws and regulations, fire safety and safety requirements and regulations, and privacy regulations, ESG matters and anti-corruption laws, and trade sanctions imposed by the United States and other countries; Changes in applicable tax or accounting rules, the inability to establish and maintain effective internal controls for financial reporting, the impact of the introduction of new accounting rules and standards or the impairment of our goodwill and intangible assets, and the performance of our equity investments in companies that we do not control.

Additional information on factors that may affect the Company’s financial information is available under “Risk Factors,” “Management’s Discussion and Analysis of Financial Position and Results of Operations,” “Quantitative and Qualitative Disclosures of Market Risk,” and “Cautionary Note Regarding Forward-Looking Statements” in our Annual Report on Form 10-K for the year ended December 31, 2022, our most recent Quarterly Report on Form 10-Q, and in the and other periodic filings with the Securities and Exchange Commission (SEC). These documents are in the public domain and can be obtained on the Company’s website at www.cbre.com or upon written request from CBRE’s Investor Relations Department at investorrelations@cbre.com.

The terms “net sales,” “adjusted net income,” “core EBITDA,” “core earnings per share,” “operating income (loss) of the business,” “segment operating profit as of sales margin,” “segment operating profit as of net sales margin,” “net debt” and “free cash flow” used by CBRE in this press release are non-GAAP financial measures under SEC policies that are set forth in the footnotes below and in the section “Not GAAP Financial Measures” in this press release. We have also included in this section reconciliations of these measures for specific periods to the most comparable financial measures calculated and presented in accordance with GAAP for those periods.

The sums could not be included in this announcement due to rounding in the million-euro tables.

Note: We have not reconciled the forward-looking (non-GAAP) core earnings per share projections contained in this presentation with the most comparable GAAP measure, as this is not possible without disproportionate effort due to the variability and low visibility of costs associated with acquisitions, interest-bearing incentive compensation and financing costs, which represent potential adjustments to future earnings. We anticipate that the variability of these items will have a potentially unpredictable and potentially material impact on our future GAAP financial results.

- Resilient businesses include facility management, project management, credit services, valuations, other portfolio services, property management, and recurring investment management fees. Transactional businesses include real estate sales, leasing, mortgage origination, carry interest and incentive fees in the investment management business, and development fees.

- The percentage change in local currency is calculated by comparing the results of the current period at the exchange rates of the previous period with the results of the previous period.

- Concurrent costs represent certain costs incurred in connection with services contracted out to subcontractors

- Core Adjusted Net Income and Core EPS exclude certain effects from US GAAP net income and earnings per diluted share, respectively. The adjustments made in the periods presented included, among other things: non-cash amortization of intangible assets related to acquisitions; interest expense related to indirect tax audits and settlements; the write-off of financing costs in the case of prematurely repaid liabilities; impact of adjustments on NCI; and the tax effects of adjusted items and strategic non-core investments; integration and other acquisition-related costs; (Chargebacks of) performance-related payments from carried interest to align with related revenues; expenses related to indirect tax audits and settlements; Net income related to the resolution of certain business areas; impact of non-cash fair value adjustments related to non-consolidated equity investments; transformational actions in the areas of business and finance; non-cash losses from pension settlements (buy-out settlements); costs related to efficiency and cost reduction initiatives; costs related to the restructuring of legal entities; net fair value adjustments for strategic non-core investments; and provisions related to Telford’s actions to address fire safety deficiencies.

- Core EBITDA refers to earnings before non-controlling interests, depreciation and amortization of property, plant and equipment, and intangible assets, asset impairments, net interest expenses, the amortization of financing costs on prematurely repaid liabilities, and income taxes. In addition, it is adjusted for integration and other acquisition-related costs; (Chargebacks of) performance-related payments from carried interest to align with related revenues; expenses related to indirect tax audits and settlements; Net income related to the resolution of certain business areas; impact of non-cash fair value adjustments related to non-consolidated equity investments; transformational actions in the areas of business and finance; non-cash losses from pension settlements (buy-out settlements); costs related to efficiency and cost reduction initiatives; costs related to the restructuring of legal entities; net fair value adjustments for strategic non-core investments; and provisions related to Telford’s actions to address fire safety deficiencies.

- Free cash flow is calculated as cash flow from operating activities plus gains on the sale of real estate assets less capital expenditures (reported in the capital expenditure section of the consolidated statement of cash flows).

- The Operating Profit (SOP) segment is the metric reported to the Chief Operating Decision Maker (CODM) to assess performance and allocate resources to each segment. SOP presents income including non-controlling interests, before net interest expense, amortization of financing costs on early repaid liabilities, income taxes, depreciation of property, plant and equipment, and intangible assets, and impairment of assets. In addition, SOP includes adjustments with respect to: integration and other acquisition-related costs; (Chargebacks of) performance-related payments from carried interest to align with related revenues; expenses related to indirect tax audits and settlements; Net income related to the resolution of certain business areas; impact of non-cash fair value adjustments related to non-consolidated equity investments; transformational actions in the areas of business and finance; non-cash losses from pension settlements (buy-out settlements); costs related to efficiency and cost reduction initiatives; costs related to the restructuring of legal entities; and provisions related to Telford’s actions to address fire safety deficiencies.

- Represents the profitability or losses of the respective business line in adjusted form.

- Net debt is calculated as total debt (excluding non-recourse liabilities) minus cash and cash equivalents.