BNP Paribas Real Estate publishes figures on the residential investment market for Q2 2025

In the first half of 2025, the German residential investment market continued its recovery, with In the second quarter, there was a moderate slowdown in momentum compared to the first quarter. In total, €4.5 billion was invested in larger residential portfolios of 30 residential units or more in the first half of 2025. Although the long-term average was missed by 33%, the half-year result from the previous year was exceeded by 36%. The noticeable market recovery is likely to gain momentum in the second half of the year in view of the completion of the price and consolidation phase, the ECB’s loose monetary policy and the current historically high rent increases. This is the result of the analysis by BNP Paribas Real Estate.

“After the first six months of 2025, the residential investment volume amounted to €4.5 billion. Residential thus remains the asset class with the highest turnover in the German real estate market. A positive indicator of a sustainable market recovery is the significantly increased weight of large-volume nationwide portfolios, including in the value-add segment. Evidence of the significant improvement in sentiment is also the strong commitment of foreign investors, especially from the USA, who are already increasingly realizing attractive investment opportunities again,” explains Christoph Meszelinsky, Managing Director and Head of Residential Investment at BNP Paribas Real Estate GmbH. “Overall, the number of transactions completed in the second quarter decreased slightly compared to the first quarter. however, the further increase in the frequency of large-volume transactions in excess of € 100 million is a clear positive signal for the market. Although the economic and geopolitical imponderables and risks are not diminishing, the German residential investment market is increasingly gaining favour with investors due to healthy fundamentals on the demand side and improved capital availability. This is reflected in a very well-filled pipeline of transactions in the market that will be completed in the next few months and should drive the German residential investment market in the short and medium term.

Major deals over €100 million have a market share of 40%

Large deals over €100 million (Ø10 years: 46%) make the highest contribution to the total investment volume at 40%. Eight nationwide portfolios have already been included here. In addition, the mid-size segment (€25–50 million) is buoyant with a market share of 24%.

Existing portfolios account for almost half of the investment volume

One indicator of the consolidation phase that has come to an end is the significantly increased importance of large-volume portfolios. With a market share of 49% (Ø10 years: 43%), the German residential investment market currently has a much stronger dominance of this asset class than in previous quarters. Although the investment volume of just under

€2.2bn remains significantly below the ten-year average (-34%, €3.3bn) in absolute terms, the volume from the same period of the previous year (€1bn) was more than doubled.

Equity/Real Estate Funds strongest buyer group with highest transaction volume since 2012

As was the case at the end of the first quarter, equity/real estate funds represent by far the strongest group of buyers, with a market share of 26% and an investment volume of €1.2 billion, respectively. This is accompanied by the above-average market share of 38% of foreign capital on the buyer side (Ø10 years: 28%). Equity/real estate funds or foreign investors are increasingly taking advantage of the opportunity as first movers to realize investment opportunities.

Only about a third of the investment volume is accounted for by the A-cities

The distribution of the investment volume shows that the stable investment environment of the A-cities has been less in demand recently. For example, A-cities only contribute a below-average share of

33% (Ø10 years: 47%) to total sales. Although Berlin is still the top location with by far the highest investment volume (just under €830 million), it also has a market share of 19%, which is below the average (Ø10 years: 25%). This is likely to be explained in particular by the renewed increase in the importance of large nationwide portfolios.

Prospects

The significant increase in the total number of registered transactions as well as the increase in large-volume portfolio transactions compared to the previous year and the renewed investor interest in the value-add segment are proof that the German residential investment market has entered a new phase of upswing. Nevertheless, the overall picture for the investment markets is currently still ambivalent. On the one hand, negative geopolitical and customs trends continue to keep the markets on their toes. On the other hand, however, the fiscal policy measures adopted are likely to give the German economy a noticeable boost. In addition, the new federal government wants to provide some positive impetus for the German housing market, such as lowering regulatory requirements and bureaucratic hurdles, among other things through the “construction turbo”. The cost of borrowing, which has settled on a stable plateau, also suggests that the positive developments clearly outweigh the negative developments and continue to provide a tailwind for the German residential investment market.

The healthy fundamentals, especially on the demand side, also speak in favour of the German residential investment market. Interest in German residential real estate will remain high in the medium to long term and will tend to increase. On the one hand, the persistently high excess demand on the rental markets is likely to persist at least in the medium term, which ensures stable rental income and potential for appreciation. On the other hand, residential real estate is a safe asset class, especially in volatile times. In addition, more and more international investors are recognizing the potential of the German residential real estate market and contributing to its dynamism. This is favoured by the stable political and economic environment in Germany by international standards. Overall, the German residential real estate market thus remains an attractive option for investors looking for long-term investments and secure cash flows.

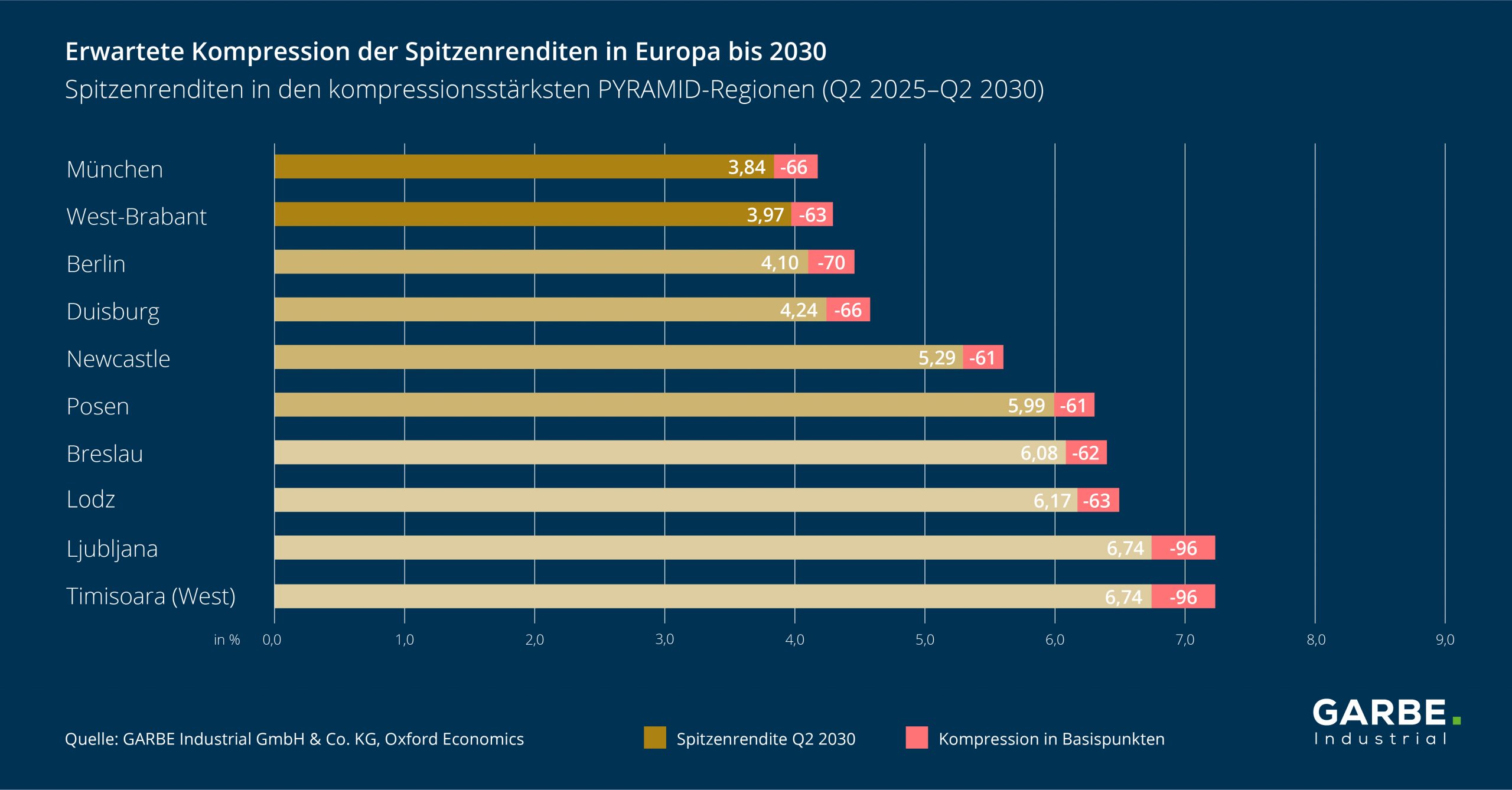

“For the second half of the year, we expect a sustained and more comprehensive market recovery. Many investment products only came onto the market in the second quarter and have filled the pipeline of transactions that have not yet been completed. Against this backdrop and in anticipation of further portfolio adjustments, we expect an investment volume in the double-digit billion range and a resumption of yield compression by the end of the year,” says Christoph Meszelinsky, summarizing the further outlook.