Annual Report 2025 / Trends 2026 of DIP – Deutsche Immobilien-Partner.

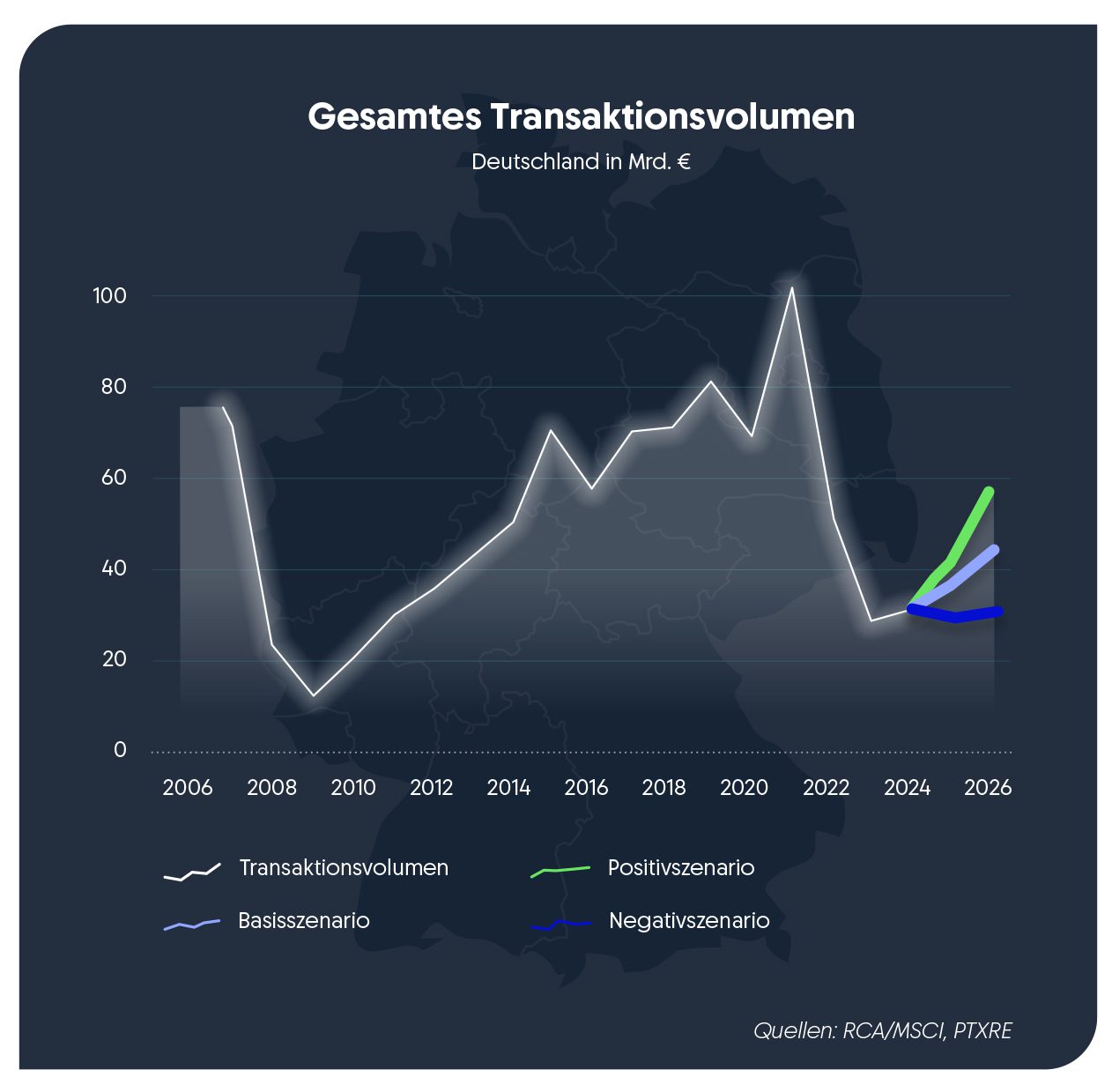

According to analyses by DIP, the German investment market generated a cash turnover of around EUR 33.1 billion (residential portfolios and commercial investments) in 2025. This figure is around 5% below the previous year’s figure (2024: EUR 34.7 billion), but 53% below the most recent ten-year average (Ø 2015 – 2024: around EUR 70 billion).

After the record of 2021 (approx. EUR 112 billion), there were significant reductions in sales volume in 2022 and 2023. A slight recovery in transaction volume in 2024 did not continue in 2025. The background to this was the persistently difficult general conditions, even though the lending rate continued to rise to a range of 3.0 to 3.3% p.a. in the course of the year due to gradual smaller key interest rate cuts by the ECB. at the beginning of 2026. At the same time, there was no noticeable economic development in Germany, and the Bundesbank and leading economic research institutes continue to forecast only moderate growth rates of 1% for 2026 after marginal growth of only 0.2% in 2025.

In the various asset classes, market activity in 2025 is as follows:

- On the commercial investment market, a transaction volume of around EUR 24.7 billion was on a par with the previous year (2025: around EUR 25.1 billion). However, the value is 52% below the current ten-year average.

- In the residential segment, cash turnover in 2025 was around EUR 8.3 billion (excluding portfolios), around 13% below the previous year’s figure (2024: around EUR 9.6 billion). The most recent ten-year average was missed by 55%.

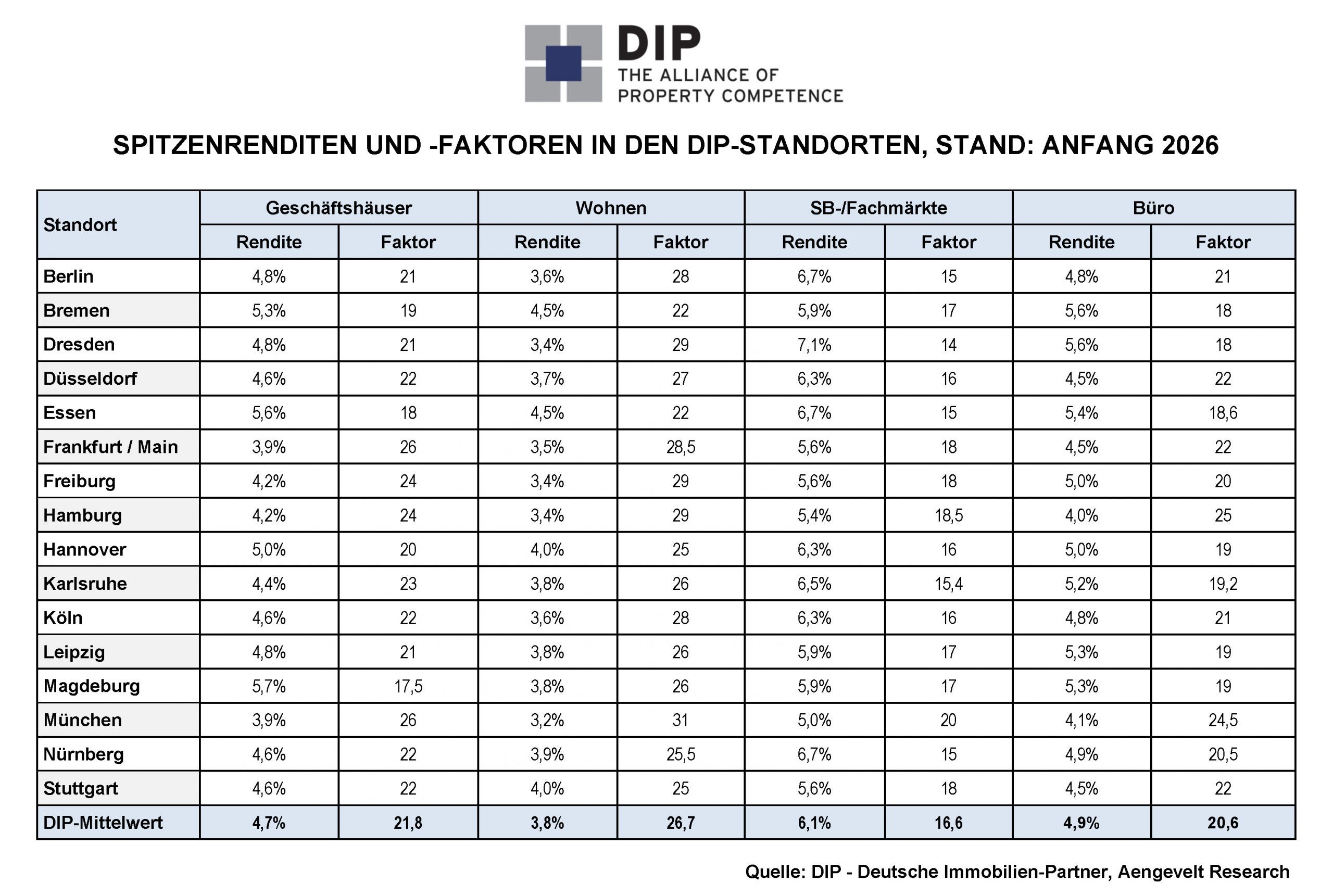

In 2025, prime yields in all asset classes will show a slight increase of 10 basis points in all asset classes except for the hypermarket, where there were no changes.

For 2026, DIP expects a moderate segment- and region-differentiated revival of investment activity. Accordingly, DIP forecasts an investment volume of around EUR 35 billion for 2026, which would still be well below the decade average.

Commercial transactions by type of use: retail in the lead.

- In the commercial investment segment, the retail and office investment asset classes recorded an increase in turnover in 2025. The strongest growth was in office investments , where contracted cash turnover rose by almost 16% to around EUR 6.28 billion (2024: EUR 5.42 billion). This means that this market segment ranks 2nd in commercial investments in 2025 after 4th place in 2024.

- The retail segment comes in first place with around EUR 6.44 billion, which corresponds to an increase of 10% (2024: EUR 5.84 billion).

- In third place is the “Logistics” segment, which suffered a decline in revenue of almost 17% to around EUR 6.12 billion in 2025 (2024: around EUR 7.34 billion).

- In the “Other” segment, which includes hotels and nursing homes, cash turnover fell by around 10% to approx. EUR 5.87 billion (2024: EUR 6.53 billion).

Commercial investments in the “Big Seven”: Berlin back in 1st place.

In the “Big Seven” Berlin, Düsseldorf, Frankfurt am Main, Hamburg, Cologne, Munich and Stuttgart, the commercial transaction volume rose by 9% or EUR 1.1 billion from EUR 12.5 billion in 2024 to EUR 11.4 billion according to DIP analyses. The market ratio fell from 46% of the commercial investment volume in Germany (2024: 50%).

- Within the “Big Seven”, Berlin once again occupies the top position with a cash turnover of EUR 3.21 billion (= -8%), ahead of Munich (EUR 2.45 billion = -5%), Hamburg (EUR 1.87 billion = -14%) and Cologne (EUR 1.33 billion = +21%).

- This is followed by Düsseldorf (EUR 1.12 billion = +11%), Frankfurt (EUR 0.786 billion = -50%) and Stuttgart (EUR 0.61 billion = +13%).

Residential investments with a significant increase.

- Revenue from residential portfolios fell by 13% to EUR 8.34 billion in 2025 (2024: EUR 9.6 billion). This value is also 55% below the ten-year average.

Yields in sideways movement.

After years of falling prime yields, prime yields rose significantly again in 2022 and 2023 and moved sideways in 2024, with the exception of the logistics segment. This trend continued in 2025. There was no change in the hypermarkets, only in the office segment did the prime yield fall slightly. This development confirms that the price discovery phase in the various asset classes is largely complete. In detail:

- For top commercial buildings , prime interest rates will rise by 10 basis points to around 4.7% p.a. on average in the DIP markets, while for pure office buildings they will fall to 4.9 % p.a. (2024: 5.0%).

- As in the previous year, residential investments achieved the lowest prime yield at 3.8% p.a. (+10 basis points). In 2025, Munich will lead the “price list” with 3.2% p.a., followed by Dresden and Freiburg with 3.4% p.a. each.

- Prime yields for hypermarkets/specialist stores are stable at 6.1% p.a.

- For logistics properties , DIP analyses a slight increase of 10 basis points in 2024 compared to the previous year to a prime yield of 5.0% p.a.