Orientation in the fog

The article summarises the key findings from the webinar “European Residential Real Estate Markets between Black Swans and Grey Rhinos” on 12 September 2025 – part of the series Macro Matters – The KINGSTONE Real Estate View.

The focus was on the price dynamics of European residential markets, an analysis of key figures for return and risk (expected value, volatility, skewness, kurtosis), the simulation of extreme scenarios using value-at-risk, and strategic derivations on pricing, quantities and equilibrium.

The European residential real estate markets are moving in a force field of permanent uncertainty. Inflation, interest rates, regulation and migration act simultaneously – and rarely linearly. Some risks appear suddenly (“black swans”), others have been visible for years but are suppressed (“gray rhinos”).

It is not the return that should be in the spotlight, but the risk – and whether the return compensates for it adequately.

Between black swans and grey rhinos – economy in a reform backlog

The “black swan” stands for rare, disruptive events, the “grey rhinoceros” for obvious but suppressed risks – structural deficits, reform backlogs or fiscal imbalances. Both shape the current situation: While interest rate turnarounds and geopolitical tensions can become a swan at any time, demographics, energy policy and debt act as persistent rhinoceroses in the background.

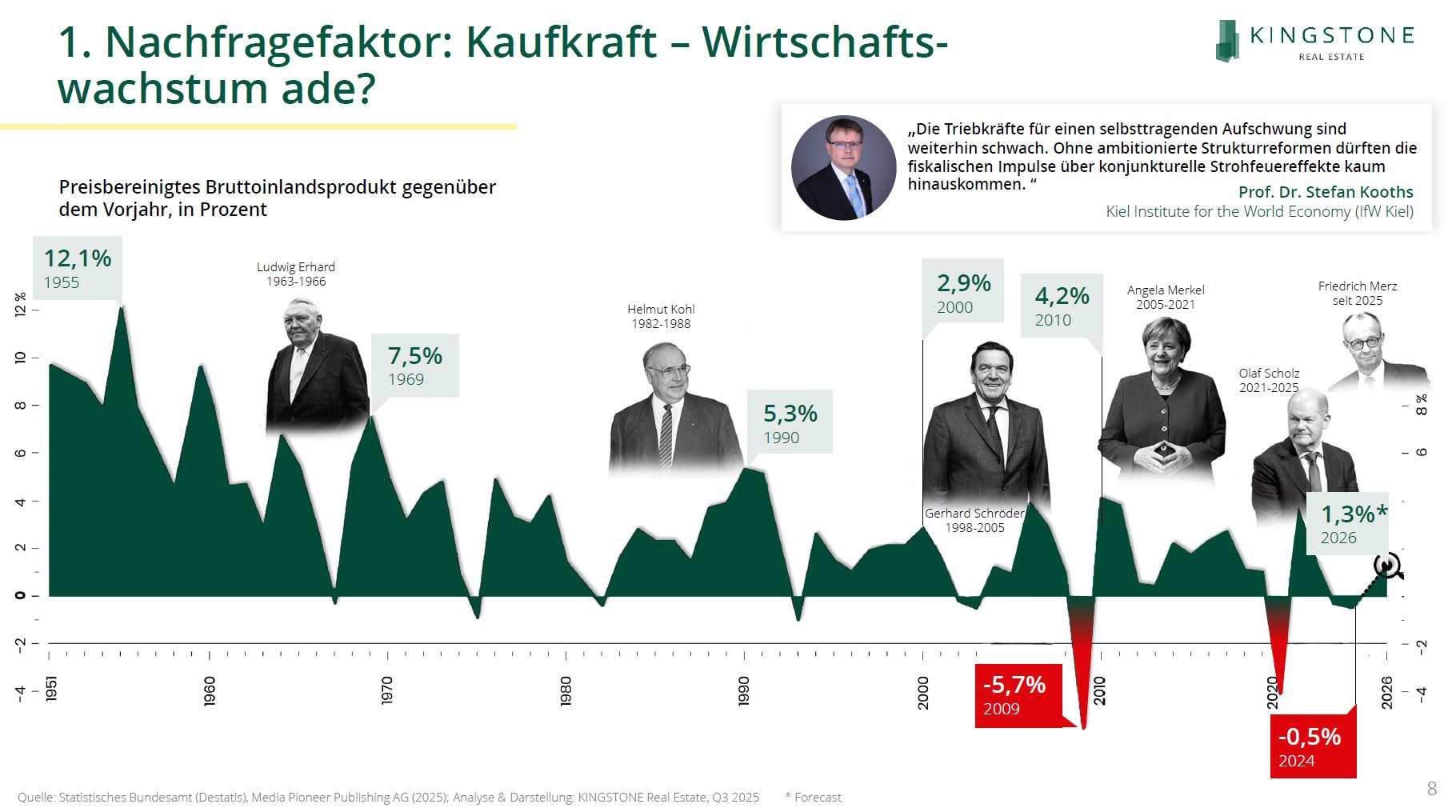

Germany is in a phase of economic fatigue: Schroeder’s agenda reforms date back two decades, the Merkel era brought stability but stagnation. Even under Olaf Scholz, the reform impulse has failed to materialise – the announced “autumn of reforms” by Friedrich Merz is still pending. Without structural reforms, the political center is threatened with a loss of economic credibility.

Unemployment, weak growth forecasts and growing uncertainty are weighing on the investment climate. The Economic Policy Uncertainty Index shows that Germany has decoupled from the European trend – uncertainties about energy prices, budgetary discipline and competitiveness remain high.

Interest rate turnaround, customs policy, currency parity – the new measurement of macroeconomic risks

Monetary policy remains on guard. Although inflation in the euro area is approaching the target value, the core rate remains above it. The ECB steers on a data-dependent basis – with the

At the same time, new US tariffs of around 15% on European products are exacerbating protectionism. Production decisions are increasingly shifting to North America. The foreign exchange market is also becoming a geopolitical instrument: a weaker US dollar strengthens exports and industrial jobs – in line with the Make America Great Again agenda.

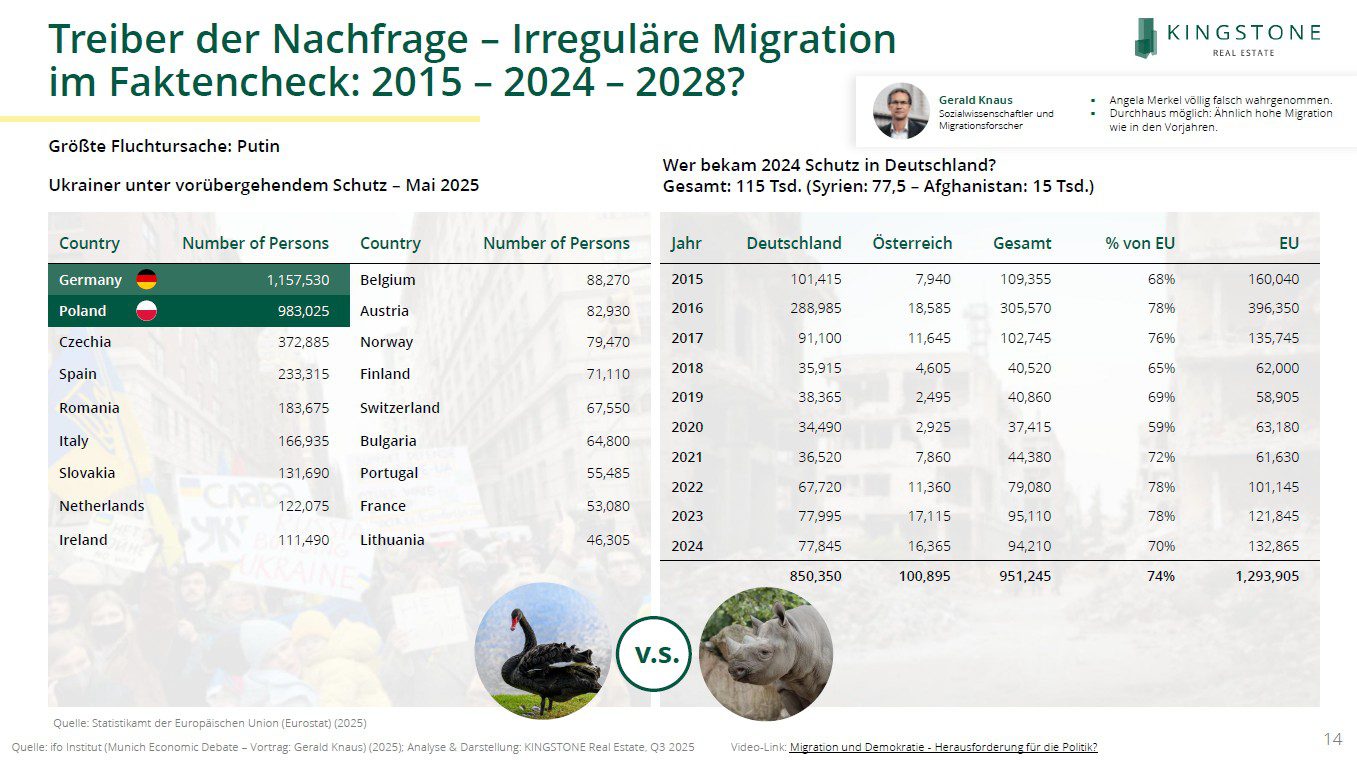

Irregular migration in fact check – black swan or grey rhinoceros?

Migration has long been a macroeconomic factor – especially for the housing market. The recent refugee movements from Ukraine, Syria and Afghanistan have noticeably changed the demand for housing in Europe. In Germany, there is a real shock in demand: the immigration of Ukrainian asylum seekers alone has significantly increased the pressure on the housing markets.

Migration researcher Gerald Knaus describes migration as a geopolitical instrument – as Putin’s “weapon of war”. An easing of the situation is not foreseeable; the end of the EU-Turkey agreement and Ankara’s more restrictive line exacerbate the situation. Migration thus remains not an outlier, but a structural reality – not a black swan, but a gray rhinoceros.

Between Market Mechanics and Statistics – Focus on Risk-Return Profiles

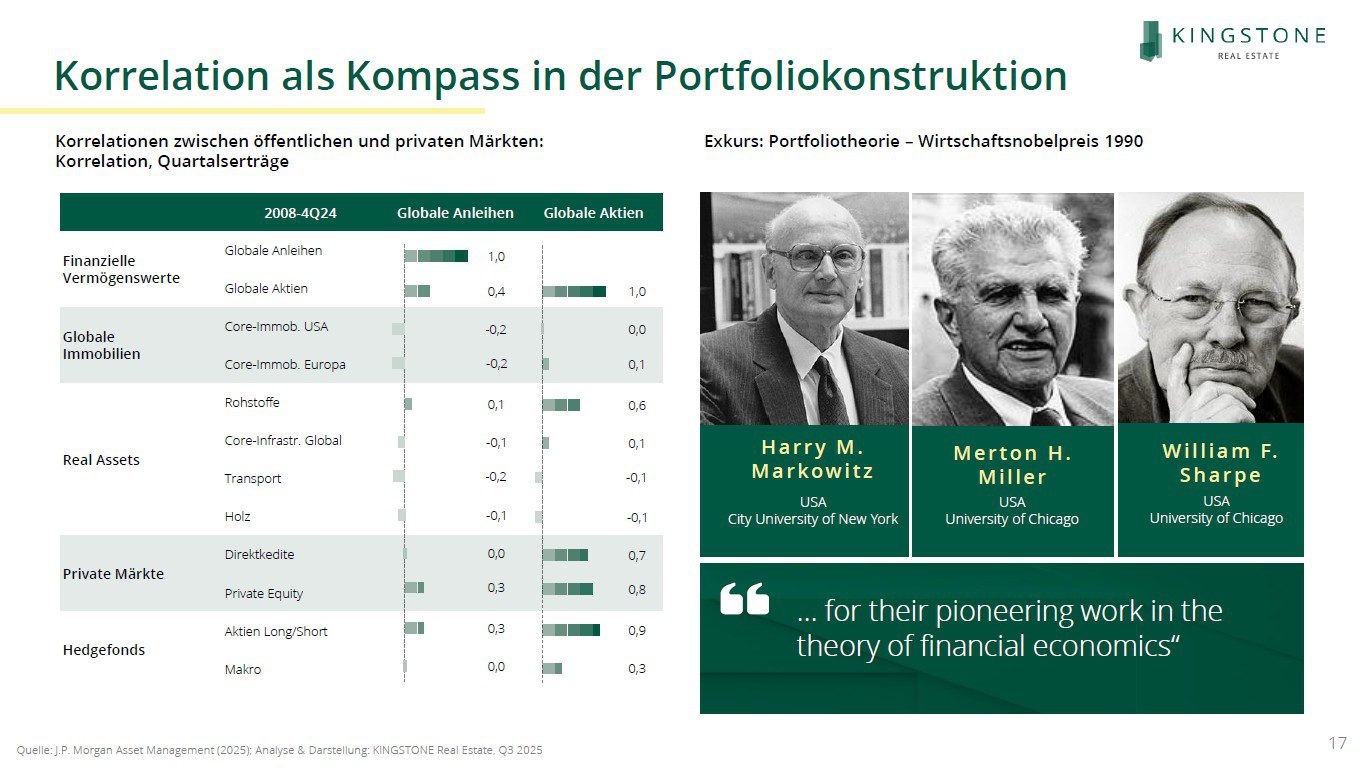

Theory and practice rarely meet – especially in real estate. But the classics of financial theory provide orientation: Markowitz, Sharpe, Fama and French connect risk and return via correlations.

Returns are the price of fluctuation – and those who bear more risk expect higher compensation. In the real estate context, this only works to a limited extent: the markets are illiquid, heterogeneous and react sluggishly. Nevertheless, the logic remains valid: diversification works.

Real estate yields do not follow a normal distribution. Extreme swings are more common than models assume. Anyone who ignores these “fat edges” underestimates the black swan. Skewness, variance and excess are therefore practical early warning systems.

Empirical evidence shows that residential real estate is stable with a slightly positive skew, logistics is profitable, and retail is volatile. Europe’s markets are moderately correlated – enough to allow for diversification, but not to avoid shocks. An efficiency portfolio according to Markowitz remains theoretical, but a useful one: stability, market size and dynamism combine to create robust portfolios.

From the expected value to the Sharpe ratio – the measurement of return and risk

Returns are not a product of chance, but statistics. Expected value, variance and standard deviation form the foundation of any risk analysis. The Sharpe ratio shows how much return per unit of risk is achieved.

In the long term, European total return yields range between 8% and 11%, income yields between 5% and 7%. Those who spread across countries significantly improve their Sharpe ratio – diversification is an empirical advantage. Germany scores with stability, Poland and Spain with dynamism; a mixed Europe portfolio has the highest volatility, but also the best risk-return ratio.

It remains unclear what is considered “risk-free” today. Government bonds are losing their appeal in view of high debt ratios and political uncertainty. Greece is stabilizing, France is drifting away – the euro crisis remains present as a shadow.

“Price vs. Value” – the return of fundamental analysis in the real estate market

There is often a misunderstanding between price and value. While sales talk about returns, every serious analysis begins with risk: Which return compensates for which risk – and which does not?

Markowitz defines risk via volatility, Fama/French complement liquidity, size and downside risk. For real estate, this means that illiquidity, valuation cycles and demand shocks have a greater impact on risk premiums than interest rates or rents.

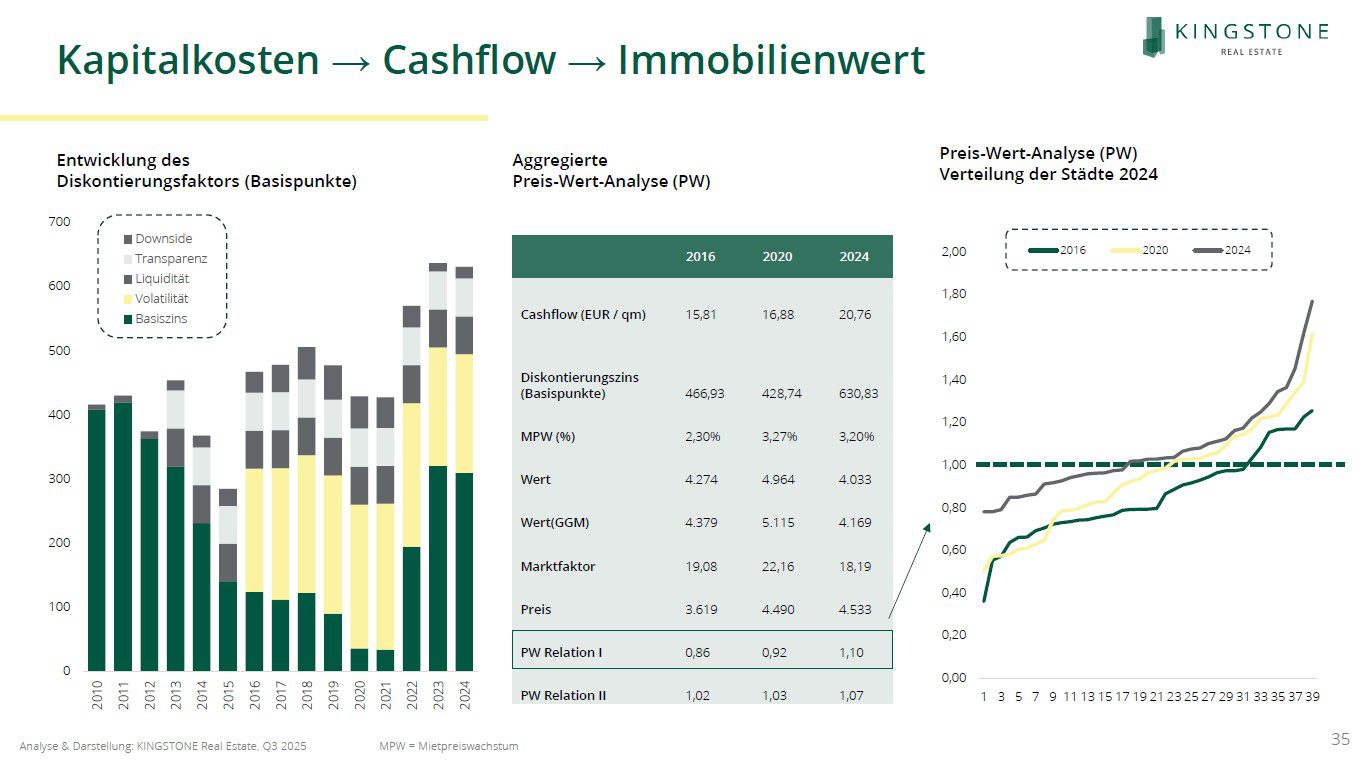

The required return remains central. In the DCF model, the property value results from the ratio of cash flow and required return – real estate value = cash flow / required return. This shifts the focus from transaction prices to capital market expectations.

Falling interest rates drove values up, rising interest rates bring them back into balance. Support rent increases, push down higher equity costs. The price-to-value ratio of many markets is normalizing – fundamental analysis is making a comeback.

Conclusion – Of black swans, grey rhinos and clear signals

The European residential real estate markets remain characterized by uncertainty: interest rate turnaround, inflation, migration and regulation are intertwined – risk is becoming the decisive control factor.

The lesson: Returns without risk analysis are blind. Anyone who understands correlations, Sharpe ratios and risk premiums will gain orientation in the fog. Diversification works, fundamental analysis replaces gut feeling.

Or, as Benjamin Graham put it: “Price is what you pay, value is what you get.”

The true value of a property lies not in price, but in the sustainability of its cash flows – and in the recognition that stability itself can become a source of return.