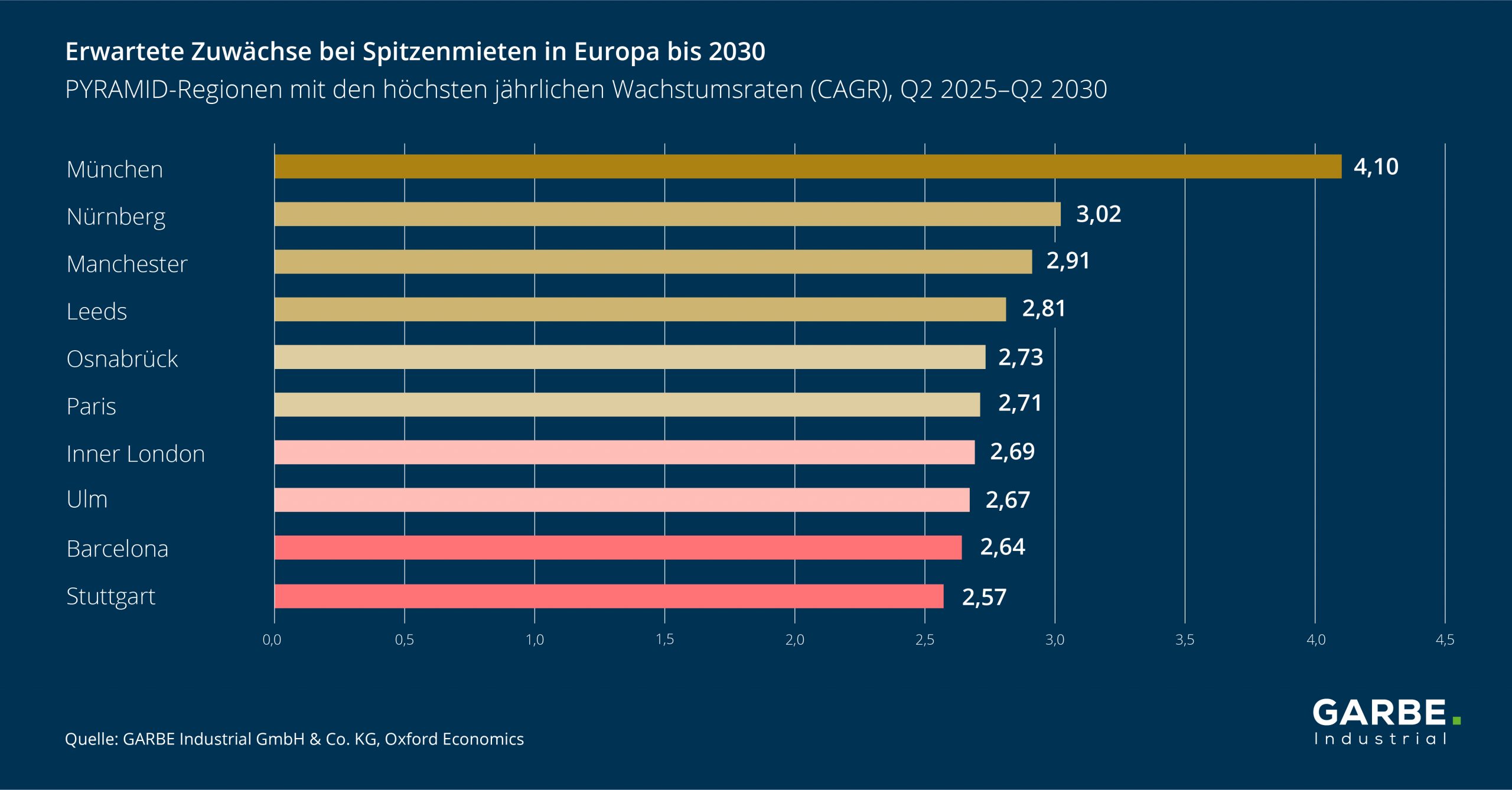

Regional differentiation is increasing – top markets remain driving forces

The European logistics real estate market is in a phase of stabilization and consolidation. Accordingly, an average rent increase of 70 cents per square metre is expected for the period from the 2nd quarter of 2025 to the 2nd quarter of 2030. This corresponds to an annual growth rate – the so-called compound annual growth rate (CAGR) – of 1.9 percent. For comparison, between Q2 2020 and Q2 2025, the CAGR was 5.6 percent. These are the findings of GARBE Research in its current GARBE PYRAMID map for the first half of 2025, an overview of prime rents and net initial yields for the 121 most important European sub-markets for logistics real estate in 25 countries. In addition, the PYRAMID contains forecast values for 88 regions, which were developed in cooperation with Oxford Economics.

Tobias Kassner, Head of Research & ESG at GARBE Industrial, explains: “The extraordinary rent increase of recent years cannot be reproduced in the long term. But our forecast shows that prices will remain stable and high-quality locations will retain their growth potential.”

Top regions hold their own – opportunities in specialized markets

According to the forecast, markets such as Munich, Stuttgart, Inner London, Manchester, Paris, Barcelona and Warsaw in particular will continue to see above-average rent growth in the coming years. These regions are expected to grow at a CAGR of more than 2.0 percent, reflecting their role as central logistics hubs. Regions that have already shown strong growth potential in recent years continue to have robust development prospects.

First half of 2025: Rent growth slowed but stable

In the first half of 2025, prime rents in Europe rose by an average of 6 cents to 7.42 euros per square metre per month. At 0.8 percent, rent growth was thus significantly more moderate than in previous years and remains below the forecast inflation rate of 2.06 percent for 2025 (source: Oxford Economics). In 59 percent of the 121 regions examined, prime rents remained unchanged. A further 36 percent recorded slight increases, on average by 18 cents per square meter. Only 5 percent of the regions reported rent declines – at the end of 2024 it was still 8 percent. This development points to stabilization.

Regional developments show a differentiated picture

In the 29 regions in Germany surveyed, rents also rose by an average of 6 cents – excluding Munich by only 3 cents. Eleven regions showed a positive development, including five of the seven largest logistics locations. Leipzig and Magdeburg recorded declines. Italy achieved rent increases in five out of seven regions with an average of 24 cents, France in four out of ten regions with an average of 4 cents, and Spain grew by an average of 13 cents in three out of four markets. In the UK, growth slowed to 11 cents, and in the Netherlands to 5 cents.

Vacancy rate up slightly – demand differentiates

The long-term trend in European take-up continued and was overall at the previous level or only slightly below. The average vacancy rate in Europe already rose to over 6.6% in the first quarter of 2025. While the UK, Italy and Slovakia are recording the largest increases, Germany, Spain and Poland are showing the first signs of recovery. The German market is showing an increasing recovery, while Austria and the Czech Republic are acting rather cautiously.

New impetus through political incentives – location quality is gaining in importance

“We expect further, albeit more moderate, rental growth in many markets – driven by structural trends, industry-specific demand and regional dynamics,” said Kassner. Political measures such as the German government’s super depreciation could provide new impetus, even if their effect is only expected in the medium term. Overall, it is clear that despite declining momentum, the market remains robust – and offers opportunities for investors, especially in regions with good connections, specialized users and high location quality.

Detailed figures and methodological information can be found in the interactive GARBE PYRAMID MAP.