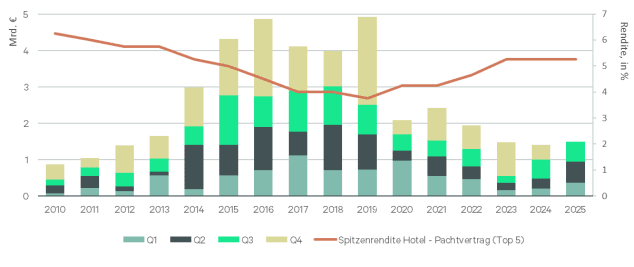

The German hotel investment market has clearly picked up speed in recent months. After two very stable quarters in the second half of 2024, each with over €400 million, the market had started 2025 comparatively weakly due to a lack of product surplus. However, in the first quarter of 2025, there was already a broad-based increase in investor interest, which was not reflected in the investment result of around € 238 million, but was repeatedly expressed in the processes currently being marketed. This is the result of the analysis by BNP Paribas Real Estate.

“In the second quarter, the registered investment volume of € 592 million impressively reflects the accelerating market momentum. For the first half of 2025, a hotel investment volume of € 830 million can thus be reported,” explains Alexander Trobitz, Managing Director and Head of Hotel Services at BNP Paribas Real Estate GmbH, adding: “Compared to the same period last year, this corresponds to an increase of 52% and the market is back on track for long-term levels.” While the first quarter was dominated by small-volume deals for long stretches, it was transactions above the €50 million mark that made the difference in the second quarter. Particularly prominent was the purchase of the Mandarin Oriental in Munich by Eagle Hills for around €150 million. The proportion of foreign investors has been at a significantly above-average level over the past two years. Convinced of the strong German hotel market and improving performance figures, they are securing attractive investment opportunities in the current market environment, especially in the premium hotel industry. Their market share is currently at a high 70%.

Munich and Berlin at the top of investors’ favor

With strong results, Munich and Berlin lead the field of the most important hotel investment markets by a wide margin. In Munich, the investment volume in the first half of the year amounted to around €261 million, while around €177 million was registered in Berlin. Both markets benefited not only from their size and the convincing development of hotel performance indicators, but above all from the attractive investment product in the large-volume segment. Notable sales can still be reported for Cologne (around €83 million) and Hamburg (around €51 million). In all other A locations, the result is still disappointing for the moment. The analysis of the absolute values shows that the investment volume in all size classes above € 10 million has increased in some cases significantly compared to the previous year. The increase in the size class between €50 million and €100 million, with an increase of around 128% to a total of €352 million, is particularly significant. The growth in deals between €10 million and €25 million to currently €150 million is similarly dynamic (+120%).

Prospects

The German hotel investment market is increasingly picking up speed. The positive sentiment among market participants already registered in the first quarter resulted in a much tighter pace of contract conclusion in the second quarter. In addition to a significant increase in the number in the mid-size segment, a number of large-volume deals were also successfully crossed the finish line, sending strong signals to the market. In addition to the Mandarin Oriental in Munich, this also includes the sale of the Motel One Hotel in the Upper West in Berlin at the beginning of the year. Although the striking landmark property opposite the Gedächtniskirche was included in the investment turnover of the Office division due to the significant share of rental income from the office segment, this transaction has sent a positive signal among the hotel market players.

“For the second half of the year, the market is well positioned overall. The accommodation statistics with persistently high numbers of guests and overnight stays in all major tourist destinations in Germany – even outside the A locations – speak for themselves. In addition, there have been very positive performance indicators in the hotel segment over the past two years. The registered expansion on the supply side continues to speak for a more dynamic second half of the year. In addition to attractive entry opportunities in the core-plus and value-add sector, there are also opportunities for core investors. Certainly, what is happening on the hotel investment market will be significantly influenced by further geopolitical and macroeconomic developments, but under the premise that no further trouble spots escalate and that the customs negotiations are resolved reasonably rationally, the German hotel investment market should convincingly continue its recovery course,” predicts Alexander Trobitz.

To the market report