Battery Energy Storage System systems (BESS or large-scale battery storage) are increasingly attracting lively investment interest from institutional investors as an infrastructure segment due to their good monetization prospects. This is accompanied by a wide range of discussions about the plant-specific risk factors. This article is specifically dedicated to the current “flood” of grid connection requests for battery storage systems from transmission and distribution system operators in Germany.

“Tsunami” in grid connection requests

As a result of the current attractive business model and the high demand for BESS services and capacities, many project developers specializing in such plants see a booming future market. The gold rush mood is reflected in the number of grid connection requests:

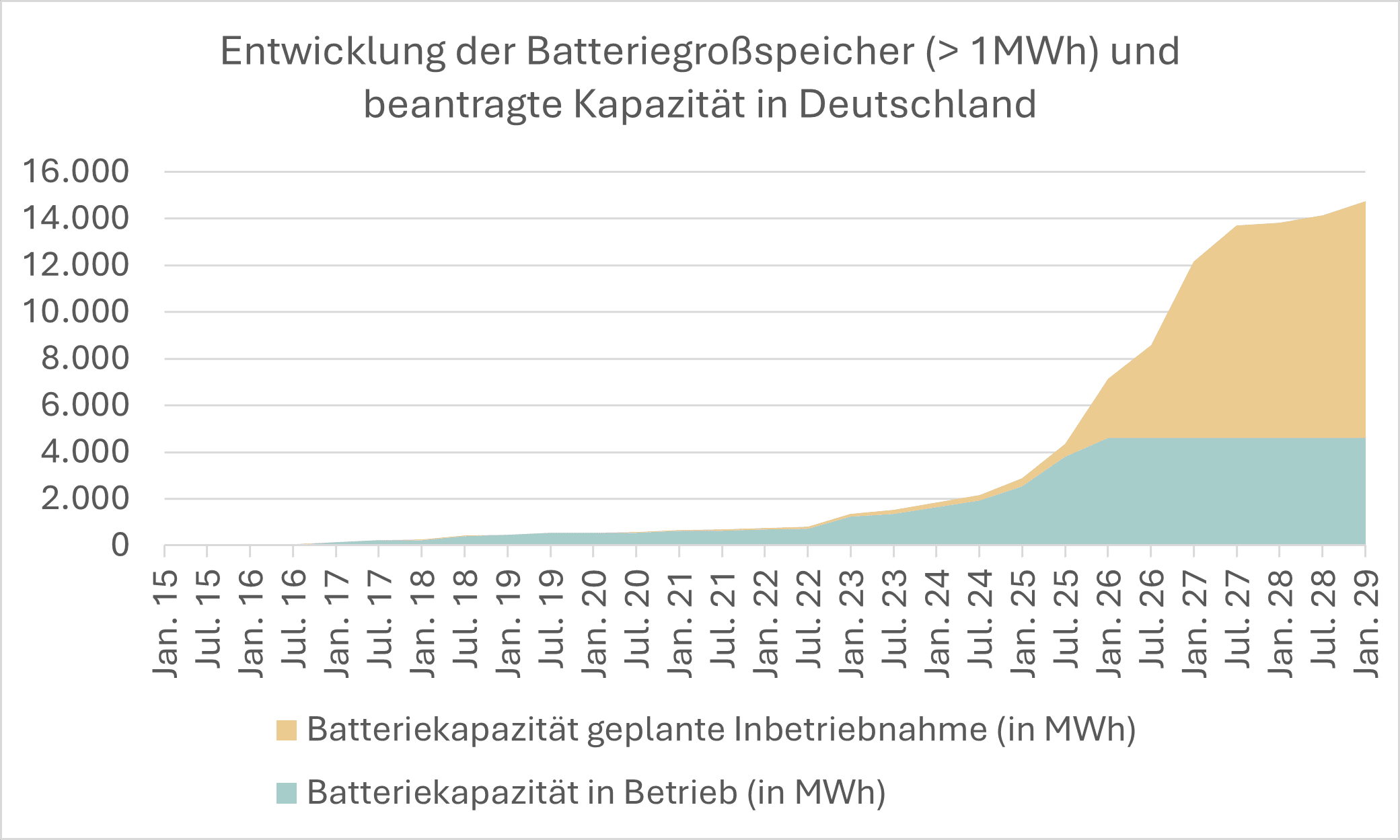

As of mid-October 2025, according to the market master data register published by the Federal Network Agency, 703 storage systems (>1 MWh) with 4,620 MWh are currently on the grid nationwide, and a further 640 storage projects with a capacity of over 10,780 MWh are currently being planned (see chart below).

According to the Energy Industry Act (EnWG), grid operators are legally obliged to connect battery storage systems to the grid infrastructure. The grid connection can only be refused to a limited extent in the event of capacity bottlenecks. The transmission system operator 50 Hertz recently announced that grid connection commitments for new projects before 2029 are no longer possible for capacity reasons.

The result is in need of reform: The legal framework forces the grid operators to process the applications on a first-come, first-served basis. It is not the degree of maturity or the grid-friendly nature of the plant, the financing of the project or the seriousness of the developer that are the decision criteria, but the date of application.

Because project rights, which include grid connection, already have a value, developers are increasingly registering large services in order to keep various options open for future value creation. This speculative behaviour ties up capacities at the network operators and also blocks connections that are important for the economy as a whole, e.g. from data centres and industrial plants

Does the “traffic jam” mean a complete “standstill” from an investor’s point of view?

The conditions described could lead to a drastic reduction in the availability of new BESS projects in ready-to-build status on the transaction market due to project cancellations or delays.

However, it is not only the four transmission system operators who create grid access for BESS systems, but also many of the approximately 850 distribution system operators in Germany – at voltage levels below the extra-high voltage (< 220 kV). Their capacities to process the applications are used to varying degrees, so that at least there is no complete standstill.

Sourcing alternative to in-house development: Growing M&A market for plant projects in various stages

Many project developers are concerned that the slow speed of grid connection or the uncertainty about an actual approval will overstrain the cost side of their own business plan, so that initiated projects (due to a lack of cost-adequate financing) are no longer economical.

In addition, battery storage systems are exempt from grid usage fees until August 2029. It is foreseeable that charges will be introduced with a relatively high degree of certainty from this date, so that BESS plants operating from this date onwards will be less economical. This puts additional pressure on project developers to complete the plants in a timely manner.

For these reasons, an M&A market for BESS projects is already developing, where developers who “speculate” with project rights sell projects. The buyers of the project projects are companies that are particularly well suited and have the financial resources to drive the implementation beyond the ready-to-build status to commissioning.

In this context, three things are important from an investor’s point of view so that investment success is not burdened with risks that are already foreseeable today:

- Does the asset manager who acquires such projects, e.g. for a fund, have the necessary know-how and a track record to assess the quality of specific projects correctly and to complete them without significant additional costs?

- Does the technical configuration of the systems, and in particular the software in the BESS system and in the inverters, comply with the latest security standards in terms of avoiding any external manipulation access, especially by companies that are not located in Europe?

- Is it guaranteed that an independently prepared market value report confirms the market fairness of the purchase price before the investments are acquired (in particular by funds)?

Politicians recognize that “first come, first serve” does not fit.

In the context of the Bundesrat’s statement on the draft of a law amending the energy industry law (printed matter 21/2076), explicit reference was made to the high number of follow-up applications for large-scale battery storage systems.

From the Federal Council’s point of view, for example, uniform nationwide reservation fees in grid connection procedures could be a suitable instrument to reduce speculative connection requests with a low probability of realization.

The report on energy monitoring by the Federal Ministry for Economic Affairs and Energy (BMWE), which clearly focuses on the total system costs of the electricity grid, reveals further control mechanisms – also with regard to the choice of location:

- For synergy reasons, storage systems should be located near plants for generating electricity from renewable energies (ideally co-location for optimal utilization of existing grid connections).

- Regionally differentiated construction cost subsidies could provide incentives for the choice of location that is beneficial to the grid (taking into account congestion costs due to storage facilities that do not serve the grid).

- Further control of the choice of location through different grid charges is conceivable.

- Prioritization of grid connection requests for grid-serving storage systems.

Result

The current debate on the approval of grid connections for BESS plants is causing uncertainty with regard to their market availability, profitability and feasibility. However, alternative ways are currently emerging for sourcing and commissioning such large-scale battery storage projects, although special skills are required from the asset managers involved.

In addition, other market players (including grid operators) and political players are working to develop and implement more appropriate approval processes for grid connection requests.