Transaction volume falls by around twelve percent, Berlin remains the frontrunner

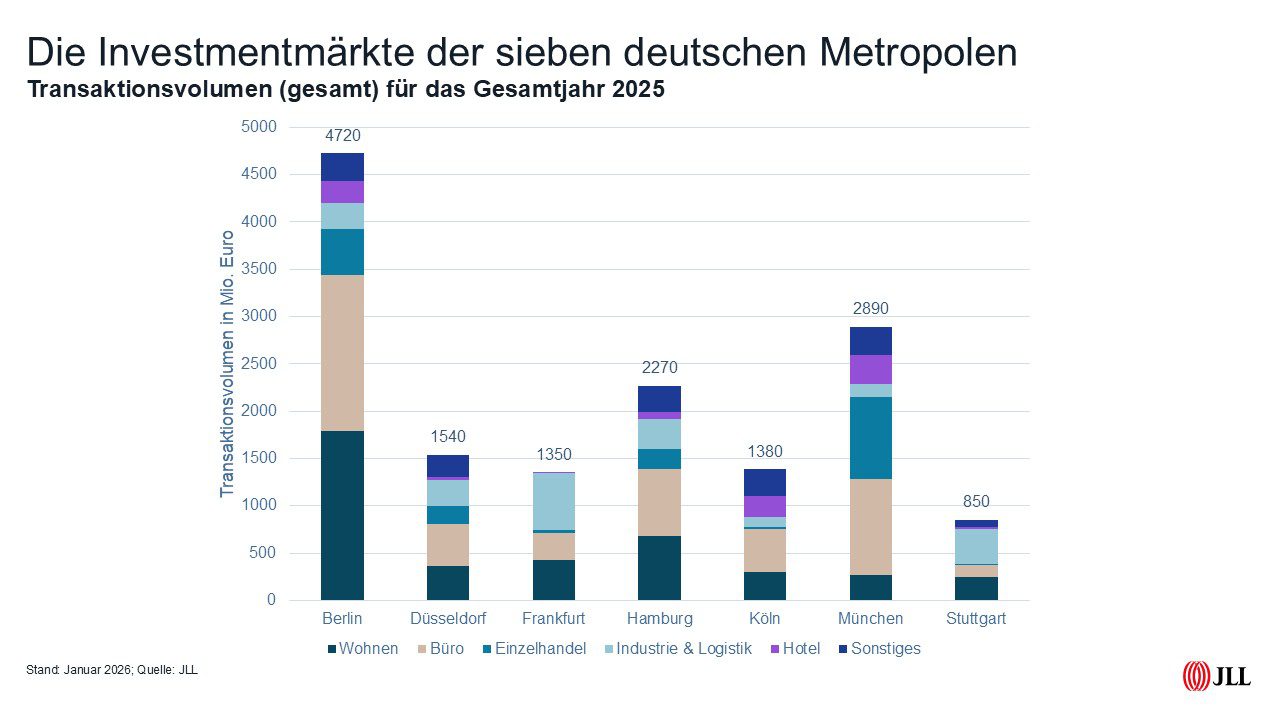

The German commercial real estate market in the seven metropolises shows a heterogeneous picture in 2025, with predominantly declining transaction volumes. In total, around 15 billion euros were invested, around twelve percent less than in the previous year (16.9 billion euros) and slightly more than a third less than the ten-year average.

While all cities recorded significant losses compared to the long-term averages, the declines varied considerably: Frankfurt recorded the sharpest slump with minus 81 percent compared to the ten-year average, Cologne the smallest with minus 38 percent. Prime yields are stable to slightly increasing, with logistics properties showing the highest yields. Foreign investors remain important market players, their share fluctuating between twelve and 46 percent, depending on the city.

Berlin leads the ranking of cities with a transaction volume of 4.72 billion euros, but records a decline of 24 percent compared to 2024. Living dominates with 1.79 billion euros, followed by office with 1.65 billion euros. Foreign buyers make 46 percent of investments, while 36 percent of sellers come from abroad. The prime yield for office properties is 4.2 percent, for retail 3.4 percent and for logistics 4.6 percent. A total of 119 deals were registered, 21 more than in the previous year. However, there was a decline in transactions of more than 100 million euros from twelve to seven.

Anja Schuhmann, Branch Manager JLL Berlin & Leipzig: “With a transaction volume of 4.72 billion euros, Berlin remains clearly the number one among Germany’s real estate metropolises – even if this meant a decline of 24 percent compared to the previous year. But despite all the challenges, I see encouraging signs for 2026: We are seeing significantly more pitch activity and already a substantial pipeline. That means there will definitely be more product coming to market. And if the German economy and especially the rental markets stabilize in the coming months, I expect a positive trend. The interest in buying and the liquidity among investors are there – these are good prerequisites for a revival of the Berlin market.”

Düsseldorf achieved an investment turnover of 1.54 billion euros, an increase of 20 percent compared to 2024. Office properties lead with 450 million euros, followed by the Living segment with 360 million euros. Foreign buyers make 36 percent of the investments, 32 percent of the sellers come from abroad. The prime yields are 4.5 percent for offices, 3.6 percent for retail and 4.6 percent for logistics. The number of deals rose from 52 to 64, but the number of major deals fell from three to zero.

Marcel Abel, Managing Director and Branch Manager of JLL Düsseldorf: “At the end of the year, we saw a noticeable return to momentum in the Düsseldorf investment market. In a longer process of convergence, the expectations of buyers and sellers have moved closer to each other again, creating a new, sustainable price basis – an important signal for the market.

The market is thus in a phase of bottoming out: most deals are still in the lower double-digit million range, but even one or two larger, qualitatively convincing transactions can significantly strengthen confidence in the location.

Even though financing conditions have hardly changed so far, confidence is growing under this impression. Institutional investors are gradually returning, review processes for new investments and project developments are resuming, and the willingness to allocate capital is increasing.”

Frankfurt reached a volume of 1.35 billion euros, which corresponds to a decline of 23 percent. Investments in the logistics industry segment lead the way with 610 million euros, Living follows with 430 million euros, followed by offices with 280 million euros. Foreign buyers make up 33 percent, 22 percent of the sellers come from abroad. The prime yields are 4.6 percent for offices, 3.5 percent for retail and up to 4.5 percent for logistics. The number of deals rose from 55 to 63, but the number of major deals fell from three to zero.

Suat Kurt, Branch Manager JLL Frankfurt: “The Frankfurt office transaction market again fell short of expectations in 2025 with around 15 deals and a volume of just under 300 million euros. This was mainly due to the lack of core products. Nevertheless, there could be a significant upward trend in the new year, as there are currently many properties, some of them large-volume, on the market and pitch activities are increasing again.

At the same time, Frankfurt’s housing market is showing the first positive signals. After the challenging previous years, movement is cautiously returning, with interest renewed, especially among international investors. Core properties and more recent holdings are attracting attention, and where sellers have adjusted their price expectations to current market conditions, there are isolated transactions.”

Hamburg recorded a transaction volume of 2.27 billion euros, which corresponds to a decline of four percent. Office properties dominate with 710 million euros, living investments reach 680 million euros. Foreign investors make up 33 percent of buyers, while 21 percent of sellers come from abroad. The prime yield for offices is 4.05 percent, for retail 3.4 percent and for logistics 4.5 percent. The number of transactions fell from 113 to 86 deals, and the number of major deals fell from four to three.

Alexander von Bülow, Branch Manager JLL Hamburg: “After the slump in the Hamburg investment market in the first half of 2025, the market has picked up speed again in the second part. Through the transactions in these months, owners and investors have received more evidence again and thus certainty about what is possible and where the market stands. This is now spurring further transactions and we are already seeing a lot of activity and transactions heading towards completion in the first two quarters of 2026. The courage to sell and buy is increasing when it comes to good properties in good locations. However, C-locations remain difficult.

Cologne recorded a transaction volume of 1.38 billion euros, an increase of eleven percent. Office properties dominate with 460 million euros, followed by Living with 300 million euros. At only twelve percent, Cologne has the lowest proportion of foreign buyers, and five percent of the sellers come from abroad. The prime yields are 4.5 percent for offices, 3.7 percent for retail and 4.6 percent for logistics. The number of transactions rose from 29 to 44, and the number of major deals fell from three to two.

Knut Kirchhoff, Branch Manager JLL Cologne: “Transactions beyond the 100 million euro mark, such as the sale of the “Gerling Gardens”, continue to be the exception, but a significant increase in the total number of deals reflects the increasing momentum in the market. Especially at the end of the year, deals and marketing have increased again, so we can look optimistically to 2026. An important factor in this optimism is that institutional investors who have been on the sidelines for a long time are increasingly taking action to benefit from corrected prices for office properties and the opportunities that are emerging.”

Munich achieved the second-highest transaction volume at 2.88 billion euros and is only nine percent below the previous year’s figure. Office properties lead with 1.01 billion euros, followed by retail properties with 870 million euros. At 44 percent, Munich has the highest proportion of foreign sellers, while 36 percent of buyers come from abroad. The prime yields are 4.05 percent for offices, 3.2 percent for retail and 4.5 percent for logistics. At 64, the number of deals remained almost at the previous year’s level (64), but the number of major deals doubled from four to eight transactions.

Fritz Maier-Hartmann, Branch Manager Munich & Nuremberg: “2025 was the year of private investors who seized the opportunity and acquired premium properties in Munich’s pedestrian zone. It’s very rare in Munich that there are so many opportunities at once. These deals have driven the transaction result. It was quite quiet among institutional investors. However, we expect a slight revival and greater appetite among institutional investors in 2026. However, almost exclusively in the core segment. Location and quality are hard criteria. There will definitely be more product on the market. What can be placed will depend in particular on how good the individual properties are and how high the sales motivation and purchase price expectations of the owners will be. The price adjustment process, especially for the non-core properties, will continue to progress.”

Stuttgart recorded a decline of eleven percent at 850 million euros. Logistics real estate leads the field here with 360 million euros, followed by Living with 250 million euros. Foreign investors make 36 percent of the purchases, while only five percent of the sellers come from abroad. The prime yields are 4.25 percent for offices, 3.7 percent for retail and 4.6 percent for logistics. The number of transactions fell from 55 to 47, and major deals fell from one to zero.

Georg Charlier, Branch Manager JLL Stuttgart: “The transaction volume achieved in 2025 was slightly below the previous year’s figure. As expected and in line with previous years, the investment market is characterized by restraint. The logistics industry and living sectors accounted for around 75 percent of the transaction volume, while the office sector accounted for only 15 percent. This means that the industrial economic structure is also reflected in the transaction figures. A revival of the Stuttgart market is expected for 2026, especially in the Office sector.”