Global challenges could become an opportunity for Germany as a business location

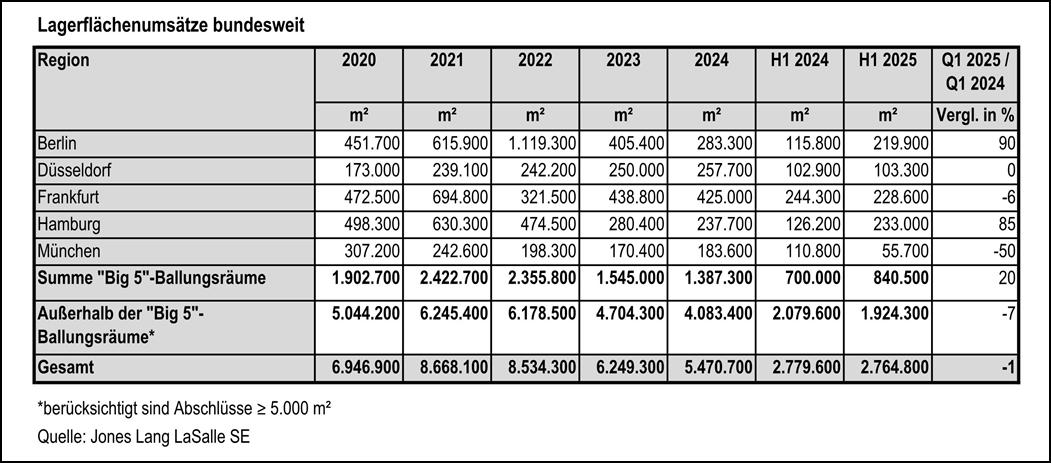

Despite the numerous economic and geopolitical uncertainties in the first half of 2025, the German market for warehouse and logistics space reached the previous year’s level with around 2.76 million m² of take-up (owner-occupiers and lettings) (H1 2024: 2.78 million m²). The proportion of owner-occupiers was also constant compared to the previous year at 27 percent. In the long-term comparison of take-up, the five-year average was 21 per cent below the five-year average and 20 per cent below the ten-year average. The number of deals, on the other hand, rose slightly year-on-year to 325.

Sarina Schekahn, Head of Industrial & Logistics Agency JLL Germany: “In view of the ongoing global debate about tariffs and an increasing number of conflicts, which also have a very strong impact on trade routes, the current consistency is positive. In addition, the mood in the market has brightened noticeably. Unfortunately, however, this has not yet been reflected in the statistics for the second half of the year. However, if the feeling also becomes facts, then we can look optimistically to the second half of the year.”

In uncertain times, Germany can become a location for hedging buffer storage

At the same time, however, Schekahn also sees opportunities for the German market in the current geopolitical situation, which must be exploited: “Due to the current constellation, the German logistics real estate market has the potential to become a location for buffer warehouses and, for example, a European hub. This applies in particular to the consumer goods industry, but also to some extent to the automotive industry.”

The “Big 5” conurbations record significant growth

In the Big 5 conurbations (Berlin, Düsseldorf, Frankfurt, Hamburg and Munich), around 850,400 m² were taken up in the first six months of the year, a total of 20 per cent more space than in the first half of 2024, but 15 per cent less than the corresponding five-year average.

A look at the regions illustrates differences. Thanks to several owner-occupier deals, Hamburg was the region with the highest take-up with 233,000 m², exceeding the previous year’s figure by 85 per cent. Frankfurt, the second-strongest region, is around six per cent below the previous year’s result with 228,600 m². Berlin follows with 219,900 m² and an increase of 90 percent year-on-year. At 55,700 m², significantly less space was taken up in the Munich region than a year ago, corresponding to a minus of 50 percent. With around 103,000 m², the Düsseldorf region achieved exactly the same result as last year.

One in three square metres in the five conurbations was taken over by companies from industry in the first half of the year (273,900 m², 42 per cent more than in the first half of 2024). Retail companies and users from the transport, traffic and warehousing sectors each contribute 28 percent to sales. While retail also increased significantly year-on-year (57 percent), logistics companies demanded around 17 percent less space.

“Asian e-commerce companies in particular are increasingly trying to enter the German market. They are usually looking for space through Asian (contract) logistics companies and would prefer to rent at the earliest possible date – ideally next month or the month after. While the focus has so far been mainly on the west of the republic, increasing tendencies towards the north and south can now also be observed,” Schekahn analyzes the actors from the Far East.

The largest deal in the five conurbations was the start of construction of the Netto logistics centre (owner-occupier) in Kremmen in the northern Berlin area in the second quarter. Around 65,000 m² are to be built here by 2027. The next two largest deals were already registered in the first quarter:

the start of construction of the new building of Körber Technologies in Hamburg-Bergedorf (around 34,300 m²), and Alnatura signed a contract for almost 30,000 m² for a logistics center in a project development in Groß-Rohrheim in the Frankfurt region.

In the first half of the year, almost 290,000 m² of warehouse space was completed in the five main regions, twice as much space as in the previous year (192,000 m²), but around 20 percent less than the average five-year average. By mid-year, around 650,000 m² are currently under construction, of which 42 percent are still unlet. Most of the space is currently being built in the regions of Berlin (around 286,000 m²), Düsseldorf (145,000 m²) and Hamburg (approx. 101,000 m² – two thirds of which are for owner-occupiers, the rest is almost completely let).

Meanwhile, prime rents in the five metropolitan areas have only risen in the Frankfurt region. They increased by 25 cents from 7.95 to 8.20 euros/m² per month. The highest rents are still achieved in Munich at 10.70 euros/m². Berlin is in second place with 10.50 euros/m², followed by Düsseldorf with 9.00 euros/m² and Hamburg with 8.50 euros/m².

Outside the five conurbations, the Ruhr area achieves the highest turnover

In the first half of 2025, the market generated sales of around 1.92 million m² outside the five conurbations. The previous year’s figure (first half of 2024: 2.08 million m²) was thus undercut by seven per cent and the five-year average by 22 per cent. Owner-occupiers accounted for around 571,500 m² (30 per cent of take-up), a year-on-year decline of twelve per cent.

Most of the space was demanded by companies from the transport, traffic and warehousing sectors. They are responsible for 39 percent of sales (an increase of twelve percent year-on-year). Retail companies contributed only 20 percent to sales (down 35 percent year-on-year) and industrial users around 32 percent (ten percent less than in the first half of 20241).

The region with the highest take-up was the Ruhr region with 212,200 m² (down 13 per cent compared to the first half of 2024), with the Mönchengladbach region in second place with 144,000 m² (up 108 per cent year-on-year). Bremen follows with 102,000 m² (up 89 percent).

One of the largest leases in the second quarter was the closing of ID Logistics. The company leased 60,000 m² in the “Mittelweser Park” in Estorf. The logistics company was also responsible for the largest letting in the first quarter, when the company leased around 61,500 m² in Diemelstadt.