Real Estate in the Field of Tension of Global Megatrends – A Strategic Survey of Economic, Political and Regulatory Drivers

Growth limits, capital shortages, climate targets, demographics, digitization – the reality of the real estate industry has long since ceased to be one-dimensional. Rather, it resembles a puzzle tableau of global megatrends that overlap, reinforce or counteract each other. These developments have an impact on both cash flows and the cost of capital – and cannot be ignored. On the contrary, they require precise discussion, strategic positioning and entrepreneurial responsiveness.

As part of the webinar “Puzzle of Megatrends” on May 9, 2025 , Prof. Dr. Thomas Beyerle (Biberach University of Applied Sciences) and Maximilian Radert, LL.M., EMBA (KINGSTONE Real Estate) faced a live prioritization by the participating expert audience. The pieces of the puzzle – structured in three categories – were weighted and discussed by interactive voting. The video recording of the webinar is available via this article. In the following selection, those topics are deliberately taken up that achieved high relevance in the participant voting, but could not be deepened in the live format.

Demographic change, urbanisation and climate targets are not economic phenomena – they are structural drivers that will shape the demand for housing in the coming decade.

First section – Macro trends: “America First – and what’s left for Europe?”

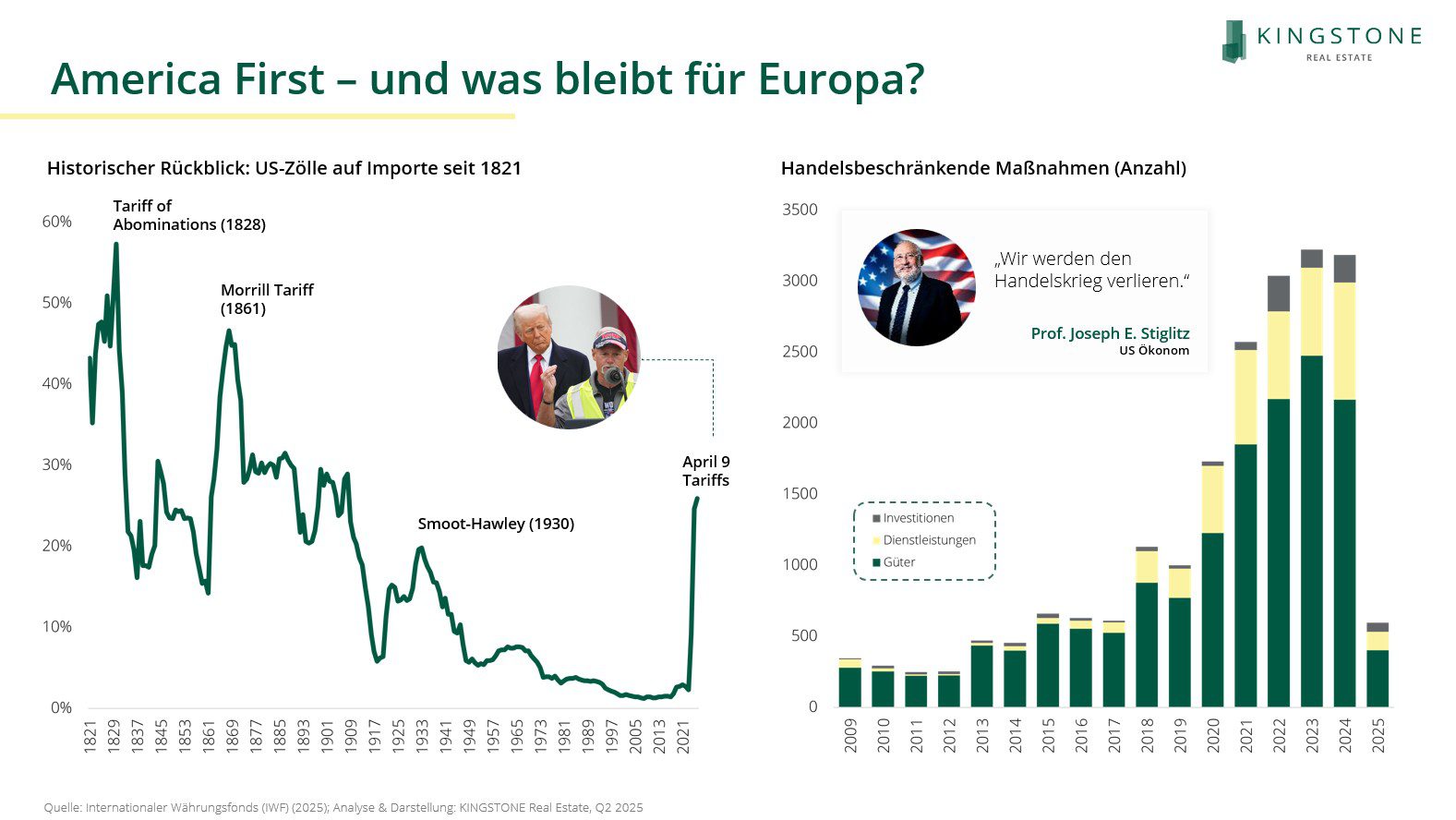

The return of protectionist trade and industrial policy in the USA marks a strategic turning point. Under a potential second Trump mandate, tariffs, subsidy regimes and geopolitically motivated supply chain upheavals threaten – with far-reaching repercussions for Europe. According to the ifo Institute, German GDP could fall by up to 0.5%, while the eurozone loses between 0.5% and 1.1% in export output. The German automotive industry would be particularly affected, with estimated additional costs of 6 billion euros per year.

The economist Joseph Stiglitz speaks of a self-inflicted shock that drives inflation, inhibits investment and conceals structural weaknesses: “These jobs are not coming back. And if they do, they make robots.” History shows that from the US tariff hikes in the 19th century to the Smoot-Hawley tariff in 1930, protectionist phases were economically destructive. The IMF documents a sharp increase in trade-restrictive measures since 2018 – most recently with renewed escalation. Europe faces the challenge of defining economic resilience not through self-sufficiency, but through targeted openness, technological depth and capital allocation.

Second section – Market mechanisms: “Prices, policies, prospects – Europe’s housing markets in comparison”

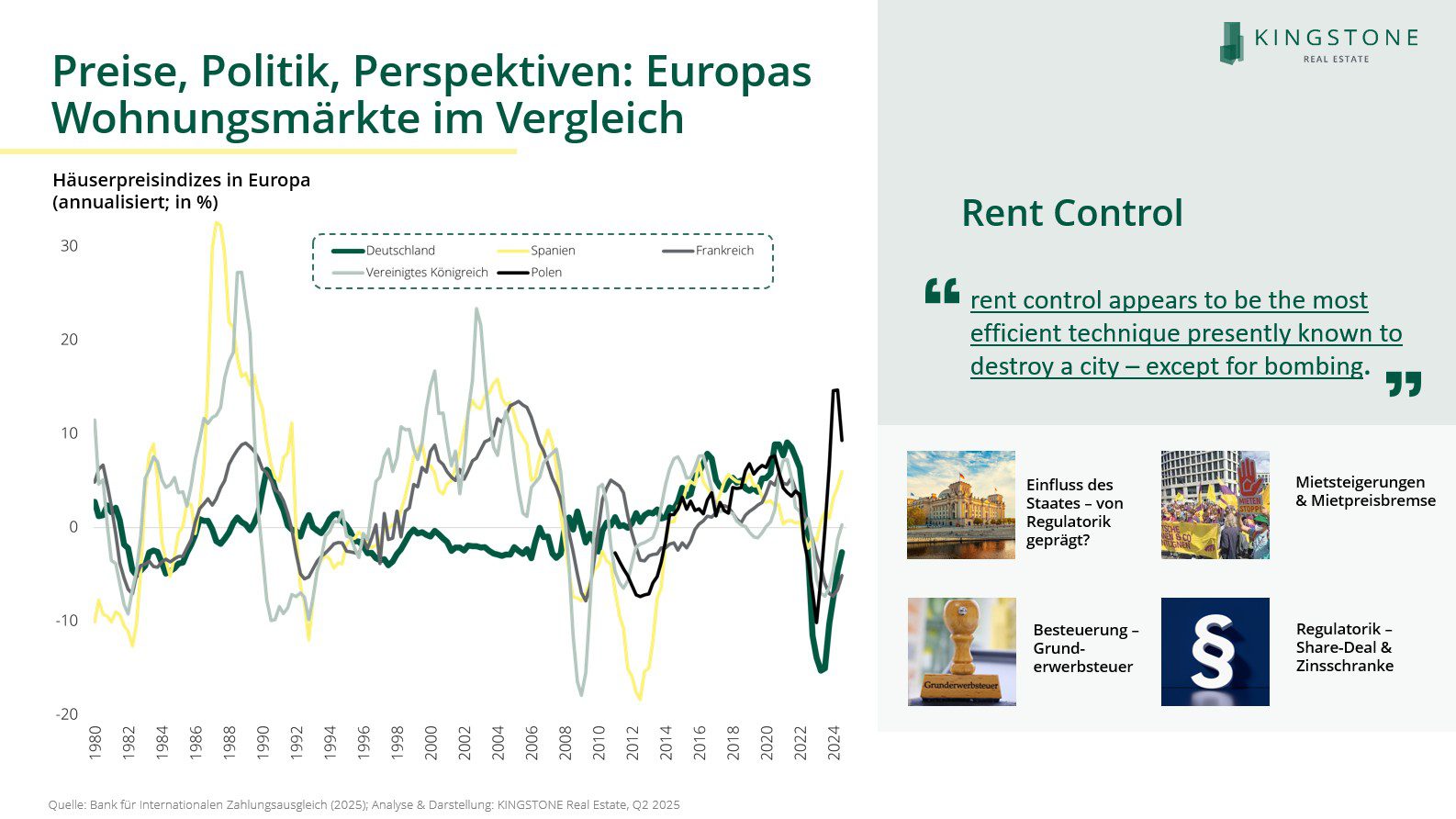

Europe’s housing and rental markets are increasingly characterised by regulatory heterogeneity – with implications for the real economy. Germany, France and Spain regulate through rent controls, real estate transfer taxes and tax-related subsidy logics. On the other hand, there are liberal models such as those in Poland, Ireland or Estonia, where the development of rents is almost entirely left to the market. Poland is increasingly coming into focus – not only because of favorable fundamentals, but also thanks to lean regulation.

Sweden marks the upper end of regulatory density with point systems and collectively negotiated rents. The Netherlands shows a hybrid picture: the lower rental segment is highly regulated, while the middle and upper market segment is largely free. These divergent framework conditions create not only price differences, but also structural divergences in capital allocation. For investors, this means that market analysis must be carried out today not only economically, but also legally and politically sound.

Third section – Real estate asset classes: “The trade-off between climate protection and affordability”

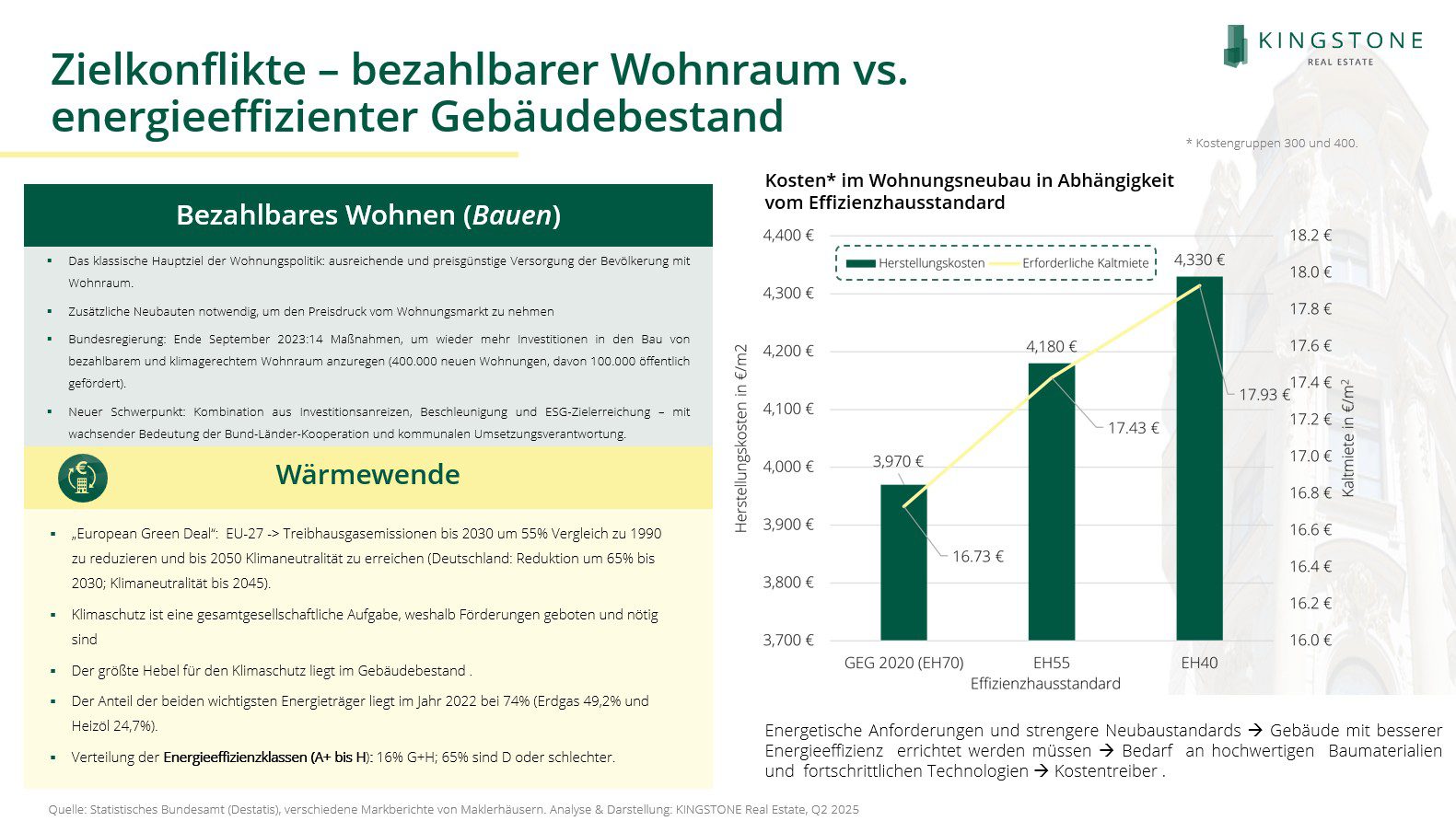

The politically set goals for the decarbonization of the building stock come into conflict with the reality of the market – especially in residential construction. While Germany relies on ambitious new construction and renovation standards, construction costs in many regions already exceed the profitability threshold. Compared to France or Poland, the German price level for new construction is significantly higher – with a noticeable impact on the supply of housing.

The Federal Institute for Research on Building, Urban Affairs and Spatial Development (BBSR) estimates the annual need for new construction at around 320,000 apartments. The main driver is demographic change: According to the BBSR, the number of households will increase by 1.3% to 42.6 million households by 2030.

Although the obligation to renovate under the EU Buildings Directive has been eased for the time being, the structural challenge remains: How can ecological target paths be reconciled with socially acceptable rents?

The balance between climate goals and affordable housing is becoming a strategic challenge for investors. The distinction between the standards is crucial: energy efficiency classes are based on final energy consumption – directly noticeable for households. Efficiency house standards , on the other hand, capture primary energy demand – crucial for subsidy programs and ESG ratings. Between the two lies an evaluation space that will significantly shape prices, funding logics and investment decisions in the future.

With its 500 billion infrastructure fund , the new federal government is sending a strong signal: housing construction is to become an investment engine again – ecologically, socially and affordably. KfW is bundling its programmes on renovation and new construction, and it is foreseeable that a significant part will flow into the decarbonisation of the residential real estate market .

Final Reflection & Outlook

The puzzle of megatrends is more complex than ever. Geopolitical disruptions, fragmented regulatory landscapes and structural trade-offs are challenging the real estate industry on several fronts. The days of clear market mechanisms are over; anyone who allocates capital today must not only read economic fundamentals, but also interpret regulatory signals and integrate geopolitical scenarios into their assessment.

At the same time, new opportunities are opening up: Those who understand the dynamics of inflation, energy, technology and demography not as exogenous risks but as endogenous value drivers can benefit strategically from them.

The webinar “Macro Matters – Puzzle of Megatrends” was a first step towards giving structure to this multidimensional structure of effects. The response shows that there is a great need for classification, prioritization and common orientation.

On June 13, 2025 , the series will be continued – with Prof. Dr. Tobias Just FRICS (IREBS) under the title: “Cities under Pressure to Adapt – Back to Density, to Mix, to Housing?” A topic that addresses the next central megatrend – urban change.