Student housing moves into the focus of investors

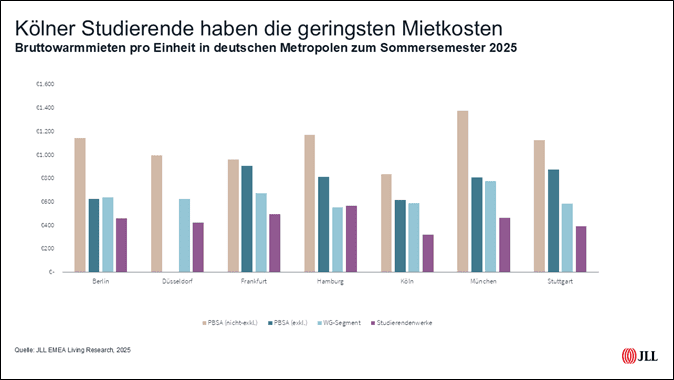

When choosing a course of study, it is worthwhile for students to compare both the various housing offers and the university location. According to an analysis by JLL, there are considerable price differences for student housing between the seven German metropolises of Berlin, Düsseldorf, Frankfurt, Hamburg, Cologne, Munich and Stuttgart. For example, the average gross warm rent for privately rented units in halls of residence (Purpose-Built Student Accomodations; PBSA), at the beginning of the summer semester 2025 in Hamburg it is 954 euros, in Berlin it is 805 euros and in Cologne 791 euros.

The discrepancy becomes even greater if you only look at accommodation that can also be rented by non-students – so-called hybrid concepts. Here, Munich is ahead with 1,374 euros per residential unit, followed by Hamburg (1,171 euros) and Berlin (1,140 euros). The cheapest university location here is also Cologne with an average of 836 euros.

Students have to pay significantly less rent for a public dormitory place of the student unions. Here, the range ranges from an average of 563 euros in Hamburg and 494 euros in Frankfurt to 390 euros in Stuttgart and 321 euros in Cologne. An average of 776 euros have to be paid for a room in a shared flat in Munich, 637 euros in Berlin and 550 euros in Hamburg. “This means that in cities like Berlin and Munich, it makes little difference whether a room in a shared flat is rented or a room in a private dormitory that is aimed exclusively at students,” emphasizes Dr. Sören Gröbel, Director of Living Research JLL Germany.

The sometimes high difference between the rents for hybrid concepts and for properties that are offered exclusively to students and were financed with subsidies is also striking. For example, hybrid living concepts cost almost twice as much on average in Berlin, while in Munich the price difference is 70 percent on average. Compared to the winter semester 2024/2025, new contract rents for halls of residence with hybrid use have risen by an average of 4.8 percent, while rents for those reserved exclusively for students have remained constant.

Rent differences are likely to become even greater

“The delta is likely to become even greater in the coming years due to the tense situation on the rental housing markets in the metropolises. Especially in cities such as Berlin and Munich, there is a significant undersupply of student housing, which is reflected in long waiting times for dormitory places at the student unions. For privately rented apartments built with subsidies, prices will remain relatively stable due to rent and occupancy restrictions. In the case of privately financed halls of residence, on the other hand, further rent increases are to be expected,” says Gröbel.

This should also increase the attractiveness of private student halls of residence for institutional investors. Last year, such investments accounted for only one percent of the total transaction volume in the living segment in Germany. By comparison, in the rest of Europe, the share of student housing was 16 percent. “This underlines the growth potential of this sector in Germany. Pan-European investors who have already gained experience in other markets are increasingly involved in Germany. This will provide additional impetus,” says Marius Romer, Team Leader Residential Investment JLL Germany.

Higher market activity increases transaction volume

In addition, the recent decline in the yield gap to traditional residential investments is an indication that the risk profile of this asset class is currently being assessed much more positively again. For example, the spread to prime yields on the residential investment markets of Germany’s seven largest cities has fallen from 120 to 130 basis points in 2021 to the current 75 to 85 basis points. “Since the end of 2024, market activity has picked up noticeably. We are currently observing an increasing number of sales processes for existing properties, developments and platforms. We therefore expect an increase in transaction volume in 2025,” says Romer.

Here you can find the complete report German PBSA 2025.