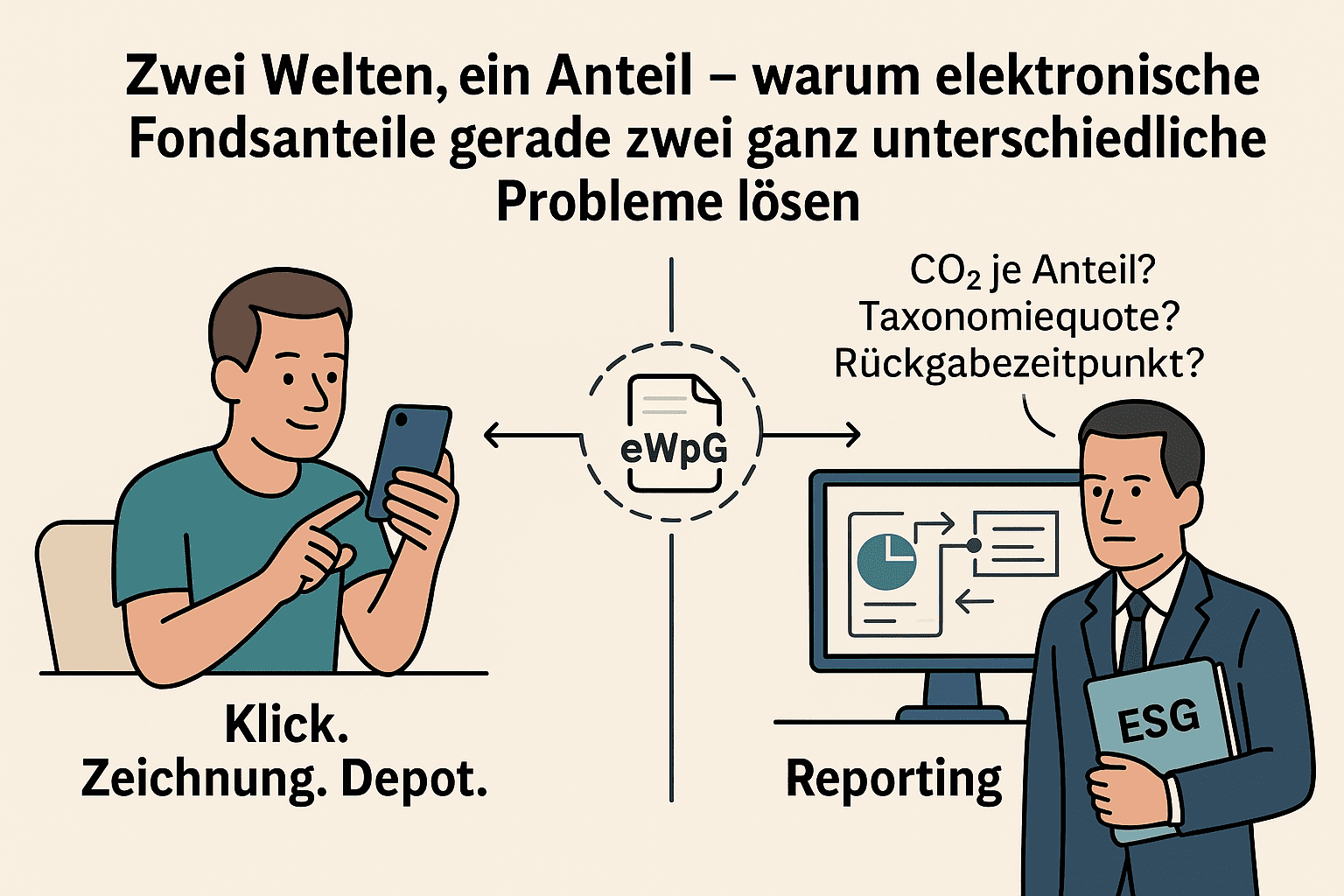

Electronic fund units have been a topic in the fund industry for some time, although interest in them is only just beginning to awaken. Many isolated pilot projects in the area of so-called crypto fund shares can currently be observed. How does the issuance of electronic fund units differ? What are the potential applications for sales, processing and reporting? In addition, there is a duality in the concrete utility, which is why a distinction must be made between “retail” and “insti” investors.

We come from the analogue world: “Securitization”

We come from and still live in the analogue world. In this document, the ownership of fund units is assigned by securitizing the rights associated with the investment fund in a physical deed.

“Very early” in the analogue world: The issue of fund units was even in paper form. The fund’s investors received individual securities certificates that securitized their right to the fund. From the point of view of today’s digital age, proof of ownership cannot be more anachronistic: These fund units as paper securitized individual certificates, the so-called effective pieces, had to be taken into physical custody by the investor (safe!) and had to be sent back and forth via physical transport in the case of share certificate transactions.

“Present” in the analogue world: Subsequently, the so-called giro collective custody prevailed – still – in the analogue world. This is still the standard in industry. The assignment of ownership to the investors is also carried out by securitization. The difference to the effective pieces is that the securitisation takes place only in a single securities certificate, the collective certificate. And the issuing capital management company deposits this centrally with the central securities depository. The pure legal principle of securitisation is therefore the same as for individual certificates of effective shares, but the implementation method opens up a largely technologically automated processing of the share certificate business. For the settlement of the securities business, the investors’ custodians and the fund’s custodians are directly connected to the CSD via electronic interfaces. If the investor orders from his custodian, the custodian receives his shares booked in or out of his custody account with the involvement of the fund’s custodian and, in return, the central securities depository values the collective certificate, also known as a global certificate, up or down.

And what are electronic securities and fund units?

Electronic securities do not require a physical deed, but are dematerialized, so they are actually exclusively digital representations in the form of an entry in an electronic register. This is called the so-called securitisation waiver, which was made possible by legislative activities in the context of the digitalisation of the financial market. Central to this is the Electronic Securities Act (eWpG), which came into force on 10 June 2021. As a substitute for securitization, the register entry is made. The legal force for electronic securities, which is equivalent to a securities issued by means of a certificate, is established by virtue of a statutory order in section 2 of the eWpG. Electronic fund units come within the scope of application of the eWpG in accordance with Section 95 (1) sentence 1 variant 1 KAGB . KVG therefore has the right to choose whether to continue to securitise fund units or issue them electronically. If the KVG decides to issue electronic securities, it will again have two different main types of electronic fund units to choose from on the basis of the legal basis reference in section 95 (3) KAGB and section 95 (5) KAGB in conjunction with the Ordinance on Crypto Fund Units (KryptoFAV):

>> Central Register Shares (§ 12 eWpG)

>> Shares in the Crypto Securities Register (§ 16 eWpG)

We will now go into more detail about the differences below.

Central Register Shares

Who: Central register keepers may only be central securities depositories (CSDs) or credit institutions or financial service providers with BaFin authorisation. Clearstream from Deutsche Börse Group is currently the only market partner in Germany through which central register shares can be issued within the meaning of the eWpG .

What: In the case of central register shares, not much changes in the overall structure, especially from the investor’s point of view. The only difference to the securities certificate is that the central securities depository does not document the ownership of the share in the fund by filing a collective certificate, but by entering it in the electronic register. The entire settlement logic of the securities business, i.e. the so-called “settlement”, remains the same. Payment and delivery transactions (delivery versus payment) continue to run through the usual channels. Fund platforms and custodians will continue to use their standardised interfaces.

Crypto Registry Shares

Who: Crypto securities registry leaders can be the issuer itself or an agent. It already follows that crypto securities registries are decentralized, especially since they are based on distributed ledger technology, see below. They are subject to special regulatory requirements: Management is a financial service subject to authorisation in accordance with section 1 (1a) sentence 2 no. 8 of the German Banking Act (KWG), which is associated with high requirements in terms of organisational and conduct obligations. These result from the KWG, eWpG and the Ordinance on Requirements for Electronic Securities Registers (eWpRV). Currently, nine service providers offer crypto securities registers under German supervision, two of which are banks. On the “Crypto Securities List according to eWpG” published by BaFin, the crypto products and respective crypto securities register guides can be traced.

What: To put it simply, a crypto securities registry is based on distributed ledger technology (DLT), such as blockchain. In order to obtain the legal status of an electronic security, registration in the Crypto Securities Register is required, which is the difference from “traditional” tokenization as a security token. Total issues or individual registrations are possible. It must be labelled as a crypto security, published in the Federal Gazette and notified to the supervisory authority. So if the legal requirement for registration must also be met here, the technical design through the integration into the blockchain opens up the advantages: Good proof of ownership through transparent register, secondary trading without intermediaries and instead directly on blockchain-based platforms (so-called peer-to-peer trading with high interoperability and thus real-time transactions instead of T+2 settlement). And – regulatory hurdles disregarded – global sales are conceivable from the technological side, because every potential investor in the world – even without a local bank (an issue in emerging markets) – could invest with Internet access alone. In addition, the subscription process is cheaper and faster because it does not require a large number of intermediaries. It follows that the distribution of smaller subscription sums, the so-called “fractionalization of funds”, also pays off.

What can be observed in practice right now

From the characteristics of central register shares and crypto securities register shares presented above, it is quite clear that the latter is the much more digital and innovative main type. And yet – at least at present – this does not correspond to the level of distribution in the market.

Central register shares currently clearly dominate : This can be explained by the fact that

- Central Register shares – as already described above – can be integrated very well into existing operational fund accounting and custodian processes, because nothing changes in the settlement logic of the securities business as such, and that

- a significantly improved digital sales route to the investor can be built through the waiver of securitisation; this can convince with media discontinuity in subscription and redemption, according to which the investor can purchase fund units directly via an app, banking platform or robo advisor without having to send subscription documents by post.

Therefore, this is particularly an issue in the retail sector at the moment, and so far almost only in the UCITS. In the private markets, ELTIF 2.0 in particular is expected to receive great support through digital distribution based on central register shares.

The crypto securities register securities are actually in no way inferior to the advantages of central register securities in digital distribution, but they are not as widespread. Both are based on a register logic without media discontinuity, only with a different technical foundation (classic IT versus DLT/blockchain). However, there are still some factors slowing down crypto securities registry securities, such as: No full compatibility with classic custody and bank structures and still legal question marks when it comes to integration into MiFID. Crypto securities registry shares have nevertheless already experienced concrete pilots . For example, in September 2023, Metzler Asset Management, in cooperation with Fundsonchain and Cashlink, proved in the first German pilot project that crypto fund shares under the KryptoFAV also work in practice. In this context, crypto fund shares were issued, with Bankhaus Metzler itself acting as the sole investor. For this purpose, a share class of a house mutual fund, which had been excluded to the public, was issued as a crypto fund share based on Polygon blockchain technology. There are also numerous European tokenization initiatives, which are listed, for example, by the European Fund and Asset Management Association (EFAMA ).

Other fields of application for electronic fund units

Central register shares are particularly common in the mutual fund sector because they can fit seamlessly into digital distribution channels. In the case of special funds , the focus will be primarily on reporting and investor transparency in the future, where technical integration has so far been less standardised. In the future, relevant fields of application in the field of (ESG) reporting for special fund investors may arise there! But what do ESG/CRREM reporting on the one hand and electronic securities on the other have to do with each other? At first, they seem thematically unconnected. But there is an important connection in practice, and that is about the flow of data and automation in fund structures:

- Register = Key point for ESG allocation at the share level

- For correct ESG reports (see SFDR, PAI, CRREM), data must be able to be correctly attributed to investors

- Who holds which shares and when?

- How many issues are attributable to a particular investor on a pro rata basis?

- In the case of classic custody account entries , this exact allocation is often lacking – especially in the case of special funds with many share classes, transactions and redemptions

- For correct ESG reports (see SFDR, PAI, CRREM), data must be able to be correctly attributed to investors

- Electronic Registries = Allow machine-readable transaction histories

- Central Register shares can provide fully automated, structured historical data :

- Share Class, Holding Time, Position Size, Investor ID

- This data could be automatically linked to ESG databases , such as:

- Asset data from CRREM tools

- other ESG platforms

- GRESB, ECORE etc.

- Central Register shares can provide fully automated, structured historical data :

- Addition of look-through at asset level through register structure

- In real estate funds, for example, it is often time-consuming to calculate ESG performance at the shareholder level – especially when redemptions or reinvestments come into play

- The electronic register allows the investor to trace back at the exact time:

- Who had how many shares in the fund – and thus in the issue profile of the assets?

- This is important to know for: Taxonomy compliance per investor, PAI calculation at investor level, investor sustainability reports

This will be a real enabler for transparency , especially for institutional real estate and infrastructure funds with an ESG focus. It is to be expected that investors in special funds will therefore actively demand the issuance of electronic shares in the future.

Results:

- In the retail sector, electronic fund units primarily enable digital access to the product (digital sales channel)

- In the institutional sector, electronic fund units improve reporting in particular and, in particular, digital transparency about the share-related impact

- This duality is also reflected in the technical implementation