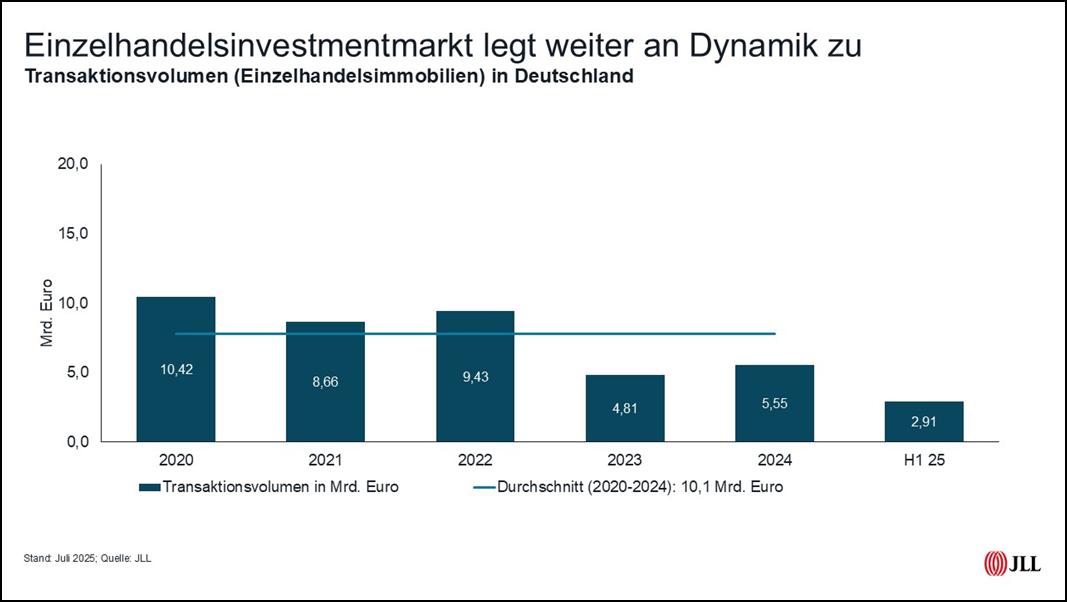

Transaction volume is clearly up at EUR 2.9 billion at the end of the first half of the year

At the end of the first half of the year, the investment market for retail real estate continued its recovery and, with a transaction volume of EUR 2.9 billion, exceeded the previous year’s figure by ten percent. However, there is still a gap of 15 percent to the average of the past five years. The number of transactions also increased with the volume, rising from 96 to 112 trades year-on-year. Once again, retail park products were the focus of the transaction activity. It is noteworthy that there has been a significant increase in non-food-anchored trade mark transactions.

“These are one-off effects from some portfolio transactions in this segment. Nevertheless, it should be said that non-food-anchored properties have also experienced a significant increase in liquidity,” observes Sarah Hoffmann, Head of Retail Investment at JLL Germany. Nevertheless: “The current product landscape is dominated by classic products, which will also be the focus of transactions in the segment in the further course of the year,” adds Hoffmann.

Three major transactions together raise more than 1.5 billion euros

In addition to the two transactions in the three-digit million range from the first quarter, another has now been added with the takeover of the Porta Group by XXXL Lutz, which together add up to more than 1.5 billion euros. This means that the three major deals together achieve more volume than four transactions of more than EUR 100 million in the same period of the previous year.

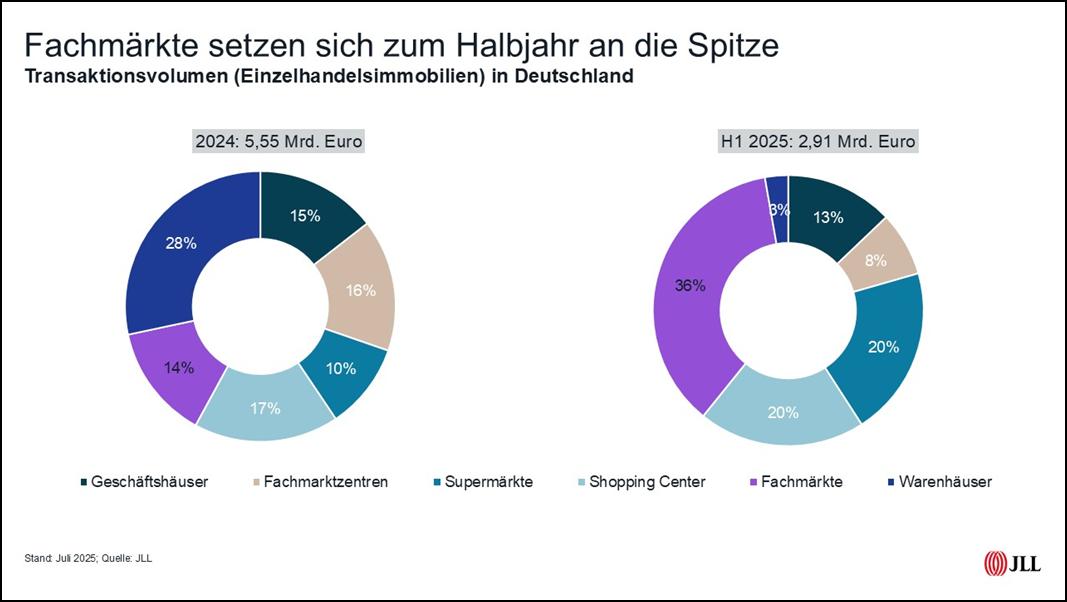

The strong dominance of supermarkets, which accounted for 43 percent of the total volume in the first quarter through a portfolio transaction, was put into perspective in the second quarter. With a total of 64 percent, retail park products are still by far the most important part of the market. However, specialty stores themselves contribute the most with 36 percent, while supermarkets now follow with 20 percent and retail parks with eight percent. Shopping centers come to 20 percent, commercial buildings to 13 percent and department stores were hardly traded with a share of three percent.

But Hoffmann advises looking at the details in addition to the shares: “A remarkable transaction was the purchase of the Galeria in Freiburg im Breisgau, which is one of the first deals of existing department stores.” In general, she is observing increased acquisition activity in the area of commercial buildings in both A and B cities: “Some transactions in this segment have already been notarised and are in the closing process. In addition, further properties with a significant volume are currently being offered on the market. This also applies to shopping centers, where some transaction processes are currently underway. We expect a significant increase in transaction volume in these segments by the end of the year,” says Hoffmann , giving an outlook.

In a comparison of asset classes, the focus shifted from Core to Core plus in the second quarter, which now accounts for 48 percent, while Core comes to 26 percent. Value add (15 percent) and opportunistic objects with eleven percent complete the field. International investors built up their holdings by more than one billion euros, as they contributed 62 percent as buyers and only 27 percent as sellers.

Prime yields constant across all cities and types of use

Prime yields in the central prime locations continue to be constant. Commercial buildings in Munich have the lowest prime yield at 3.2 percent. This is followed by Berlin and Hamburg with 3.4 percent, ahead of Frankfurt (3.5 percent) and Düsseldorf (3.6 percent). The field of seven metropolises is completed by Stuttgart and Cologne with 3.7 percent each.

The other types of use also registered a sideways movement in prime yields in the second quarter: shopping centers and individual specialty stores remain at 5.9 percent, while retail parks remain at 4.6 percent.

Sarah Hoffmann assumes that the market will continue to grow: “We are observing continued dynamic transaction activity in all retail sub-segments. The stability of the rental market is making a substantial contribution to the dynamism in this market. Investors benefit from a range of opportunities, ranging from high-yield investments to prestigious trophy assets. The supply side is currently extremely diversified and heterogeneous, which is attracting a wide variety of capital to the asset class.”