The institutional real estate market remains characterized by uncertainties in the middle of 2025 – and yet strategic investment opportunities are emerging. A recent survey of 58 institutional investors and asset managers conducted by Real Blue Kapitalverwaltungsgesellschaft in May 2025 shows that interest in future-proof, resilient real estate is increasing, especially in the residential, logistics and – increasingly – data center segments.

In the recent past, the latter in particular have developed from a niche segment to a medium-term component in many investment strategies. 74 percent of those surveyed expect data centers to establish themselves as a marketable investment product. This is a remarkable change: just a few years ago, they were considered too technical, too specialized, too energy-intensive. Today, they are emblematic of the digital transformation of our economy – and of the growing importance of infrastructure real estate in the institutional portfolio.

However, data centers are not a typical core asset. They require a high level of technical expertise, careful choice of location, secure energy supply and clarification of the waste heat issue – in return, they offer stable rental income, high barriers to entry and growth dynamics. The growing demand from cloud providers, artificial intelligence and Industry 4.0 makes the properties sought-after assets with significant potential for value appreciation – 69 percent of those surveyed expect price increases in this segment.

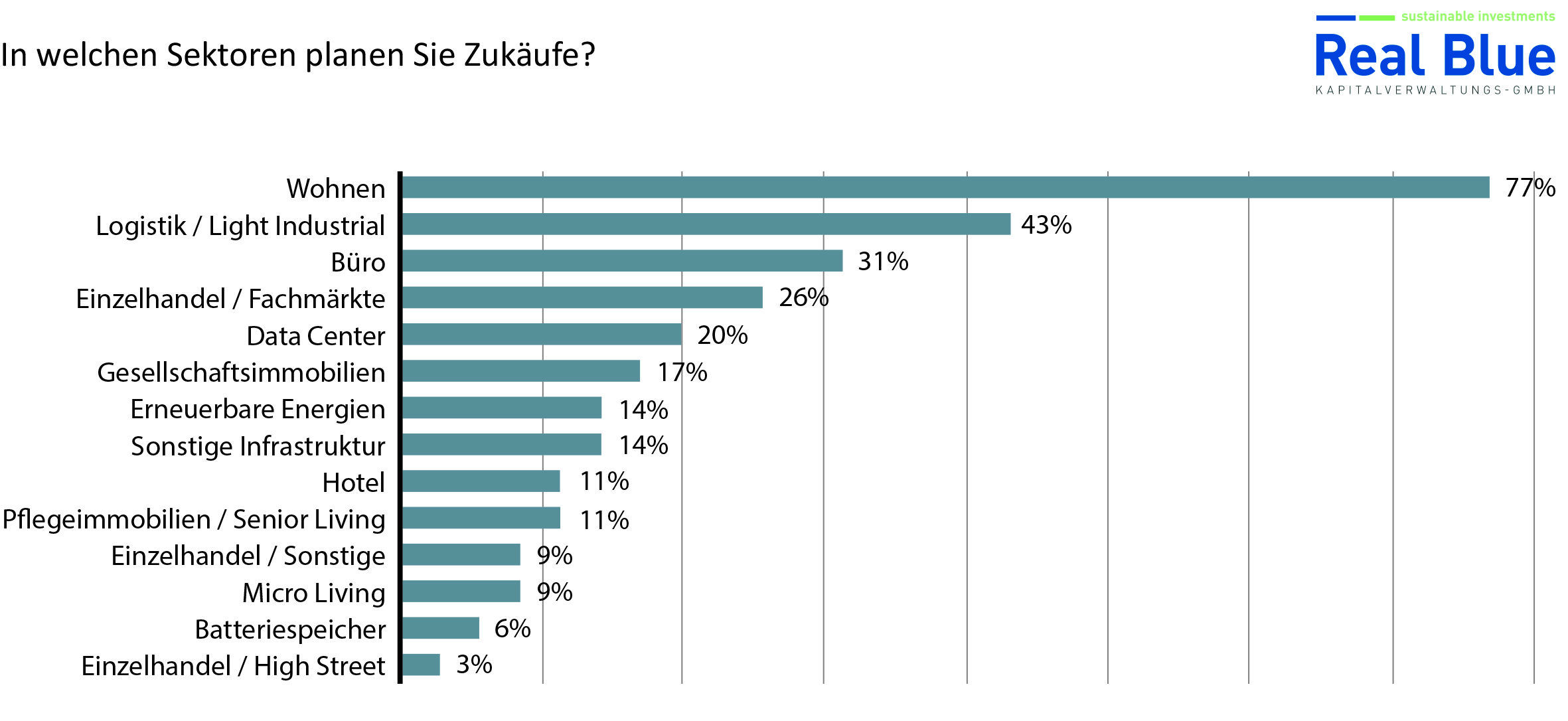

In addition, the survey shows that housing remains the dominant asset class. Here, 77 percent are planning acquisitions. This is followed by logistics/light industrial (43 percent) and office (31 percent). However, the growing attention to niche segments such as data centers, micro living and renewable energies is striking. Although the investment focus is on classic asset classes, new segments are coming to the fore in terms of expected performance: 45 percent expect price increases in micro living, 43 percent each in renewable energies and healthcare properties, and 38 percent in the care properties/senior living sector. This underlines the trend towards broader diversification – with growing relevance for real estate that reflects social, environmental and digital infrastructure.

Buy, Hold or Sell: The New Art of Portfolio Management

While 60 percent of the institutional properties surveyed want to buy additional properties, 52 percent are planning to sell. The motivations for this are complex – from strategic portfolio adjustment to liquidity requirements and the fulfilment of ESG criteria.

The latter is decisive for how future-proof a portfolio really is. Modern portfolio analyses have long since taken into account not only return expectations, but also transformation potential and regulatory resilience. Properties with high CO₂ emissions but limited retrofitting potential should be identified at an early stage and, if necessary, outsourced to separate structures. Structuring alternatives offer the opportunity to make holding strategies more efficient, flexible and ESG-compliant.

Sustainability as a duty – no longer as a freestyle

This is because the pressure on institutional investors to systematically manage sustainability risks is increasing. Increasing ESG requirements require an in-depth understanding of the climate impact of one’s own portfolio. Real estate that does not remain on the path to climate neutrality by 2045 is at risk of becoming “stranded assets” – with significant accounting, regulatory and market consequences. In addition, there are the extended requirements for the energy intensity of buildings due to the EPBD (Energy Performance of Buildings Directive).

This is no longer just about greenwashing, but about resilient strategies: energy intensities must be surveyed, CO₂ balances analyzed, retrofit measures planned and ESG monitoring implemented.

One thing is certain: The institutional real estate market in 2025 will require strategic clarity, technical competence and regulatory know-how more than ever. Anyone who recognizes data centers today as a resilient component of a future-oriented portfolio benefits from stable rental income and long-term value intrinsic value. Those who actively manage ESG risks protect themselves from losses in value and regulatory pitfalls.

However, the decisive factor here is that only those who think digitalisation, sustainability and diversification together will succeed in an increasingly fragmented market environment.