Strategic starting point

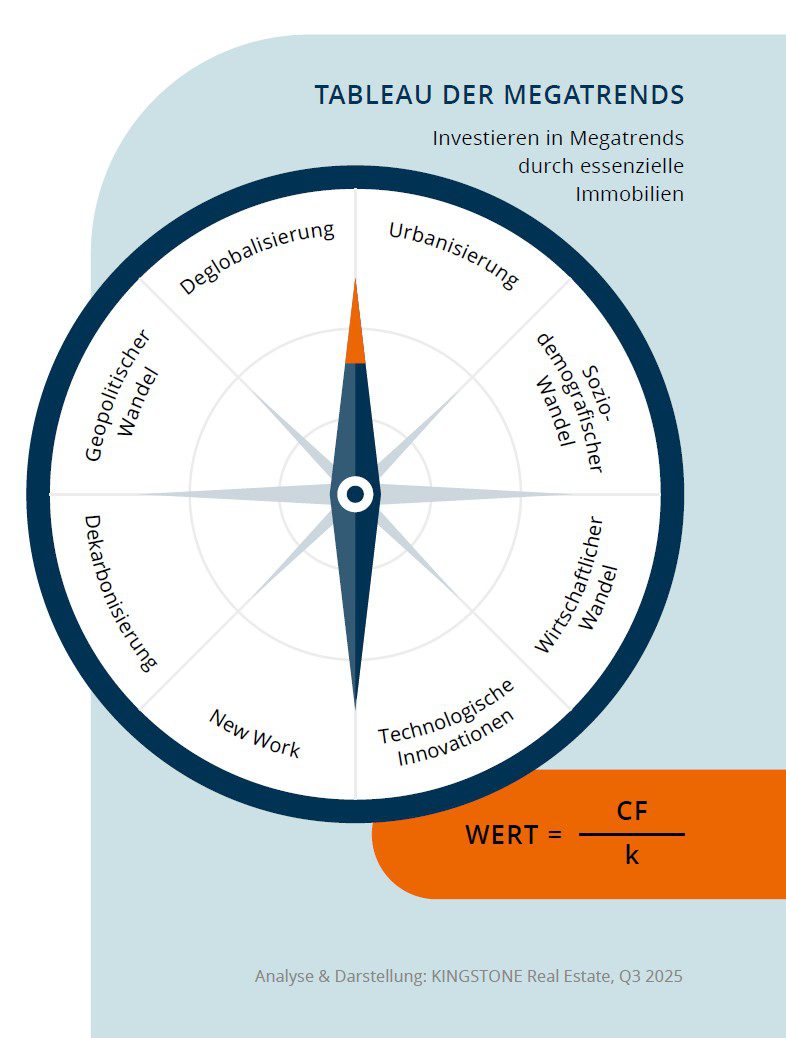

Geopolitical risks are no longer a side note in institutional investment strategies – they have become the central navigation point. Our puzzle tableau of megatrends shows that geopolitical change marks the “north” of a strategic compass that real estate investors must increasingly use as a guide. Decarbonisation, technological innovation, urbanisation and demographic change remain important drivers – but in times of war, trade conflicts and a slowing global economy, security of supply is becoming the central currency.

Against this background, we at KINGSTONE Real Estate are pleased to be able to make a contribution to GRR GARBE Retail Real Estate’s GRR Basic Retail Report 2025 once again this year.

GRR Basic Retail Report 2025

Europe’s New Reality: Caution Instead of Consumption

The geopolitical situation in Europe will remain characterized by a high degree of uncertainty in 2025. Conflicts at the external borders, disrupted trade relations and increasing dependencies on non-European supply chains have prompted the European Commission to strategically reprioritise security of supply in the food sector. Measures such as the establishment of a European Union (EU) crisis response mechanism and recommendations to strengthen the food chain illustrate this change of course.

At the same time, the geopolitical environment is increasingly having an impact on consumer behaviour. At -14.8 points, the EU Consumer Confidence Indicator (CCI) remains well below the long-term average. The savings rate in the euro area remains at around 15 percent, and in Germany even at just under 20 percent – an expression of pronounced consumer restraint. Even though real incomes are gradually stabilizing, the propensity to consume remains subdued.

Engel’s Law shows that in uncertain times, the focus shifts to the basic supply – local suppliers are then at the centre of a resilient consumption logic.

Between Price Elasticity and Basic Needs Orientation: The New Logic of Consumption

Surveys by McKinsey, the Society for Consumer Research (GfK) and the EU Commission show a clear shift in the demand preferences of European households towards low-cost, accessible and quality-oriented basic services. Higher-quality consumer goods are increasingly being avoided in favor of stable basic assortments in crisis situations. The study “The Effect of Macroeconomic Uncertainty on Household Spending” by the European Central Bank (ECB) provides empirical evidence of this trend.

The ECB distinguishes between two effects:

- The demand effect shows that even a moderate increase in perceived uncertainty reduces monthly consumer spending by around 5 percent.

- The segment effect describes the decline in spending on non-essential, discretionary goods (e.g., travel, entertainment, and luxury items) in particular.

Local suppliers benefit in particular in this environment. With their price- and access-oriented basic supply, they offer a robust, demand-stable format. In the food segment, there is a clear differentiation: In the lower price segment, consumers react strongly to price changes – an expression of high price elasticity. Even small price changes lead to noticeable fluctuations in demand. In the upper segment, on the other hand, quality and origin characteristics dominate. Price elasticity is also central in the context of “Engel’s Law” – named after the German economist Ernst Engel (1821–1896). This states that the relative share of food expenditure decreases with increasing income. In uncertain times with stagnating or falling incomes, however, this proportion rises again.

Local value creation as the foundation of local supply

The typical assortment of local suppliers is geared towards basic supplies: fresh produce such as fruit and vegetables, non-perishable food, beverages and household items. According to Eurostat (Statistical Office of the European Union), the share of agricultural products in EU imports in 2024 was around 7.2 percent, while exports weighed somewhat heavier at 8.9 percent. Local suppliers are exposed to imports in certain product groups such as exotic fruits, coffee or spices, but overall they are strongly embedded in European in-house production. This is based on favourable agricultural conditions (availability of land, climate, proximity to sales markets) as well as on thehigh demand for regional and fresh products. A central stabilisation factor is the EU’s Common Agricultural Policy (CAP). Since 1962, it has been ensuring that agriculture can be planned, supported by subsidies and is largely resilient. Despite political criticism of its size in the EU budget, the CAP offers important calculation and supply security, especially for local suppliers.

Industry-dependent, less supply-relevant: China’s limited role for local suppliers

From a geopolitical point of view – especially for Germany – China is considered a “grey rhino“: an obvious risk that is difficult to avoid. In 2023, around 20 percent of EU goods imports came from China, while the export share was only about 9 percent. The focus is primarily on industrial products such as electronics, machines and vehicles. China, on the other hand, plays a

From Ricardo to Trump: the price of supposed trade asymmetries

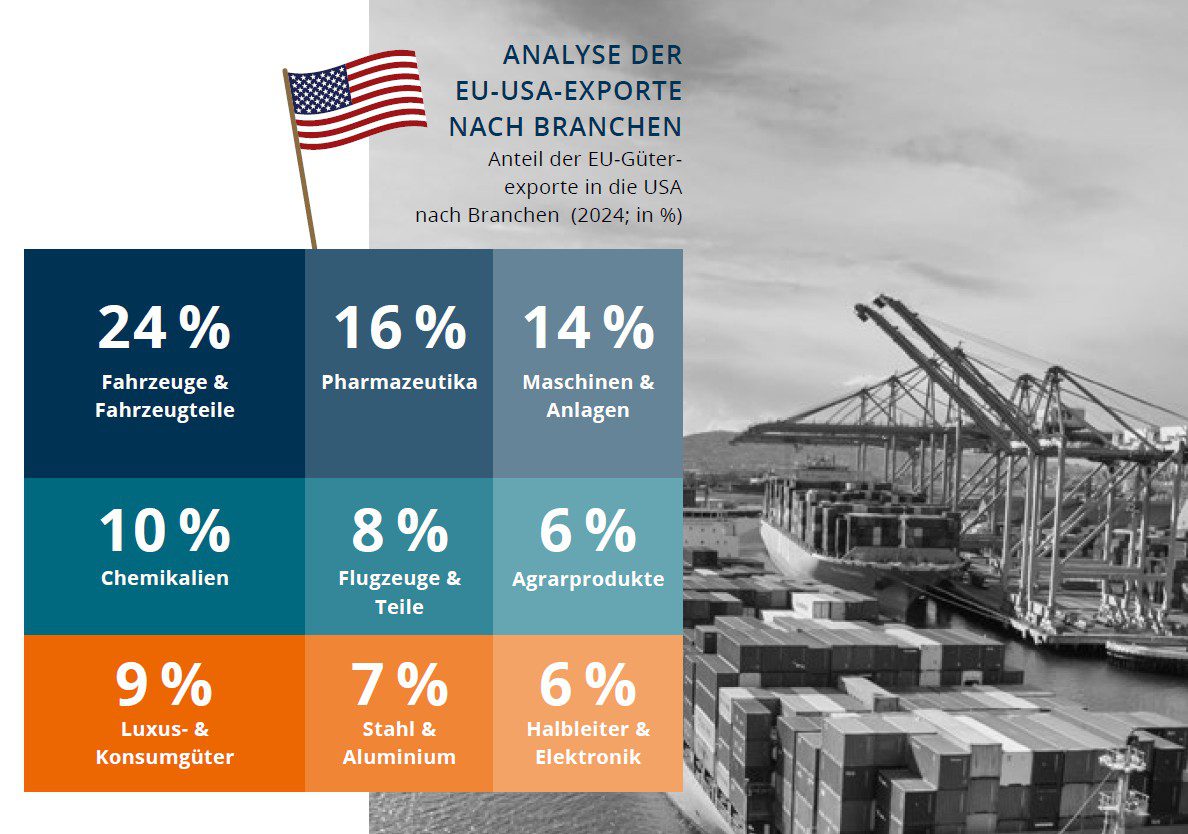

The latest agreement in the transatlantic trade conflict between EU Commission President Ursula von der Leyen and US President Donald Trump marks another chapter in the departure from Ricardo’s free trade theory. The USA is the EU’s most important export market with around 532 billion euros, while imports amount to 333 billion euros. The resulting trade surplus of almost 200 billion euros regularly causes criticism from Washington – for Trump, current account deficits are the central measure of his tariff policy. The economist Prof. Bofinger points out that although it is problematic when countries consume more than they earn in the long term – this does not apply across the board to the USA. Because of the US dollar as the global reserve currency, the US can borrow relatively incurred without consequences without risking a loss of confidence. True to the famous sentence of US Treasury Secretary John Connally (1971): “The dollar is our currency, but your problem“, the USA enjoys a special trade policy privilege.

In addition to a massive expansion of European energy imports and investments in the US market, the so-called “Trade Deal” also provides for a flat 15 percent tariff on most EU export goods. But since both sides interpret the agreement differently and central details remain open, the story of the departure from free trade will probably continue.

In the agricultural sector, the USA – despite its position as the second largest third market for EU food exports – remains largely irrelevant for European local supply. The corresponding imports account for only around 8 percent and mainly concern special assortments such as wine, olive oil or spirits. The restricted market access for U.S. products is less economic than regulatory: The

Quintessence for resilient local supply in geopolitically uncertain times

In the geopolitical environment, local supply stands for stability, proximity and reliability. It is less dependent on global trade risks, strongly anchored in the region and fulfils key basic needs – especially in phases of economic uncertainty. Price-elastic demand, regional supply chains and political support – for example through EU agricultural policy – make it a structurally robust market segment. For investors, this means that local supply properties offer real resilience where other markets show volatility.