Battery Energy Storage Systems (BESS) are positioned to play a crucial role in pursuit of a carbon-neutral economy and ambitious renewable energy goals

The Emergence of BESS as Catalyst for Energy Transition in Germany

BESS and Co-location BESS in Germany

Germany’s Energiewende aims for 80% renewable electricity (RE) by 2030 and carbon neutrality by 2045. While 100 GW of solar and 67 GW of wind as of 2025 are impressive, the transition to renewable energy faces challenges from variability of these energy sources, leading to grid congestion and curtailment.

Battery Energy Storage Systems (BESS) have emerged as a critical enabler, providing flexibility, stabilising frequency, and unlocking new revenue streams. Buildout of grid-scale systems has been accelerating, and installed capacity is expected to reach 3 GW by year-end and doubling to almost 6 GW by end of 2026.

While this buildout was predominantly driven by stand-alone BESS, the arrival of the Solar Peak Act 2025 (Solarspitzengesetz) provided considerable impetus to systems where BESS are combined with renewable generation at a shared grid connection point – so called co-location BESS.

While introduced to manage solar generation surpluses and negative price periods in general, its design inherently benefits co-located BESS more than stand-alone systems because

- the act now allows grid + renewable, or mixed-mode charging of the BESS, thus unlocking merchant arbitrage and ancillary services for co-located systems while retaining EEG-linked benefits;

- co-located BESS can absorb excess electricity generation during negative price periods, providing an answer to EEG suspension during negative price periods, curtailment mitigation and improving PV plant economics;

- co-located BESS, upon installation of smart meters, can benefit from bonus payments (+0.6 ct/kWh) during positive price periods for green electricity/under EEG, reinforcing hybrid PV+BESS integration rather than independent storage; and

- rather than relying on a single source income stream like a PPA or market sales, with the same grid connection, co-location projects can produce stacked revenues (EEG premium + merchant + ancillary), making them more bankable and attractive for financing.

“The Solar Peak Act 2025 is an economic boost for co-located BESS projects, aligning policy incentives with grid flexibility and renewable integration.”

Co-location BESS and their Integration into Wind/Solar Power Plants

Business Case for Co-location BESS

One clear advantage of co-location BESS is access to an existing grid connection. In a country with a long backlog of grid connection approvals, sites with existing connection capacity are highly valuable. By sharing the point of connection, operators can optimise grid capacity usage, enabling faster access to export rights and reducing bottlenecks.

Additionally, co-location improves curtailment management because excess renewables generation can be stored in the battery rather than spilled, preserving revenue and enhancing system efficiency.

Sharing transformers and cabling in co-located projects eliminates duplicate high voltage equipment and civil works, cutting capital expenditure by up to 15%. It also reduces grid connection fees and accelerates permitting, which lowers both direct costs and financing overheads.

Additionally, bundling assets under one EPC scope creates economies of scale in procurement and construction, further improving project economics. And, for green co-location BESS, Baukostenzuschuss (BKZ) under § 17 EEG may not apply.

Technical Realisation

AC coupling is often chosen for adding BESS to existing wind or solar plants because it requires minimal redesign of the original system. This allows for connection of the battery to the grid on the AC side, making it retrofit friendly and allowing independent operation of generation and storage. The downside of this is that it introduces extra conversion steps that reduce round trip efficiency.

Alternatively, DC coupling integrates the battery on the DC side of the PV array, enabling direct energy transfer without repeated AC/DC conversions. This improves efficiency and lowers CapEx. However, DC coupling demands more complex engineering, customised inverters, and careful control strategies, making it less straightforward for retrofits.

The graph below visualises AC-coupled (left) vs. DC-coupled (right) co-location BESS:

Revenue Stack and IRR of co-location BESS

Revenue Stack

Historically, EEG regulations restricted grid charging of co-location BESS, which limited flexibility and constrained arbitrage opportunities. As noted earlier, the Solar Peak Act changed this by enabling mixed mode operation, allowing batteries to charge from both on-site renewables and the grid.

This regulatory shift significantly broadens operational options and deepens the revenue stack for co-located projects in that it allows the battery to charge from both on-site renewables and the grid. Hence, the operator can exploit price spreads (arbitrage), avoid curtailment and participate in ancillary service markets without being constrained by renewable generation alone.

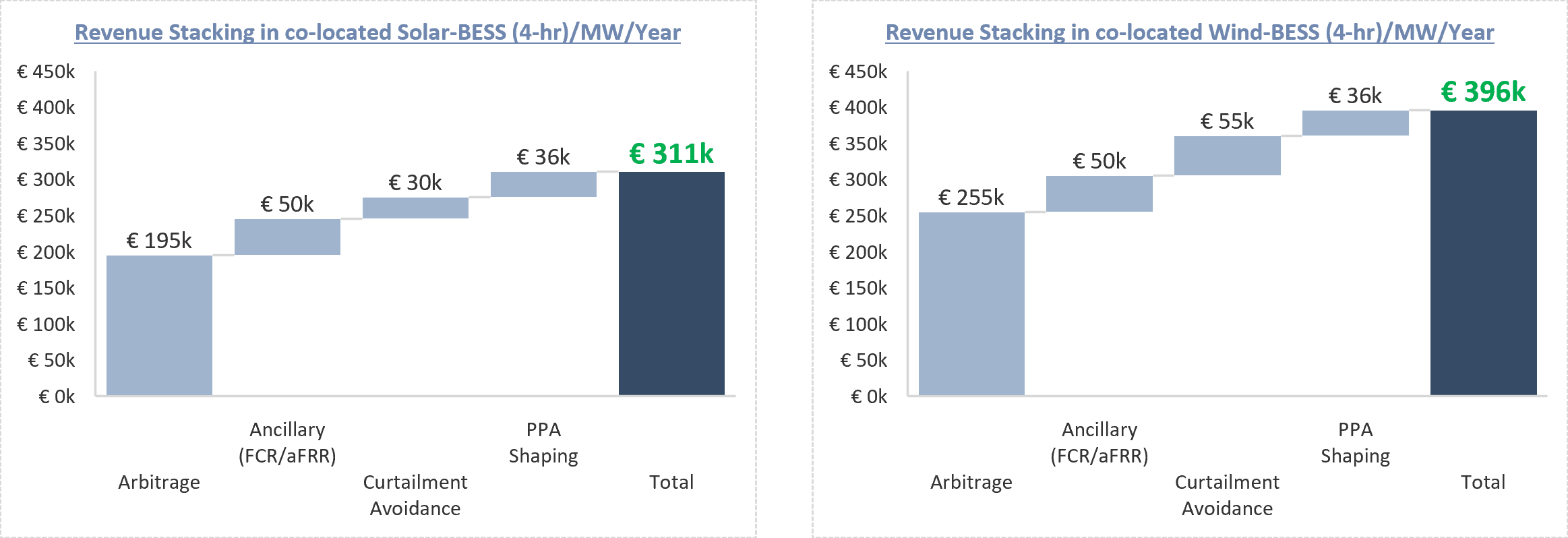

This allows for a revenue stack for co-location BESS as follows:

At any given moment, the BESS can only deliver one primary service (or a carefully combined set that doesn’t violate constraints). However, an operator can stack them over the year to maximise the installation’s revenue stream.

Wind co-locations typically offer a larger stack (~EUR 400k/MW vs ~EUR 310k/MW for solar, based on 4-hour system), not only on a total basis, but usually for each element of the stack. For instance, wind offers higher arbitrage potential due to greater variability of production and associated price spread opportunities, as well as stronger value ancillary services as a reflection of the stronger grid service value.

Furthermore, regions with high wind production tend to suffer from more frequent grid congestion, increasing the value of the battery as a mitigant for curtailment. And co-location BESS combined with a windfarm can support PPA shaping, as the battery can store excess energy during high wind periods and discharge during lulls, reducing volatility and making the output closer to the contracted shape.

Co-location BESS to Increase IRR

As one would expect, additional revenues generated by the co-location battery have an impact on the plants’ IRR, namely as a function of additional CapEx and such revenues.

Assuming a CapEx uplift of ~EUR 600k/MW for the battery, and a partially offset by shared infrastructure savings, the IRR-uplift can reach up to 3.5% for wind and 4% for solar, with improving economics the higher the battery capacity. This is because the incremental revenue from greater flexibility and market participation grows faster than the additional capital cost, improving overall project returns.

On a levered basis (see financing example later down), IRR can reach levels of 16% – 19% for solar + BESS and 17% – 22% for wind + BESS, showing that wind remains the stronger case, consistent with market experience.

Innovation Tender with comparable IRR uplift

- Co-location BESS under Innovation Tenders (§39n EEG & Innovation Tendering Ordinance) can equally benefit from an IRR uplift.

- Even though the battery’s revenue stack is slightly lower as for EEG due to the project’s limitation to feed the battery only with green electricity from the renewable energy source, its guaranteed premium provides additional certainty of revenues and an uplift over EEG feed-in tariff. This, in turn, is honored by lenders by providing higher leverage for Innovation Tender co-location BESS vs. more classic EEG co-location projects.

- While, on an unlevered basis, IRR for Innovation Tender projects can be expected to be around 10% (vs. 11.5% for EEG), on a levered basis they may well be at par with EEG projects at around 20-21%, dependent on leverage and capital structure.

Financing Parameter and Capital Structure for Co-location BESS

Illustrative Financial Model for Co-located BESS

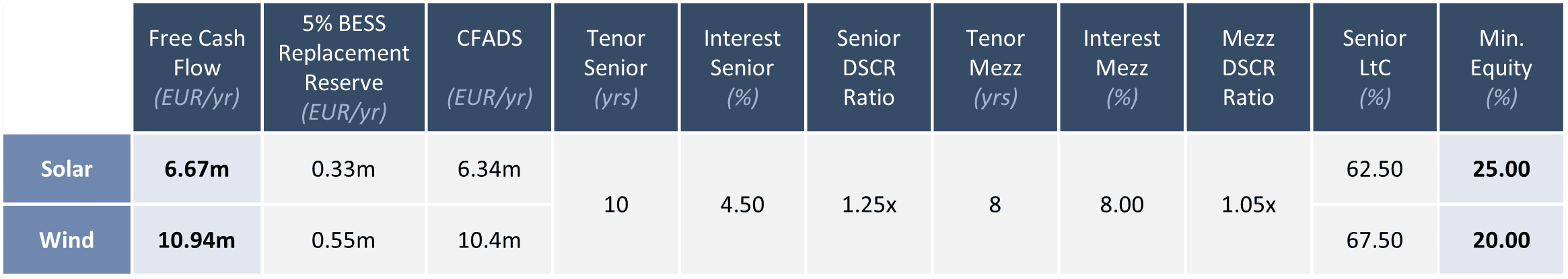

This section details the debt parameters and indicative capital structure for a 50 MWp solar or wind installation co-located with a 25 MW, 4-hour BESS. The projects’ CapEx, performance and cash flow parameters are as follows:

*incl. 12% uplift for grid connection, contingency, DD and structuring fees, **30% tax rate, Source(s): r2 Advisors

CapEx for solar and BESS historically displayed quite some volatility with a downward trend. Nevertheless, our assumptions of EUR 560k/MW for solar, EUR 1.57m/MW for wind, and EUR 137.5k/MWh for BESS (each uplifted by 12%) should reflect an average of current German market, reflecting efficient EPC procurement and typical co-location synergies.

Revenue assumptions reflect a blended merchant-plus-ancillary-services outlook and incorporate performance assumptions of 12% capacity factor (CF) for solar, 30% CF for wind, and 2% annual degradation for BESS.

The financing assumptions reflect a typical German project-finance structure for co-located wind/solar + BESS, combining senior debt and a mezzanine tranche to bridge the gap between bankable leverage and total CAPEX. Mezzanine financing is priced at market-appropriate levels and partially amortised through equity cash sweeps to balance lender protection with investor return expectations.

Wind + BESS in Germany is structurally easier to finance than solar + BESS, because wind yields higher annual energy and resulting higher cashflow per nominal MW. This is also reflected in higher LtC granted by lenders to such projects.

Developing a Capital Structure for a Typical Co-Location BESS

German lenders generally limit senior debt tenor for co-location projects to 8 – 12 years, because the batteries’ technical and economic life is shorter than that of PV or wind. Tenors are primarily constrained by battery warranties and degradation expectations, which make longer repayment periods risky.

Even in co-located hybrids with strong revenue stacks under the Solar Peak Act, senior LtC is capped at 60% – 70% because hybrid renewable-plus-storage projects carry material merchant, volatility, and degradation risks that are not fully captured in a simple DSCR sizing. They also require a meaningful equity buffer (20% – 25% for wind and solar, respectively) to absorb downside scenarios, preserve resilience in low-price years, and ensure the project remains robust beyond the debt tenor.

While a co-location project might well have a lifespan of 25 years, extending the financing tenor beyond 10 years typically requires BESS replacement reserves, extended warranties, or third-party guarantees on the battery. Such reserves protect lenders from mid-life degradation or performance failure by ensuring that sufficient funds exist to refurbish or augment the battery.

Banks typically size the reserve at 10 – 20% of initial CapEx, an amount high enough to cover refurbishment costs to restore the batteries’ capacities to initial level. This reserve is trapped from operating cash flow, in our example 5%. The availability of a robust BESS replacement reserve might enable lenders to accept longer tenors than they otherwise would for co-location projects.

We also assumed a 50% cash sweep for accelerated principal repayment, lowering outstanding exposure, and improving coverage ratios. From the lender’s point of view, sweeps signal strong discipline in cashflow allocation and provide protection against volatility, especially in merchant-exposed hybrid BESS projects.

For equity investors, sweeps lower total interest cost and shorten the mezzanine tail, but they also reduce early-year distributions, which slightly suppresses IRR due to timing effects. Therefore, it is important to find the right balance between the amount a sponsor can and wants to sweep, and the impact it will have on timing of distributions and the project’s overall return.

Based on the above parameter, a capital structure for a co-location BESS project could look as follows:

Single SPV-Structures to dominate Legal Set-Up

- As hybrid assets with shared grid connections and integrated dispatch are becoming the norm, German co-location projects are typically structured with one SPV combining PV and BESS.

- Banks prefer this model due to simpler security packages, clearer risk allocation, and lower financing costs.

- As the Solar Peak Act expands grid-charging and merchant optionality, some developers will still use two SPVs to separate EEG-compliant PV from fully merchant storage.

- However, improved metering and demarcation rules will reduce the need for such structural separation.

- As a result, two-SPV setups will remain niche, used mainly for investor segmentation or highly merchant BESS strategies.

Investor Types and Underwriting Appetite

Debt Market Perspectives for Co-Location BESS

Debt sizing is not necessarily cash-flow constrained, as banks in practice still apply portfolio-derived stress cases – such as multi-year low spreads in intraday markets or reduced ancillary-service revenues – to keep leverage in the 60–70% range for new-build co-located systems, unless backed by innovation tenders or strong PPAs.

Key considerations now include banks’ heightened scrutiny of battery augmentation plans, revenue-stack saturation risk (especially as more BESS enters aFRR markets), and the robustness of energy management systems (EMS) optimisation across hybrid assets.

Mezzanine lenders, by contrast, are targeting higher returns and show greater appetite for merchant uplift from arbitrage and aFRR/FCR markets, making them well suited for projects with more flexible operational strategies or where developers want to maximise leverage without breaching bank covenants.

Funding volumes are expanding as dedicated energy-transition credit funds and infrastructure debt platforms increasingly carve out BESS-only or hybrid sleeves, enabling tickets from EUR 10–50m mezz and EUR 30–150m senior per asset depending on size and tenor.

In their analysis, lenders are starting to differentiate between AC- and DC-coupled configurations, with DC-coupled solar hybrids viewed favourably for their improved round-trip efficiency but scrutinised for technology-integration risk and vendor bankability.

Finally, both senior and mezz providers emphasise the importance of granular metering and dispatch separation to ensure regulatory compliance under the Solar Peak Act, as any ambiguity in charge origin or settlement flows directly into perceived credit risk.

Potential Debt Investor Groups and their Investment Motivations

Conclusion and How r2 Advisors can Help

Future Potential of Co-located BESS in Germany

Co-located storage is becoming a core element of Germany’s energy transition, driven by grid congestion, rapid renewable expansion, and policies that increasingly reward flexible generation. Pairing storage with existing grid access transforms renewable plants into dynamic assets capable of shaping output, stabilising local networks, and improving utilisation of constrained infrastructure. This marks a shift away from batteries as optional enhancements and toward their role as foundational components of a modernised, resilience-oriented power system.

The broadened revenue opportunities created by hybrid configurations introduce a fundamentally different economic logic. Arbitrage, curtailment mitigation, ancillary services, and contract shaping together form a diversified earnings base, but

Financing models are adjusting accordingly. Banks remain risk-cautious, focusing on BESS replacement reserves, strong warranties, degradation control, and clear metering, while alternative lenders show greater appetite for merchant-driven returns and flexible operating modes. This differentiation signals a market where capital providers increasingly specialise by risk profile. Achieving bankability requires disciplined structuring and transparent technical planning, while mezzanine and private credit can serve as engines of leverage and upside for more complex or merchant-exposed projects.

Looking forward, hybrid renewable-plus-storage assets are set to evolve into multi-service platforms that extend beyond simple peak-shaving or curtailment avoidance. Improvements in control systems, inverter technology, and regulatory clarity will deepen their role in system stability and local flexibility provision. The projects that succeed will be those designed with adaptability in mind—technically integrated, commercially agile, and financially structured to thrive in markets defined by both volatility and opportunity.

How r2 Advisors can Help

r2 Advisors brings deep expertise in energy transition, equity capital raise, project finance, and asset-based lending, supported by a strong network of equity, senior, and mezzanine investors. We help developers build bankable projects and portfolios, optimise capital structures, and secure the right funding through performance-driven modelling, risk management, and transaction execution.

“As the sector evolves, we remain a committed partner – unlocking value, mitigating risks, and enabling clients to move quickly and confidently in an increasingly complex market environment.”

About the Authors

This document makes descriptive reference to trademarks that may be owned by others. The use of such trademarks herein is not an assertion of ownership of such trademarks by r2 Advisors and is not intended to represent or commercially benefit from it or imply the existence of an association between r2 Advisors and the lawful owners of such trademarks. Information regarding third-party products, services and organizations was obtained from publicly available sources, and r2 Advisors cannot confirm the accuracy or reliability of such sources or information. Its inclusion does not imply an endorsement by or of any third party.

Copyright © 2025 r2 Invest GmbH

References

- BDO. (2024). Update on the regulatory framework of battery storage projects – Part 1: Grid connection and construction cost subsidy: https://www.bdolegal.de/de-de/erweiterte-suche/aktuelles/2024/update-regulatorischen-rahmen-von-batteriespeicherprojekten-t1-netzanschluss-und-baukostenzuschuss

- Bird & Bird. (2025, February). Solar Peak Act – Key considerations: https://www.twobirds.com/en/insights/2025/germany/another-summit-for-energy-markets-key-considerations-of-the-solar-peak-act

- Energy Storage Industry News. (2025, October). Future-proof or fail: How battery storage projects can thrive in Germany: https://www.ess-news.com/2025/10/22/future-proof-or-fail-how-battery-storage-projects-can-thrive-in-germany/

- Energy-Storage.News. (2025, June). Unlocking BESS revenues in Europe’s key markets: https://www.energy-storage.news/unlocking-bess-revenues-in-europes-key-markets/

- hep Solar. (2025, February). Solar power in Germany: PPAs instead of feed-in tariffs: https://hep.global/en/blog/2025/02/20/solar-power-in-germany-ppas-instead-of-feed-in-tariffs/

- Jeff Shepard. (2023). When does DC coupling maximize the performance of battery storage plus solar?: https://www.batterypowertips.com/when-does-dc-coupling-maximize-the-performance-battery-storage-plus-solar-faq/

- KTH Royal Institute of Technology. (2024). Techno-economic analysis of utility scale BESS projects: https://kth.diva-portal.org/smash/get/diva2:1949584/FULLTEXT01.pdf

- Lo Franco, F., Morandi, A., Raboni, P., & Grandi, G. (2021). Efficiency comparison of DC and AC coupling solutions for large-scale PV+BESS power plants: https://pdfs.semanticscholar.org/a00e/df1bd6f90f036c5e3816a0ba2142f52ca194.pdf

- Matikainen, K. (2024). Technical and commercial comparison of AC- and DC-coupled battery energy storage systems. Tampere University: https://trepo.tuni.fi/bitstream/handle/10024/160043/MatikainenKonsta.pdf?sequence=2

- McDermott Will & Emery. (2025, February). German battery storage on a rise: Legislative changes: https://www.mwe.com/insights/german-battery-storage-on-a-rise/

- Modo Energy. (2025). Germany Battery Buildout Report: Battery capacity hits 2 GW: https://modoenergy.com/research/en/de-germany-bess-batteries-buildout-construction-growth-capacity-energy-storage-august-2025

- Pexapark. (2025, September). BESS co-location in Europe: A bumpy road to commercial maturity: https://pexapark.com/blog/bess-co-location-in-europe-a-bumpy-road-to-commercial-maturity/

- PV Magazine. (2025). Solar Peak Act and its implications for PV operators: https://www.pv-magazine.com

- r2 Advisors. (2025). BESS in Germany 2025 and beyond: Use cases, business models and financing considerations: https://r2advisors.com/assets/files/BESS%20in%20Germany%202025%20and%20Beyond.pdf

- Rabobank. (2025). Merchant revenue insights for hybrid renewable projects: https://www.rabobank.com

- Rafael Antunes. (2024). Revenue Stacking in Co-Located BESS: https://synertics.io/blog/154/revenue-stacking-in-co-located-bess

- Rystad Energy. (2025). Energy Storage Outlook: Global and European Utility-Scale Battery Storage

- Scanu, p. (2025). Solar and BESS co-location: Value streams and technical configurations. Ethical Power: https://ipowere.org/wp-content/uploads/2025/02/Paper-661.pdf

- Solax Power. (2025, February). Germany’s Solar Peak Act: Seizing the opportunity for a sustainable and profitable renewable energy future: https://ie.solaxpower.com/blogs/germanys-solar-peak-act-seizing-the-opportunity-for-a-sustainable-and-profitable-renewable-energy-future.html

- Synertics. (2025). Revenue stacking in co-located BESS: https://synertics.io/blog/154/revenue-stacking-in-co-located-bess

- Timera Energy. (2025, May). BESS co-location resurgence in Germany: https://timera-energy.com/blog/bess-co-location-resurgence-in-germany/