The month of “May” as a touchstone for real estate investors

Every spring, it haunts the financial world again: the stock market wisdom “Sell in May and go away – and come back on St. Leger’s Day”. Originally from the Anglo-Saxon world, it can be traced back to a seasonal phenomenon: wealthy British investors left the city in May, retreated to their summer residences – and with them trading activity on the stock exchanges ebbed away. It was not until September, just in time for the traditional horse race in Doncaster, that they returned – and with them fresh capital.

But can this capital market logic be transferred to the real estate market? At a time when headlines oscillate between interest rate turnaround, housing shortage and slump in transactions , the question arises: Is it perhaps more of a “buy in May” today?

After numerous quarters of declining prices and stagnating activity, there are increasing signs of a bottoming out. The valuation of many residential properties looks much more realistic again. Initial transaction data show tentatively rising volumes. At the same time, uncertainty remains high: How sustainable is this trend? How strongly does psychology affect timing decisions? And what do current sentiment indicators really say?

Time for a reality check between a change in sentiment and fundamental valuation – and for a critical examination of the psychological pitfalls on the way to the next investment decision.

Residential climate vs. economic sentiment – The scissors of the indicators as a signal provider?

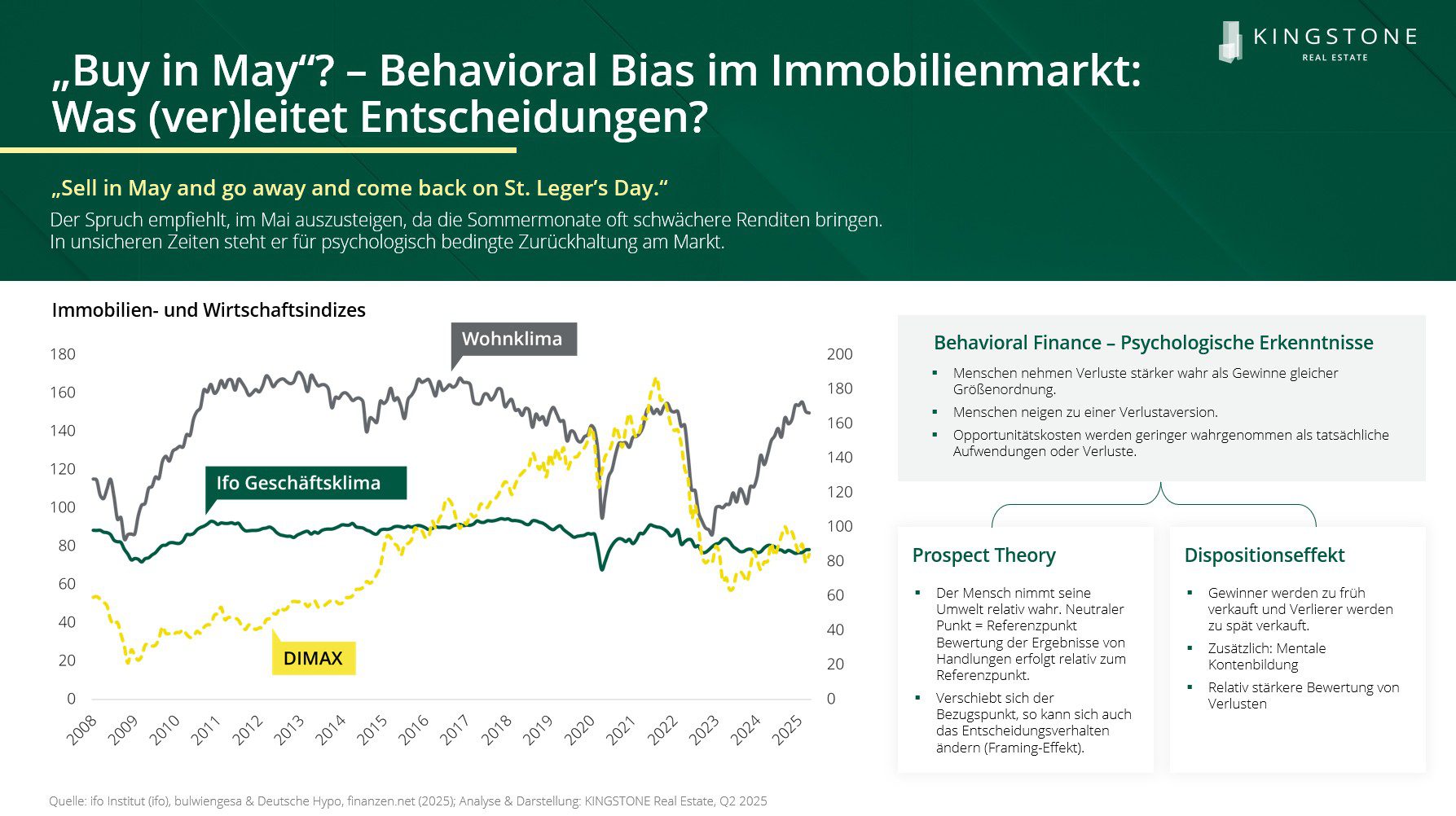

The residential climate barometer of bulwiengesa and Deutsche Hypo traditionally shows a close correlation with the ifo business climate index. Both indicators are considered relevant early warning systems for investment behaviour and price developments. Since the beginning of 2024, however, there have been significant deviations between the two indices. While the ifo business climate remains at a low level and the German economy as a whole tends to be characterized by uncertainty, restrained consumption and reluctance to invest, the residential climate is significantly higher. This divergence cannot be explained primarily by short-term economic impulses, but refers to structural expectations of shortages that could increasingly have a price-forming effect.

The background to this is the sharp decline in construction activity: in 2023, around 294,000 apartments were completed nationwide – in 2024 only 252,000 units. This means that new construction activity is significantly below the structural demand of around 320,000 apartments per year identified by the BBSR (Federal Office for Building and Regional Planning). In conjunction with rising construction costs, regulatory uncertainties and financing hurdles, this results in a supply bottleneck that stabilises medium-term earnings expectations in the residential segment despite macroeconomic weakness – especially in high-demand sub-markets.

The German Real Estate Stock Index (DIMAX), which is traditionally strongly influenced by listed housing portfolio holders, is currently showing some stabilisation, but does not reflect the recent significant increase in the residential climate to a comparable extent. Rather, a persistent market restraint can be seen, which corresponds to the well-known seasonal stock market wisdom “Sell in May”.

This discrepancy can also be classified in terms of behavioral economics: Both prospect theory and the disposition effect, central concepts of behavioral finance theory, provide explanations for why a structurally justifiable brightening of gross cash flow expectations has so far only been moderately reflected in the price development. According to prospect theory, market participants evaluate their environment relative to a mental reference point. After significant price losses – as observed in the wake of the interest rate shock – this reference point often remains negatively coloured. Even objective improvements are then perceived as distorted or underweighted, a classic framing effect. The disposition effect further reinforces this: losses are sat out, winners are realized too early – which slows down the repricing process. Taken together, these cognitive distortions lead to an asymmetrical reaction to new information – the structurally increasing gross rental income is thus superimposed by the psychological processing of past losses.

“Buy in May” – Spring signals as reflected in investor behaviour

The explanation of the previous market inertia on the basis of behavioral economic effects – such as prospect theory or disposition effect – is still comprehensible. However, fundamental conditions are once again becoming more important for investment decisions in 2025: shortages, stable financing costs and the first signs of a revaluation on the market.

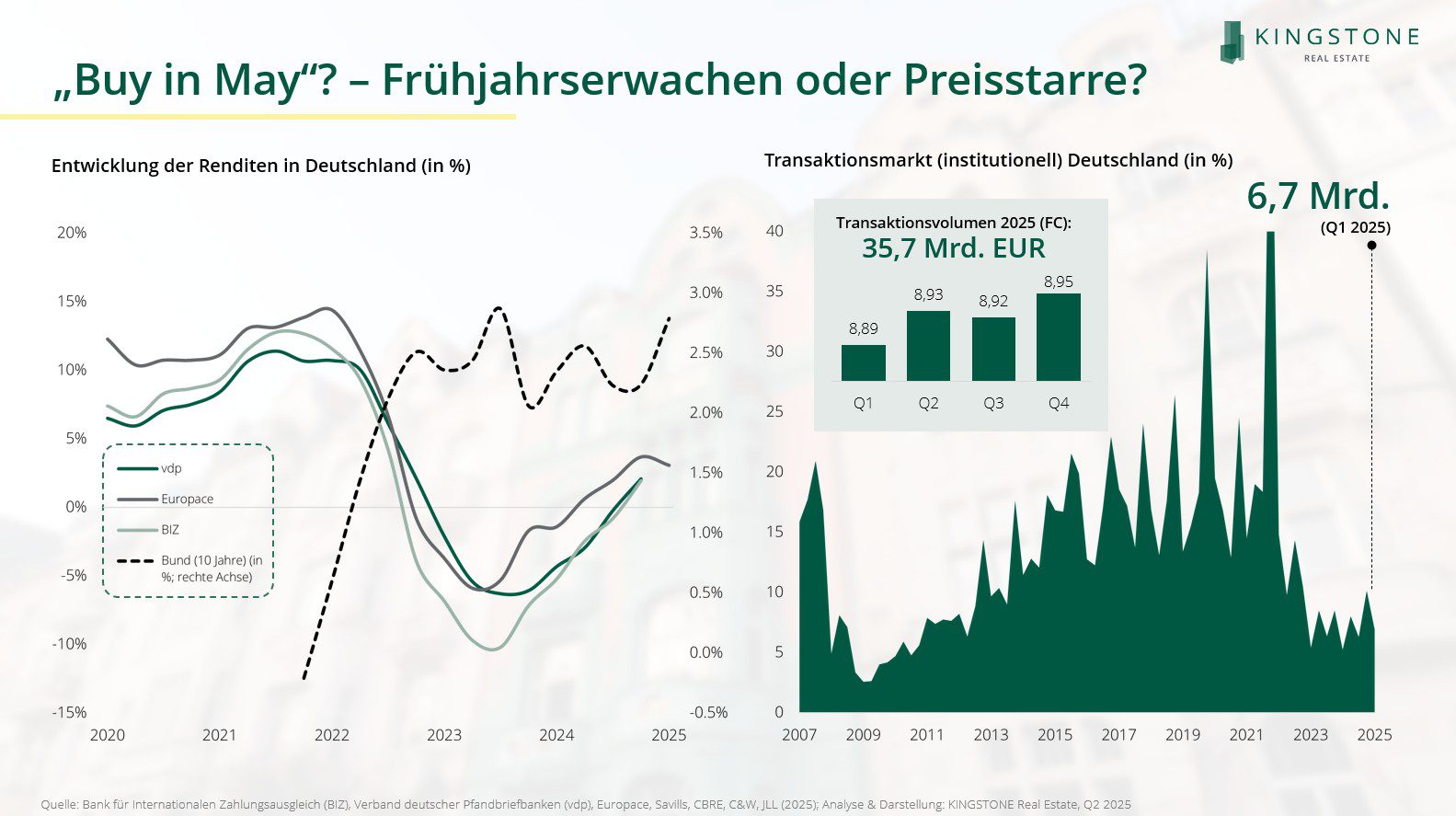

A key element is the long-term interest rate level, which has reached a new normal after the interest rate shock. On 5 June 2025, the European Central Bank (ECB) lowered the deposit rate by 25 basis points to 2.0% – a step that, according to market observers, is largely in line with the equilibrium, neutral interest rate level. More importantly for real estate investors, however, the capital market interest rates relevant for long-term financing have already settled at a stable plateau for several quarters. In combination with adjusted price levels, this opens up calculable investment leeway again.

In fact, the data of the vdp real estate price index show the first signs of a trend reversal: Although the calendar year 2024 was still in negative territory (overall index: -2.1%; Trade: -5.4%; Housing: -1.4%), but the first quarter of 2025 showed positive growth rates across the board for the first time. Across all real estate asset classes, capital values increased compared with the same quarter of the previous year – both residential (+3.3%) and commercial (+2.3%).

This development is accompanied by continued subdued but increasing transaction activity: the institutional transaction volume reached around EUR 6.7 billion in the first quarter of 2025, which represents a cautious upward trend compared to the previous quarters – but is still far from the long-term average.

The ECB’s further short-end rate cut is a positive signal – but the continued stability of long-term interest rates is even more important for real estate investors.

Final Reflection & Outlook

The residential real estate market in 2025 is caught between psychologically induced restraint and improving fundamental conditions. Although past losses and uncertainties continue to have an inhibiting effect, the increasing shortage of supply, the stabilisation of interest rates and the first positive price impulses suggest that market momentum is gradually returning.

At the same time, the transaction market remains below the long-term average – despite a noticeable upturn. This underlines that a nationwide market turnaround is not yet in place. Rather, a phased re-entry is to be assumed.

For investors, this means that the timing for a strategic repositioning in the market environment is improving, but continues to require a high level of discipline in the selection of properties and locations. In an environment that is increasingly defined by scarcity and price stabilization, microeconomic factors, asset quality and medium-term demand prospects are becoming decisive selection criteria.

The narrative of a “buy in May” cannot therefore be interpreted as a blanket market call – but as an indication of an incipient normalization under changed circumstances. For well-informed investors with a long-term horizon, this results in targeted entry opportunities in a readjusting residential investment market.