The line is in place, the tone is friendly but firm: With the “Call for Evidence for an Impact Assessment” called for participation in constructive criticism of the SFDR – and not at some point, but only recently. Under scrutiny: the previous classification system with Articles 8 and 9, the disclosure requirements and the famous Principal Adverse Impacts (PAI). What remains? What could change? What is the further timetable?

The EU Sustainable Finance Disclosure Regulation (“SFDR”) is an EU regulation that obliges financial market participants to disclose information about their sustainability performance. The aim is to create more transparency about sustainable investment products and avoid greenwashing.

Explanatory context for the Call for Evidence (“CfE”)

It is undisputed that the goals pursued by the SFDR are meaningful. However, the regulatory scheme has proven to be far too complicated for the actual achievement of the target. This is associated with sheer application overload and excessive bureaucracy. In response to this, product providers have demonstrated an overcompensating implementation skill, although in some places this has been able to show exaggerated tendencies that miss the focus of measurable effectiveness factors. There is no automatism that well-designed SFDR engineering makes a meaningful contribution to sustainability goals and fund strategy. This critical finding has already been highlighted in another article by the author .

Criticism of this was not kept behind the fence. The commission was open to emerging doubts and dissatisfaction. To channel this criticism from industry, the Commission launched a comprehensive evaluation of the SFDR back in December 2022. These included public consultation, technical workshops with industry and discussions with Member States and regulators. After this past problem assessment, the CfE now focuses on involving the industry through constructive criticism in the form of concrete suggestions for improvement.

Call for Evidence for an Impact Assessment

The CfE was sent out on 2 May and until 30 May. the participants had time to make their entries . In short, the CfE comprises three main thematic blocks to which participants should refer in terms of content:

- Practical application of SFDR: streamlining and reducing disclosure requirements

The Commission is seeking to streamline and reduce disclosure requirements by focusing on providing investors with only the most important information, which may lead to targeted changes and clarifications to existing SFDR disclosures. In the retail fund industry, for example, there is significant support for simplifying SFDR disclosures and for managers to have more leeway in disclosing the required information instead of having to adhere to a prescribed template.

- Product classification: simplifying key concepts

Simplifying key concepts: Consideration will be given to introducing product categories that are easy for retail investors to understand, take into account different sustainability objectives and take into account current market practices in terms of available data and financial products. In the CfE, the Commission has put forward three possible options for future product classification:

-

-

- Option A: Maintain the status quo

Articles 6, 8 and 9 of the SFDR were retained. The aim would then be to improve application through clear definitions and guidelines. Focus: Improving legal clarity and coherence. - Option B: Reformed system within the SFDR structure

Articles 8 and 9 of the SFDR remained in place, but there are structural adjustments in the system. The aim would then be to achieve greater standardisation by supplementing the minimum technical requirements. Focus: Reduction of room for interpretation and thus of greenwashing potential. - Option C: New classification system

The complete replacement of Articles 6, 8 and 9 of the SFDR with product categories to be designated with clear criteria would mean the most drastic revision of the existing system. The aim would then be: To establish a completely new system that is more institutional. Proposals put forward: “Sustainable” for products with a focus on sustainable investments, “Transition” for products with measurable transformation goals (example: decarbonization path) and “ESG strategy” or “Responsible” for products with ESG integration but without a specific sustainability goal.

- Option A: Maintain the status quo

-

- PAI Indicators

The Commission is also at odds with the PAI indicators. PAI stands for “Principal Adverse Impacts”, i.e. the significant negative effects of investment decisions on the environment and society. Financial market participants are to use the PAI indicators to disclose the damage their investments could cause. However, the existing PAI indicators are not always practicable, meaningful and also not consistent with neighbouring regulatory fields (CSRD, EU taxonomy). Therefore, the Commission asked for feedback on whether the PAIs should be clearly focused, e.g. on key KPIs. In addition, the PAIs are to be better aligned with whether data is available for measurement at all, especially for illiquid assets.

Responses to the Call for Evidence

A final overview of the exact responses received specifically to this Call for Evidence is not yet publicly available as a complete list. At present, isolated reactions are publicly available, for example from IIGCC (The Institutional Investors Group of Climate Change), EBF (European Banking Federation), Eurosif (European Investment Forum). On the supervisory side, for example, the Autoriteit Financiele Markten AFM (Netherlands), the Federal Financial Supervisory Authority BaFin (Germany) and the Financial Market Authority FMA (Austria) have expressed their views in the Joint Letter to the Commission on the Revision of the SFDR of 27 May 2025 . The full evaluation of all comments by the Commission will probably not be achieved until late summer 2025 .

Overlaps as well as specific requirements

As a not complete, but nevertheless more far-reaching intersection of the individual public reactions, there are similarities on the following topics:

- Definitions: Clear definitions of key terms, v. “sustainable investment”

- PAI Reports: Reduction or focus on material impacts

- Templates & Readability: Simpler, more understandable disclosure specifically for end investors

- Regulatorycoherence: harmonisation with taxonomy, CSRD, MiFID II/PRIIPs, UK-SDR

Differences in focus:

Autoriteit Financiele Markten AFM (Netherlands), the Federal Financial Supervisory Authority (BaFin) (Germany) and the Financial Market Authority FMA (Austria) have specifically addressed the topic of product categorisation in the Joint Letter to the Commission on the Revision of the SFDR:

- The preference is expressed that the EU Commission should follow the approach of two main categories for ESG financial products: “Sustainable” and “Transition”. This is intended to increase the comprehensibility and feasibility of the product categories.

- In the event that the Commission does pursue the approach of a third product category, the supervisors in the Joint Letter will at least attach importance to clear minimum requirements and stricter rules on naming and advertising. The aim is to avoid misleading claims, as is currently the case with some Art. 8 SFDR products.

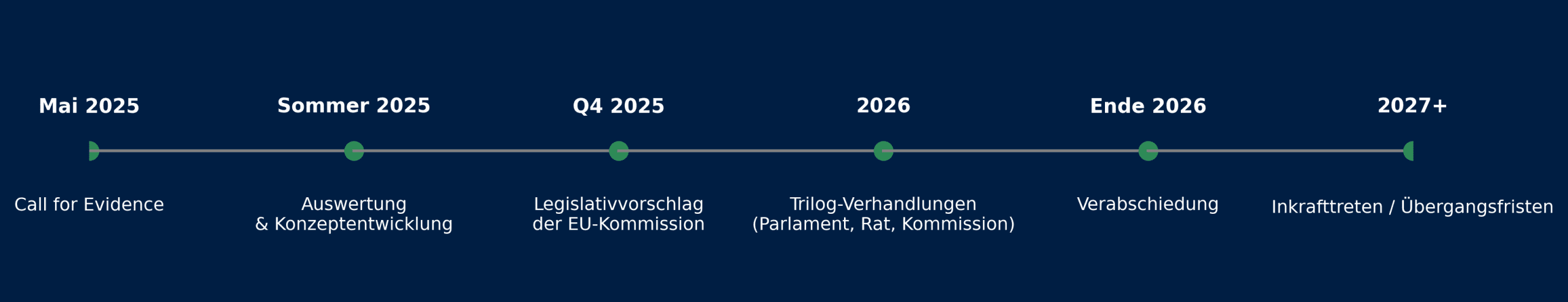

Roadmap and results

The Call of Evidence was now the kick-off stage in the implementation of SFDR 2.0. Further stages will follow, with the finish line or the entry into force of the new SFDR 2.0 rules announced for the beginning of 2027.

The results of the public feedback on the CfE are:

- There is unanimous agreement that SFDR 2.0 should be streamlined and simplified in general, and that PAI indicators should be better aligned with the measurability of data

- Tension lies in the area of product classification; the third product category (“Responsible”) could promise the promise of intuitive categorisation for private investors, especially in the retail market, whereby

- firstly, institutional investors are less likely to want to rely on product categorisations, but probably want to look at more detailed information at product level on strategy, goals and sustainability characteristics

- secondly, BaFin then at least – rightly – wants to see the problem of possible misleading solutions as with some Art. 8 SFDR funds

- The next stages of voting will now follow with the goal of having an SFDR 2.0 at the beginning of 2027; whether this is to be done through extensive adjustments to the SFDR 1.0 or through a completely new regulation has yet to be decided.