Dynamic revenue development in the third quarter

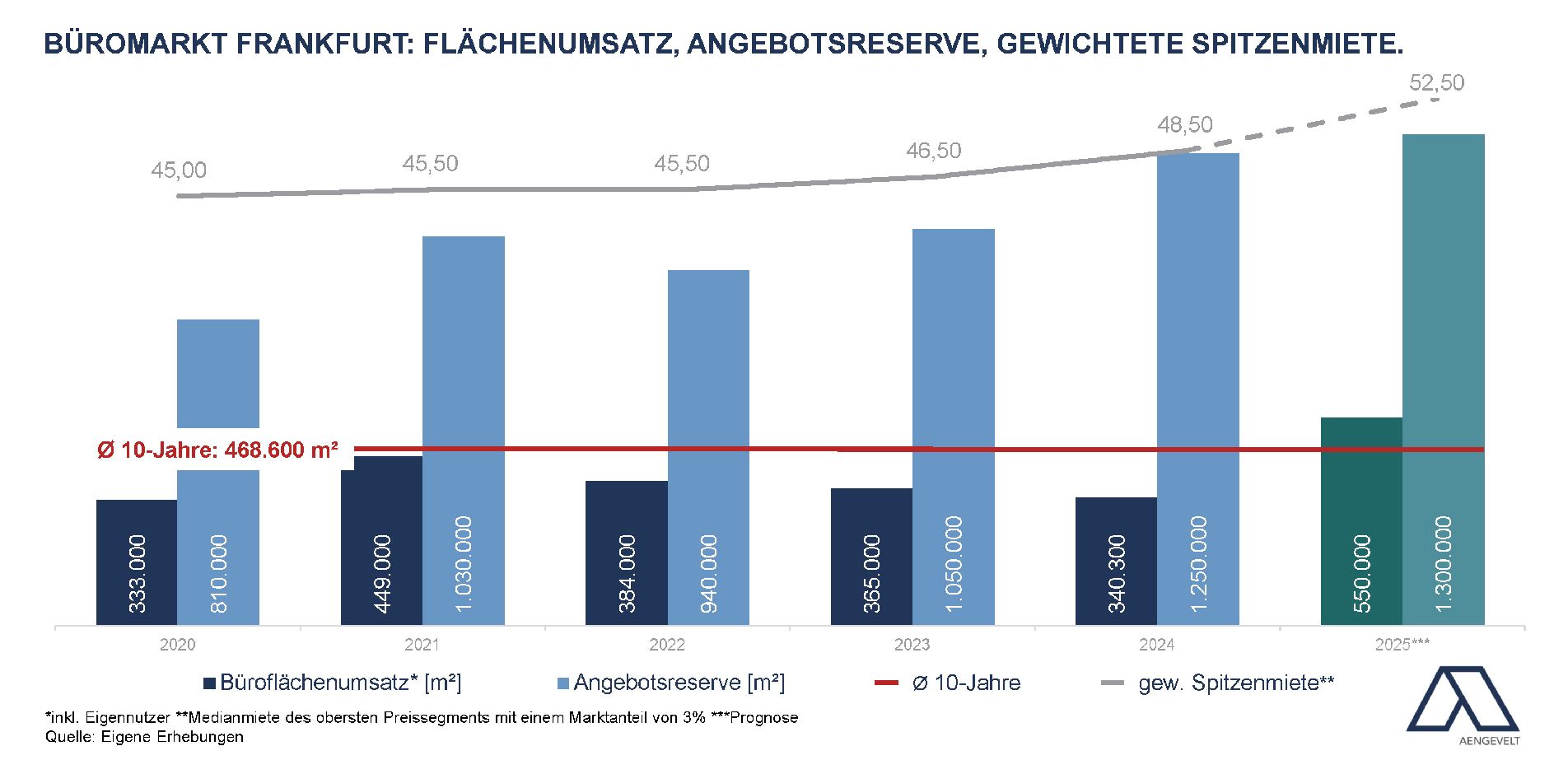

According to analyses by Aengevelt Research, the Frankfurt office market achieved office space take-up (including owner-occupiers) of around 460,000 m² in the first three quarters of 2025. Compared to the same period last year (Q1–Q3 2024: 262,300 m²), this represents an increase of around 75%. Compared to the decade average (Ø Q1–Q3 2015–2024: 315,600 m² p.a.), the figure is 46% higher.

Sebastian Stein, Head of Commercial Leasing at Aengevelt Frankfurt, commented: “A key factor in this development is the high number of large-volume contracts: more than half of take-up is accounted for by contracts of 5,000 m² or more. The Frankfurt office market continued to be very dynamic in the third quarter of 2025, despite the challenging market conditions. At around 116,000 m², take-up in the third quarter of 2025 increased by 51% compared to the same period last year (Q3 2024: 76,700 m²).

For 2025 as a whole , Aengevelt Research forecasts office space take-up of around 550,000 m² in Frankfurt, which would be 62% higher than the previous year’s figure (2024: 340,300 m²) and also around 17% above the ten-year average (Ø 2015–2024: 468,600 m² p.a.).

Supply reserve continues to rise

The short-term supply reserve (ready for occupancy within three months) in Frankfurt has risen significantly since the end of 2022, from 940,000 m² to around 1,250,000 m² at the end of 2024.

Sebastian Stein: Since then, vacancy growth has slowed down, partly due to high market performance and declining completion of new office space.

For example, Aengevelt Research analyses a slower increase in the supply reserve of around 50,000 m² to around 1,300,000 m² from the beginning of the year to the end of September 2025. Compared to the same time last year (end of September 2024: 1,160,000 m²), this represents an increase of around 11%. The vacancy rate for a total stock of around 11.8 million m² is accordingly 11% (end of September 2024: around 10.1%).

By the end of 2025, Aengevelt Research forecasts that the supply of office space will largely stabilize.

Office space completion just below decade average

For 2024 as a whole, Aengevelt Research forecasts a completion volume of around 116,000 m² in Frankfurt. This would be around 74,000 m² or 39% less than in the previous year (2024: 190,000 m²). In addition, the value would be 18% below the decade average (Ø 2015–2024: 141,400 m² p.a.).

Rising rent level

The positive development on the Frankfurt office market is also reflected in the weighted prime rent . This recorded an increase of 9% compared to the same time last year (end of September 2024: EUR 48/m²) to currently EUR 52.50/m².

This puts Frankfurt in 2nd place in Germany behind the rent leader Munich (> EUR 53.50/m²), followed by Berlin with EUR 45/m². Regardless of the overall high office vacancy rate, the ESG-compliant market supply on the part of the often international or internationally active clientele is scarce, especially in new construction properties, and therefore achieves top prices, Sebastian Stein explains the price development.

The median rent in city locations also increased to around EUR 32.50/m² compared to the previous quarter (end of September 2024: EUR 29/m²).

By the end of the year, Aengevelt Research forecasts a largely stable, at most slightly rising prime rent.