Infrastructure

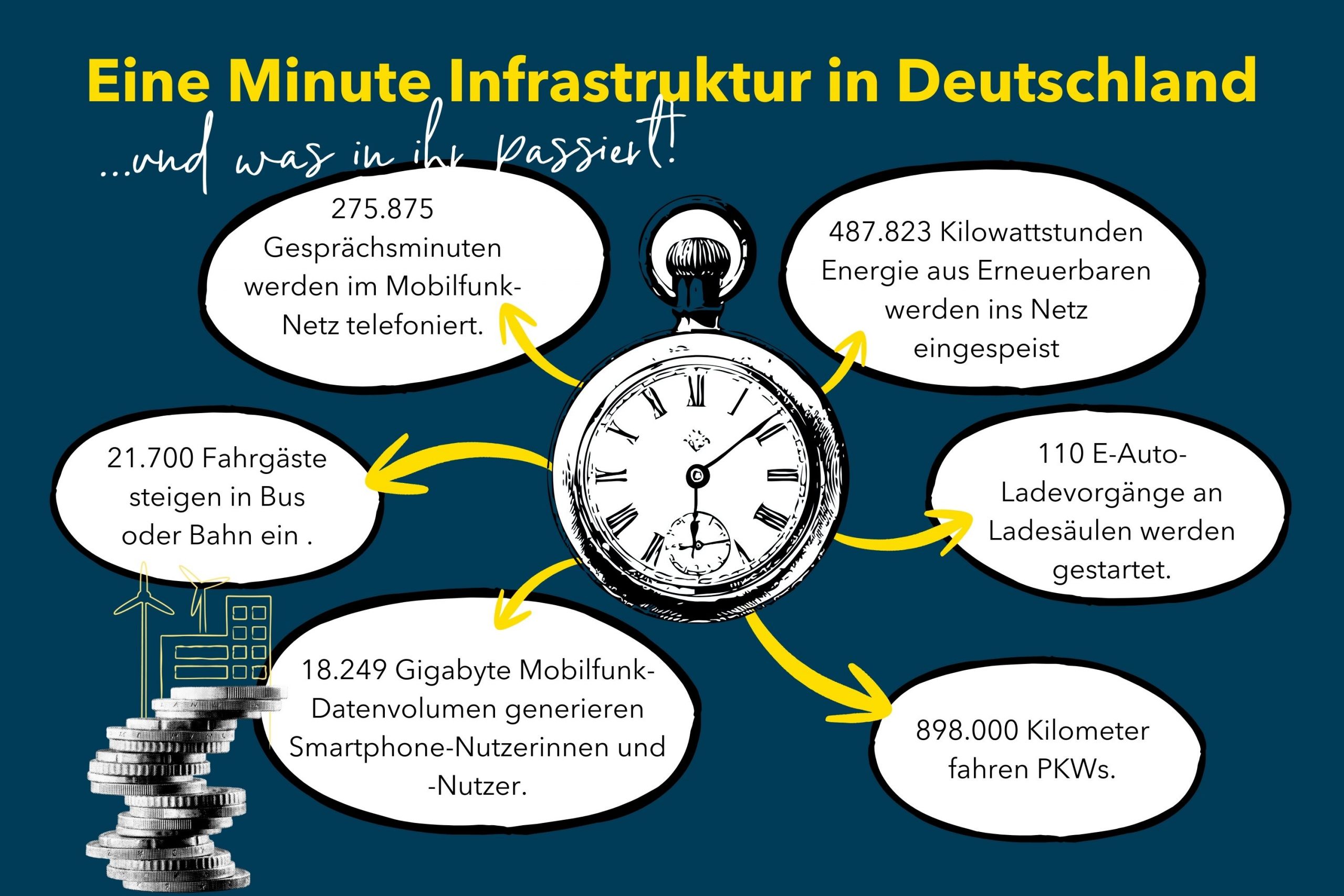

The importance of the infrastructure asset class is increasing continuously: transportation, energy and communication projects as well as social infrastructure properties are of great social importance and have a sustained need for capital.