Investors and owners are more optimistic about the residential investment market than they have been for years. This is the result of a survey conducted by SCHICK IMMOBILIEN, a leading investment brokerage firm from Berlin, among more than 3,000 private and commercial property owners and investors. The Residential Investment Barometer, published by SCHICK IMMOBILIEN for the fifth time, determines the mood of market players and has also taken a close look at Berlin as a business location for the first time in its current edition. It is striking that around 60 percent of those surveyed continue to consider the capital one of the most attractive locations despite political uncertainties.

Jürgen Michael Schick, Managing Director of SCHICK IMMOBILIEN, says: “Our exclusive survey clearly shows where the market is headed. Investors are trading more actively again, orienting themselves on numbers instead of headlines. It is now crucial that politicians do not jeopardize this constructive market trend by intervening unnecessarily. We see the results as a clear signal of departure. The positive mood of investors also reflects our impressions from sales.”

Residential investment index shows positive picture despite interest rate and tenancy law concerns

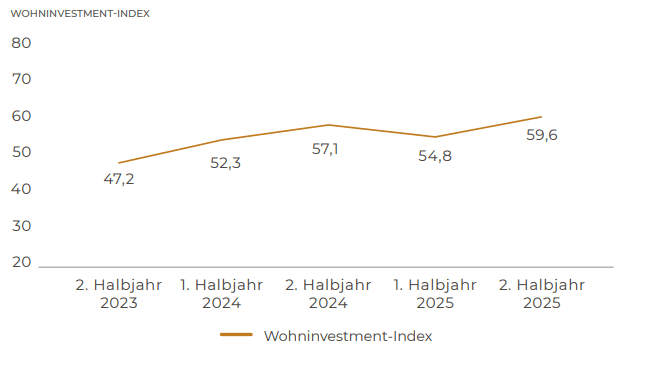

The new Residential Investment Barometer shows that more than 80 percent of the investors surveyed expect prices to remain stable or rise, and the willingness to buy is also continuing to increase. This is also underpinned by the Residential Investment Index, which at 59.6 points reached its highest level since the survey began in 2023. The index depicts the core components of the survey – assessment of investment opportunities, price development and purchase and selling intentions – in a single benchmark and thus provides an up-to-date picture of the market. On a scale from 0 (very pessimistic) to 100 (very optimistic), it offers a clear, condensed assessment of the current situation for the residential investment market.

Compared to 2023, this corresponds to an increase of over twelve points. This positive attitude is supported by stable price expectations, a high willingness to buy and confidence in reliable fundamentals. More than 80 percent expect prices to remain stable or rise, more than half are planning new purchases, and long-term portfolio management continues to gain in importance. At the same time, the answers show that economic risks are becoming less acute, and the decisive uncertainties continue to come from politics.

“The new index value shows how stable the mood is despite all the political uncertainties. Investors assess the market soberly and based on facts. That’s exactly what makes the current trend so resilient,” says Jürgen Michael Schick.

Investors see good investment opportunities – stable or rising prices expected

More than 85 percent of those surveyed rate the current investment opportunities as neutral to positive. Almost 40 percent of those surveyed now rate the investment opportunities as “good” or “very good” – noticeably more than in the previous year’s survey, in which this figure was around 35 percent. The proportion of negative assessments drops to around 15 percent. The majority of participants continue to rate the market situation as “medium” (46 percent), which underlines the ongoing stabilization of the residential investment market.

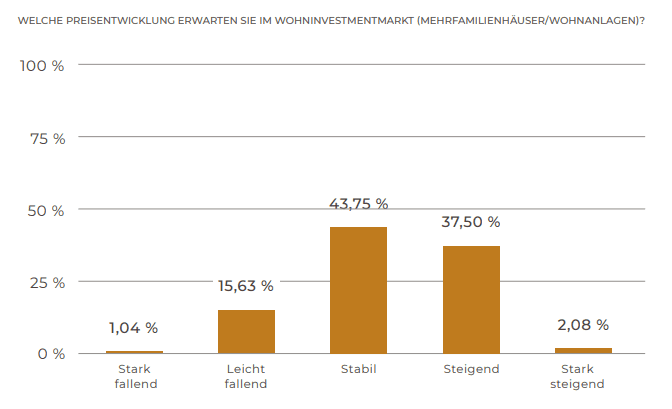

The survey also shows that more than 80 percent of respondents expect prices to remain stable or rise. The expectation of rising prices remains at a consistently high level of around 38 percent, while the proportion of falling price forecasts has fallen significantly: only around 17 percent expect purchase prices to fall, after almost 24 percent compared to the previous year. At the same time, the proportion of those who expect prices to remain stable has risen from a good 37 to just under 44 percent.

Willingness to buy is increasing – strong trend towards portfolio management

The willingness of market participants to buy continues to increase. Around 60 percent of those surveyed plan to purchase new residential properties in the next twelve months, which represents an increase compared to the previous year’s barometer. At the same time, the propensity to sell remains almost unchanged: about one in five is considering selling. On the other hand, the proportion of those who rely exclusively on the further development of their holdings has fallen significantly. The decline from 40 to 33 percent shows that market participants want to act more actively again and take advantage of opportunities in a targeted manner.

It is striking that long-term portfolio management remains the dominant model and continues to gain in importance: 81 percent of those surveyed are currently relying on this strategy – a significant increase compared to the previous year’s figure of around 74 percent. At the same time, the value-add strategy is coming more into focus.

Tenancy law remains a top structural risk – investors lack planning security

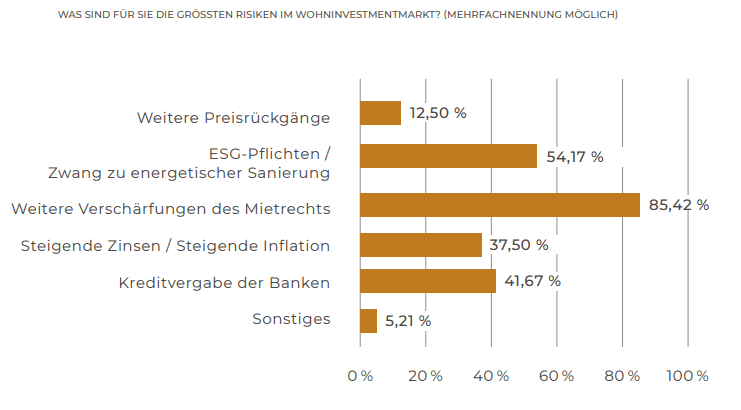

Investors see politics as the biggest risk in residential investments. A possible tightening of tenancy law continues to be considered the greatest investment risk by more than 85 percent of respondents. Concerns about regulatory intervention have become entrenched at historically high levels and are increasingly becoming a permanent structural risk for the residential investment market.

At the same time, however, ESG obligations and energy-efficient renovation requirements for investors continue to lose their sharpness. Only around 54 percent of those surveyed still see this as a central risk, compared to just under 69 percent in the previous year. The willingness of owners to invest in energy-efficient renovations remains subdued year-on-year and continues to decline. Only around 25 percent of those surveyed are planning concrete measures in the next three to five years – after a good 30 percent in the previous year’s barometer. The trend shows that despite the high relevance of the topic, many owners still lack planning security to reliably implement extensive renovation measures.

Jürgen Michael Schick says: “Investors have accepted the market environment. What unsettles them is not the numbers, but the rules.”

Focus on core markets – Berlin attractive despite political risks

The investment priorities of market participants are once again shifting slightly in favour of the large cities. Around 67 percent of those surveyed are planning purchases in Class A cities – a small but clear increase compared to the previous year’s barometer. The surrounding areas of the metropolises also remain a stable target market. The results thus show that investors are increasingly focusing on central, robust markets and less on broad geographical diversification.

Berlin is clearly one of the most attractive locations in the residential investment market for the investors surveyed nationwide. Around 60 percent rate the capital as attractive or very attractive, although the political framework conditions remain challenging. For 45 percent of respondents, population growth is decisive, followed by the city’s economic and scientific strengths.

“Berlin thus combines positive fundamentals and political tensions like hardly any other market. The political risks are known, but they are priced in. Anyone who invests in Berlin is deliberately betting on the long game,” says Jürgen Michael Schick, CEO of SCHICK IMMOBILIEN and publisher of the Interest Rate Market Report Germany and Berlin.