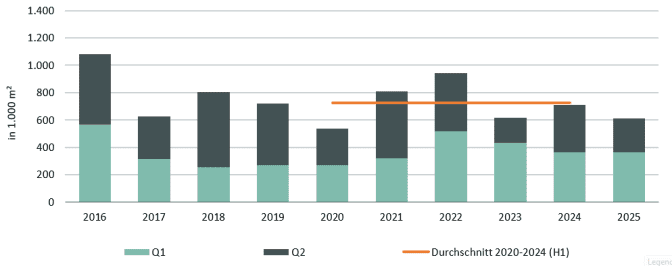

Take-up fell by 14 per cent to 609,000 square metres* in the first half of 2025

After a solid start to the year, the industrial and logistics real estate market in North Rhine-Westphalia recorded a decline of 14 per cent in the first half of the year as a whole, with take-up of 609,000 square metres compared to the same period last year. A look at the average of the first halves of the last five years also shows a decline of 16 percent. The share of new buildings in take-up also declined – by 25 percentage points to just 26 percent. The focus on existing properties can be attributed to both their lower asking rents and their wider availability. In line with this, four of the five largest deals are in existing properties. The proportion of owner-occupiers also fell – by 14 percentage points to a total share of 14 percent. The big-box vacancy rate rose slightly to 2.8 percent over the past twelve months – a good one percent less than the national average. These are the results of a recent analysis by the global real estate service provider CBRE.

“The second quarter of the industrial and logistics market in North Rhine-Westphalia was somewhat weaker overall than the first quarter. Nevertheless, the half-year was quite solid considering the macroeconomic situation,” says Imad El Akrouche, Team Leader Industrial & Logistics NRW at CBRE. “Currently, there is a strong interest from Asian online retailers, who are looking for their logistics service providers, especially in the western Ruhr area.”

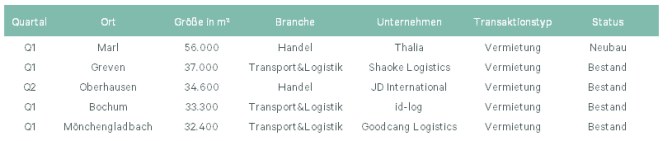

This is one of the reasons why take-up in the Ruhr region increased by 28 per cent to 258,000 square metres compared to the same period last year. With 95,200 square metres in the first half of the year, the Mönchengladbach region achieved the largest percentage increase compared to the first half of 2024 with an increase of 38 per cent. However, the largest deal in the second quarter of 2025 was reached in Oberhausen in the Ruhr region, where the Chinese online retailer JD.Com rented an area of 34,600 square meters. In contrast, the markets in Düsseldorf (down 45 per cent to 58,000 square metres) and Cologne (down 62 per cent to 61,300 square metres) declined. “The availability of space in Düsseldorf and Cologne has decreased compared to the previous year – but there is a good pipeline, especially in Cologne,” says El Akrouche. In the rest of North Rhine-Westphalia, take-up also declined – by 21 per cent to 136,100 square metres.

In terms of demand by sector, transport and logistics companies once again dominated in the first half of 2025. They accounted for 300,200 square metres, which corresponded to a share of 49 per cent (plus 17 percentage points). The shares of both retail companies (including online retailers) and manufacturing companies fell significantly – by 19 percentage points to 26 percent and by six percentage points to 14 percent, respectively.

The focus of the market activity was on the size classes from 20,000 to 50,000 square metres (up 37 per cent to 136,000 square metres) and 10,000 to 20,000 square metres (up 22 per cent to 165,300 square metres).

Prime rents for logistics properties have stagnated in many places over the past twelve months. Exceptions were Düsseldorf, where the prime rent rose by one percentage point to 8.90 euros per square metre, and the Mönchengladbach region, which recorded the strongest increase of three percentage points to 7.20 euros per square metre. Prime rents are stagnating at 8.80 euros per square metre in Cologne and at 7.90 euros per square metre in the Ruhr area.

Outlook for the rest of the year

“In view of the geopolitical developments and the tariff discussions, which are leading to uncertainty, it is difficult to predict the development. In view of the traditionally stable NRW market, however, take-up of space of 1-1.3 million square metres in 2025 as a whole can be assumed in the course of the year.”

*Outside of Düsseldorf, CBRE only records deals of 5,000 square metres or more.

Logistics market North Rhine-Westphalia: Take-up of space (letting and owner-occupancy)