The readjustment of the portfolio allocation has begun. This is shown by a survey conducted by INDUSTRIA Immobilien in spring 2025.

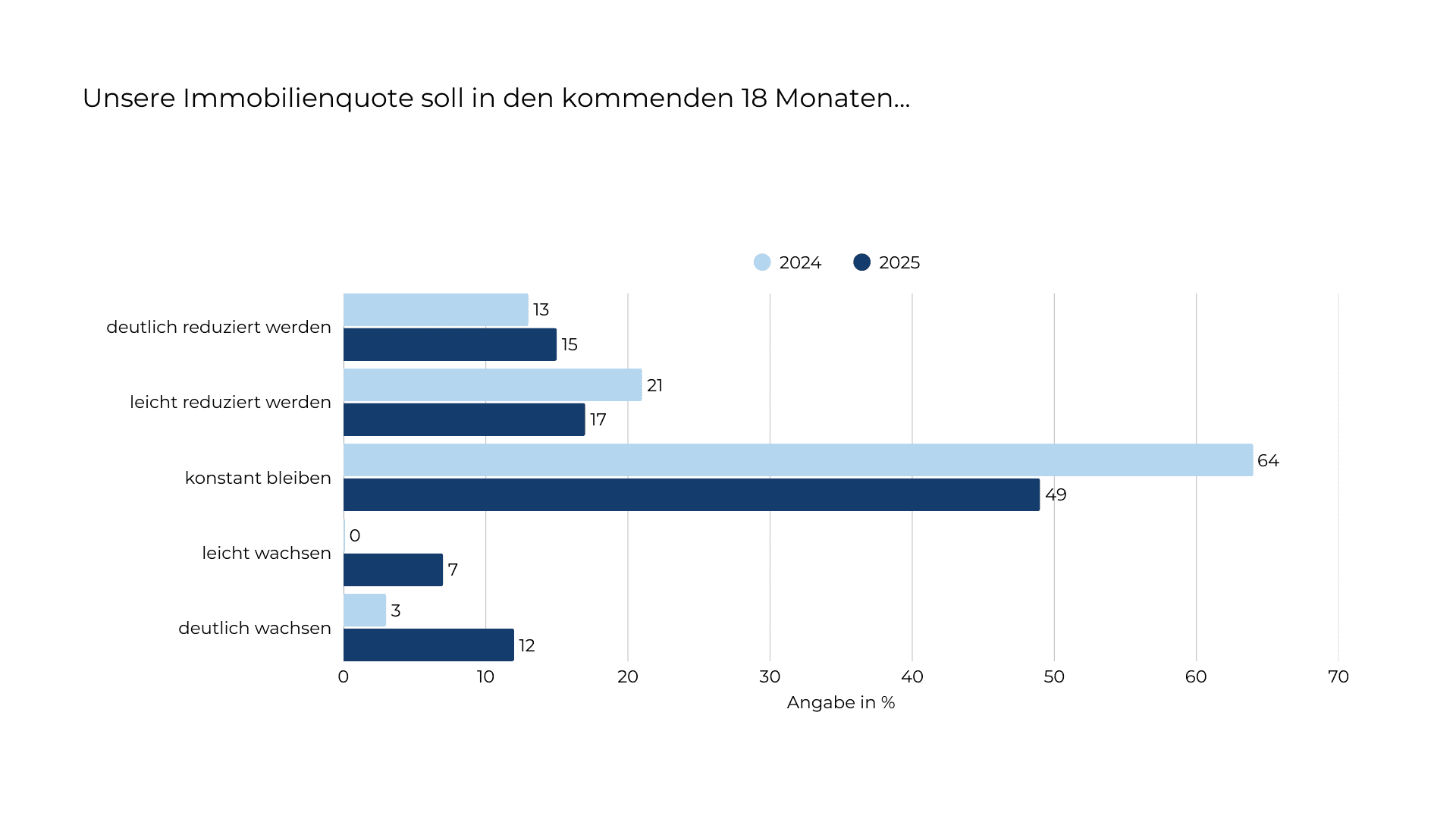

The institutional real estate market is thawing: For 19 percent of the investors surveyed, the real estate quota is expected to grow slightly or significantly in the next 18 months. In the survey in spring 2024, on the other hand, it was only three percent. Almost half of institutional investors want to keep their real estate quota constant over the next one and a half years – a decline compared to the previous year, but still an expression of stability. It wants to reduce around a third slightly or significantly, about as much as in 2024. The average current real estate quota of the investors surveyed is 22 percent.

On average, respondents willing to invest want to invest 69.1 million euros indirectly in real estate over the next 1.5 years, with an average of 17.5 million euros directly. However, about three-quarters of those surveyed do not plan to invest directly during the period mentioned, and about two-thirds do not want to invest indirectly.

Almost half of institutional investors want to keep their real estate quota constant over the next one and a half years – a decline compared to the previous year, but still an expression of stability.

Trend towards Club Deals is emerging

There were surprising findings when asked about the preferred fund structures: About a third of the capital that is to be invested indirectly in real estate in the current year is to flow into German open-ended funds. In 2024, it was just under half. In contrast, the popularity of German closed-end special AIFs has increased significantly from eleven to 30 percent – an indication of a trend towards club deals with a smaller number of investors and greater influence. The popularity of Luxembourg vehicles, on the other hand, fell slightly: from 28 to 27 percent for open-ended special funds and from 14 to nine percent for closed-end AIFs.

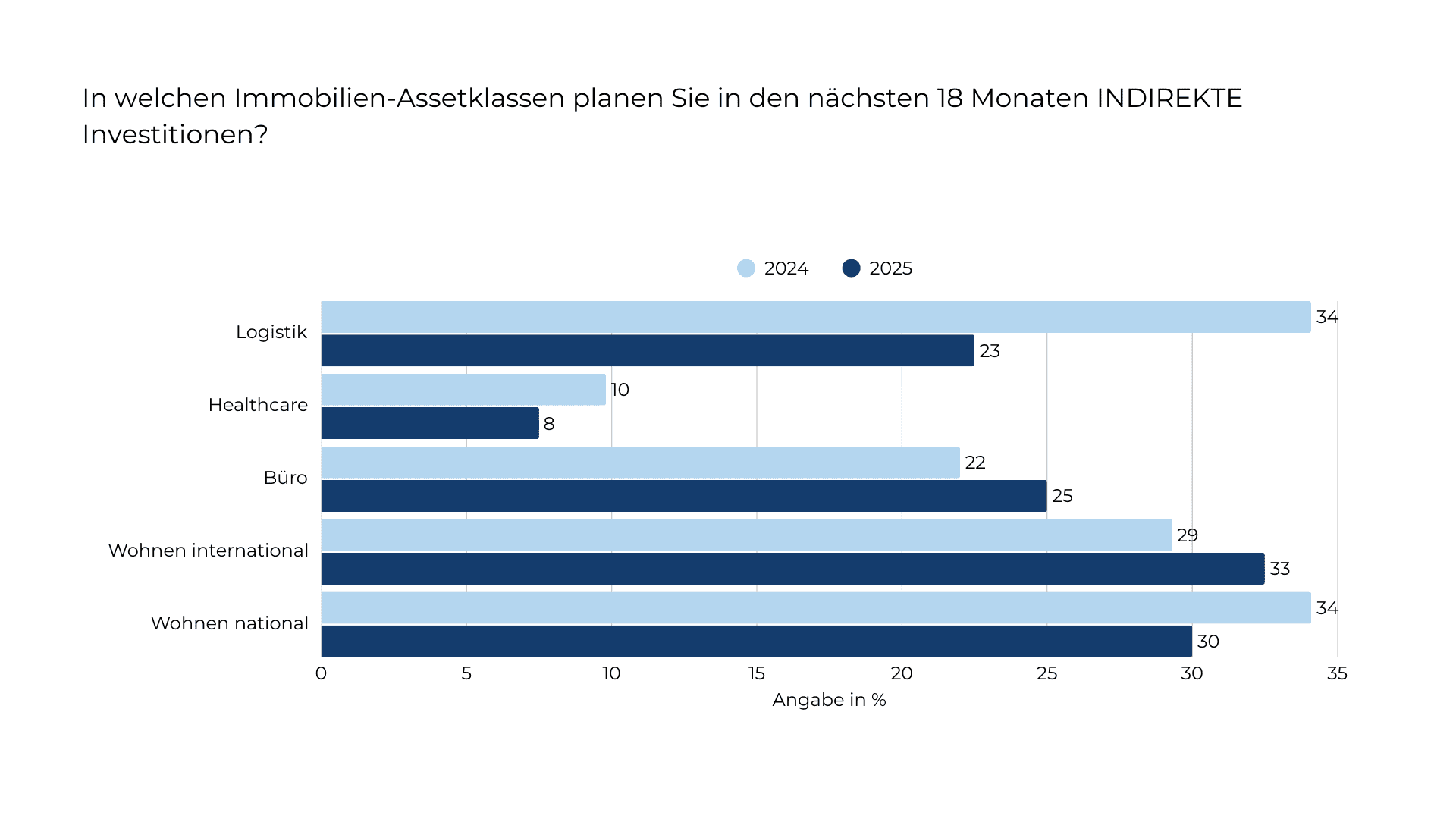

Housing beats logistics as the most popular type of use for investments

In terms of the types of use in which investments are to be made indirectly over the next 18 months, ‘international housing’ (32.5 per cent) and ‘national housing’ (30.0 per cent) have overtaken logistics (22.5 per cent) as the most popular type of use. In the 2024 survey, ‘Wohnen national’ and Logistik were the most popular with 34.1 per cent each, followed by ‘Wohnen international’ with 29.3 per cent. Büro was able to increase from 22.0 to 25.0 percent this year. The niche asset class healthcare is only mentioned by 7.5 instead of 9.8 percent of investors for the next 18 months.

Serial construction becomes investable

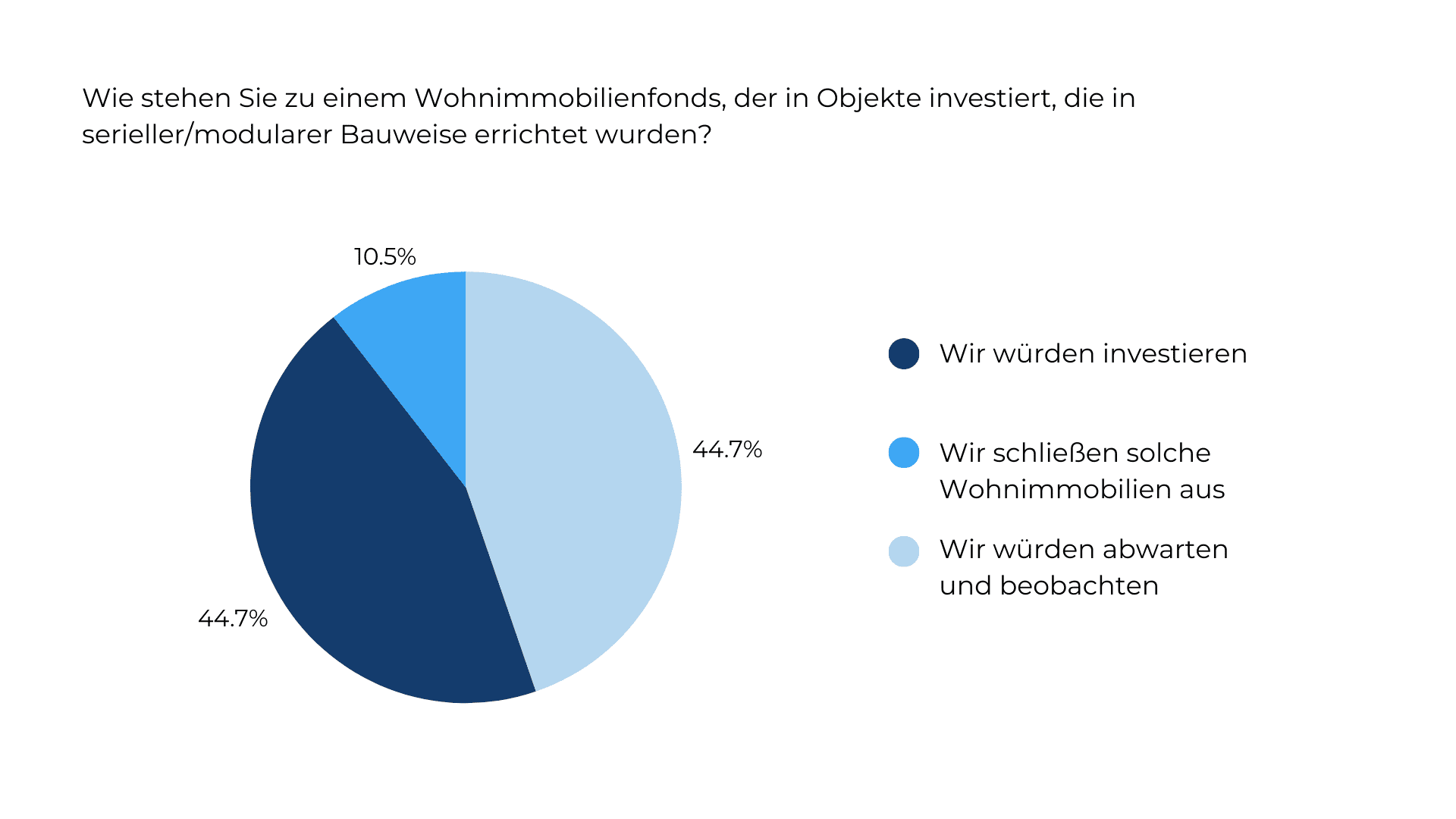

The respondents are open to the topic of serial or modular construction. 44.7 percent of investors can imagine investing in funds with corresponding properties. Only around ten percent categorically reject this. Expected returns are decisive for acceptance: 56 percent of those surveyed expect higher returns than with conventional construction methods – a realistic picture in view of shorter construction times and potential economies of scale. At the same time, new ways are emerging here to make affordable housing viable.

While the preference for core and core+ investments remains dominant, value-add strategies are gaining traction again. Opportunistic investments and project developments will also be given somewhat greater consideration again in 2025 – a cautious change in sentiment that opens up scope for investments with higher return potential. Compared to 2024, slightly more development risks will be taken again in 2025, as more investors want to buy projects. At the same time, dividend expectations in the residential segment are falling.

44.7 percent of investors can imagine investing in funds with properties that have been built in serial or modular construction. Only around ten percent categorically reject this.

For a third, ESG criteria are not of great relevance

The focus on Article 8 funds for new investments is also declining. Although 57.5 percent of respondents continue to invest under Article 8 of the EU Disclosure Regulation, this is significantly less than in 2024 (72.2 percent). In contrast, 32.5 percent of survey participants said that ESG criteria are not or hardly relevant for them when making investment decisions. However, the growth in Article 9 funds is striking: Ten percent of those surveyed plan to invest mainly in them – almost twice as many as in the previous year.

Result

The institutional real estate market is at a turning point. The reluctance of many investors remains understandable – in view of geopolitical uncertainties, a volatile interest rate environment and open valuation questions. But the INDUSTRIA survey shows that the willingness to invest is returning – more selective, more demanding, but strategically motivated. Residential real estate, closed-end special AIFs, serial construction methods and club deal structures will play an even more important role in the future.

Here you can download the full survey results of INDUSTRIAYou need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More Information