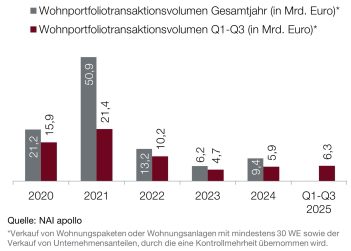

According to NAI apollo, a member of NAI Partners Germany, market activity in the German residential portfolio transaction market (from 30 residential units) remained at the subdued level of the previous quarter in the third quarter of 2025 with a transaction volume of around EUR 2 billion. Compared to the third quarter of 2024, this represents a decline of 25.3 percent. For the year as a whole, however, the picture has been more positive so far: with a total of EUR 6.3 billion and 42,600 residential units sold, the transaction volume is 6.1 percent higher than the previous year’s figure. Even the overall result of 2023 is already being exceeded (2023: 6.2 billion euros, 33,700 residential units).

“Despite the persistently difficult economic environment, the market for residential portfolio transactions was largely stable with slightly positive trends. Investor demand was mainly concentrated on mid-range portfolio volumes, the large metropolitan regions, as well as on project developments and new-build properties in the core and core-plus segments. In addition, capital continued to flow specifically into existing portfolios with potential for value appreciation. However, there have been no major deals worth more than EUR 500 million in the last three months,” says Dr. Marcel Crommen, Managing Director of NAI apollo, summarizing the developments of the last few months.

Sales increases in medium-sized portfolio segments

“A year-on-year comparison shows a shift in market activities towards medium-sized portfolio transactions. The segment between 25 and 50 million euros stands out in particular. With a market share of 23 percent, the traded volume grew by 145.1 percent to 1.5 billion euros. Deals in the range of 50 to 100 million euros also increased, albeit more moderately – the sales volume rose by 46.8 percent to 1.1 billion euros,” says Dr. Konrad Kanzler, Head of Research at NAI apollo. “Demand in the mid-size segment was mainly from domestic investors and was primarily directed towards the larger conurbations as well as new buildings and project developments,” adds Stefan Mergen, Managing Partner of apollo valuation & research GmbH. However, the cluster with the highest turnover remained the segment above EUR 100 million. With 2.4 billion euros and a market share of 38.8 percent, it continues to dominate. This also includes the largest transaction of the year so far: the sale of around 8,000 residential and commercial units from the open-ended real estate fund UniImmo: Wohnen ZBI from the first quarter of 2025. In contrast, smaller deals of less than 10 million euros lost importance. The volume fell by 17.7 percent year-on-year to EUR 272 million.

Group of open-ended real estate and special funds dominates on the buyer side, project developers & property developers with the highest sales volume

The most important buyer groups so far this year include open-ended real estate and special funds with a market share of 19.6 percent. However, their acquisition volume fell from around 1.3 billion euros in the previous year to 1.2 billion euros in the first three quarters of 2025. In second place are private equity and opportunity funds with 15.6 percent, which were able to increase significantly year-on-year. Their acquisition volume rose from around EUR 111 million in the same period of the previous year to EUR 980 million at present. A total of EUR 3.9 billion of the total volume (share: 61.6 percent) was attributable to domestic investors. This represents a decrease of 14.3 percent compared to the previous year. International buyers, on the other hand, expanded their activities and increased the acquisition volume by 71.2 percent to 2.4 billion euros. “While German investors continue to take a wait-and-see attitude, the interest of foreign buyers has increased – they continue to see German residential portfolios as an inflation-protected and reliable investment destination,” said Kanzler.

On the seller side, project developers and property developers were able to make significant gains. Their volume rose by 39.8 percent to 2.8 billion euros compared to the previous year. In doing so, they displaced the open-ended real estate and special funds leading until the middle of the year from the top position, which now occupy second place with 1.7 billion euros.

Market share of project developments at around 49 percent in the third quarter

Trade in project developments has increased significantly despite the difficult conditions. Compared to the previous year, the transaction volume of forward deals climbed by 17.5 percent to EUR 2.1 billion. This corresponds to a market share of 33.3 percent. In the last three months, the half-year result of 1.1 billion euros has almost doubled, reaching around 49 percent of the total volume of the third quarter of 2025. “The government’s planned measures, including the ‘construction turbo’, could further stimulate long-term investment in sustainable project developments, while additional funding and simplified densification processes offer new opportunities for investors in already strained markets”, said Chancellor.

Cautious optimism due to weak economic outlook

“Despite economic uncertainties and geopolitical risks, the German residential portfolio transaction market remains in demand, especially from international investors who continue to regard Germany as a safe haven. While large-volume deals have been rare recently, medium-sized portfolios are increasingly determining transaction activity,” says Mergen. “The limited supply in the core segment supports prices in the metropolises, while buyers in secondary locations act more selectively and demand higher yields. Core assets and mid-sized portfolios with a manage-to-green approach remain preferred targets. In view of the weak volume of new construction, the supply bottleneck is likely to persist for several years, which will further support price dynamics and rents,” says Crommen. Investors are increasingly focusing on sustainable new construction projects, in some cases with a high proportion of subsidized housing. Serial construction methods will increasingly help to reduce the high construction costs and long completion times. “A more significant revival in transaction volume is not expected until 2026. For 2025, an investment volume of less than EUR 10 billion is forecast, which is in line with the previous year’s level of EUR 9.4 billion,” explains Mergen.