Office Letting Market in Berlin Q2-2025

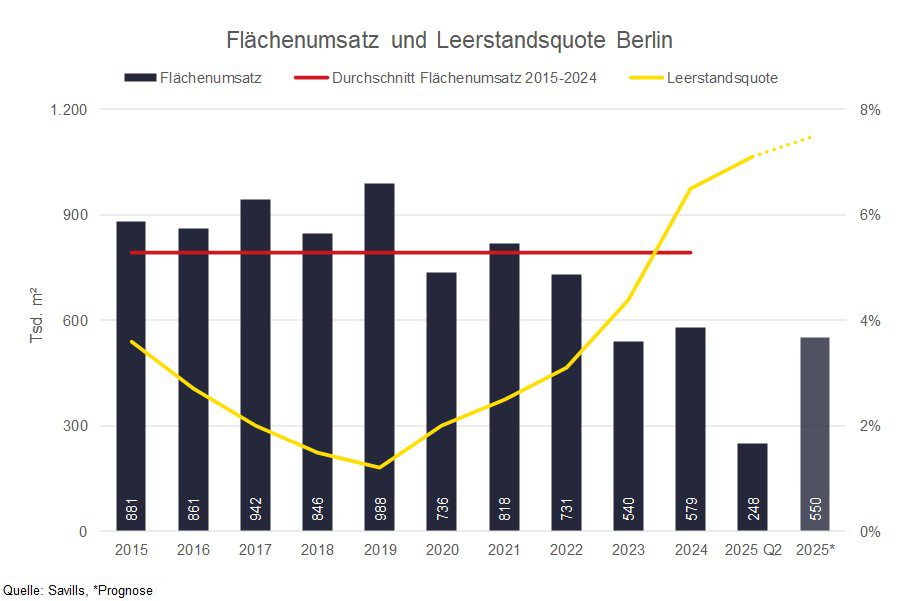

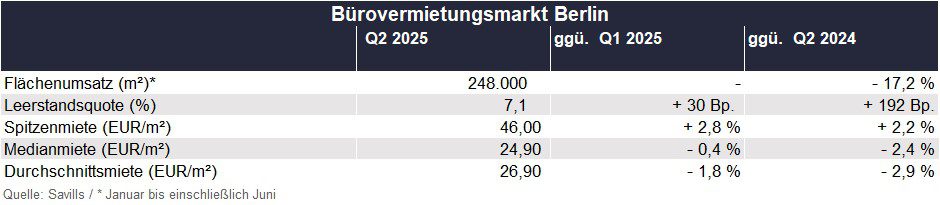

In the first half of 2025, take-up on the Berlin office letting market amounted to 248,000 m². This represents a decrease of 17.2% compared to the same period last year. Compared to the 10-year average of the 1st half of the year, sales decreased by 34%.

The vacancy rate in the second quarter of 2025 rose by 30 basis points to 7.1% compared with the previous quarter. Year-on-year, the ratio increased by 192 basis points. The prime rent in the second quarter of 2025 was EUR 46.00/m², an increase of 2.8% compared to the previous quarter. Compared with the same quarter a year earlier, it increased by 2.2%. The median rent reached EUR 24.90/m². This represents a decrease of 0.4% compared with the previous quarter and a decrease of 2.4% compared with the same quarter a year earlier.

Karina Sauer, Associate Director and Team Leader Office Agency at Savills in Berlin, comments: “The Berlin office leasing market continued to be subdued in the second quarter of 2025. Nevertheless, demand impulses can be observed in individual sub-markets – especially in new construction projects around Kurfürstendamm and in the Mediaspree submarket. A good example is the large-volume leasing of over 10,000 m² by the ‘House of Games’ in Friedrichshain. With this project, Berlin wants to position itself as an attractive location for the games industry and attract start-ups, developer studios and established companies. Despite such lighthouse projects, the vacancy rate on the Mediaspree remains above average – both in the form of classic vacancy space and in the form of shadow vacancy as a result of subletting and speculative project developments. Vacancies are also continuing to rise throughout Berlin, putting many owners under increasing pressure. Against this background, it can be observed that some owners are relying on management contracts with coworking providers and operator concepts are gaining in importance.”

Savills expects take-up for the year as a whole to be slightly below the previous year’s level. At the same time, the ongoing trend towards high-quality office space is likely to ensure that prime rents remain stable over the remainder of the year.