A low-transaction second quarter of 2025 ensures earnings at previous year’s level

After a promising start to the year, the momentum on the German real estate investment market slowed down again in the second quarter of 2025. With a transaction volume of around seven billion euros from April to June, half-year sales totaled just under 15.3 billion euros, almost at the same level as in the first half of 2024.

Konstantin Kortmann, CEO JLL Germany & Head of Capital Markets: “Although the turbulence on the financial markets due to the Israel/USA-Iran conflict has failed to materialise or was only briefly reflected in rising oil prices, the subdued investment market also shows that uncertainty and volatility are not good ingredients for real estate transactions. The impression remains that every day a new event could cause disruption. This ensures that the mood is much more pessimistic than the actual market situation, especially in the real estate industry.”

At the same time, good news is coming from the economy: inflation is no longer an issue at the moment – at least as long as the conflict in the Middle East does not swell further. However, economists believe that closing the Strait of Hormuz could increase inflation in the euro area by 80 basis points. The risk of this happening is estimated to be low, but it shows that geopolitical developments need to be carefully considered.

Investors remain cautious, because the tariff conflict with the USA also remains in place and when the 90-day deadline expires on July 9, there is a possibility that no agreement has been reached with the EU. “Potentially higher tariffs and rising oil prices have an enormous influence on the development of inflation and thus on the further development of interest rates. At least the latter is proving to be stimulating with regard to real estate and its (re)financing, especially since the macroeconomic conditions also improved somewhat in the course of the second quarter,” analyses Helge Scheunemann, Head of Research at JLL Germany. From the current perspective, the European Central Bank (ECB) is likely to pause interest rates in July and cut interest rates moderately again later this year. A somewhat more positive mood is also shown by financiers and banks, who are signalling more willingness to invest in real estate projects again. In addition to interest rate developments, confidence in economic development is also increasing after the formation of a government in Germany, also thanks to the economic stimulus program.

Investors’ view of the US market has changed

In addition, due to a rather skeptical attitude towards the USA, investors want to invest more in Europe, which should also benefit real estate. According to data from the US financial information service provider Morningstar, 26 billion euros flowed into European equity funds in the first quarter of this year, after twelve quarters – i.e. three years – of net outflows. In April and May, a further 22 billion euros net flowed into European funds.

“Capital collectors and international investors have withdrawn billions of dollars from the US markets and shifted them to Europe. Investors are feeling the urge to reduce their U.S. holdings and diversify more. In addition to the political development in the USA and the fact that many investors had previously built up a very large overweight in the USA, the main driver is also the concern about a further weakening of the dollar and the hope of an increase in competitiveness in the European Economic Area,” Kortmann observes.

Overall, the market is likely to pick up moderately in the second half of the year for the reasons mentioned. “However, JLL does not expect a boom in the months of July to December, but rather a return to the old normal, i.e. the market conditions that prevailed before the zero interest rate era,” says Scheunemann. “Overall, the market is likely to pick up moderately in the second half of the year, but we do not expect a boom, so we expect a transaction volume of 35 billion to 40 billion euros for 2025 as a whole.”

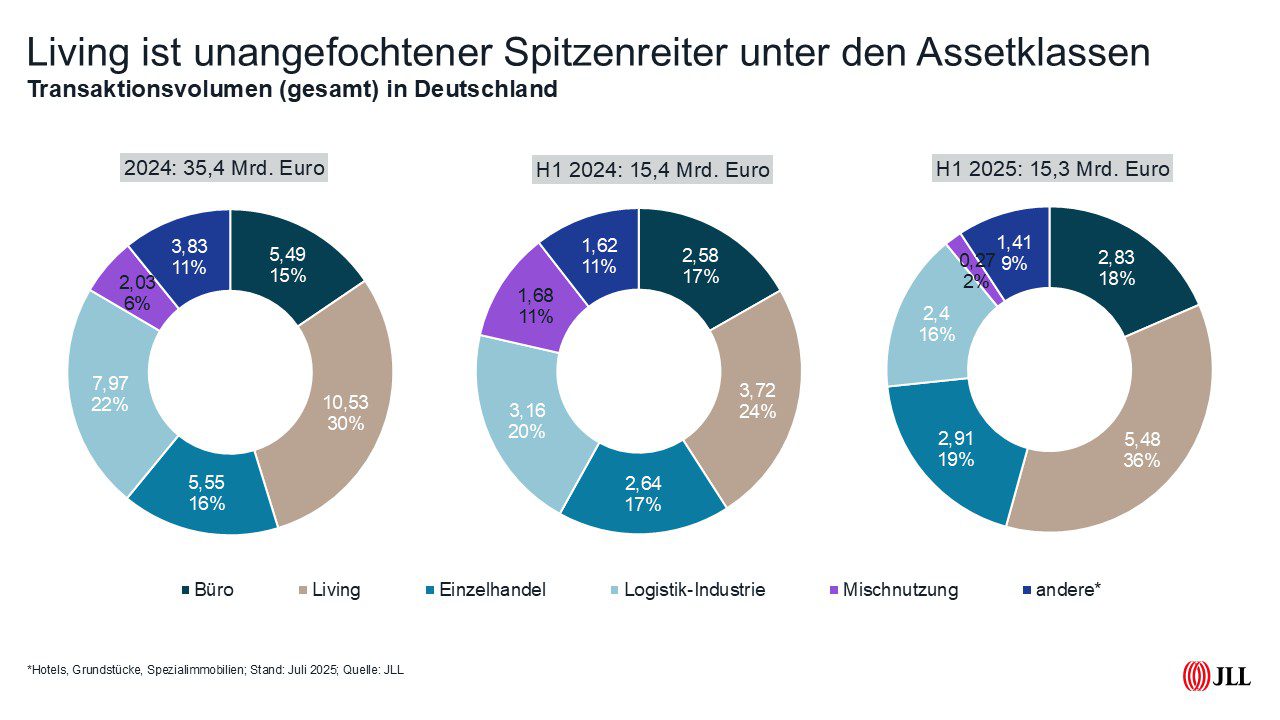

Living remains the strongest asset class – office properties not yet stabilised

After the promising start to the year with increased demand for offices, this trend could not continue in the second quarter. The office investment market has not yet found a stable bottom and so only properties with a volume of 2.8 billion euros found a new owner at the end of the first half of the year. However, two-thirds of these deals were already made in the first quarter. Residential real estate , on the other hand, continues to account for the majority of investments with a half-year volume of 5.5 billion euros (36 percent) and confirms its position as currently the most sought-after asset class.

In the first half of 2025, there was a lack of large transactions across asset classes. In the second quarter of 2025, for example, only one office transaction worth more than 100 million euros was recorded: a portfolio of two properties in Munich and Hamburg. Across all asset classes, there were only a total of nine deals beyond the 100 million euro mark. Institutional investors, who normally handle such transactions, have not yet fully returned to the market. Private investors and family offices, on the other hand, are still active, but with exceptions, their “sweet spot” is more likely to be in the range of 50 million to 80 million euros.

By far the largest transaction was in the retail park segment and concerned the sale of more than 100 furniture stores by the Porta Group to XXXLutz for a high three-digit million euro amount. Interesting developments are emerging in the retail sector . JLL sees more product offering across all usage types. After years of restraint, the first tender seedlings are also appearing among institutional investors who are selectively entering this asset class again. The yield spread between inner-city commercial buildings, shopping centres and retail parks remains considerable and reflects the different risk assessments within the sector. “There is currently a good window of opportunity for investments in the retail sector. The combination of attractive yields and a stabilizing retail landscape after the pandemic creates interesting entry opportunities before the market fully recovers,” Kortmann compares. In total, this sector was able to achieve a volume of 2.9 billion euros in the first half of the year, a share of 19 percent.

Despite the still tense global trade situation, the logistics sector is again somewhat more robust than in the first quarter. With a transaction volume of around 2.3 billion euros at the end of the first half of the year, this asset class ranks fourth. Investors continue to see attractive investment opportunities, with the topic of armaments/defence and security also increasingly on the agenda.

What is interesting about the first half of the year is that portfolio transactions have developed better than the market as a whole. This is mainly due to the higher momentum in the Living segment. More than half of all portfolio deals were for residential products. In the first half of 2025, the transaction volume for portfolios rose by around 26 percent to 5.3 billion euros compared to the same period last year, while individual properties fell by more than eleven percent to ten billion euros.

Real estate strongholds with significant transaction losses

The seven real estate strongholds of Berlin, Düsseldorf, Frankfurt, Hamburg, Cologne, Munich and Stuttgart together recorded around 5.9 billion euros in investments in the first half of the year, which corresponds to a decline of 29 percent compared to the same period last year. A look at the metropolises shows that Berlin is still the most active market with 1.93 billion euros despite a decline of 45 percent. This is followed by Hamburg with one billion euros and an increase of a whopping 42 percent. Apart from Hamburg, only Stuttgart was able to show growth among the strongholds. Munich comes in third place with 990 million euros and had to cope with a sharp decline of more than 44 percent, as did Berlin and Cologne. While the seven metropolises still contributed more than half of the transaction volume in the first half of 2024, this share fell to 39 percent currently.

“This value, which is below average even in a ten-year comparison, is not due to the lack of attractiveness of the metropolises, but to the current shortage of core products,” analyzes Konstantin Kortmann. “In addition, the transaction result in the seven real estate strongholds has been based on a high proportion of office transactions in the past – an asset class that is still viewed with scepticism by some investors.”

Office properties are experiencing slight yield compression for the first time again

The yield trend shows interesting shifts. In the case of office properties, a slight compression of the aggregated net initial yield in the seven metropolises to 4.33 percent can be observed for the first time in the second quarter of 2025, after it had been constant at 4.36 percent since the third quarter of 2024. “In view of the weak transaction figures, this decline may come as a surprise, but we see confirmation of this compression in some deals that were concluded in the second quarter,” explains Scheunemann.

In the residential segment, the trend towards lower yields continues. The prime yield for apartment buildings fell slightly by a further five basis points to 3.51 percent in the second quarter of 2025. This underlines the continuing high demand for this asset class, which is considered safe.

In the retail segment, the development is stable, but a look at the sub-asset classes reveals a differentiated picture: At a constant 5.9 percent, shopping centers offer the highest yields among all the real estate classes considered. Retail parks remain at 4.6 percent and commercial buildings in prime locations also remain constant at their low level at 3.5 percent.

Deviating from the general trend, prime yields for logistics and industrial properties rose slightly by ten basis points to 4.4 percent in the second quarter. The investment market thus also reflects the current dip in the rental market. User types and industries are changing, and so are rents, which ultimately affects purchase prices.

“Yields, especially in the living sector and for food-anchored retail properties, could fall by five to ten basis points by the end of 2025, while stabilization at the current level is expected for the other asset classes,” Scheunemann predicts. “Alternative sectors such as hotels, data centers and life sciences, which are benefiting from global megatrends, are developing particularly dynamically.”

Data centers – so far a lot of attention, but few transactions

Data centers in particular have come more into focus since the boom in artificial intelligence, with impressive growth forecasts for the coming years. However, these very special infrastructure investments require a lot of expertise and JLL sees many declarations of intent to invest in this asset class, but this has only been reflected in a few transactions so far.